Why should you consider Sectoral funds for your portfolio?

A large section of retail investors has traditionally favored diversified equity funds for their investment portfolios. As per AMFI June 2024 data, more than 85% of active equity funds assets under management (AUM) are in funds which are diversified in nature (including market cap specific funds). By diversified funds, we mean mutual fund schemes which invest across multiple sectors. Diversification funds reduce company and sector risks. As such, these funds are suitable for both new and seasoned investors. However, for more informed investors, sectoral funds can be attractive investment options for portfolio building.

Core and satellite allocations

Financial advisors often recommend core and satellite strategy for building your investment portfolios. The investment objective of your core portfolio is to provide stability and long term growth to meet your financial goals. Advisors recommend diversified equity funds for building the core portfolio. You can supplement your core portfolio with satellite allocations to funds investing in specific sectors or themes. The satellite allocations can boost your portfolio returns and enhance wealth creation. In this article we will discuss about sectoral funds.

What are sectoral funds?

Unlike diversified funds, sectoral funds invest in stocks in a particular sector. Therefore, while the company concentration risk is diversified, sectoral funds are subject to sector risks. In the past investors had limited options in terms of sector choices e.g. Banking, FMCG, Infrastructure etc. Over the years, many more sectoral / thematic choices have been provided to investors e.g. Consumption, Healthcare, IT, Energy, Manufacturing, PSUs, MNCs etc.

Are sectoral funds for short term or long-term investments?

Here opinions differ among financial advisors. Some recommend that an element of timing is required in sector investments. Their argument is that different sectors outperform each other in different market phases or investment cycles. For example, cyclical sectors (like bank, automobiles, infrastructure etc) outperform defensive sectors (like Pharmaceuticals, FMCG etc) in growth phase and underperform in slowdowns. However, some financial advisors argue in a growth economy like India, some sectors are more likely to outperform the broad market over long investment horizons. These can be long term investment themes which do not need market timing.

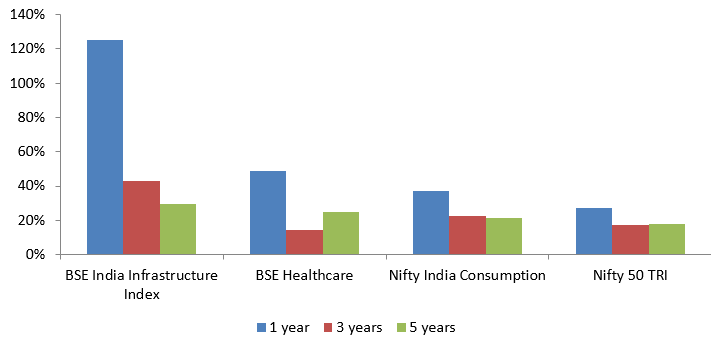

Trying to time the market is not only difficult for retail investors, it is also risky. If your entry or exit is too late, then you may get lower than the expected returns or even make a loss. On the other hand, if you have a well thought out investment plan and long investment horizon, your chances of success are much higher. There are several sectors which have outperformed the broad market over long investment horizons (see the chart below) across different market cycles. You can have long investment horizons in these sectors.

Source: BSE, NSE, Advisorkhoj Research, as on 10th July 2024

How have sectoral funds performed?

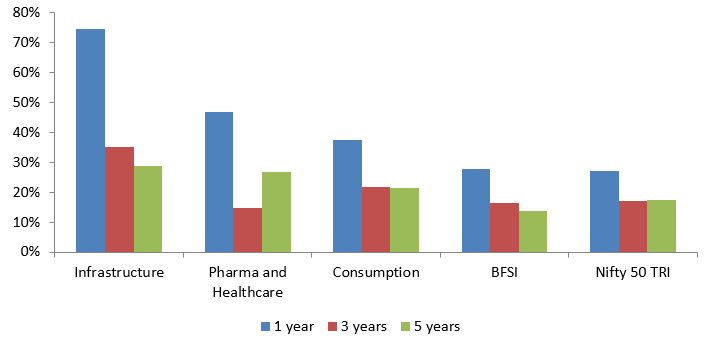

The chart below shows the category average returns of various sector fund sub-categories (sectors) versus Nifty 50. You can see that even over long horizons like 5 years, sectoral funds were able to beat the broad market index.

Source: Advisorkhoj Research, as on 10th July 2024

Importance of sector selection

When you are investing in sectoral funds, you should try to invest in sectors that have the potential of outperforming the broad market in the long term. From the perspective of India Growth Story and how different sectors participate in the India growth story, you should look at the following linkages with industry sectors:-

- Favorable demography

- Rising per capita income (affluence)

- Manufacturing led growth (Atmanirbhar Bharat)

- Government spending

- Digital India (JAM Trinity)

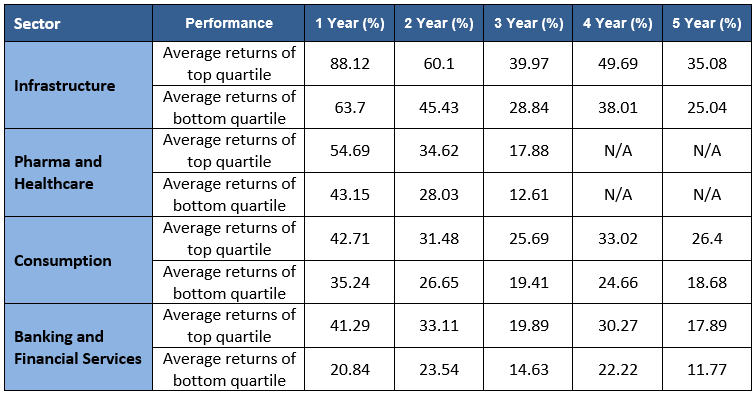

Importance of fund selection within sectors

There is a significant difference in returns of top quartile funds and bottom quartile funds, even within the same sector. You should select funds which have strong performance track records in the long term. Apart from the fund manager’s track record, you should also look at the AMC’s track record of performance across different categories. You should consult with your financial advisor or mutual fund distributor, if you need help in selecting the right sector(s) and fund(s) for your satellite portfolio.

Source: Advisorkhoj Research, as on 10th July 2024

Who should invest in Sectoral Funds?

- Investors willing to have satellite allocation to overall equity portfolio.

- Investors looking for capital appreciation or wealth creation over long investment tenures.

- Investors with very high-risk appetites.

- Investors with minimum 5 years investment tenures.

- You can invest either in lumpsum or SIP depending on your investment needs.

Investors should consult their financial advisors or mutual fund distributors to see if sectoral funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY