SBI Multicap Fund: Off to a great start

SBI Mutual Fund launched SBI Multicap Fund in 2022. The fund will complete 3 years in March. Though it is still a relatively young fund, the performance of the fund in the last 2 years or so has been quite encouraging since it has outperformed its peers across different market conditions. The fund has bucked the fall relatively better amongst peers in the recent market drawdowns, managing to stay in the 1st and 2nd quartile all through.

Current market context

The market has been quite volatile in the past month or so, weighed down by global factors. The Nifty fell by 1,600 points to close at 24,205. The Sensex slumped nearly 5,000 points to close below the psychologically important 80,000 level. The market breadth was negative as the broader market underperformed versus the Nifty. Uncertainty about US Presidential election results and the Fed monetary policy stance were the main factors behind weakening global risk sentiments. Though the US elections are now behind us and markets rallied on the news of Republican win, the uncertainty regarding timing and quantum of rate cuts still remain. As a result, weakness continues to prevail in Indian equity market.

Why Multicap now?

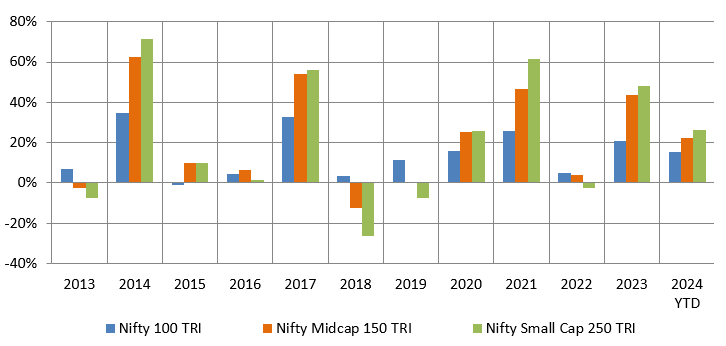

- Different segments of the market outperform each other in different market conditions (see the chart below). Large caps usually outperform small and midcaps in bear markets. Midcap and small cap stocks tend to outperform in bull markets.

Source: National Stock Exchange, Advisorkhoj Research, as on 31.10.2024. Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may not be sustained in the future

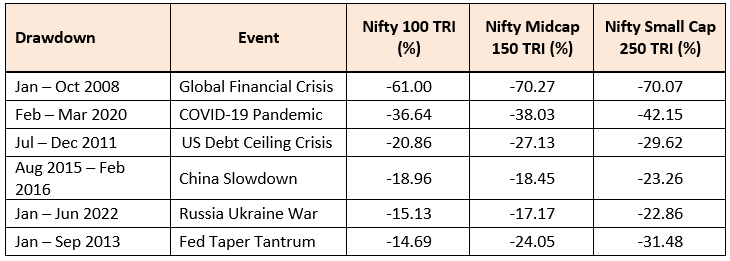

- Lower downside risks: The table below shows the 6 biggest drawdowns in the market in the last 20 years and the impact on various market capitalization segments. You can see that large caps are considerably less volatile than midcap and small cap stocks. Multicap funds can have 50% allocation to large caps.

Source: National Stock Exchange, Advisorkhoj Research (as on 31st October 2024). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

- Potential of generating alphas: Large cap stocks have high percentage of institutional ownership, are more researched and therefore have better price discovery. Opportunities of alpha creation are higher in midcaps and small caps, which are less researched compared to large cap stocks. Multicap fund managers may be able to find quality mid and small cap stocks at attractive valuations, thereby creating alphas for investors over long investment horizons.

- Wealth has grown across all segments: Wealth has grown 2.4 to 4.9 times across all three market cap segments i.e. large cap, midcaps and small caps over the last 10 years. Though large caps have traditionally been favoured by retail investors, historical returns show the wealth creation of potential of equity as an asset class across all three market cap segments.

- India Growth Story is for all segments: The long term structural India Growth Story is not about any one market cap segment. The elements of the India Growth Story e.g. consumption growth, rising per capita income, Atmanirbhar Bharat / Make in India, shift from unorganized sectors to organized sectors, digitalization etc, spans across all three market cap segments and multiple industry sectors. Multicap funds are well positioned to capture the long term growth opportunities in India’s journey to Viksit Bharat.

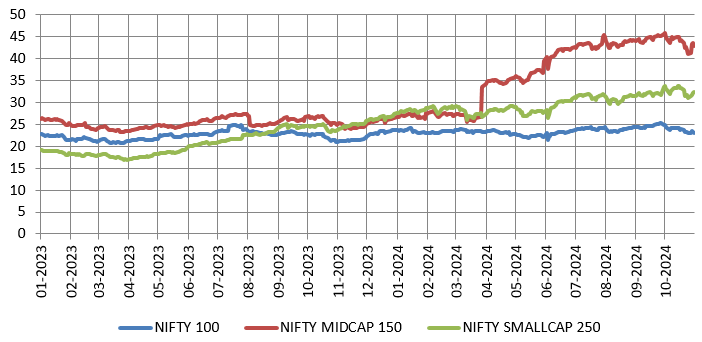

Midcaps and small caps are trading a premium to large cap valuations

Source: National Stock Exchange, Advisorkhoj Research (as on 31st October 2024).

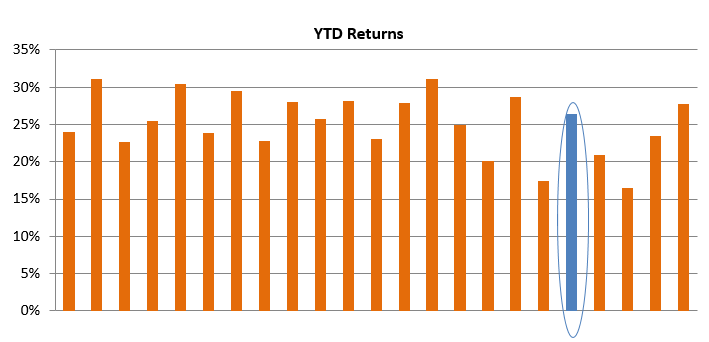

SBI Multicap Fund outperformed peers in 2024 YTD

The chart below shows the YTD returns of multicap funds, which have completed 1 year. You can see that SBI Multicap Fund (marked in blue) outperformed most of its peers to rank in the top 2 quartiles. The performance is credit worthy because 2024 saw spurts of high volatility.

Source: Advisorkhoj Research, SBI Mutual Fund, as on 31st October 2024

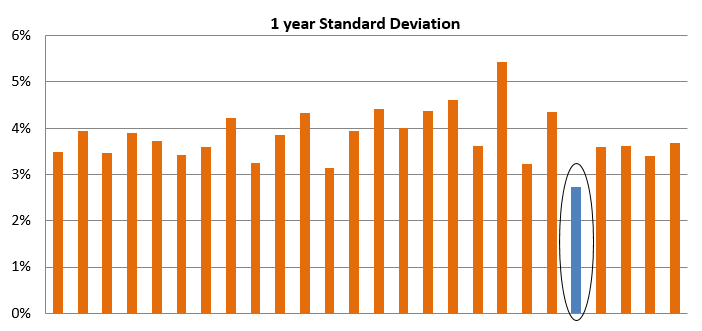

Lower volatility compared to peers

The chart below shows the 1 year standard deviation of multicap funds. Standard deviation is a measure of volatility of returns. You can see that SBI Multicap Fund (marked in blue) had the lowest volatility among its peer funds.

Source: Advisorkhoj Research, SBI Mutual Fund, as on 31st October 2024

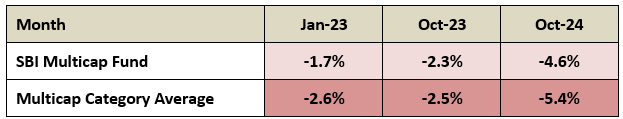

Lesser downside risk – smaller drawdowns than peers

The table below shows the months in which the market was down since the beginning of 2023. You can see that in most months SBI Multicap Fund was able to limit downside risks for investors more than the peer average.

Source: Advisorkhoj Research, as on 31st October 2024

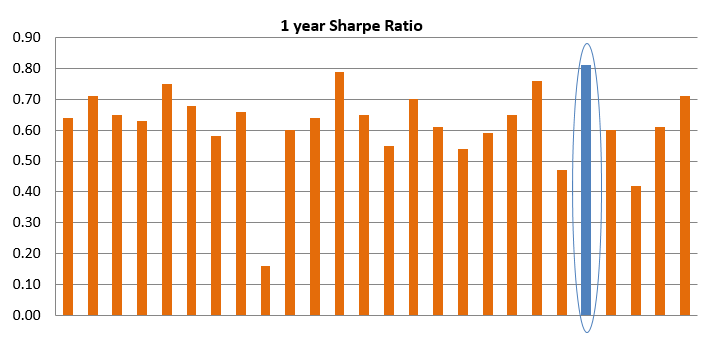

Superior risk adjusted returns

Sharpe ratio is a measure of risk adjusted returns. The chart below shows the 1 year Sharpe Ratio of multicap funds. You can see that SBI Multicap Fund (marked in blue) had the highest Sharpe Ratio (i.e. highest risk adjusted return) among its peer funds.

Source: Advisorkhoj Research, SBI Mutual Fund, as on 31st October 2024

Investment strategy of SBI Multicap Fund

- Unconstrained, sector agnostic approach

- Active Stock Management with Bottom-up strategy

- High Conviction Play through Analyst Portfolio

- Style Agnostic with broader opportunity set for stock selection

- Strong pedigree of Investment Expertise across market cap

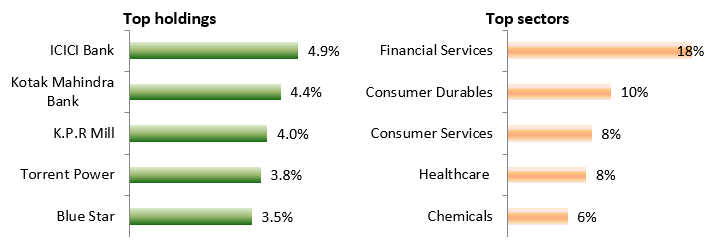

Current portfolio positioning

Source: SBI Mutual Fund, as on 31st October 2024

Who should invest in SBI Multicap Fund?

- Investors who are looking for capital appreciation over long investment horizon

- Investors with high to very high risk appetites

- Investors with minimum 5 years investment tenures

- You can invest in this scheme either in lump sum or SIP depending on your investment needs

- Investors should consult with their financial advisors or mutual fund distributors if SBI Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

- SBI Contra Fund: Great wealth creation track record

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY