SBI Arbitrage Opportunities Fund: An Option for Tactical Investors

SBI Funds Management Ltd is a subsidiary of the State Bank of India. Just as its parent bank, this is the largest asset management company in India. Though it has many funds across categories that are doing well, herein let us explore the SBI Arbitrage Opportunities Fund.

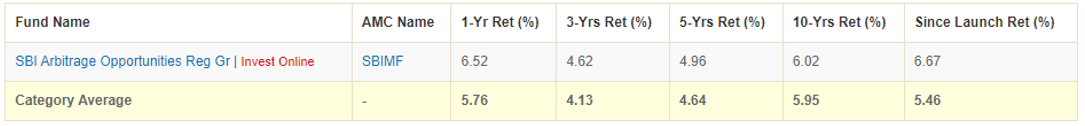

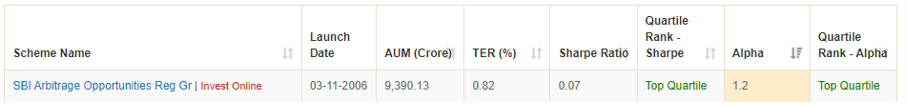

The fund was launched on 03-Nov-2006. The fund manager, Neeraj Kumar, has managed the fund since Oct 2012. The fund’s returns have been among the top quartile in recent times.

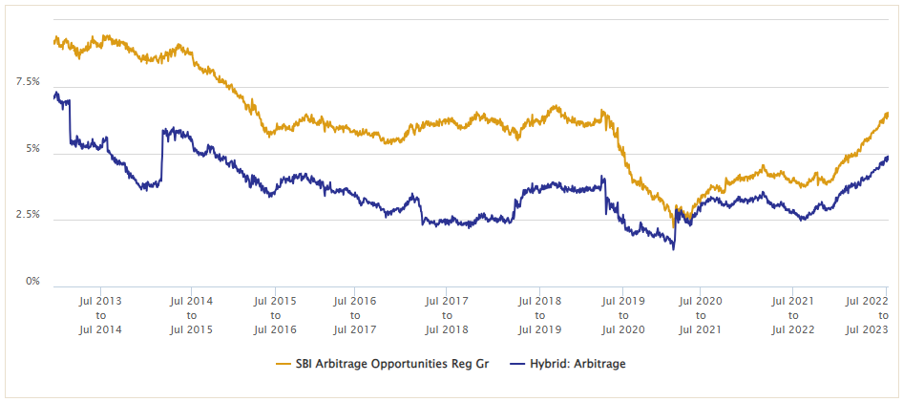

Source: Advisorkhoj.com. To see latest data click on Mutual Funds Performance Comparison - Hybrid: Arbitrage

Deep Dive on Performance

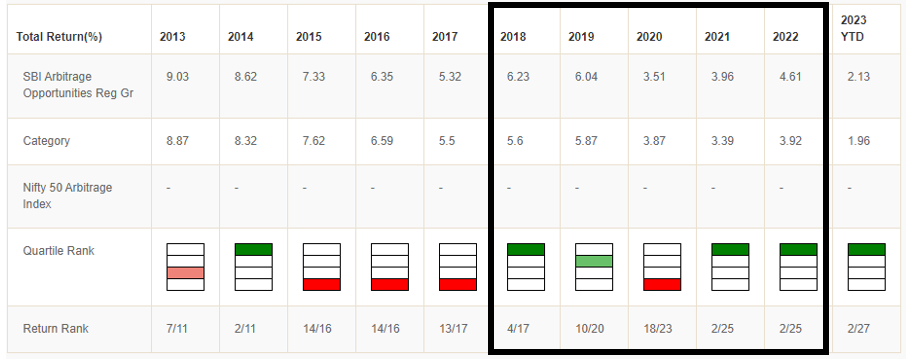

The fund’s year-on-year performance shows how it has, except for 2016,2017 and 2020, the fund has always outperformed its category. On the quartile side also, the fund has recently been outperforming. In the last five years, 2018-2022, it was quartile-1 on three occasions and quartile-2 on one occasion.

Source: Advisorkhoj.com

Also in terms of risk adjusted returns, the fund shows top-quartile performance be it the Sharpe ratio or the Alpha that the fund has generated within its category.

Source: Advisorkhoj.com

On a one year rolling basis for more than 10 years the fund has been outperforming the average of the category with consistency. The only times its performance was close to the average of the category was between Mar-Jul 2020.

Revisiting Basics of Arbitrage Fund

Arbitrage funds are a category of mutual funds that aim to exploit price differentials between cash and derivative markets. These funds capitalise on the price inefficiencies of securities traded in different markets, such as the spot and futures markets. These funds aim to generate profits irrespective of market direction by simultaneously buying low and selling high, making money from the spread between the two.

Suppose a stock ABC is trading at Rs. 100 in the spot market, while its corresponding futures contract is priced at Rs. 105. In this scenario, an arbitrage fund manager would buy the stock in the spot market at Rs. 100 and simultaneously sell the futures contract at Rs. 105. The fund manager locks in a profit of Rs. 5 (105 - 100) per share, regardless of the future movement of the stock price.

Investment Strategy

There are two avenues of returns in the fund. The first is the benefit from the arbitrage opportunities. And then second is from the debt holdings of the investment portfolio. “The scheme hence always runs a hedged position in equities. A minimum of 65% is always invested in such cash-futures arbitrage, with the balance invested in debt and money market securities, including for margin purposes,” says Neeraj Kumar, Fund Manager of SBI Arbitrage Opportunities Fund.

Neeraj elaborated on the opportunities in the market: Finding arbitrage opportunities depends on factors like market efficiency, volatility, liquidity, and the overall macroeconomic environment. During economic uncertainty, market volatility increases; thereby increasing arbitrage opportunities available in the market. The chances of finding high-potential arbitrage opportunities are lower during a stable market environment.

Fund Manager

The Fund is managed by a veteran Fund Manager, Neeraj Kumar. Neeraj joined SBIFM in 2006 as an Equity Dealer. Before joining the SBI Fund Management team, Neeraj was associated with the Life Insurance Corporation of India (LIC) for 10 years. He started as an assistant administrative officer in LIC’s finance and accounts department. After that he worked as an equity analyst for five years and subsequently as a dealer for three years. He is a Commerce graduate from Magadh University and Chartered Accountant from ICAI.

Why invest in Arbitrage Strategies?

- Lower risk: Arbitrage funds are known for their relatively lower risk than pure equity investments. They aim to generate consistent returns irrespective of market direction, providing stability to the investment portfolio.

- Tax efficiency: Arbitrage funds can provide tax-efficient returns due to the favourable tax treatment of arbitrage transactions. The gains from these funds are typically taxed as short-term capital gains, attracting lower tax rates than long-term capital gains. Also these funds are a superior choice against the debt funds.

- Hedging against volatility: Arbitrage funds can hedge against market volatility. They have the potential to generate steady returns even in uncertain market conditions, offering stability to the investment portfolio.

- For better cash management.

Key metrics to consider before investing in Arbitrage Funds.

- Investors investing in an arbitrage fund should consider factors i.e., risk appetite, tax planning and investment horizon.

- Additionally, check the expense ratios and tracking errors

- Looking at the quality of portfolio allocation in debt instruments and debt quants would reveal if there is any credit or duration risk to the fund.

- Looking at the float in equity and the depth of the futures side of the portfolio will help identify the risk.

- Keeping track of the exit loads will help optimize the redemption/switch from arbitrage fund.

A combination of all of these will assist investors with better evaluation of the fund.

Why invest in SBI Arbitrage Opportunities Funds?

- No price risk, since the equity exposure of arbitrage funds is completely hedged.

- There is no credit risk in arbitrage funds.

- There is no counterparty risk since settlement of all futures contracts (including futures contract settlements in arbitrage trades) are guaranteed by the stock exchange

- Potential of getting higher returns than savings bank interest

- SBI Mutual Fund is one of the most trusted names in mutual funds

- SBI Arbitrage Opportunities Fund has a strong 17-year track record

- Advantage of equity taxation in short-term and long term

Who should invest in SBI Arbitrage Opportunities Fund?

- Investors who want higher returns (compared to savings banks) on their short-term funds while enjoying some tax advantage

- Investors who want very low risk for their investment while investing

- Investors in higher tax brackets who want to take advantage of equity taxation

- Investors looking for tactical investment for more than 6 months, meaning they would want to take out the money after 6-months. Arbitrage funds may not be suitable for just a few days or weeks

- Investors should consult with their financial advisor if arbitrage funds are suitable for them

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY