How to select the best mutual fund: The importance of Alpha

A few years back, I was over at my old school friend’s place for lunch. My friend’s financial advisor was supposed to drop by for a quick chat and my friend wanted me to sit through it. The financial advisor after getting some paperwork done, recommended a few equity mutual funds to my friend. My friend asked his financial advisor why the recommended funds were better than the others. The advisor said these funds were top performers and cited past one year returns to support why he felt that these funds were top performers. I do not think my friend was too satisfied with the answer. My friend is a Vice President of Finance in a multinational company and as such is a very analytical person. Later he asked me, how one can determine if a “top performing fund” will continue to perform well in the future. After all, he had read somewhere that past performance of a mutual fund is not an indicator of future performance. I told him in addition to past performance of a fund across different time scales, one also needs to look at the pedigree of the mutual fund house and the track record of the fund manager. “Track record of the fund manager” seemed too fuzzy and qualitative for my quantitatively oriented friend. Since we were getting late for lunch with our discussion on how to select the best mutual fund, I told my friend that, if you are looking for a single quantitative metric to determine whether a fund can outperform in the future, the answer is Alpha. In my interactions with many mutual investors and financial advisors over the years, I found that most of them have absolutely no idea of what Alpha means, and of the few that do, they have only a very high level understanding of the concept. In my opinion, if you understand what Alpha is and apply the understanding to your fund selection, you will be able to select the best mutual funds. We will devote this blog to understanding Alpha.

What is Alpha?

If you ask a financial advisor “what is Alpha”, the answer you are most likely to get, if at all, is that, “it is the excess returns of a fund over its benchmark index”. Actually, you will find this definition of alpha in some finance blogs as well. Is a fund’s Alpha the excess returns of the fund over its benchmark index? It is only partially correct but not entirely correct. If for example, if a fund’s benchmark is the Nifty and if the fund gives a 20% return while Nifty gives 15% return, the fund’s alpha is not 5%. Alpha in very simple terms is the value generated by the fund manager, relative to risk taken by him or her. But is not risk and return related, in other words, higher the risk, higher the returns? Yes it is. For example, midcap funds are more risky than large cap funds, but midcap funds can potentially give higher returns than large cap funds, as is evident from the average returns of midcap funds over the last one year compared to large cap funds. However, this also means that a fund manager can outperform another fund manager in a bull market simply by taking more risks. But it does not mean that he or she has added more value to the investor, because if the market declines, then the net asset value (NAV) his or her fund will decline more than the fund which takes lesser risks. Alpha is a measure of the value added by the fund manager, after factoring in the risks taken by the fund manager. Therefore an understanding of alpha is not complete unless we have an understanding of risk. To get an understanding of risk, we need to understand a concept called Beta.

How will you understand, how much risk your fund manager is taking? A popular measure of risk is standard deviation of returns. Standard deviation defines a range within which you can expect your returns to be, based on a certain confidence level. However, if the market itself is very volatile the standard deviation of a fund will be high and if the market is less volatile the standard of a fund will be less.

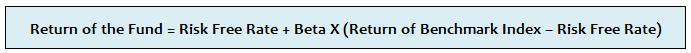

While standard deviation is a measure of total risk, it does not measure risk relative to the market. Beta is a metric which helps us understand the risk taken by a stock or fund relative to the market. Beta of a fund is defined as the excess returns of the fund over the risk free rate relative to the excess returns of the benchmark index over the risk free rate. Let us understand this with the help of an example. Let us assume you can get 8% interest from your fixed deposit. This is the risk free rate because you do not take any risk when investing in Fixed Deposits. Let us further assume that you have invested in a fund whose benchmark index is BSE-100 and the beta is 2. If BSE-100 rises by 15%, how much return can you expect from your fund? The answer lies in a theory called Capital Asset Pricing Model, in finance parlance, popularly known as CAPM (pronounced as Cap-M). As per CAPM:-

In the above example:-

Expected Return of the Fund = 8% + 2 X (15% - 8%) = 22%

What if BSE-100 falls by 10%? As per CAPM:-

Expected Return of the Fund = 8% + 2 X (-10% - 8%) = -28%

We can see that, beta is a double edged sword. Higher the beta, higher is the potential returns in bull market, but we also risk higher losses during bear markets.

Beta is a very popular concept in share trading. Investors who follow share markets regularly would have heard of high beta stocks and low beta stocks. In our market, banking stocks are examples of high beta stocks. These stocks rise and fall by a bigger percentage than the market index, e.g. Nifty. Traders often prefer to trade in high beta stocks, because they can make more money by buying high beta stocks when market rises and selling high beta stocks when market falls. On the other hand, Fast Moving Consumer Goods (FMCG) stocks are low beta stocks. These stocks rise or fall by smaller percentage relative to the market. Beta is an important concept in mutual funds also. A mutual fund has a higher beta if has a higher allocation to high beta stocks. For our readers, who are more mathematically inclined, beta is calculated by running a regression analysis of daily excess returns of a fund over the risk free rate versus the daily excess returns of the benchmark index over the risk free rate. However, as an investor you do not need to have knowledge of statistics to know the beta of a fund. Most good mutual fund research websites have information on a fund’s beta.

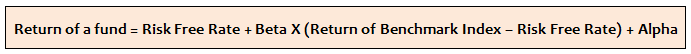

Now that we have understood what beta is, let us understand alpha. Alpha is the excess returns generated by the fund manager, compared to what he or she would have expected to get after factoring in the risk taken by him or her. In mathematical terms:-

Compare this formula with the formula in the box shaded light blue. You will realize that alpha is the value added by the fund manager, for the same amount of risk. Let us understand this concept by revisiting the example discussed earlier. Let us assume you can get 8% interest from your fixed deposit, which is the risk free rate. Let us further assume that you have invested in a fund whose benchmark index is BSE-100 and beta is 2. If BSE-100 rises by 15%, how much return can you expect from your fund? As per Capital Asset Pricing Model (discussed earlier) you can expect a return of 22% from your fund. Let us assume you get a return of 25%. How did you get 3% extra returns? It was a result of the value created by your fund manager. The 3% is the alpha of the fund. What if BSE-100 falls by 10%? As per CAPM your expected return would be -28%, but if your fund manager is able to generate a 3% alpha, your actual return would be -25%. From a conceptual standpoint, alpha is the excess return generated by your fund manager versus what is predicted by CAPM. The top performing funds that have sustained their outperformance over a sufficiently long period of time are undoubtedly funds with high alphas. If a fund manager has generated high alpha, it is quite likely that he or she will generate high alpha in the future as well. High alpha speaks to the fund manager’s ability of stock selection and portfolio construction. I have read many investment blogs, where the authors focused on expense ratios. Would you mind paying 50 bps points extra in terms of expense ratio, if the fund manager is able to generate an alpha of 3%? I am sure you will not. We have discussed this in our blog, How much importance should mutual fund investors give to expense ratios. When selecting equity funds for your mutual fund portfolio, you should always select funds with high alphas. Most good mutual fund research websites have information on a fund’s alpha. You should look up a fund’s alpha before investing or ask your financial advisor.

What is a good alpha?

It depends on the type of mutual fund. Normally, the alphas of large cap equity funds are lower than midcap equity funds. This is because midcap companies are under-researched compared to large cap funds and therefore the potential valuation gap is higher in the case of midcap funds. In the Indian market context an alpha of 3 – 4% and above may be good for a large cap fund. For diversified equity flexicap funds, alpha of more than 5 - 6% may be considered to be good. It is not uncommon for small and midcap funds to generate much higher alphas. Alphas of good small and midcap funds can be higher than 12 – 13%. As discussed earlier, most good mutual fund research websites have information on a fund’s alpha.

How to use Alpha and Beta for Fund Selection?

Now that we understand the concepts of Alpha and Beta, we can put them to use while selecting funds for our mutual fund portfolio. Firstly, you need to determine your investment objectives and risk tolerance level. Based on your risk tolerance level, you need to identify the category or categories of funds that you will invest in and the relative allocations to each category. For example, if you have a high risk tolerance level you may have a higher allocation to small and midcap funds. On the other hand, if you have a lower risk tolerance level your portfolio should be biased towards large cap funds. Once you have determined your allocation to a particular category or categories, you should select funds based on your investment objectives or goals. If you have an aggressive goal you can select high beta funds in that particular category; on the other hand if you are less aggressive and want more stability in your portfolio you should select a low beta funds in that category. In either case, you should select funds that have given high alphas. It is usually recommended that you select moderate beta and high alpha funds, but if you have a high risk appetite then you can select high beta and high alpha funds. If you can explore the mutual fund space for products that meet your investment, you will have a variety of choices. You can always take the help of a financial advisor, if you are struggling to make a decision.

Conclusion

In this blog we have reviewed some important concepts related to mutual fund selection. Alpha is the most important metric that tells you whether a mutual fund will be able to outperform in the future, as long as the fund manager and the investment strategy of the scheme remain unchanged. Pay attention to alphas and you will emerge as a savvier and more successful investor.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY