SBI Energy Opportunities Fund NFO review: Investing in India's energy sector

SBI Mutual Fund has launched a new fund offer (NFO), SBI Energy Opportunities Fund on 6th February 2024. This is a thematic fund which will invest in companies engaging in activities such as exploration, production, distribution, transportation and processing of traditional & new energy including but not limited to sectors such as oil & gas, utilities and power. Raj Gandhi and Pradeep Kesavan are the fund managers of this scheme. The NFO will remain open for subscription till 20th February 2024. In this article, we will review this NFO.

Energy sector in India at a glance

- India is among the largest and fastest growing energy markets. India is the third largest energy market after China and the United States (source: SBI MF, CY 2019).

- Our energy consumption mix comprises primarily of coal, oil and natural gas accounting for nearly 75% of our energy consumption (source: SBI MF, CY 2019).

- Renewable energy (e.g. solar, wind, geothermal, biomass etc) currently accounts for 22%. Renewable energy is expected to grow at an accelerated pace due to favourable Government policies (source: SBI MF, CY 2019).

- The national gas grid has grown by 40% over past five year to 23,173 km and is expected to further grow by 25% by FY27. Last mile city gas distribution network has been growing at a high double digit growth (source: SBI MF, FY 2023).

- India is the 5th cheapest producer of solar power and onshore wind power in the world. India has trilogy of solar and wind power peaking at different time of the day plus hydro power availability which acts as an economical and renewable form of battery substitute (source: SBI MF).

Why is the energy theme a long term secular growth story?

- India among the largest and fastest growing energy markets. By 2050, India is expected to be the second largest energy market.

- With a shift from combustion to electrification (i.e. shift to electric vehicles), energy consumption of coal & oil to grow at 6.4% CAGR through 2050.

- India’s natural advantage in green energy to result in India moving from energy deficiency to energy self-sufficiency.

- Stable policies combined with past underinvestment in select segment of value chain could improve cash flows from existing businesses.

- Remunerative realisation for domestic Oil and Gas along with favourable exploration and production policy to encourage growth in domestic production.

- Government targets to increase the share of natural gas from current ~6.5% to 15% by 2030. Accordingly, national gas grid has been expanded by 40% over past 5 years. Emphasis has been laid on expansion of city gas distribution (CGD) networks by bidding out districts covering 95% of the population.

- Impetus on domestic coal production will ensure fuel security. Reforms in power transmission and distribution will ensure that this ecosystem builds the necessary capacity to facilitate growth in efficient manner.

- Redeployment of cash flow from traditional energy business into green energy could enhance value.

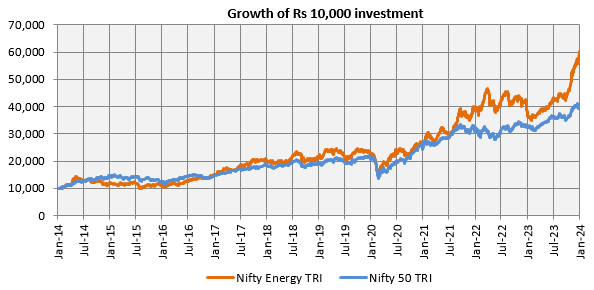

Energy theme has outperformed broad market returns -

The chart 1 below shows the growth of Rs 10,000 investment in Nifty Energy TRI versus the broad market index Nifty 50 TRI

Chart 1

Source: National Stock Exchange, Advisorkhoj Research, as on 31st January 2024

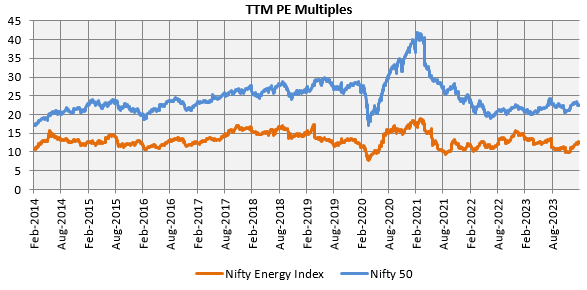

Reasonable valuations

As you can see from the chart 2 below, Nifty Energy Index has been trading at considerable discounts to Nifty despite the outperformance.

Chart 2

Source: National Stock Exchange, Advisorkhoj Research, as on 31st January 2024

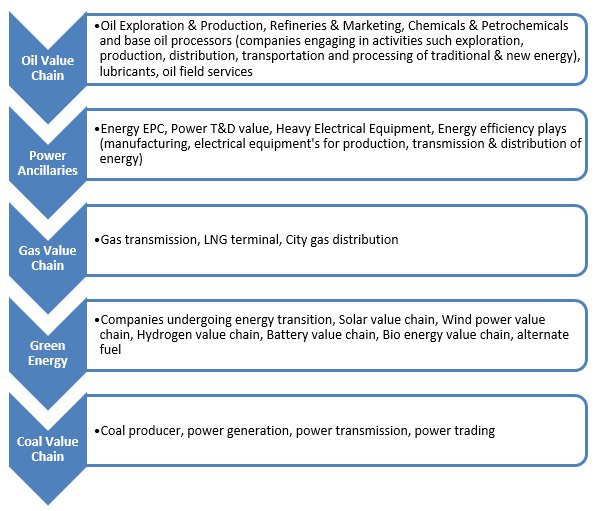

About SBI Energy Opportunities Fund – Investment Universe

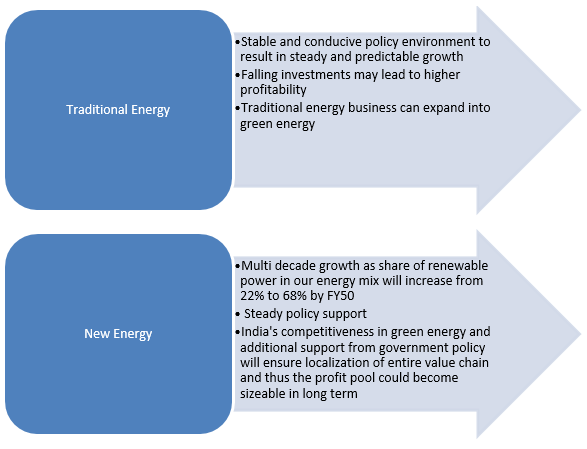

SBI Energy Opportunities Fund – Barbell Investment Strategy

The fund will invest in an optimal mix of traditional & new energy and power utility companies, reducing return volatility and offer better risk adjusted returns.

Recap - Why invest in SBI Energy Opportunities Fund?

- India is expected to be the fastest growing energy market in the world.

- Economic growth is expected to lead to a rise in per capita energy consumption in India.

- Natural advantage in green energy to help India move from energy deficiency to energy self-sufficiency.

- Policy framework for traditional and new energy companies is conducive for growth impetus and stability in earnings.

- Energy segment is underrepresented in the broader market index.

- Valuations are reasonable relative to broad market

Mr. D P Singh, Deputy MD & Joint CEO, SBI Funds Management Limited, says, "The SBI Energy Opportunities Fund is an opportunity to participate in the growth of the India Energy sector. The sector has seen rapid strides in terms of infrastructure and policy reforms, helping improve the profitability of the sector. Historically, energy consumption in an economy is directly linked to economic growth. With our country expected to be the third largest economy in the world, its per capita energy consumption could also witness significant rise and opportunities exist across the entire spectrum of the energy value chain. Investors who believe and seek to leverage this growth journey should look at investing in the fund in line with their risk profile and portfolio needs.”

Who should invest in SBI Energy Opportunities Fund?

- Investors willing to have tactical allocation to overall equity portfolio.

- Investors looking for capital appreciation over long investment tenures from energy theme.

- Investors with very high-risk appetites.

- Investors with minimum 3-to-5-year investment tenures.

- You can invest either in lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors before investing.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY