Arbitrage Funds: A tax efficient option of parking your short term funds

What are arbitrage funds?

Arbitrage funds are hybrid mutual fund schemes which aim to generate arbitrage profits by exploiting price differences of the same underlying assets in different capital market segments. These funds can also invest in debt and money market instruments. As per SEBI’s directive, arbitrage funds must invest at least 65% of their assets in equity and equity related securities (e.g. stock futures, index futures etc). Since 65% of the assets of these funds are invested in equity and equity related securities, they enjoy equity taxation.

What is arbitrage?

Arbitrage is simultaneous buying and selling the same underlying security in different market segments to make risk free profits. If the price of a security is different in different markets, you can make risk free profits by buying the security in the market where price is lower and simultaneously selling it in the market where price is higher. It is important that both buy and sell transactions are executed simultaneously so that you are not be exposed to price movement risk. Since arbitrageurs aim to make risk free profits the buy and sell positions are totally (100%) hedged.

How does arbitrage work?

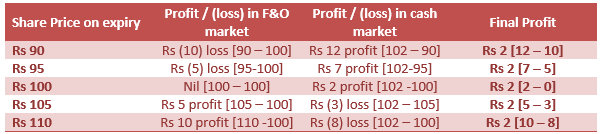

Let us assume that a stock is trading at Rs 100 in the cash market and for Rs 102 in the F&O (derivatives) market. You can lock in risk free profits by simultaneously buying shares of the stock in cash market and selling same number of futures in the F&O market. On expiry of futures, last Thursday of the month (depending on the F&O series), the cash (spot) price and futures price will converge. This strategy is totally market neutral as explained below.

On expiry of the futures the market value of your long (cash) and short (futures) position will be equal in value irrespective of the direction (up or down) of price movement since the initiation of the trades. You can see in the table below that arbitrage profit is the same whether the share price moves up or down. Please note that, fund managers may not wait till expiry to square off their trades. They may square off before expiry depending on the price difference and profit making opportunity.

Disclaimer: Table above is purely illustrative

Arbitrage returns depend on market conditions

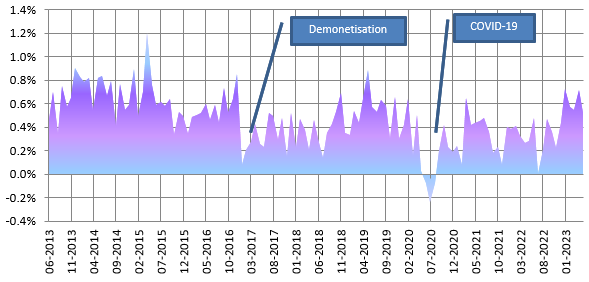

Though arbitrage funds are low risk investments, their returns can vary depending on market conditions. The chart below shows the monthly returns of Nifty 50 Arbitrage Index over the last 10 years (as on 30th April 2023). You can see that, monthly returns were low in bearish market conditions (e.g. demonetization, COVID etc). In extreme market conditions (e.g. COVID-19 first wave), returns may even be negative for a few weeks. Average and median monthly return of Nifty 50 Arbitrage Index over the last 5.5 years was 0.5% (around 6% annualized return), which is higher than savings bank account interest rates on a post tax basis (we will discuss tax implications in details later). However, you should be prepared for short term volatility and remain invested for at least 1 – 3 months in Arbitrage Funds.

Source: National Stock Exchange, Advisorkhoj Research (Period: 01.05.2013 to 30.04.2023). Disclaimer: Past performance may or may not be sustained in the future.

Taxation Advantage

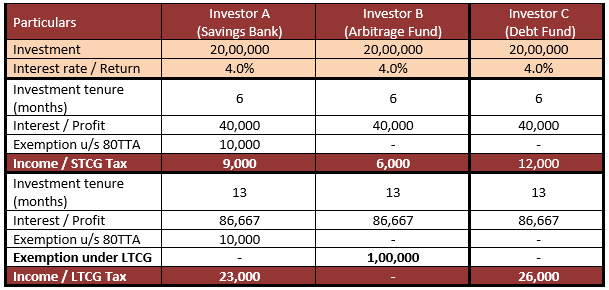

Let us assume that Investor A has Rs 20 lakhs in his savings bank account. The bank pays 4% interest on savings bank account balance. Investor B invested Rs 20 lakhs in an arbitrage fund. Investor C invested the same in a debt fund. Let us assume that all investors are in the 30% tax bracket. Let us compare their post tax returns.

Disclaimer: Table above is purely illustrative. Consult with your financial advisor to know the tax consequences of your investment.

After SEBI removed indexation benefit of below 35% equity portfolios, arbitrage funds can be a good option for HNI/NRI investors wanting to invest short term. Even if the investment is less than a year, the STCG rate of 15% is much better than current debt taxation.

About SBI Arbitrage Opportunities Fund

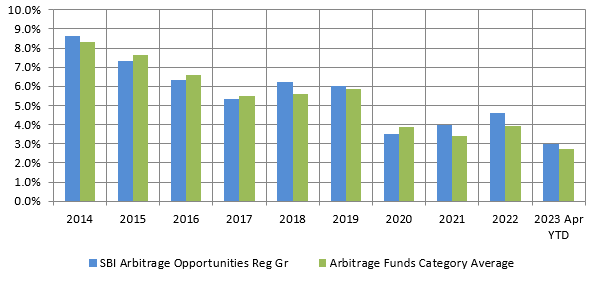

SBI Arbitrage Opportunities Fund is the top performing arbitrage fund in the last 1, 3 and 6 month periods (see our best performing arbitrage funds). The scheme has given 0.6% return in the last 1 month and 3.7% return in the last 6 months. The scheme has a 15 years plus track record and has given 6.6% CAGR returns since inception. The expense ratio of the regular plan of the scheme is just 0.82%. The chart below shows the annual returns of SBI Arbitrage Opportunities fund over the last 10 years versus the category average. You can see scheme was able to outperform the arbitrage funds category on a fairly consistent basis

Source: National Stock Exchange, Advisorkhoj Research (Period: 01.01.2014 to 30.04.2023).

Why invest in SBI Arbitrage Opportunities Funds?

- No price risk, since the equity exposure of arbitrage funds is completely hedged.

- There is no credit risk in arbitrage funds.

- There is no counterparty risk since settlement of all futures contracts (including futures contract settlements in arbitrage trades) are guaranteed by the stock exchange.

- Potential of getting higher returns than savings bank interest.

- SBI Mutual Fund is one of the most trusted names in mutual funds

- SBI Arbitrage Opportunities Fund has a strong 17 year track record

- Advantage of equity taxation.

Who should invest in SBI Arbitrage Opportunities Fund?

- Investors who want higher returns (compared to savings bank) on their short term funds.

- Investors who want very low risk for their investment.

- Investors in higher tax brackets who want to take advantage of equity taxation.

- Investors who have investment tenures of at least 3 month or longer. Arbitrage funds may not be suitable for just a few days or weeks.

- Investors should consult with their financial advisor if arbitrage funds are suitable for them.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY