Importance of liquidity in investing: Mutual funds are ideal solutions

When making investment decisions, most investors want to know how much returns they will get from their investments. While returns are obviously important, another important factor, liquidity, is not often given the importance it deserves. As result some investors find themselves in frustrating and financially distressful situations with regards to their investments. Let us discuss why liquidity should be an important consideration in making investment decisions:-

- Financial situations are not always predictable. There might be unforeseen circumstances when you need money for which you need to redeem or sell your assets. Loss of income (due to redundancy at workplace), sudden large unavoidable expense like urgent house repair, serious illness in the family etc. are some situations where you may need liquidity from your assets. If you are unable to sell your asset, then it can lead to distress.

- Even if you did adequate diligence on a financial product before investing, your investment may underperform for a variety of reasons. Most of us can live with short term underperformance, but if your asset underperforms for a long period then it will harm your financial interests. If your investment is liquid, then you can switch to a better investment even by booking a loss, but if your investment is not liquid then you have to suffer underperformance for a long period of time, detrimental to your personal financial goals.

- There is a time lag between your investment and goal time-line. There might be changes to your financial situation or market dynamics, which will require you to make alterations to your investment plan. If your money is stuck in an illiquid investment, then it will invariably lead to sub-optimal results.

- Land, real estate / property (residential or commercial), insurance savings plans (traditional or unit linked), structured financial products (with lock-in periods), illiquid small cap stocks, post office small savings schemes etc. are examples of illiquid investments. Some of these illiquid investments (e.g. real estate, stocks etc.) will require you to find a buyer, while others may have lock in periods before which you cannot redeem your investment.

- Another important point to consider in terms of liquidity is the cost of redemption in case of early withdrawals. Company fixed deposits and insurance savings plans (traditional or unit linked) charge penalty or surrender charges for early withdrawals.

You may like to read: What is a reasonable rate of return from equity mutual funds

Liquidity versus returns

Some people say that there is trade-off between liquidity and returns. After all, your savings bank account balance is more liquid than any other asset but the interest rate paid by savings bank is usually lower than the inflation rate. As stated earlier in this post, returns are also very important for your financial goals and it is important to make your money productive, not just liquid. Fortunately, open ended mutual funds offer both liquidity and profitability over suitable investment tenures.

Suggested reading: How to get more returns from mutual fund investments

Mutual funds – best of both worlds

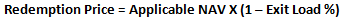

Open ended mutual funds offer high liquidity as well as good returns consistent with the risk profile of the fund. If you want to sell or redeem your open ended mutual fund units, you do not need to look for a buyer. You can sell your mutual fund units back to the Asset Management Company (AMC) using the redemption facility provided by the AMC. The price at which the AMC will buy back the units from investor is known as the repurchase price or commonly as, redemption price. Redemption price depends on the applicable Net Asset Value (NAV) of the scheme on that day and the applicable exit load (if any).

Let us understand price at which you buy or sell mutual fund units. If you are investing in a mutual fund scheme at the time of its inception (New Funds Offering or NFO), you will buy units of the scheme at face value i.e. Rs 10 per unit. Once the NFO subscription unit closes, then you can invest in / buy mutual fund units at applicable NAVs, which are computed daily based on closing price of all the securities that the scheme holds adjusted for liabilities. Redemption price is the price at which you can sell your mutual fund units back to the AMC.

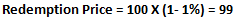

Exit load is levied for redemptions within a particular period from investment date. For example, if exit load is 1% for redemptions within 1 year from investment date and you are redeeming after 6 months (from date of investment) when current NAV is Rs 100, redemption price will be:-

If you are selling after the exit load period, then there will be no deductions from the NAV for redemptions, either partial or full. There are certain types of mutual funds e.g. overnight funds, liquid funds etc. where no exit load is charged. You can use these mutual fund schemes to park your funds for a few days or weeks or months and get higher returns than your savings bank account interest.

Redemptions from liquid mutual funds and overnight funds are processed and credited to your bank account within 1 business day of receiving the redemption instruction. Redemptions from other fund categories are processed and credited to your bank account in 3 working days; for illiquid assets like real estate, insurance etc., you may have to wait for months or even years.

Liquidity for investment management – Switch, STP

Liquidity is not just important for financial exigencies. You need liquidity in your investments for asset rebalancing, taking advantage of emerging market opportunities, balancing your risks with changes in life-stages etc. Mutual funds offer the facility of switching from one fund to another, without having to redeem your investment, receive the money in your bank account and then make a fresh investment.

Did you read this? Thinking on lump sum investments in mutual funds: What about STP

For example, at the peak of a bull market you may want to switch from your midcap or small funds to large cap funds etc. For rebalancing your asset allocation you may want to switch from equity to debt fund or vice versa.

Mutual funds provide liquidity and convenience of making switches between different asset categories in your mutual fund folio with a single instruction at any point of time. Investors should note that though switches do not involve money being credited to your bank account and re-investment from a procedural standpoint, the AMC treats the switch as a redemption and fresh investment from an exit load perspective. A switch is also treated as redemption and re-investment from a taxation standpoint. Investors should therefore, keep short term capital gains taxation and exit load in mind when making switches.

Mutual funds also offer the facility of Systematic Transfer Plan, whereby you switch from one fund to another, on a systematic basis (weekly, fortnightly, monthly etc.). Many investors use STP when they want to make lump sum investments near market bottoms but are concerned about continuing volatility in the near term. Both switches and STPs are essentially, liquidity facilities provided to mutual fund investors to manage their investments.

Suggested reading: What should be the ideal tenure of a STP in Large Cap Equity Mutual Funds

What should be the ideal tenure of a STP in Mid Cap Equity Mutual Funds

Conclusion

In this blog post, we have discussed why liquidity should be an important consideration for investment decision making. Liquidity of assets not only helps you be prepared for financial exigencies, it also provides of flexibility of managing your investment portfolio with changing needs or situations. Open ended mutual funds are ideal investment options which provide both liquidity and good returns according to your investment needs. There is a vast array of mutual fund products that are suitable for a wide range of risk appetites and investment needs. While we are not suggesting that you exclude products that do not provide short term liquidity from your investment portfolio, you should ensure that substantial part of your portfolio has sufficiently high liquidity so that you are prepared for most situations.

You may also like to read – 5 strategies to make you a successful mutual fund investor

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- What should the ideal tenure of an STP: Midcap Equity Mutual Funds

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY