Capture the potential of multiple asset classes with SBI Multi Asset Allocation Fund

Market and economic context

In the FOMC meeting in December 2023 the US Federal Reserve indicated multiples interest rate cuts in 2024, once the central bank is comfortable with inflation risks. Reserve Bank of India has a similar stance on rate cuts in India. Fed’s guidance on future interest rate actions has cheered both equity and debt markets. The Nifty closed Year 2023 at its all time high. While rate cuts are imminent, there is uncertainty with timing of rate cuts. The Fed’s long-term inflation target for the US is 2%, but the Fed Chairman has indicated that the central bank may not wait till inflation comes down to 2%. The labour market in the US is still strong and economists do not expect the Fed to cut interest rates before the middle of 2024. Lower interest rates may provide tailwinds for multi-year gold rally which began in 2022 and continued in 2023. At the same, the medium to long term outlook of Indian equities is bright, as India is expected to be the fastest growing major (G-20) economy in 2024 and going forward. In the current market and economic context, Multi Asset Allocation strategy can be beneficial for your investment portfolios as it seeks to capture the potential of multiple asset classes like Equity, Debt & Gold. In this article, we will review SBI Multi Asset Allocation Fund.

What are Multi Asset Allocation Funds?

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI regulations multi asset allocation funds must invest minimum 10% each in at least 3 asset classes. Apart from the two most popular asset classes, debt and equity, these schemes invest in asset classes like gold, real estate investment trusts (REIT), infrastructure investment trusts (InvITs) etc.

Multi-asset allocation provides better diversification -

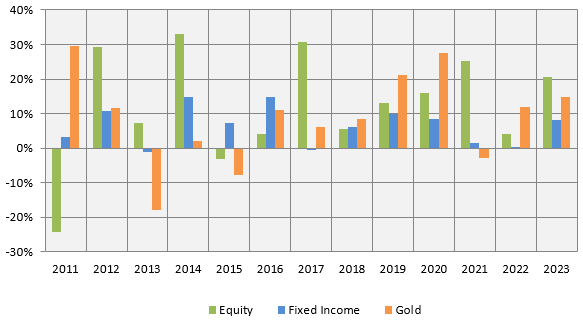

The chart below shows the annual returns of different asset classes. You can see that different asset classes outperform / underperform each other in different market / economic conditions. You can see that debt is much more stable than equity. While equity and debt can have some positive correlation (usually with a lag) depending on fiscal and monetary policies, gold and equity are usually counter cyclical to each other i.e. gold outperforms when equity underperforms and vice versa. As such, a combination of 3 or more asset classes can balance risk and return more effectively than a combination of just equity and debt.

Source: National Stock Exchange, MCX, Advisorkhoj Research, as on 31st December 2023. Nifty 50 TRI is used as a proxy for equity as an asset class, Nifty 10-year benchmark G-Sec Index is used as proxy for debt as an asset class and spot price of Gold (in MCX) is used as proxy for Gold as an asset class. Disclaimer: Past performance may or may not be sustained in the future.

About SBI Multi Asset allocation Fund

The scheme was launched in December 2005 and has Rs 2,753 crores of assets under management (AUM). Previously known as SBI Magnum Monthly Income Plan – Floater, this scheme in its multi asset allocation fund avatar came into being in May 2018 after AMCs rationalized and re-classified their older schemes to comply with SEBI’s mutual fund rationalization and re-classification directive.

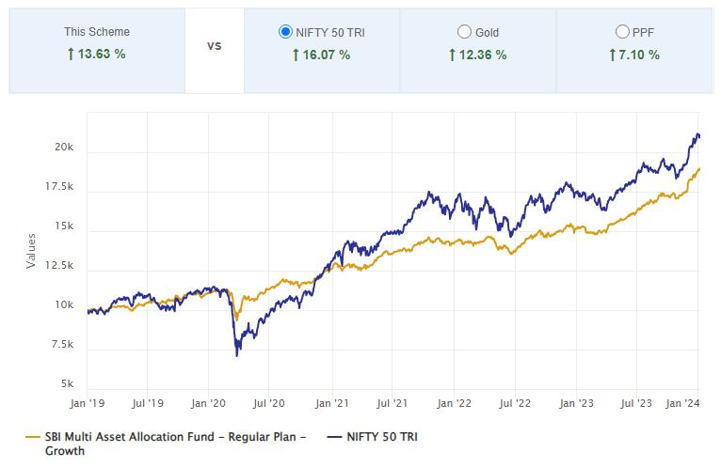

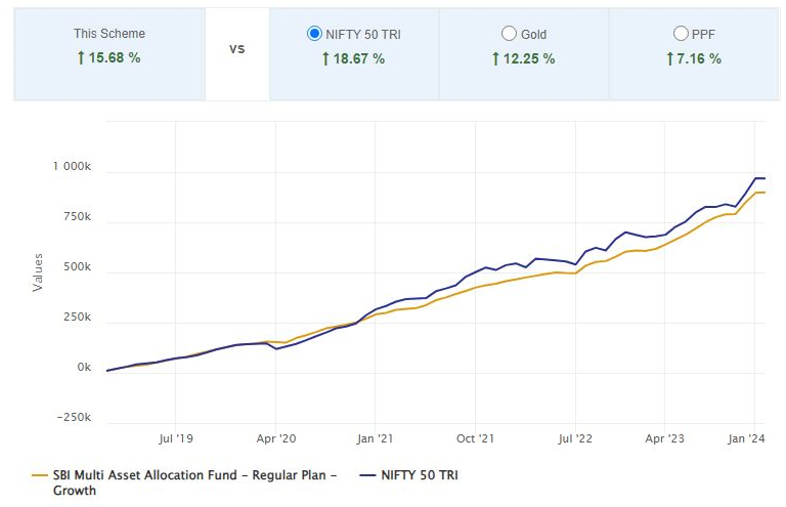

The expense ratio of the scheme is 1.58%. Dinesh Balachandran, Raj Gandhi and Mansi Sajeja are the fund managers of this scheme. The scheme has given 11.88% CAGR returns since inception (as on 31st December 2023). The chart below shows the growth of Rs 10,000 investment in the scheme over the last 5 years (ending 5th January 2024) versus Nifty 50 TRI.

Source: Advisorkhoj Research

Limited Downside Risks

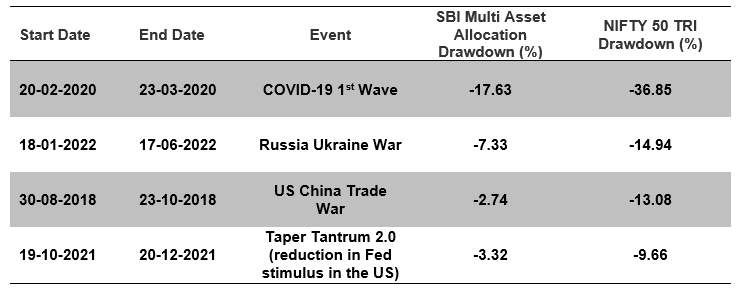

The multi asset allocation strategy of the scheme provides some downside protection and limits downside risks in highly volatile markets. The table below shows the 4 biggest drawdowns in the equity market over the last 5 years and its impact on SBI Multi Asset Allocation Fund. You can see that, in the major periods of high volatility in the equity markets, SBI Multi Asset Allocation Fund saw much smaller drawdowns compared to equity. This scheme can provide stability to your investment portfolio.

Source: Advisorkhoj Research

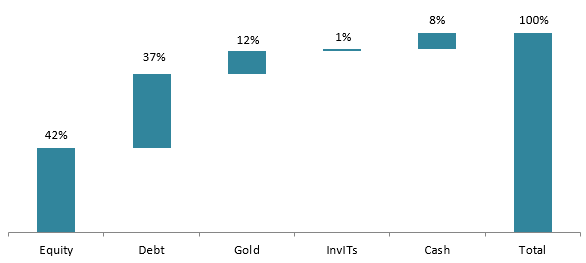

Current Asset Allocation

The waterfall chart below shows the current asset allocation of SBI Multi Asset Allocation Fund. The fund managers are very prudent about risks. The equity allocation is diversified across market cap segments, while the debt portion is relatively high quality.

Source: Advisorkhoj Research, SBI MF monthly fund factsheet (as on 30th November 2023).

Wealth creation track record -

The chart below shows the growth of Rs 10,000 monthly SIP in SBI Multi Asset Allocation Fund over the last 5 years (ending 5th January 2024). With a cumulative investment of Rs 6 lakhs you could have accumulated a corpus of around Rs 9 lakhs at XIRR of 15.33%. The SIP performance of SBI Multi Asset Allocation Fund shows its potential as a wealth creator over long investment tenure.

Source: Advisorkhoj Research

Why invest in SBI Multi Asset Allocation Fund?

- Convenience: The fund invests in multiple asset classes depending on the opportunities that exist in each asset class. This saves you the hassle of investing in an equity, debt and gold fund on your own. Also, you incur the cost of investing in one fund vis-à-vis if you invested separately in each asset class-based fund.

- Diversification: As the fund invests in multiple asset classes, having low correlation with each other, the opportunity for stable long-term capital growth is better. The good performance of any one asset class in a year helps cushion against the poor performance of others thus stabilising the returns.

- Actively Managed Portfolio in one Fund: The fund is actively managed which means it makes the reallocation decision across asset classes for you according to the current market scenario. This eliminates the hassle of the investors timing the market and rebalancing the portfolio consisting of multiple asset classes.

Who should invest in SBI Multi Asset Allocation Fund?

- Investors looking for a long-term strategic allocation to different asset classes.

- Investors looking for relatively stable returns with low downside risks.

- Investors with long investment tenures. We recommend 5 years + investment tenure for this scheme.

- Investors should consult with their financial advisors or mutual fund distributors if SBI Multi Asset Allocation Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY