Large cap or Midcap equity mutual funds: Which is better in the long term

2018 has been a harsh year for midcap mutual funds. The Nifty Midcap 100 index has fallen nearly 16% on a year to date basis. Midcap equity mutual funds actually fared better than the midcap benchmark, but even midcap mutual funds lost 10% this year and small cap funds fared even worse. By June / July when the Midcap index had fallen by 15% from the January peak, many investors were asking in social media platforms whether this was a good time to invest in midcaps. But the market correction in September and October saw further cuts in midcap prices. Midcap funds which had garnered huge investor interest from 2014 onwards saw substantial redemptions in 2018.

Did you know which are the 10 things that you should do in volatile markets

Large cap equity mutual funds, on the other hand, fared much better in this volatile market and on an average investors did not make losses in these funds on a year to date basis. Based on investor activity on our website, large cap funds are in favor this year and I think, will continue to be in favor as long as volatility persists. We have often stated in our blog that you should not base your equity mutual fund investment decisions based on short term market movements. In this blog post we will take a long term view and compare large cap versus midcap mutual fund performance across different market conditions. First let us understand what are large cap and midcap equity mutual funds.

Large Cap Mutual Funds

SEBI has defined the large cap segment as the top 100 companies by market capitalization. These are the largest companies of the country. They are market leaders in their industry sectors, have many years of history and large balance sheets. They are perceived by investors to be stable businesses and therefore, safer from investment standpoint. Usually investors are ready to pay a valuation premium for large cap stocks. Equity mutual funds which invest in large cap stocks are large cap mutual funds. Investors usually associate Nifty or the Sensex with the large cap segment. Nifty – 100 or BSE – 100 is the more appropriate benchmark for large cap mutual funds because there are many good large cap stocks which are not in the Nifty or Sensex.

Midcap Mutual Funds

SEBI has defined the midcap segment as the next 150 companies by market capitalization, after the large cap companies, as midcap companies. So 101st to the 250th companies by market capitalization are defined as midcap companies. These companies are relatively younger than large cap companies, have less capital intensive business models and the potential to grow revenues and earnings per share (EPS) faster than the large cap companies. However, since these companies are smaller and are more susceptible to be adversely affected by economic recessions, these companies are also perceived to be more risky. Midcap mutual funds are mutual fund schemes which invest primarily in midcap companies.

Suggested reading: 5 myths you need to know about mid cap and small cap mutual funds

What led to the big correction in midcap?

Investors who were following Advisorkhoj blog regularly over the last 2 -3 years should have known that this correction was inevitable. Midcap stocks surged in 2014 in the wake of the NDA Government coming to power. Subsequent structural reforms instituted by the Government were seen by investors as the appropriate measures to put our economy on the growth path. Midcap and small cap companies which depend on domestic consumption were seen as the big potential beneficiaries of these reforms.

There was also substantial increase in liquidity from domestic investors. Retail investor participation in the stock market through mutual funds increased substantially over the past 4 years and there was a lot of money flowing into midcap and small cap stocks, which are seen as high growth stocks.

I have stated earlier that in India a very large percentage of shareholding in midcap and small cap companies is held by the promoter and the related parties; percentage of free floating shares (shares held by the public and traded in the market) is quite small. When a lot of money chases a few things, it is only natural that the price will go up very fast. Throughout 2017, in numerous blog articles on Advisorkhoj, we were saying that midcap valuations were very high. Midcap stocks usually trade at discount (in terms of valuations) to large cap stocks but by the end of 2017 they were trading at twice the valuation of large cap stocks. Midcap prices were bound to correct, unless earnings caught up. But at such high valuations, there was no way earnings would catch up, even if the economy was doing extremely well. Therefore, a correction was inevitable.

In the month of January 2018 we wrote this article – Are midcap valuations a cause of concern for mid cap mutual funds

Which performs better in the long term – Large Cap or Midcap?

The two most important factors in investment decisions are investment goal and risk appetite. If you do not have high risk appetite, you should not invest in midcaps because as discussed earlier, midcap is riskier than large cap. However, based on my experience, most investors do not know what their risk appetite is. Only when they are faced with a loss, do many investors realize what their actual risk appetite is. It is also true that risk and return are related. If the risk return trade-off is in favor of the riskier asset, then investors will be willing to take the extra risk.

In the context of risk return trade-off, we will compare large cap versus midcap mutual funds performance. Before we dive into numbers, you should know that the performance of an asset depends on the investment tenor. We had mentioned earlier that we will be discussing long term performance in this blog post.

The definition of long term also varies from investor to investor. For some investors, 3 years is sufficiently long investment tenors. For others, 5 years or 10 years is long term. In our view, equity investments should be made with a horizon of at least 3 years. Beyond 3 years, the definition of what is long term can differ from investor to investor, but the longer the better.

The biggest problem with many blogs or research content related to mutual funds in the online space is that they focus on last 1 year, 2 year or 3 year returns; in finance parlance, these are trailing returns.

You may read – return expectations from mutual funds: how important is past performance

The problem with trailing returns is that they pertain to a certain period e.g. last 1 year, 3 years etc. While trailing returns give you information about a fund’s performance, it is not very instructive for making investment decisions. Mutual fund performance is dependent on the market conditions. If you have an investment tenor of 3 years, last 3 year trailing returns of a fund is not useful because over the next three years, the market conditions can be different.

Suggested reading – investing in large cap funds versus mid cap mutual funds

We overcome the market condition dependency problem of trailing returns by using rolling returns. Rolling returns measures returns of a fund or funds for particular tenors across all market conditions. For purposes of this analysis, we will look at rolling returns of large cap and midcap funds for different investment tenors across the last 12 years. Last 12 year period covers possibly all market conditions – bull markets, bear markets, range-bound markets etc.

We purposively chose last 12 years instead of last 10 year or 15 years because firstly, we wanted to include the period covering the worst bear market (2008 financial crisis) in the last 6 decades and also we wanted to ensure that we include sufficient number of schemes. The mutual industry really took off after 2004; prior to that, we had far fewer schemes.

Let us now look at rolling returns performance of large cap versus midcap for investment tenor of 3 years across different market conditions over the last 12 years. Please note that we have used category averages here because performance of individual funds can vary lot.

Source: Advisorkhoj Research

The last chart above shows that across different market conditions midcap funds gave higher average returns than large cap. However, you should also note that potential loss is also higher in midcap funds. You can see risk return relationship in play in this chart. Let us now see possibility of getting different returns from midcap versus large cap.

Source: Advisorkhoj Research

You can see that possibility of making a loss is higher in midcap. At the same time, possibility of getting more than 12 to 15% returns is also higher in midcap. Armed with this analysis, you will now be better informed to make risk return trade off decisions.

We have mentioned a number of times in our blog that effect of volatility reduces with investment tenor. Let us now see what the results will be if your investment tenor was 5 years.

The results are very similar to what we saw with 3 years investment tenor. Let us now see possibility of getting different returns from midcap versus large cap, if you had a 5 year investment tenor.

This is the more interesting chart to look at. You can see that possibility of making loss reduces a lot if you have a longer tenor. Look the possibility of getting in excess of 15% returns if you have a 5 year investment tenor. It is much higher in the case of midcap versus large cap, compared to what it was with 3 year tenor. Therefore, if you have a longer tenor and high risk appetite, you can increase your allocation to midcaps.

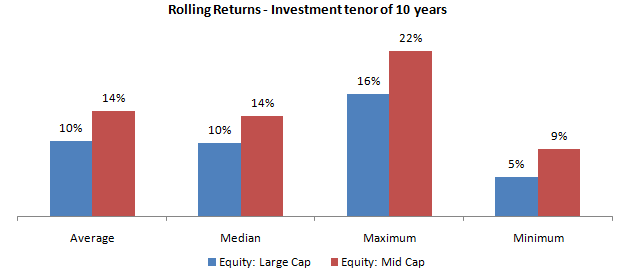

Let us now see, what the results will be if your investment tenor was 10 years.

This is the tenor over which midcap funds not only outperform large cap not just in terms of average returns but also returns on the downside. The next chart, possibility of getting returns over 10 years investment tenor is even more insightful.

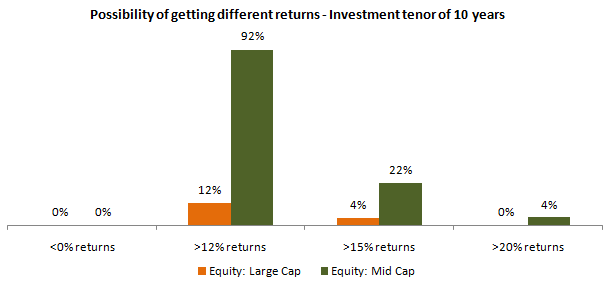

This chart shows that the results for midcap are most spectacular over a very long tenor. Firstly observe that over 10 year investment tenor, there is no loss in either large cap or midcap. Next, look at percentage of times, midcap funds delivered more than 12% returns over 10 years investment tenors – it is more than 90% of the times.

Nifty represents 63% of free float market cap of all stocks listed on National Stock Exchange and Nifty 100 (the index of all large cap stocks) represent 75% of free float market cap of all stocks listed on National Stock Exchange. In order to be sufficiently diversified, a large cap fund, will invest in a large number of the Nifty 100 stocks. Therefore, over a long investment tenor, the performance of large cap funds will be in line with the market performance; perhaps they will add a few percentage points of alpha. Also in the long term, the market will grow in line or a little faster than the GDP growth of India.

Midcap is the space where fund managers will have the ability to identify high growth or value opportunities and therefore, can produce high alphas. You can see that 20%+ of the times, midcap mutual funds were able to give returns in excess of 15% over 10 year investment tenors. Therefore, over long investment tenors midcap funds can produce better results in terms of wealth creation compared to large cap funds even though they are riskier in the short term than large cap funds.

Conclusion

As stated earlier, your investment decisions should be based on your financial goals and your risk appetite. If you are new investor or if you are unsure about your risk appetite, perhaps this blog post will give you an idea of what to expect in terms of risk / return trade-off across different market conditions and investment tenors.

You must read how to build the perfect investment portfolio

In these dynamic times, liquidity and the impact cost on your portfolio, should you suddenly need liquidity for any unforeseen reason is also important. If you suddenly need liquidity when the market is down, you will be much better off, if you get the liquidity from large cap mutual funds instead of midcap mutual funds. You should factor in all the requirements when constructing your portfolio.

Suggested reading – How to select mutual funds based on your investment needs

Therefore, you need to so sensible allocations to different market cap segments. In our next part, we will examine another category of funds which invest in both large and midcap stocks.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY