Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

In the first part of this blog post, Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1, we discussed about hybrid mutual funds which invest in different asset classes like equity, fixed income etc. We also clarified about some common misconceptions about hybrid mutual funds. In this blog post, we will discuss about evolution of hybrid mutual funds in India, different types of hybrid mutual funds and how you can select the right fund category according to your investment needs.

Evolution of hybrid mutual funds

Hybrid mutual funds were introduced in the mid nineties and in the mutual fund industry parlance were known as balanced funds. Capital gains and dividend taxation played an important role in the asset allocation profiles of these funds. Though they were called balanced funds, they were essentially equity oriented (minimum 65% allocation to equity) hybrid funds and enjoyed equity taxation. Equity oriented hybrid funds is still the most popular variety of hybrid funds.

Dynamic asset allocation funds were introduced in mid 2000s and enjoyed great success across different market cycles, reducing downside risks in volatile market. We will discuss about these funds in more detail later in this post. Along with equity oriented hybrid funds, debt oriented hybrid funds (75 to 90% allocation) were introduced in early to mid 2000s for conservative investors. Many of these funds were previously known as monthly income plans (MIP).

In the Budget of 2014, after NDA government came to power, the taxation of debt funds was changed. Prior to 2014, the minimum holding period for long term capital gains taxation for debt funds was 1 year. Long term capital gains were taxed at either flat 10% or 20% with indexation, which ever was lower. In 2014, the Government increased the minimum holding period for long term capital gains taxation for debt funds to 3 years. The flat 10% long term capital gains taxation for debt funds was done away with and long term capital gains in debt funds are now taxed at 20% with indexation.

This taxation change led to the next round of product evolution in the hybrid mutual funds category, as fund houses wanted to offer investors with moderate risk appetites a product, whose risk profile is between debt oriented hybrid funds and equity oriented hybrid funds, while enjoying equity taxation. These funds were called equity savings funds.

As hybrid funds became increasingly popular with investors, especially after the stock market crash in 2008, fund houses introduced different types of hybrid funds with different investment characteristics which layman investors found difficult to understand and distinguish between different types of hybrid funds. SEBI, in its bid to bring in uniformity in the characteristics of similar type of schemes launched by different mutual funds, standardized the scheme categories and characteristics of each category.

Vide its circular in late 2017, SEBI asked the asset management companies (AMCs) to re-classify their schemes in the different standard categories / sub-categories and ensure that they have only one scheme for each category. This led to the AMCs renaming schemes, defining investment characteristics and merging schemes, wherever required. SEBI’s mutual fund re-classification and rationalization initiative has brought a lot of clarity about different types of products and ensure that investors are able to evaluate the different options available to them before taking an informed decision to invest in a scheme.

Let us now discuss different types of hybrid fund sub-categories.

Different type of hybrid fund categories

Aggressive Hybrid funds:

These schemes invest 65 to 80% of their assets in equity or equity related securities and 20 to 35% of their assets in debt and money market instruments. The primary investment objective of these schemes is capital appreciation. These schemes are suitable for investors with moderately high risk appetites. These schemes enjoy equity taxation.Conservative Hybrid funds:

These schemes invest 10 to 25% of their assets in equity or equity related securities and 75 to 90% of their assets in debt and money market instruments. The primary investment objective of these schemes is income generation. However, the equity component of the scheme can provide a kicker to returns over a long investment horizon. These schemes are suitable for investors with conservative or moderately low risk appetites. These schemes are taxed like debt funds.Dynamic Asset Allocation funds:

These schemes manage their asset allocation dynamically. There are upper or lower asset allocation limits for asset classes. Dynamic asset allocation funds increase or decrease their equity allocation according to market valuations. Most dynamic asset allocation funds increase their equity allocation (decrease their debt allocation) when equity market valuations are lower and vice versa – these funds follow anti-cyclical strategy. A few dynamic asset allocation funds follow the opposite strategy – pro-cyclical strategy. The investment objective is capital appreciation and income generation, while reducing downside risk in volatile markets. These funds are suitable for investors with moderately high risk appetites who want to avoid high volatility. These schemes usually enjoy equity taxation.Equity Savings funds:

These funds invest minimum 65% of their assets in equity or equity related securities (including derivatives) and minimum 10% in debt or money market instruments. These funds are allowed to hedge their equity exposure by using derivatives, thereby reducing the portfolio risk. These funds are required to state their minimum hedged and un-hedged exposure in their scheme information document (SID). Investors should read the SID before investing. The investment objectives of these funds are capital appreciation and income generation. These funds are suitable for investors with moderate risk appetites. These schemes enjoy equity taxation.Multi Asset funds:

These funds invest in minimum 3 asset classes (e.g. equity, debt, gold, real estate etc.) with a minimum allocation of at least 10% in all three asset classes. These funds usually invest in stocks, money market instruments, bonds, NCDs, gold and real estate investment trusts (REITs). Different assets have different performance trajectories in different market conditions. These funds are suitable for investors who want exposure to asset classes like gold, real estate etc. along with equity and debt, with the expectation of relatively stable performance across different market conditions and lower downside risks.Arbitrage funds:

These funds follow arbitrage (risk free profits) strategy by exploiting the price differences of the same underlying security in different equity market segments e.g. cash market and derivative market. These funds are required to have minimum 65% allocation to equity and the balance in money market or debt instruments. These schemes have the lowest risk profile among all hybrid schemes. The risk profile of arbitrage funds is comparable to liquid or ultra-short duration debt funds. The biggest advantage of arbitrage funds over liquid or ultra-short duration funds is that they enjoy equity taxation. They are suitable for conservative investors with very short investment tenures – few days or months. Investors should note that arbitrage funds may charge exit load for redemption within 30 days and plan their investments accordingly.

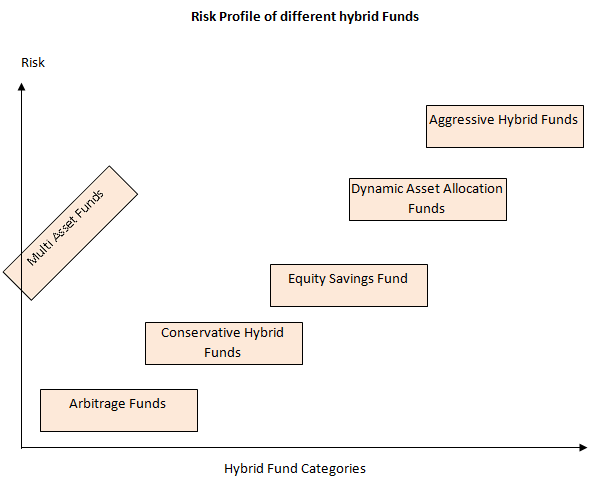

We have summarized the risk profiles of different types of hybrid mutual funds in the diagram above. Except for arbitrage funds, you should have sufficiently long investment horizons (at least 3 years) for other types of hybrid funds. For aggressive hybrid funds and dynamic asset allocation funds, 5 years plus investment tenures are advisable. You should select the right scheme according to your investment needs and risk appetite.

Suggested reading: Knowing investment risk is more important than looking for best mutual funds

Benefits of hybrid funds

- Asset allocation is one of the most important aspects of financial planning for achieving different financial goals. Hybrid mutual funds offer a range of asset allocation solutions for different investment needs.

You must read – Importance of asset allocation in volatile markets - One of the biggest benefits of hybrid mutual funds is that it provides automatic asset rebalancing. Asset rebalancing ensures that the asset allocation of your investment do not deviate from the intended asset allocation due to market movements.

- Equity oriented balanced funds enjoy beneficial taxation. If you are unclear about the taxation of your investment, please consult with your financial advisor.

Summary

Hybrid mutual funds offer a broad spectrum of solutions for different investment needs and risk appetites. It is important for investors to understand the risk / return characteristics of different types of hybrid funds before investing. In this two part blog post, we discussed about hybrid funds, tried to clarify some misconceptions, different types of hybrid funds and how to choose them according to your investment needs. Our humble objective in this two part series was to improve your understanding of hybrid funds, so that you are able to make informed investment decisions. You should always consult with your financial advisor if you have any doubt or question.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

- What should the ideal tenure of an STP: Midcap Equity Mutual Funds

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY