LIC MF Flexicap Fund: Strong bounce back in performance

LIC MF Flexi Cap Fund is one the oldest diversified equity funds in India. The scheme has a 30 year plus track record. It has been underperforming for several years but recently has made a strong comeback. In the last 6 months, LIC MF Flexi Cap Fund has been a top quartile performer, ranking in the Top 5 funds in the Flexicap category (see our Top Performing Flexicap Funds). LIC Mutual Fund Asset Management Limited has been in the news over the past week or so for its aggressive growth plans.

About LIC Mutual Fund

LIC MF is a PSU Sponsored AMC with stakeholders LIC of India, LIC Housing Finance Ltd, GIC Housing Finance Ltd and Union Bank of India. The AMC was established in 1989; one of the first AMCs to be established when the Government wanted to bring in more players in mutual fund industry after more than 2 decades of monopoly of Unit Trust of India. LIC MF offer a complete basket of products covering ETF, Debt, Equity, Hybrid, Passive and Solution oriented themes. LIC has built a brand which is synonymous to trust.

LIC Mutual Fund, under the aegis of LIC of India, strives to achieve similar level in the Mutual Fund Industry. LIC MF has aggressive plans of transforming itself into one of the largest AMCs in the country. To that effect, the AMC has announced the acquisition of IDBI MF schemes. For expanding distribution reach, the AMC plans to leverage the giant distribution network of its sponsor (LIC insurance agents) especially in Tier 2 and below cities. We think that the growth prospects of LIC MF AMC in the coming years are very promising. The turnaround in LIC MF Flexi Cap Fund performance has nicely coincided with the growth plans of the AMC.

About Flexicap Funds

Flexicap funds are diversified equity mutual fund schemes which can invest across market cap segments. There are no upper or lower limits with respect to allocations to any market cap segment viz. large cap, midcap and small cap. As per SEBI, large cap stocksare the top 100 stocks by market capitalization, midcap stocks are the 101st to 250th stocks by market cap and small cap stocks are 251st and smaller stocks by market cap.

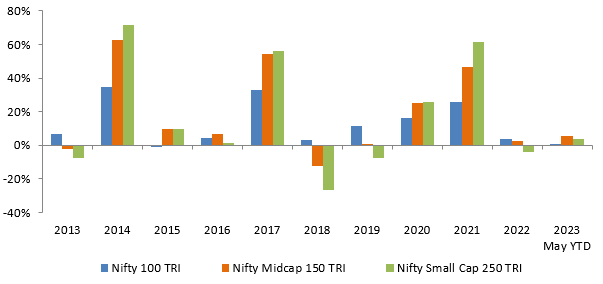

Different market cap segments have different risk / return characteristics. Midcap and small cap stocks can be more volatile than large caps, but they can give superior returns over long investment horizons. Different market cap segments underperform / outperform each in different market conditions (see the chart below). The fund managers of these schemes can invest any percentage of their assets in any market cap segment according to their market outlook. These schemes have wealth creation potential in the long term while balancing downside risks in the short term.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st May 2023

Why invest in equities now?

- Indian economy today is undoubtedly one of the fastest growing economies in the world and more importantly at a size of $3.2T GDP. For the March 2023 quarter India's GDP growth stood at 6.1% compared to 4.5% for China ($18T), 4% for Brazil ($1.6T), 1.6% for United States of America ($23T), 1% for the Euro Zone ($14.5T) or 5.0% for Indonesia ($1.2T), 6.4% for Philippines ($400B) and 3.3% for Vietnam at ($0.4B). Having said that, the current growth rate of Indian economy is still not reflecting its true potential.

- Over the last one and half year the Indian equity market has delivered a flat return. During this period the performance of the equity market was challenged by run-away inflation and sharp rise in interest rates. The rise in the cost of capital led to fall in the equity valuations which dragged the stocks down, however, relatively strong operating performance and strong earnings growth of corporates in the listed space recouped the drag on valuations due to higher interest rates delivering overall flat returns.

- Relatively resilient earnings of corporate India in the recently concluded March 2023 results season coupled with near consensus that Central banks would pause interest rate hike cycle has led to the recent sigh of relief rally in themarket. India’s outperformance in the Emerging Market pack has led to change in FII sentiments about Indian equities and further aided this rally.

- Coming decade is once in a lifetime opportunity for Indian Equities as India occupies a key role in changing global order with strong role in global manufacturing, strong role in new energy order and becomes one of the largest consumption markets by taking up podium position as the 3rd largest economy behind US and China.

Why invest in Flexicap?

- The bulk of the drag on the markets due to high inflation and high interest rates is behind us. However, the double whammy inflation/higher price levels and high cost of capital is resulting into demand slowdown and sluggish economic growth. As demand slows down operating margin recovery from falling commodity prices could get challenged as companies will trade of pricing power to volume growth. This phenomenon has thrown the equity markets into a phase which isgenerally known as earnings downgrade cycle where the key risk is lower than expected corporate profitability. In the quarter ahead, the returns from Indian equity markets will be governed by how this equity downgrade cycle plays out.

- It would be premature to declare, based upon relatively strong earnings performance of March 2023 quarter, that earnings downgrade cycle which market is fearful of wouldnot be meaningful.

- Globally, there are still fears of the US economy getting into recession into the second half of 2023. The poor earnings performance of broader US companies does support this view. Any such global slowdown would be counter-productive for Indian businesses not to mention that consumption side of Indian economy which accounts for near 60% of GDP continues to struggle with the growth. So, investors need to be very watchful of the earnings downgrade cycle which will determine the direction of the stock market.

In context of the risks and opportunities discussed above, a Flexicap strategy may be the most prudent one, taking advantage of growth opportunities as they present themselves in the market while retaining the flexibility of quickly shedding risks if situation so warrants.

Investment strategy

- Investment Style: Blend of Growth, Value, Turnaround, Tactical opportunities.

- Market Cap allocation: Dynamic driven by pricing anomalies and macros across the market cap spectrum. The fund manager has maintained relatively lower exposure to large cap as compared to the benchmark. The portfolio consists of 50-55 stocks and is biased towards sector rotation.

- Portfolio turnover / churn: The portfolio has high churn due to tactical changes as per the changing environment.

- Business Quality: Medium to High Quality business due to Value/ Turnaround / Tactical plays.

Why invest in LIC MF Flexi Cap Fund?

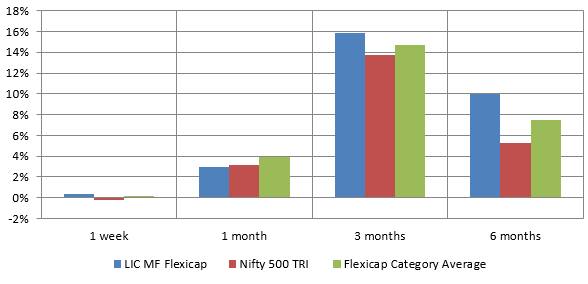

- Strong turnaround in performance in recent past (see the chart below). The scheme has outperformed both the benchmark index and the Flexicap category average.

Source: Advisorkhoj Research

- The recent bounce back in performance is a token of confidence in the fund manager’s investment philosophy, strategies, and stock picking skills.

- The fund manager follows a prudent and pragmatic investment strategy to take advantage of opportunities across market cap segments and industry sectors.

- The fund manager has a judicious approach towards stock selection based on near term risk factors especially high interest rates, slowdown in consumption expenditure and global economic slowdown. The fund manager avoids sectors that may be more vulnerable to the near term risk factors in the post pandemic scenario.

- The fund manager has maintained relatively lower exposure to large cap as compared to the benchmark. The portfolio consists of 50-55 stocks and is biased towards sector rotation.

- The portfolio has high churn due to tactical changes as per the changing environment. The fund manager focusses on Medium to High Quality business.

- The investment strategy of the scheme and turnaround in performance gives us the confidence that the scheme can create alphas for investors over sufficiently long investment horizons.

Whoshould invest in LIC MF Flexi Cap Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with high-risk appetites.

- Investors with minimum 5-year investment tenures.

- Depending on your investment needs, you can invest either in lumpsum or SIP.

Investors should consult their mutual fund distributors or financial advisors if LIC MF Flexi Cap Fund suits their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Multi Cap Fund: Good choice for long term investors in current market

- LIC MF Large and Mid Cap Fund: Strong performance recovery

- LIC MF Multi Asset Allocation Fund: Create long term equity wealth with low volatility

- LIC MF Balanced Advantage Funds: Good risk return trade off with relatively lower volatility

- LIC MF Value Fund: Good fund in volatile market

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY