Should you invest in SBI IT and Private Banks ETFs

ETF or Exchange Traded Fund is an instrument which invests in the basket of securities that, reflects the composition of a market index like Nifty, Sensex, Nifty – 100, etc. ETFs aim to replicate the performance of an index as closely as possible. Unlike actively managed funds, ETFs do not aim to beat the market. After the NFO subscription period, investors can buy or sell units of ETFs in stock exchanges, like shares of companies. Investors can also buy or sell ETF units in lot sizes directly with the AMCs. Investors need to have a demat account and trading account to invest in ETFs.

Advantages of ETFs versus actively managed funds

- The biggest advantage of ETFs is low cost. The expense ratios of ETFs are much lower than actively managed equity funds. For the same performance, lower expense ratios imply higher returns for investors.

- There is no unsystematic risk in ETFs because they invest in the entire basket of stocks in the index they are tracking. Even though actively managed funds also aim to reduce unsystematic risks by diversifying into a sufficiently large number of stocks, they do not eliminate unsystematic risks totally because they are over-weight / under-weight on some stocks versus to benchmark index in order to create alphas.

- ETFs offer more convenience to investors since they are traded in stock exchanges. For example, if you are buying or redeeming mutual fund units, your transaction will be executed at the end of day NAV if your order is placed before 1 PM and at next day’s NAV if the order is placed after 1 PM. In either case, you do not know the NAV at the time of placing the order. In ETFs, you know exactly what price you are buying or selling when you are placing the order, because transaction will be executed at real time prices.

SBI MF ETFs – IT and Private Banks

SBI MF has launched two thematic ETFs – one for the IT sector– SBI ETF IT - and another one for the Private Bank sector – SBI ETF PRIVATE BANK. The underlying benchmark indices of these two ETFs are Nifty IT Index and Nifty Private Bank Index. The two ETFs will invest in basket of stocks to replicate these two indices. Each of these indices comprises of 10 stocks. The ETFs will not aim to beat their respective benchmark indices. Let us next discuss about these two indices so that you can understand the risk / return characteristics of the underlying portfolios.

Nifty IT Index

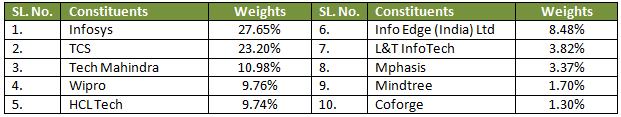

The NIFTY IT index captures the performance of the Indian IT companies. The NIFTY IT Index comprises of 10 companies listed on the National Stock Exchange (NSE). The NIFTY IT Index is computed using free float market capitalisation method and is rebalanced semi-annually. The index constituents and their index weights are as follows:-

Nifty it index fund, nifty it index mutual fund, nifty private bank index fund, nifty private bank index etf

Source: SBI MF

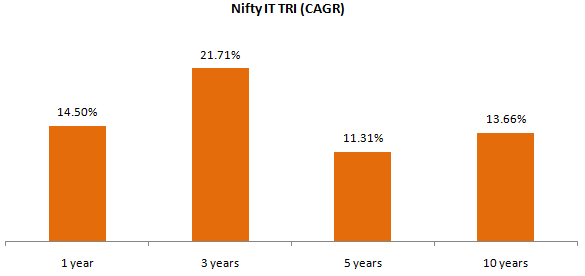

The chart below shows the 1 year, 3 years, 5 years and 10 year returns of Nifty IT Total Returns Index (TRI). You can see that the index has delivered strong returns over different investment periods

Source: SBI MF, as on 31st August 2020. Disclaimer: Past performance may or may not be sustained in the future

Why invest in Nifty IT Index

- Nifty IT Index is one of the best performing industry sectors in the country with revenues of $191 billion (exports + domestic) growing at CAGR of 7.7%

- IT Export revenues is $147 billion growing at CAGR of 8.1%

- There is huge exports growth potential as India is the number 1 destination in Asia (and 2nd globally) for new innovation centres.

- India is also the 2nd fastest growing data centre region in all of Asia Pacific.

- Share of digital (technology macro-trend of the future) in 26 – 28% indicating huge growth potential.

- The IT sector can benefit from key Government initiatives like JAM trinity (Jan Dhan, Aadhaar and Mobile to enable digitization across industries), Bharat Net (which aims to provide high speed internet to 625,000), push for digital payments (which can reach a size of $1 Trillion by 2023), investments in Smart Cities, Open FDI policy (up to 100%), National e-Governance Plan etc.

- The IT sector market size is expected to grow from $191 billion (FY 2020E) to $350 billion (FY 2025E).

- The COVID-19 pandemic has magnified the extent of reliance on technology in every aspect of life and business. It will provide an impetus on the adoption of technology.

Nifty Private Bank Index

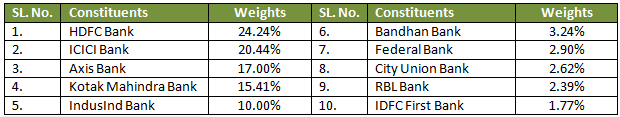

The NIFTY Private Bank index captures the performance of banks from private sector. The NIFTY Private Bank index comprises of 10 companies listed on the National Stock Exchange (NSE). The NIFTY Private Bank index is computed using free float market capitalisation method and is rebalanced semi-annually. The index constituents and their index weights are as follows:-

Source: SBI MF

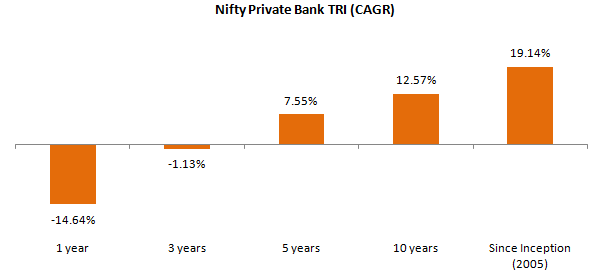

The chart below shows the 1 year, 3 years, 5 years and 10 year returns of Nifty IT Total Returns Index. You can see that though returns have been negative over the last 1 year due to the COVID – 19 pandemic and also the recent credit crisis, the index has delivered strong returns over long investment periods.

Source: SBI MF, as on 31st August 2020. Disclaimer: Past performance may or may not be sustained in the future

Why invest in Nifty Private Bank Index

- The banking sector is one of the most important sectors and is closely intertwined with the economy. The Indian economy cannot grow without growth in banking sector and vice versa.

- The private banking sector has seen good growth historically and is not as severely affected by the NPA issues as public sector banks.

- Though the sector has struggled with credit issues in the recent past, there is huge growth potential because of the under-penetration of credit markets in India relative to other economies.

- The Government and RBI have taken a number of steps to accelerate pickup in corporate Capex. This is in turn will lead to higher revenues and earnings for private banks.

- The Government’s focus on financial inclusion will bring more people under the banking system.

- Increasing financialisation i.e. shift in household savings from physical to financial assets will bring more liquidity and increase demand for bank products.

- The sector will also benefit from the digitization (shift towards digital payments) initiatives of the Government.

- The banking sector has underperformed versus the Sensex over the last one year or so. This has resulted in relative valuations correcting to levels from which we have seen strong bounce in share price performance in the past e.g. 2013.

- The Government and RBI have announced a number of measures to help MSMEs and NBFCs. These measures will help the banking sector in alleviating stress on asset quality and increase credit off take.

About the SBI MF ETFs

Both the SBI MF ETFs, SBI ETF – IT and SBI ETF – Private Banks were launched on 6th October. The NFO will close on 13th October 2020.

The minimum subscription amount is Rs 5,000 and in multiples of Re 1 thereof. Creation unit size of SBI ETF-IT is 4,000 units and in multiples thereof and that of SBI ETF – Private Banks is 8,000 units. This means you can redeem units of SBI ETF-IT and EBI ETF – Private Banks directly with the AMC in lot sizes of 4,000 and 8,000 units respectively, or their multiples thereof. However, after the NFO closes, you can buy or sell any number of these units on the stock exchanges.

You can get exposure to IT and Private Bank sectors through these two ETFs, according to your investment needs. You need to have high risk appetite for both these ETFs.

In our view, you can boost your portfolio returns by adding any one or both of these ETFs to your portfolio. However, you need to have sufficiently long investment tenures for both these ETFs. Investors should consult with their financial advisors if either of these two ETFs - SBI ETF – IT and SBI ETF – Private Bank or both the ETFs are suitable for their investment needs. Read the scheme related documents carefully before investing.

Download KIM - SBI ETF PRIVATE BANK

Download PRESENTATION – SBI ETF PRIVATE BANK

Download KIM - SBI ETF IT

Download PRESENTATION – SBI ETF PRIVATE BANK

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY