Why should investors consider Smart Beta Index Funds over broad market indices in their portfolio?

What are smart beta funds?

Smart beta funds are funds which combines passive and active methods of investing. Smart beta funds track factor indices. Most investors still associate passive equity investments with investing in broad market indices like Nifty 50 or Sensex. Though relatively new, more than 20 smart-beta index products are currently available. Smart beta funds combine passive and active methods of investing i.e. you can get alpha generation at much lower costs compared to actively managed funds. In this article we will discuss smart beta funds.

What are factor indices?

Factor indices are constructed based on quantitative, rule-based investment strategies based on factors which historically driven portfolio returns and risk. Factor indices are constructed based on quantitative, rule-based investment strategies based on factors which historically drive portfolio returns and risk. Factor indices select stocks from the constituents of a certain benchmark index like Nifty 50, Nifty 100, Nifty 500 etc based on different factors like Momentum, Volatility, Beta, Alpha, Dividend Yield, Value, and Quality etc. Factor indices are generally non-market cap weighted.

Suggested reading importance of investing in factor based index funds

Factor indices can be of two types:-

- Single factor indices – In single factor indices stocks are selected from a certain investment universe e.g. Nifty 50, Nifty 100, Nifty 500 etc based on a single factor. For example, the Nifty 100 Low Volatility 30 index tracks the performance of 30 stocks in Nifty 100 with the lowest volatility in last one year.

- Multi factor indices - In these indices stocks are selected from a certain investment universe based on multiple factors. For example, the Nifty Alpha Low Volatility 30 index tracks the performance of 30 stocks selected based on the top combination of Alpha and Low Volatility (both high alpha and low volatility) from the Nifty 100 and Nifty Midcap 50 indices.

What are the different factors used in factor-based indices?

Here are some of the factors that are used in factor-based indices or strategy indices. Please note that this is not an exhaustive list of factors used in strategy indices. Our objective in this blog post is to give you a sense of the factors that can lead to superior performance or lower risk.

- Momentum – Momentum refers trend in share price movement, upwards of downwards. It is measured in terms of 6 and 12 months returns adjusted for volatility.

- Volatility – Volatility refers to the deviation in returns from the average. Low volatility index selects stocks with the lowest volatility.

- Quality – Quality refers to performance of a stock on parameters like return on equity (ROE), leverage (debt / equity ratio) and average change in Earnings per share. Stocks with high scores on these parameters are high quality stocks.

- Alpha – Alpha is the excess return (outperformance) of a portfolio of stocks adjusted for risk (beta) relative to the market index return. Alpha is a measure of risk adjusted returns.

- Beta – Beta is the movement in price of a stock relative to movement in market index. For example, if the beta of a stock is 1.2, then for every 1% rise in the market index, the share price will rise by 1.2% and for every 1% fall in the market index, the share price will fall by 1%. Beta is a measure of risk. A high beta will outperform in rising markets and underperform in falling markets.

- Dividend yield – Dividend yield is the annual dividend paid by the stock divided by the share price. Suppose the share price of a company is Rs 100, and the company declares a dividend of Rs 10. The dividend yield will be Rs 10 ÷ 100 = 10%. High dividend risk is usually a sign of lower risk.

- Value – Value stocks refer to companies which may be trading at significant discounts to their intrinsic or fair valuation. Value stocks are selected on the basis of Return on Capital Employed (ROCE), Price-Earnings (PE), Price-Book Value (PB) and Dividend yield.

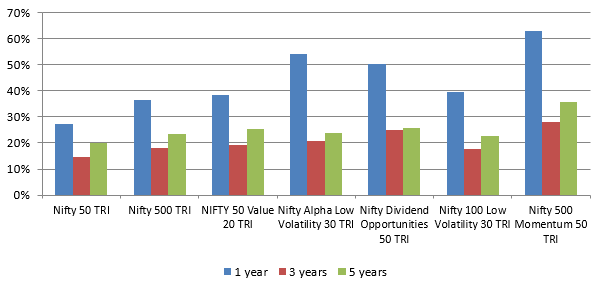

Factor based indices outperformed broad market indices

Source: Advisorkhoj Research, as on 17th September 2024. Returns over periods exceeding 1 year are in CAGR.

Why should you look at smart index funds?

Smart index funds are relatively new. Most smart beta index funds have not yet completed 3 years, and many have not completed even a year since launch. But there are compelling reasons as to why you need to look at these funds, when you are building your portfolio of passive funds.

- Smart beta funds have the potential of generating superior returns compared to broad market index e.g. Nifty 50, Nifty 500 etc.

- Provides diversification across market caps (Large, Mid etc.) unlike market cap-based index funds like Nifty 50, Nifty 100, Nifty Midcap etc.

- Elimination of non-systematic risks like stock picking and portfolio manager selection.

- Low-cost investments. TERs are much lower than actively managed equity funds.

- Investors who do not have Demat accounts can invest in index funds.

- You can invest from your regular savings through Systematic Investment Plans (SIPs).

- Smart beta index funds can provide solutions for a spectrum of investment needs, styles and risk appetites. You should understand different underlying factors on which the factor indices and smart beta funds are constructed and make informed investment decisions.

Conclusion

The difference between smart index funds and actively managed diversified equity funds is that the factor-based index funds provide low-cost investment opportunities of superior returns versus broad indices, free from human biases. Investments in smart beta funds require understanding of the factors and strategies used, but they can be very useful from a portfolio diversification perspective. These funds are more suited for experienced investors. However, if you can educate yourself on smart beta index funds and make informed investment decisions, you can potentially get superior returns relative to broad market indices. Investors should consult with their financial advisors or mutual fund distributors if smart beta index funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Importance of staying invested in the choppy market

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY