Investing for the future of your children: SBI Magnum Childrens Benefit Fund

Children’s future is the most important concern for all parents. Child’s higher education, career and marriage are among the most important milestones of the life-stage of investors. With growing economic opportunities in the country, aspirations are also changing compared to what it was one or two generations back. In the past, parents wanted their children to have secure professions like engineers, doctors and chartered accountants etc. and children would usually want to fulfil their parent’s aspirations. Now with rising prosperity and increasing exposure to global media and technology trends, children’s aspirations are changing and want to follow their dreams. Some want to be an artist, a musician, film maker, pursue a career in sports or become an entrepreneur.

Why you need to plan for your children’s future?

Your child has the right to dream big and you should support their dreams. But parents have to be realist. You need to think about how much you need to save and invest to help your child fulfil his / her aspirations. It is important to factor in inflation while planning for your children’s future. Cost of higher education is increasing at a faster rate than normal inflation rate. You also should think of how to protect your children’s future against unforeseen exigencies which can result in you falling short of your goal for your children.

How to plan for your children’s future?

- Make an investment in your child’s name: One of the biggest mistakes most people make is saving money in a general purpose bank account and withdrawing money from it in an ad-hoc basis whenever you want. Financial advisors suggest that you have separate investments for specific financial goals, so that you can keep track of how much you have accumulated for each goal. By making an investment in your child’s name you have a separate fund for your child. It also will create mental accounting bias which can help you remain disciplined and dedicated for your child’s needs. Since the investment is tied to your child’s name, you will frame your behaviour to use these funds only for your child and not for any otherfinancial requirement.

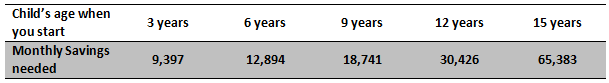

- Start investing early: One of the most important factors of investing is time. By starting early you give your investments more time to compound and grow to a larger corpus. Early start also enables you to reach your financial target with comparatively less monthly savings. Let us assume you want to save Rs 25 lakhs at today’s prices for your child’s higher education when he turns 18. Let us assume that annualized return on investment is 10% and inflation rate is 3%.

The table below shows how much you need to save on a monthly basis to reach your goal depending on when you start investing. You can see that with an early start you can reach your goal with much smaller monthly savings. You may try this calculator

![Mutual Funds - Early start you can reach your goal with much smaller monthly savings Mutual Funds - Early start you can reach your goal with much smaller monthly savings]()

Disclaimer: This example is purely illustrative. Past performance may or may not be sustained in the future

- Do not withdraw your money from your child’s investment for any other purpose: Money needs to remain invested in order to grow. If you withdraw money earmarked for your child’s future for any other purpose, then you will lose some of the benefits of compounding and fall short of your goal.

For example, let us assume, to meet a goal of Rs 25 Lakhs when your child turns 18 (his present age is 3 yrs), you have been saving Rs 6,032 monthly. Now let us assume that, you withdraw Rs 5 lakhs from your child’s funds when he was 10 years old in order to make a down-payment for a house purchase. Even if you continue with your SIP till your child turns 18, you will fall short of your target by Rs 11.26 lakhs even though you withdrew only Rs 5 lakhs (Disclaimer: This example is purely illustrative. Past performance may or may not be sustained in the future). This is because you lost a lot of benefits of compounding when you withdrew the sum. The solution is to set up a dedicated fund for your child’s goals. - Stay invested for the long term: You need to start early and remain to have invested for the long term to meet your child’s goals. Do not stop your monthly SIP or switch to safer options. With increase in salary and savings, increase your SIP amounts using annual top-ups. You have to be disciplined in your savings and investments to meet your long term financial goals.

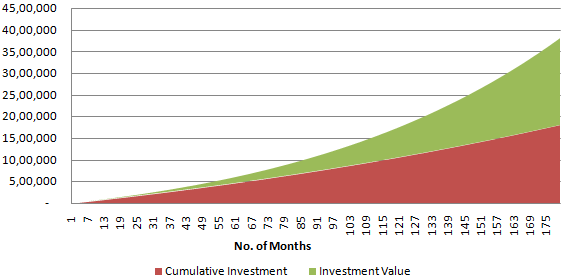

The chart below shows the growth of Rs 7,000 monthly SIP with 5% annual top-up. Assuming annualized return of 10%, accumulated corpus in 15 years will be Rs 38 lakhs. Without top-up you would accumulated a corpus of Rs 29 lakhs. You can see that the top-up is a powerful tool for wealth creation (Disclaimer: This example is purely illustrative. Past performance may or may not be sustained in the future)

![Mutual Funds - Growth of Rs 7,000 monthly SIP with 5% annual top-up Mutual Funds - Growth of Rs 7,000 monthly SIP with 5% annual top-up]()

Disclaimer: This example is purely illustrative. Past performance may or may not be sustained in the future

- Choosing option in sync with your risk-reward expectations: The choice of investment depends on many factors like age of your child, amount you can invest regularly, target corpus required in the future, risk tolerance levels, Corpus already accumulated and earmarked for future use, and Inflation expectations over the entire tenure. You should consult with your financial advisor to select the investment that is most suitable for your needs.

Concerns of parents

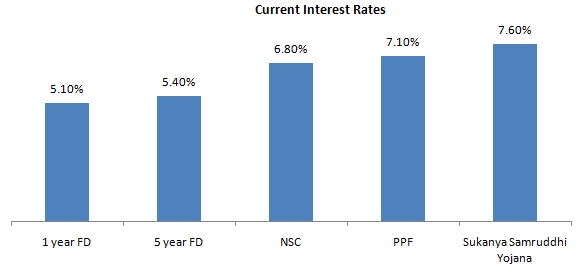

As per an insurance survey, 35% of parents worry that they may not be able to fund their children’s higher education. Rising cost of higher education is the primary concern. Cost of higher education for courses like MBA, Medical, Engineering and Law are increasing at 10% annually. Assuming a similar trajectory of increase, a course which costs Rs 15 – 20 lakhs at current prices now will cost Rs 60 – 80 lakhs 15 years later. Returns from traditional fixed income investments may not be sufficient to meet your child’s financial goals. Further, the interest rates have been declining on a secular basis over the past 20 years and are expected to fall further – Please see the chart below.

Source: SBI MF, Disclaimer: Interest rates may change in the future

Equity as an asset class can be a solution for your child’s long term goals

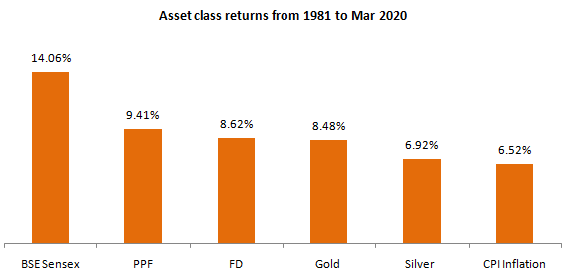

Historical data shows that equity as an asset class has outperformed other asset classes over long investment tenures. The chart below shows annualized returns of different asset classes from 1981 to March 2000. Equity is clearly the big winner.

Source: SBI MF, Disclaimer: Past performance may or may not be sustained in the future

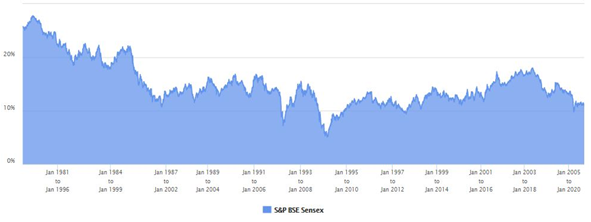

Though equity as an asset class can be highly volatile in the short term, volatility reduces over the long investment tenures. The chart below shows 15 year rolling returns of BSE Sensex from 1981 to 11th September 2020. You can see over any 15 year period, Sensex never gave negative return. Average 15 year rolling returns of Sensex over last 40 years was 14.83%. Sensex gave more than 8% annualized returns over 15 year investment periods in 98% of the instances over the last 20 years.

Source: Advisorkhoj Research

SBI Magnum Children’s Benefit Fund

SBI Magnum Children’s Benefit Fund is an open-ended fund for investment for children having a lock-in for at least 5 years or tillthe child attains age of majority (whichever is earlier). Minor represented by guardian (natural/legal) only, can invest inthe name of the child. The minor child needs to have a bank account. Payments will be accepted only from the minor’s account or from the joint account of the minor and guardian. When the minor becomes a major, then the he / she will be required to complete KYC.

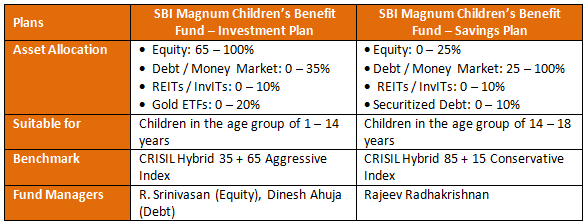

The fund has two plans:-

Conclusion

Children’s future is the most important priority of any parent. In order to ensure success of your / your children’s aspirations, you should have a plan and remain committed to it. SBI Children’s Benefit Fund is a good solution for child’s investments. You can invest in this fund either in lump sum or through SIP till your child is 18 years old. Select which plan, Investment or Savings is suitable for you based on the various considerations discussed earlier in the article. You should always consult with your financial advisor, if you are in any doubt which plan will be more suitable for you.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY