Which are the best mutual funds for medium term investments

Our financial goals can be short term, medium term and long term. The short term goals are usually the most important goals at any point of time and give the highest priority in financial planning accordingly. The long term life goals are also well known to most us, e.g. retirement planning, children’s education, children’s marriage, wealth creation in general etc. Given the long term nature of these goals investors tend to give themselves flexibility in terms of how they want to plan for these goals.

The medium term goals are trickier than either short term or long term goals. Investors usually have a clearer idea of medium term goals compared to long term goals and at the same time, there is less rigidity to their investment approach compared to short term goals.

The definitions of short term, medium term and long term are usually subjective, varying from investor to investor. While appreciating individual views which may be shaped by individual situation, we will share our views on what we consider short term, medium term and long term.

In our view, from an investment perspective, 3 years or less tenor is short term. Investment tenor of 3 years to 5 years is medium term; investment tenor of 5 years or longer is long term.

Did you know about the simple asset allocation strategies for different risk profiles

In this blog post, we will focus on medium term investments. There can be several medium term financial goals, e.g. you want to buy a house, you want to save money to start a business or invest in a business to supplement your income, you did not make sufficient investment for your child’s education earlier and want to invest now, you have funds which you do not need in the near future but you may need in the not too distant future etc.

Whatever your financial goals are, for medium term investments, risk and return are both very important. Since you have a 3 to 5 year investment tenor, you want good returns (higher than fixed income returns) and at the same time, you will not want to lose money to the vagaries of the market. From a risk profile perspective therefore, just like your investment tenor, your risk profile will also be medium or moderate. In this blog post, we will discuss different investment options and see which is best suited for medium term investment needs.

Before, we proceed let us see the top 5 reasons why you should invest in mutual funds

Different types of MF to be considered

Since you usually want higher than fixed income returns from your medium term investments, you need to have equity in your assets. At the same time, you do not want too much risk in your portfolio and therefore, in this post we will exclude for the most part the riskier equity segments namely, midcap and small cap.

In the last 1 year, while the Nifty was more or less flat; Nifty Midcap 100 Index and Nifty Small Cap Index fell 19% and 33%. You may not want high volatility if you have a medium term investment tenor, especially if the volatility comes into play towards the end of your tenor.

Did you know the difference between investing in large cap funds versus midcap equity mutual funds

In this post, we will consider less risky asset classes like large cap equity funds and hybrid funds (which invest in both debt and equity) for medium term investments. However, we will not exclude midcap completely. We will also consider multi-cap funds, which have the flexibility of investing in both large cap and midcap funds, changing the percentage allocations based on the fund manager’s outlook of the market.

Rolling returns

Regular Advisorkhoj readers know the importance we give to rolling returns in analyzing mutual fund performance. Rolling returns measures performance across different market conditions and they are not biased by market conditions prevailing over a specific point to point time. For example, midcaps may have given superlative returns in 2014 to 2017, but rolling returns over a long period may paint a slightly different picture. Rolling returns also enables us to do multi-dimensional analysis, as we will discuss in this post.

3 year Rolling Returns of Large Cap Equity versus Aggressive Hybrid Funds

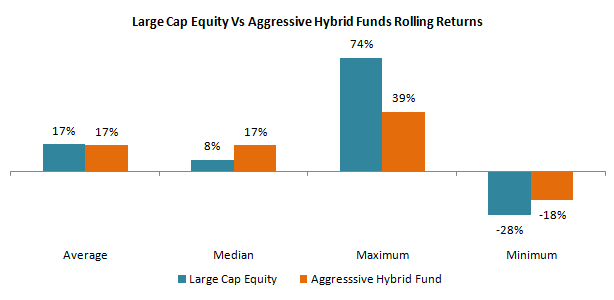

For the purpose of this analysis, we have looked at 3 year rolling returns of large cap equity and aggressive hybrid mutual fund (previously also known as balanced funds) categories over the last 20 years. The last 20 years covered a large variety of market conditions, including multiple bull and bear markets. Readers should note that, by 3 year rolling returns, we are measuring returns over a 3 year investment tenor (medium term investment) across all points of times in the last 20 years. Let us look at the various rolling returns parameters of large cap equity and aggressive hybrid fund categories in the chart below.

Source: Advisorkhoj Research

You can see that average 3 year rolling returns of the two categories are virtually the same. The median rolling returns of aggressive hybrid funds is higher and closer to the average rolling returns of the category, which shows that hybrid funds have greater performance consistency. The maximum returns are obviously higher for large cap equity funds. However, the minimum returns of the large cap funds are also much lower than hybrid funds, which means that the loss potential of equity funds over 3 year tenors is much higher than hybrid funds.

The maximum and minimum returns shown in the chart are totally consistent with the risk return characteristics of equity funds and hybrid funds. Hybrid funds have allocations to fixed income which is less risky compared to equity and therefore, have much limited downside potential compared to equity funds. On the other hand, in favorable economic conditions equity is the best performing asset class and therefore, it is not surprising that large cap outperformed hybrid funds in terms of highest returns. In this chart, in my view, investors need to pay the highest importance to average returns and minimum returns because they show the expected relative (to each other) category returns and the worst case relative category returns. This kind of analysis is only possible with rolling returns.

Suggested reading: Return expectations from mutual funds: how important is past performance

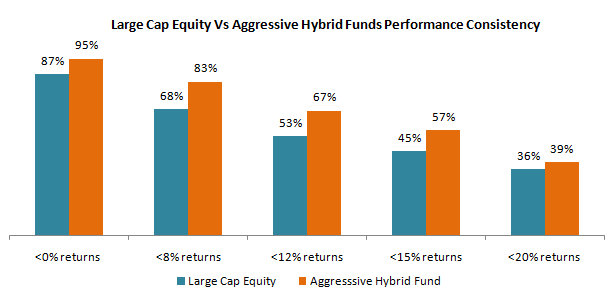

While the above chart can be very insightful for investors, the next chart is even more revealing. This chart shows the 3 year rolling returns performance consistencies of the two mutual fund categories over the last 20 years. It shows the percentage of time a category delivered returns above a specific threshold.

Source: Advisorkhoj Research

I urge investors to use this tool as much as possible for making investment decisions (it is available on our website using our tool Rolling Returns versus Category). It will give you a sense of what to expect along with associated probabilities of different outcomes. The only word of caution about using probabilities is that it represents likelihood and not certainty. You can see that the probability of making a loss is lower in Aggressive Hybrid Funds. The probability of getting higher than 8% returns, which is the expected fixed income return, is also higher in aggressive hybrid funds. Based on my experience with retail investors, they usually expect double digit returns.

Even if you look at the economy of India, the nominal GDP growth rate is expected to be around 11 – 12%. Therefore, 12% return is a reasonable expectation from equity funds. Aggressive hybrid funds, despite a sizeable debt allocation (20 to 35%), gave 12%+ returns much more consistently than large cap funds. This is very insightful and shows that asset allocation can be used to deliver superior returns not just in short term but also in the medium term.

You may like to read: what is a reasonable rate of return from equity mutual funds

Multi-Cap funds versus Aggressive Hybrid Funds

So far in this blog post we compared large cap equity funds with aggressive hybrid funds. But how will multi-cap equity funds compare? Multi-cap fund managers have the mandate of investing across market cap segments and changing percentage allocations to different segments depending on their outlook to generate higher alphas for investors. How did multi-cap equity funds fared against aggressive hybrid funds.

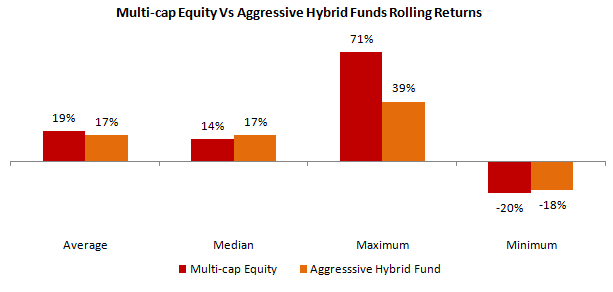

We looked at 3 year rolling returns of multi-cap equity and aggressive hybrid mutual fund categories over the last 20 years. Let us look at the various rolling returns parameters of multi-cap equity and aggressive hybrid fund categories in the chart below.

Source: Advisorkhoj Research

Multi-cap equity funds gave slightly higher average rolling returns, while worst case returns of aggressive hybrid funds was slightly better. When we compare large cap and multi-cap rolling returns performance, the alpha generated by fund managers who have a more flexible mandate is there to see. However, when you compare multi-cap equity funds with aggressive hybrid funds, you can see that there is very little to choose between the two categories. Let us hope the performance consistency chart is more insightful.

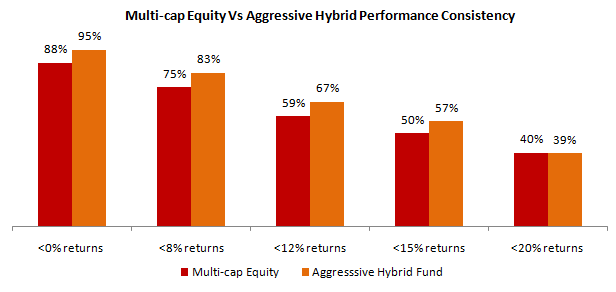

Source: Advisorkhoj Research

You can see that the probability of making a loss is lower in Aggressive Hybrid Funds. You can also see that the likelihood of getting more than 8% and 12% returns are more in Aggressive Hybrid Funds. It is most likely that multi-cap equity funds will outperform Aggressive Hybrid Funds by a big margin in a bull market, but if you are looking for consistency of returns then Aggressive Hybrid Funds are the more suitable investment choice. The choice is yours; if you have high risk appetite, you can invest in multi-cap funds, but if you have moderate risk appetite, then the analysis shows that aggressive hybrid funds are more suitable.

Read: Why multi-cap funds are good long term investment choice

About Aggressive Hybrid Funds - Conclusion

These are mutual fund schemes which invest in both equity and debt securities. As per SEBI mandate, the equity allocation for aggressive hybrid funds (also known as equity hybrid funds) range from 65% to 80%. The debt allocation provides stability and limits downside risks in volatile markets, while the equity allocation provides capital appreciation and wealth creation over long investment tenors. We have seen that these schemes provide excellent risk adjusted returns compared to equity funds over medium term tenors. However, as the investment tenor lengthens from medium towards long term, our internal research shows that equity funds start gaining advantage.

Did you know how to get more returns from your mutual fund investments

The minimum 65% equity allocation also ensures equity taxation for aggressive hybrid fund. Short term capital gains (investment holding period of less than 1 year) is taxed at 15%. Long term capital gains (investment holding period of more than a year) of up to Rs 1 Lakh is tax free. Long term capital gains in excess of Rs 1 Lakh are taxed at 10%. Many aggressive hybrid funds pay dividends. Dividends paid by aggressive hybrid funds are tax free in the hands of the investors, but the fund house has to pay 10% dividend distribution tax (DDT) before paying dividends to investors. You should consider the taxation aspect, when choosing between growth and dividend options. Investors should consult with their financial advisors, if aggressive hybrid funds are suitable for their medium term investment needs.

You must also read how to select best performing mutual funds: importance of past performance

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY