Should you invest in SBI Equity Savings Fund

The guaranteed returns of Fixed deposits make them a popular saving option in India. However, stability aside, fixed deposits interest rates have been declining over the last 20 years and hence can only be treated as savings. However, the value of the saved amount keeps getting eroded as inflation keeps rising. Even though interest rates have gone up again this year (2023) to around 7%, interest rates now seem to have peaked and the way forward may see a dip in the rates. FD interest is taxed as per the income tax rate of the investor. So even at 7% interest rate, the post-tax return is less than 5%, if you are in the high tax bracket.

Rising inflation means that the cost of living is rising. To combat this, investors need to have allocations in asset classes which have the potential to beat inflation by giving higher returns than inflation, while balancing risks according to their risk appetites. Historically, equity has shown a trend towards giving superior returns than the inflation rate. Equity savings funds can be suitable investment options for investors looking for relatively higher returns than an FD without too many additional risks.

What are Equity Savings Funds?

Equity Savings funds were launched in 2014 and are a category of hybrid mutual fund schemes which invest in equity, debt and arbitrage (using derivatives). As per SEBI, overall equity allocation of these funds (including hedged and unhedged exposures) should be minimum 65%. SEBI also requires a minimum 10% asset allocation to debt and money market instruments for these funds. One of the biggest advantages of equity savings funds is that it enjoys equity taxation as the gross equity exposure of Equity Savings funds is at least 65%. So, these funds enjoy equity taxation and are tax efficient investments for conservative investors.

On the other hand, capital gains in debt funds, irrespective of the holding period, are added to your income and taxed as per your income tax rate.

How do Equity Savings Funds work?

Equity Savings Funds invest in a mix of debt, equity and arbitrage opportunities.

- Debt: Debt exposure of Equity Savings Funds ranges from 10 to 35%. The debt allocations of these schemes are aimed at generating income, reducing overall volatility and providing stability to the scheme. The allocation to debt depends on the prevailing bond yields and arbitrage opportunities in the equity market. In bear markets, when the futures premium falls, arbitrage opportunities narrow and equity savings funds may invest up to 35% in debt.

- Active Equity: The exposure of Equity Savings Fund to equity is for capital appreciation. These funds take active (un-hedged) net equity exposure within specified allocation ranges. When fund managers go bullish on equities, they increase active or un-hedged equity exposure to the upper end of the range. The fund manager, however, has the flexibility to reduce the equity allocations and increase exposures to arbitrage or debt if volatility increases in the stock market.

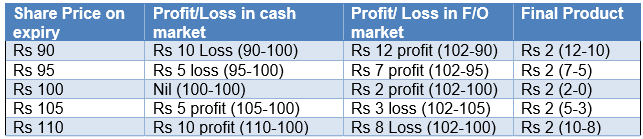

- Arbitrage: Arbitrage opportunities refer to risk free profits by exploiting the mismatches of pricing in different markets. A simple example of arbitrage is cash and carry, where you buy a stock and simultaneously sell futures of the same underlying stock. The futures premium or spread is risk-free profit, irrespective of whether the share price moves up or down (see the table below). The arbitrage portion generates returns and also ensures equity taxation. Let us see an example of how it works -

Let us assume that price of a share in cash market is Rs 100 and price in futures market is Rs 102. You can lock in risk free profits by simultaneously buying shares of the stock in cash market and selling same number of futures in the F&O market. On expiry of futures, last Thursday of the month (depending on the F&O series), the cash (spot) price and futures price will converge. For example, if the share price falls to Rs 90 on expiry, you will make Rs 10 (90 - 100) loss in cash market and Rs 12 (102 - 90) futures market. Your net profit will be Rs 2. Similarly, if the share price rises to Rs 100 on expiry, you make Rs 10 (110 - 100) profit in cash market and Rs 8 (102 - 110) loss in future market. Again, your net profit will be Rs 2. This strategy is totally market neutral as shown in the table below.

We present to you the SBI Equity Savings Fund in this category. Let us take a look at the features of this fund.

SBI Equity Savings Fund

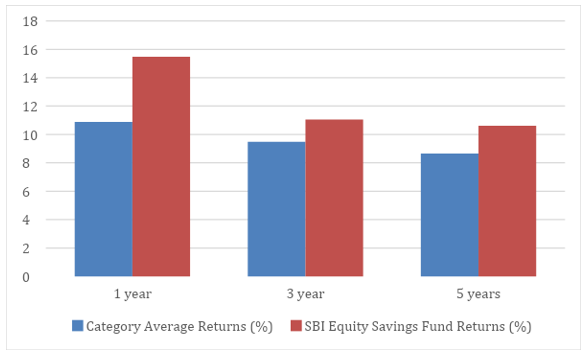

The SBI Equity Savings Fund was launched in May 2015 and has Rs 3,245.48 Crores of Assets under Management as on 30th Nov 2023. The expense ratio of the fund is 1.18% (Regular plan). For redemption of units within 15 days, the fund will charge an exit load of 0.1%. The Regular Growth plan of the scheme has given 8.85% CAGR returns since inception and a CAGR of 10.61% against the 9.32 % returns of Nifty 50 TRI and category average of 8.66% in the last 5 years as on 30th November 2023. See the chart below which represents the performance of the fund when compared to the category average in the 1 year, 3 year and 5-year periods.

(Source: Advisorkhoj Research, as on 30th November 2023)

Considering the volatility of the markets these are reasonably good returns. The fund managers for the scheme are Nidhi Chawla for the Equity portion, Neeraj Kumar for Arbitrage portion - Debt and Mansi Sajeja for the Debt portion of the fund.

The performance of SBI Equity Savings Fund

- Lumpsum investment

If you had invested Rs 10,000/- lumpsum in the SBI Equity Savings Fund at its inception, the value of your investment would be Rs 20,461/- as on 30th November 2023. A lump sum of Rs 10,000/- deposited in Fixed deposit would have become Rs 16,826/- in the same period. The fund has given 8.79% return since inception. - SIP investment

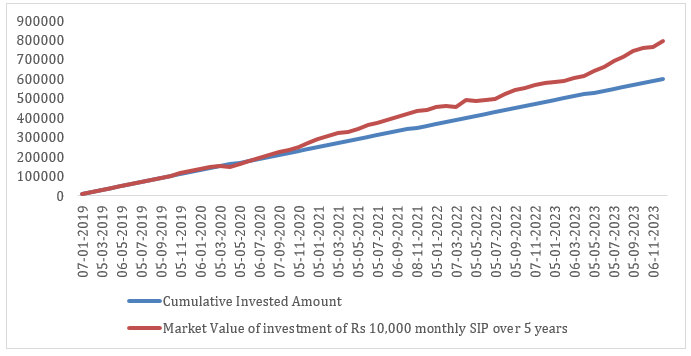

If you had started investing Rs 10,000/- as monthly SIP in the regular plan of the scheme 5 years back, the value of your investment would have been Rs 8,00,551/- (See chart below to see the growth of your invested amount of Rs 6,00,000/-) which is an absolute return of Rs 32.73% and XIRR of 11.71% as on 30th November 2023.

Source: Advisorkhoj Research. Disclaimer: Past performance may or may not be repeated in future.

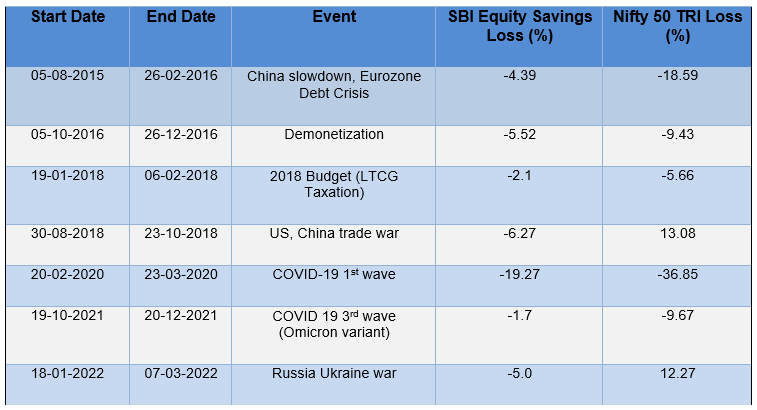

Drawdown Limited Downside risks

The markets have been volatile but the scheme was able to limit drawdowns for investors. The table below shows the biggest market drawdowns since the launch of SBI Equity Savings Fund in 2015.

Taxation details for SBI Equity Savings fund

Short term capital gains (holding period of less than 1 year) in the SBI Equity savings funds are taxed at 15%. Long term capital gains (holding period of more than 1 year) are tax exempt up to Rs 1 lakh in a financial year and taxed at 10% thereafter.

Who should invest in the SBI Equity Savings Fund?

- Investors with a minimum 3–5-year investment horizon.

- Investors with moderate to moderately high-risk appetites who want limited downside risks in volatile markets.

- Investors looking for higher returns compared to traditional fixed income investments with relatively lower volatility compared to pure equity or equity-oriented funds may invest in the SBI Equity Savings Fund.

- Investors in higher tax brackets, who prefer equity taxation

Consult your Mutual fund distributor or financial advisor to understand more about the SBI Equity Savings Fund and how to invest in it.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY