SBI Mutual Fund offers Unidiverse: Four funds, four investment styles, one investment solution

What is diversification?

Diversification refers to building a portfolio with multiple assets to reduce the risk associated with a single asset. For example, a diversified equity fund invests in a portfolio of stocks across different industry sectors and market capitalization segments. Diversification can also mean investments across different asset classes, e.g. equity, debt, commodities etc.

Why do you need a diversified portfolio?

- Asset prices and performances are subject to market risks. If you diversify, the underperformance of a particular asset will only have a limited impact on your investments. Diversification is essential to risk reduction and is one of the most important aspects of financial planning.

- Asset prices always move in cycles. A period of high returns may be inevitably followed by a period of low or even negative returns. Different assets, even within the same asset class, will be impacted differently in different market conditions. Diversification will provide relative stability to your investment portfolio across different market cycles and more consistent returns over long investment horizons.

- Risk and return have a direct relationship – if you take low risk, you will get low returns and vice versa. Diversification is needed for balancing risk and returns, which is essential to meet your financial goals.

- Empirical data suggests that diversification can produce superior risk-adjusted returns.

Why do you need to diversify within an asset class?

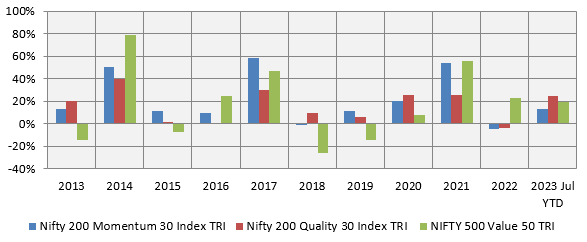

Will a diversified equity fund provide sufficient diversification to your portfolio? The answer is no. Different fund managers have different investment styles/strategies. Different investment styles tend to perform differently in market cycles. For instance, within equities, styles such as momentum, quality and value have seen wide dispersion in returns in any given year (see the chart below). A well-diversified portfolio across different investment styles, e.g. growth, value, contra, quantitative, smart beta, indexing etc., can produce much more consistent performance.

Source: National Stock Exchange, Advisorkhoj Research, as of 31st July 2023

Will investing in multiple mutual fund schemes produce more diversification?

A mutual fund scheme itself is a diversified portfolio of stocks. Theoretically speaking, if you invest in multiple schemes, you will get exposure to more stocks and get more diversification. But is this always true? If you invest in two mutual fund schemes that have a large number of common stocks in their portfolio, then you may not get the desired diversification and may even drag down the performance of your portfolio. How to avoid this? We have built a tool called Portfolio Overlap (please check the link). In this tool, we calculate what percentage of a scheme’s portfolio holdings overlap with another scheme’s holdings. While building a portfolio, the aim should not just be to invest in multiple schemes but to create a portfolio with schemes having a lower allocation to the same stocks, i.e. the schemes should have lower portfolio overlap.

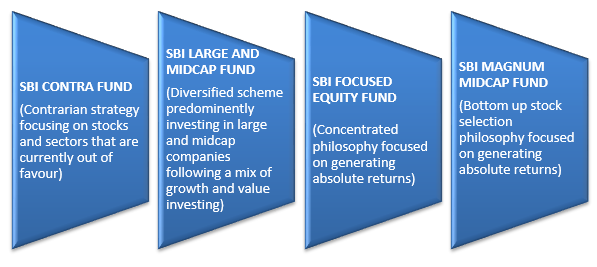

One-stop solution to build a healthy portfolio with 4 schemes with Unidiverse from SBI Mutual Fund

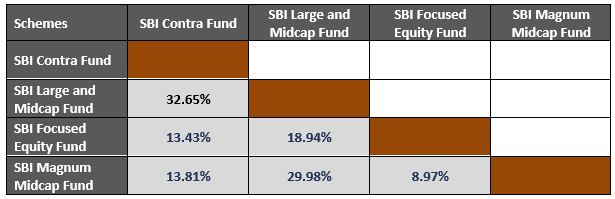

Low Portfolio Overlap

There is low portfolio overlap among the 4 schemes (see the table below). A lower portfolio overlap means the schemes follow distinct investment management strategies/styles, while a higher portfolio overlap signifies similarities in investment strategies/styles. Regular monitoring of portfolio overlap can ensure investments are well-diversified.

Source: SBI MF, as of 31st July 2023

Two schemes will have portfolio overlap if there are common stocks in both the schemes’ portfolios. Two schemes may likely have common stocks because all mutual fund schemes invest in the same universe of stocks. The table above shows how much of a scheme’s portfolio overlaps with another scheme’s portfolio. For example, 32% of SBI Large and Midcap Fund and SBI Contra Fund’s portfolios by value have common stocks. Similarly, 13% of SBI Focused Equity Fund and SBI Contra Fund’s portfolios by value have common stocks. If the portfolio overlap between two schemes in a portfolio is very large, then you will not be getting sufficient diversification, and one scheme may drag down the portfolio performance. Therefore, it is important the schemes in your mutual fund portfolio have low portfolio overlap. You can see in the table above that SBI Contra, Large and Midcap, Focused Equity and Midcap funds have relatively low portfolio overlaps among themselves. Let us discuss these individual schemes in brief.

SBI Contra Fund

SBI Contra Fund is a diversified equity fund that follows the contra investment style. The scheme was launched in 1999 and has Rs 13,631 crores of assets under management (AUM) as on 31st July 2023. The total expense ratio (TER) of the scheme is 1.78%. The fund has a distinct value bias, with portfolio valuations lower than market averages. Investment strategy involves identifying sectors that are currently out of favour, although they have long-term potential. Stock selection involves identifying companies that have strong fundamentals but are available at discounted values owing to short-term performance issues. The scheme has delivered 16.5% CAGR returns since inception (as on 24th August 2023). Click on this link, SBI Contra Fund to know the performance of the scheme, portfolio and other scheme related information.

SBI Large and Midcap Fund

SBI Large and Midcap Fund is a diversified equity fund which invests primarily in large cap (minimum 35% of assets) and midcap stocks (minimum 35% of assets). The scheme was launched in 1993 and has Rs 13,871 crores of AUM as on 31st July 2023. The TER of the scheme is 1.74%. The investment style is a blend of growth and value. Large cap bucket is managed as a benchmark conscious strategy. The objective is to minimize the benchmark risk on stocks with larger weights. The belly and the smaller stocks (constructed bottom-up) generally belong to the mid-cap and small-cap buckets respectively. Stock selection down the capitalization curve is based on buying good businesses at reasonable prices. The scheme has delivered 17.5% CAGR returns since inception (as on 24th August 2023). Click on this link, SBI Large and Midcap Fund to know the performance of the scheme, portfolio and other scheme related information.

SBI Focused Equity Fund

SBI Focused Equity Fund makes concentrated bets in high conviction stocks. The scheme was launched in 2004 and has Rs 29,921 crores of AUM as on 31st July 2023. The TER of the scheme is 1.61%. The fund follows a bottom-up, concentrated (20 – 30 stocks) conviction philosophy focused on generating absolute returns in a long-only context. The investment style is biased towards growth and quality. The fund is sector agnostic; sector active weights are largely a function of stock selection. Stock selection philosophy focuses on an optimal combination of good business and management along with reasonable valuations. The scheme has delivered 18.8% CAGR returns since inception (as on 24th August 2023). Click on this link, SBI Focused Equity Fund to know the performance of the scheme, portfolio and other scheme related information.

SBI Magnum Midcap Fund

SBI Magnum Midcap Fund invests primarily in stocks that are rank 101st to 250th in terms of market capitalization (midcap stocks). The scheme was launched in 2005 and has Rs 11,809 crores of AUM as on 31st July 2023. The TER of the scheme is 1.83%. The fund follows a bottom-up stock selection philosophy focused on generating absolute returns in a long-only context. The fund is sector agnostic; sector active weights are largely a function of stock selection. Longevity of growth, management quality (integrity, passion and execution bandwidth), capital allocation and valuations are factors considered for stock selection. The fund is benchmark agnostic and cash levels are restricted to less than 7%. The scheme has delivered 16.8% CAGR returns since inception (as on 24th August 2023). Click on this link, SBI Magnum Midcap Fund to know the performance of the scheme, portfolio and other scheme related information.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY