Navigating market uncertainties: A case for hybrid mutual funds

Current market context

Indian equities closed July 2024 at record highs, continuing its strong bull run since 2023. The Sensex closed July above the 80,000 level. Nifty also made record high, closing near the 25,000 mark. The rally was broad based with midcaps and small caps outperforming large caps. Nifty Midcap 150 and Nifty Small Cap 250 TRI have given nearly 28% and 27% YTD returns respectively in 2024 (as on 31st July 2024, source: NSE). Bullish global risk sentiments (S&P 500 at all-time high), as well as strong macro position (estimated 7% GDP growth in FY 2025 and narrowing fiscal deficit, estimated at 4.9% of GDP, source: IMF, Union Budget 2024) have supported Indian equities.

As far as the bond market is concerned, yields have declined across the curve and the curve has steepened indicating mean reversion. In the Union Budget 2024, the finance minister said that Government borrowing for FY 2025 will be Rs 1.4 lakh crores less than what was estimated in the interim Budget. This may lead to further softening of bond yields. The Federal Reserve Chairman Jerome Powell indicated that rate cuts will be on the table in the September FOMC meeting. In the commodity markets, Gold rallied by 32% in 2022 and 2023. Gold rallied by a further 9.7% in 2024 but has been flattish for the last 2 months due to the strong US dollar.

Nifty valuation, at TTM PE multiple of 23.4 (as on 31st July 2024, source: NSE) is not in the expensive zone relative to historical average PEs, but valuations may be over-heated in certain pockets of the market. In terms of global factors at play, US economy slipping into recession can be a major risk factor for global equities. The unwinding of Yen carry trade can also cause volatility in the short term. In these market conditions, with stock prices at all-time highs and near-term risk factors, asset allocation can play an important role in bringing stability to your investment portfolio in uncertain markets. In this article, we will discuss about hybrid funds which provides tax efficient asset allocation solutions to investors of different risk appetites and investment needs.

Benefits of asset allocation

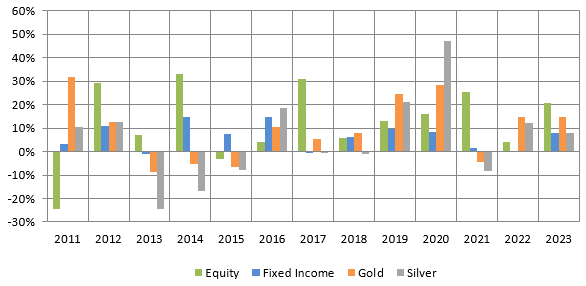

- There is low correlation between returns of different asset classes in different market conditions; equity and precious metals (e.g. gold) are usually counter cyclical to each other i.e. gold outperforms when equity underperforms and vice versa (see the chart below). Equity and gold have low correlation with fixed income.

Source: Advisorkhoj Research, As on 31st Dec 2023, Equity: Nifty 50 TRI, Debt: Nifty10 Year Benchmark G-Sec Index, Gold: MCX Spot Price, Silver: MCX Spot Price. Disclaimer: Past performance may or may not be sustained in the future

- Asset Allocation will provide stability to your investment portfolio viz. if one asset class underperforms, the outperformance of another asset class will balance the downside risk.

- Behavioural biases impact the actual returns you get from your investments. Greed and fear are the two most common behavioural biases and influence investment decisions. Irrational euphoria in bull markets and panic in bear markets causes great harm to your long-term financial interests. Asset allocation will keep you disciplined in your investments.

- When equities are rallying, asset rebalancing will prevent your asset allocation getting skewed towards a particular asset class and reduce downside risks. Similarly, in market corrections, asset rebalancing will help you take advantage of attractive valuations and generate potential risk adjusted returns for your portfolio.

- A 1986 study done in the United States showed that asset allocation is the most important determinant of portfolio performance (source: Brinson, Hood, Bee bower, Financial Analyst Journal 1986).

- Different investors have different financial goals and risk appetites. Your asset allocation depends on your risk appetite and investment goals. Accordingly, different investors may have different asset allocations. You should consult your financial advisor if you need help in determining your optimal asset allocation.

- Your asset allocation will change over time with changes to your risk profile and as you approach different life-stage goals.

Types of asset allocation strategies

- Fixed asset allocation – In this asset allocation strategy the allocation to different asset classes are fixed within a certain ranges. The fund manager will stick to the asset allocation ranges, irrespective of market conditions.

- Dynamic asset allocation – In this asset allocation strategy, the fund manager will dynamically change the asset allocation depending on market conditions. In certain market conditions the fund manager may have high allocations to equity and in certain market conditions the fund manager may have low allocation to active (unhedged) equity.

- Tactical asset allocation – In this asset allocation strategy, the core asset allocation strategy may be fixed, but the fund manager may have the flexibility to exceed the fixed asset allocation ranges to capture market opportunities e.g. momentum.

What are hybrid funds?

Hybrid funds are mutual fund schemes which invest in two or more asset classes e.g. equity, fixed income, gold etc. There are different types of hybrid funds with different asset allocation strategies which provide solutions for a wide variety investment need and a range of risk appetites:-

Suggested reading: Importance of investing in hybrid category of mutual funds

- Aggressive hybrid funds: These hybrid funds invest 65 - 80% of their assets in equity and equity related securities and 20 – 35% of their assets in debt and money market instruments. In terms of risk profile, these funds are the most aggressive compared to other hybrid funds.

- Balanced hybrid funds: These hybrid funds invest 40 - 60% of their assets in equity and equity related securities and 40 - 60% of their assets in debt and money market instruments. An AMC is allowed to offer either aggressive or balanced hybrid fund, but not both.

- Balanced Advantage funds: Also known as Dynamic Asset Allocation Funds, these funds dynamically manage their asset allocation; there is no upper or lower limit for equity or debt allocations. Dynamic asset allocation or balanced advantage funds are usually less volatile than aggressive hybrid funds. You may like to read in detail what are Balanced Advantage Funds

- Equity savings funds: These hybrid funds can partially hedge their equity allocation using derivatives, while maintaining gross equity allocation of at least 65%. These funds must invest at least 10% of their assets in debt and money market instruments. Equity savings funds must mention their minimum hedged and un-hedged equity exposures in their Scheme Information Documents (SIDs). A big advantage of equity savings funds is that they enjoy equity taxation even with fairly low net long equity exposures because of the arbitrage component.

- Multi asset allocation funds: These hybrid funds can provide exposure to three or more asset classes e.g. equity, debt, gold, international equity, real estate investment trusts (REITs), infrastructure investment trusts (InvITs) etc. Multi asset allocation funds must invest at least 10% each in three asset classes e.g. minimum 10% in equity, minimum 10% in debt and 10% in commodities. You may also like to read why one should consider gold as a part of portfolio considering their prices in the current situation.

- Conservative hybrid funds: These hybrid funds invest 75 - 90% of their assets in debt and money market instruments and 10 – 25% of their assets in equity and equity related securities. These funds can be suitable for investors with moderately low to moderate risk appetites and at the same time get equity kicker for inflation adjusted returns.

- Arbitrage funds: These hybrid funds can fully hedge their equity exposure using arbitrage strategy. Arbitrage funds must maintain gross equity allocation of at least 65%. Maximum investment in debt and money market instruments is capped at 35%. These funds are suitable for parking your surplus funds for a few months since the risk is low. The main advantage of these funds compared to low-risk debt funds is that arbitrage funds enjoy equity taxation.

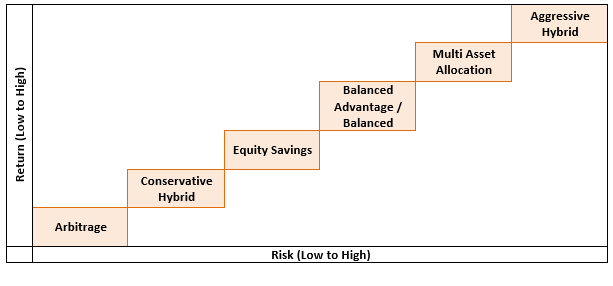

Risk Return Profile

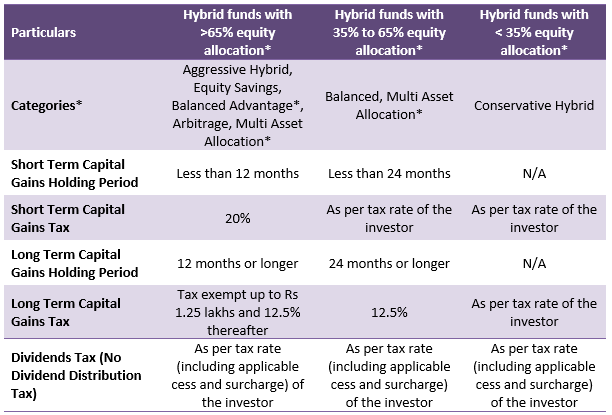

Taxation of hybrid funds

The Government made a number of changes to capital gains taxation in the Union Budget of 2024. The table below summarizes the taxation of hybrid funds. Please note that this table is for general guidance – different schemes within the same category may have different tax consequences.

*Investors should consult with their financial advisors to know the tax treatment of their hybrid funds. Disclaimer: The table is purely for the purpose of investor education to illustrate the taxation changes of hybrid funds. Investors should not use to assess the taxation of their mutual fund transactions. Different schemes within in the same fund category may have different taxations. You should consult with your financial or tax advisor to know the tax consequences of your mutual fund transactions.

Why invest in hybrid funds?

- Hybrid mutual funds offer asset allocation benefits whereby investors can balance risk and return to achieve their financial goals. The equity allocation of hybrid funds can generate higher potential returns in the long term while the debt allocation reduces volatility and provides stability to your portfolio. Multi asset allocation funds provide greater asset class diversification since they invest 3 or more asset classes.

- Hybrid funds provide the benefit of periodic portfolio rebalancing. Rebalancing of assets ensures that the asset allocation of your investments do not deviate from the targeted asset allocation despite market movements. Portfolio rebalancing is aimed to reduce risk and help in generating relatively better risk adjusted returns over sufficiently long investment tenures.

- Since hybrid funds are less volatile compared to pure equity funds, they are suitable for first time or new investors looking for the long term but who do not have experienced high market volatility.

- Hybrid funds provide a more stable investment experience. Investment experience should be an important consideration because high volatility can lead to wrong investment decisions due to behavioural biases.

- Arbitrage funds can be suitable for Systematic Transfer Plans in volatile market conditions. STP is a mutual fund facility whereby you can transfer fixed amounts from one mutual fund scheme to another scheme over certain tenure.

- Hybrid funds are tax efficient asset allocation solutions. Funds which have more than 65% gross equity allocation (including hedging) enjoy equity taxation. Capital gains in funds with 35% - 65% equity allocation are taxed at 12.5% for investments held for 24 months or longer.

What to look in Hybrid Funds before investing?

- You should always invest in a fund suited to your risk appetite and investment needs. Consult with your financial advisor, if you need help in understanding your risk appetite and the risk profile of the fund you are investing.

- Since different assets classes have their own market cycles, investors must look at this category in long term perspective. We recommend a horizon of 3 to 5 years minimum for hybrid funds, excluding arbitrage funds which are meant for short term investments.

- Different hybrid funds have different tax consequences. You should know the tax consequence of your investment and make informed decisions. However, investment decisions should not be made purely on tax considerations. You should invest according to your risk appetite financial goals.

- You should read the scheme information document (SID) of the fund carefully and consult with your financial advisor if you need any help in understanding the risk profile or taxation of a hybrid fund and make informed investment decisions.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Importance of staying invested in the choppy market

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY