Why you should consider Quant Funds for your portfolio

What is quantitative investing?

Quantitative investing or quant is a rule based investment strategy that uses mathematical and statistical techniques to make investment decisions. Since quant investments are based on mathematical models, there is very limited human intervention in quant investing. Quant funds are thematic equity mutual fund schemes which use quantitative investment strategies. Though the investment strategy of quant funds are driven by quantitative models quant funds are actively managed schemes. The fund managers of quant schemes are responsible for developing the quantitative models and reviewing the models on a periodic basis. In this article we will review 360 ONE Quant Fund.

How are quant funds different from passive funds?

Both funds follow rules based approach, without day to day human (fund manager) intervention. However, quant funds are active funds. Passive funds like ETFs and index funds, do not aim to beat the index; they track a market benchmark index. Historical data shows that quant funds have been able to beat the market benchmark and create alphas for investors.

Benefits of quant funds

- Fund managers are human beings and all humans have emotions. No matter how objective a person tries to be in decision, there can be situations where his / her decisions are biased by emotions.

- Human biases can lead to undesired over-exposure or under-exposure. It can also lead to hanging on to losers or selling winners too early.

- The desire to look for trophy investments e.g. multibaggers or trying to time the market can lead to costly mistakes.

- Quant based investment approach helps you to avoid behavioural biases like herd mentality, relying on tips, market grapevine etc.

- Quant funds have the benefits of the active funds like active stock selection and risk management. At the same time it avoids some of the pitfalls like, human biases and fund manager discretion over the investment process.

Misconceptions of quant funds

There are several misconceptions about quant investments:-

- Overdependence on machines / models: The fund managers review the models and may also make updates to quantitative models from time to time.

- Difficult to understand: The parameters of the model are clearly laid out

- Missing out on bottom up stock picking: Quant models are actively managed schemes. They have clearly defined process of generating alphas by applying same signals across a set of comparable stocks

- Too theoretical: Emphasis on process over short term results. Happy to live with short term underperformance versus drifting from process.

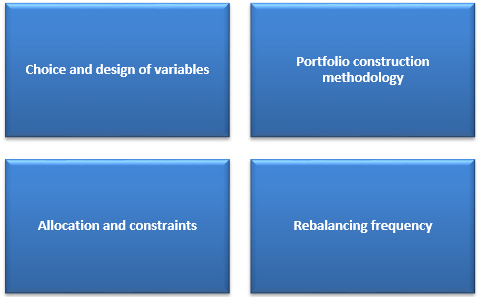

Differentiators among quant funds

360 ONE Quant Fund

360 ONE Quant Fund, formerly IIFL Quant Fund, uses the momentum investing strategy. The fund was launched around 2 years back in November 2021. The benchmark index of this scheme is S&P BSE 200 TRI. The fund has given 14.72% CAGR returns since inception beating the benchmark index by a large margin (as on 31st October 2023). The expense ratio (TER) of the fund is only 1.58% (as on 30th September 2023).

Investment Philosophy - 360 ONE Quant Fund

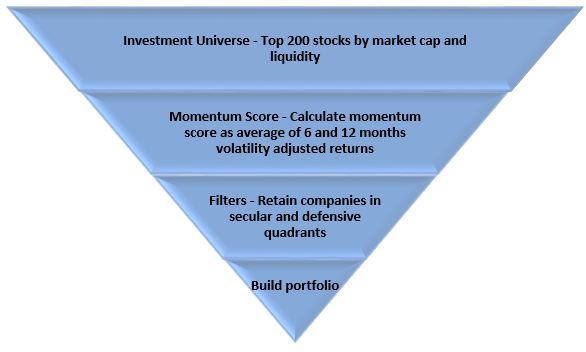

Stock selection Strategy- 360 ONE Quant Fund

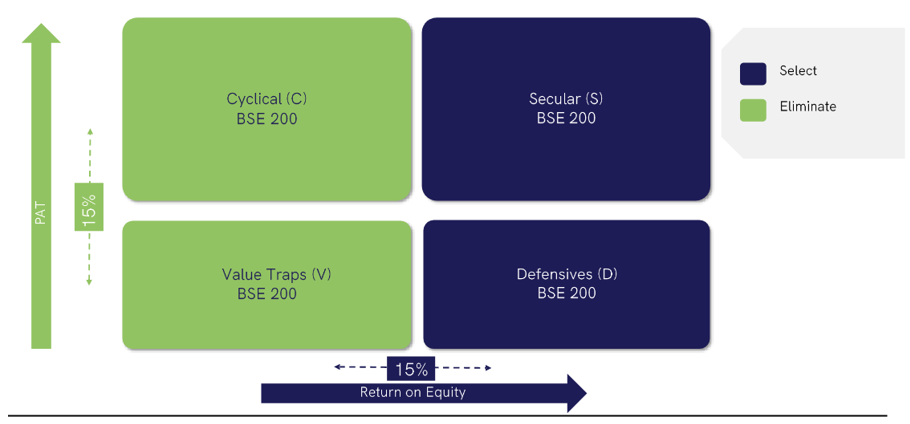

Quality filter based on SCDV: Investment framework- 360 ONE Quant Fund

Disclaimer: Sectors stated in SCDV investment framework are indicative and based on internal research. The scheme may or may not hold the securities in all the sectors as mentioned in the investment framework above.S- Secular – Companies with consistent ROE & PAT growth >15%, C- Cyclical – Companies with PAT growth > 15% but ROE < 15%, D- Defensive – Companies with ROE > 15% but PAT growth < 15%, V- Value Traps – Companies with both ROE & PAT growth < 15%. ROE = Return on Equity, PAT = Profit after Tax

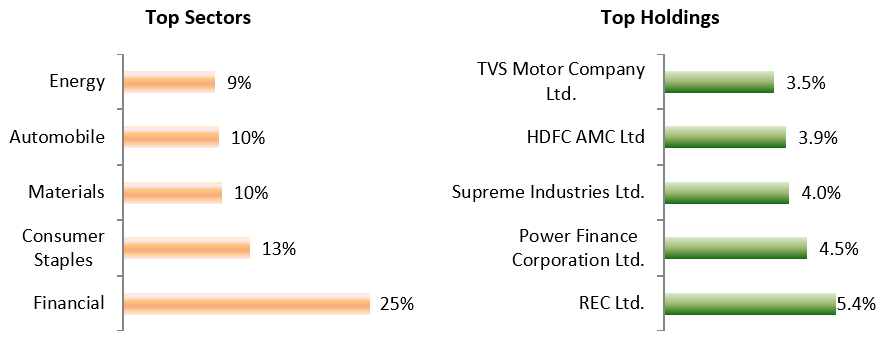

Portfolio Construction- 360 ONE Quant Fund

Source: Advisorkhoj Research, as on 30th September 2023

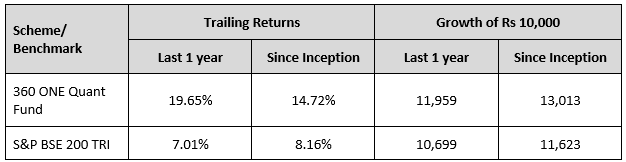

Performance of 360 ONE Quant Fund

Source: Advisorkhoj Research, as on 31st October 2023. The above investment simulation is for illustrative purposes only and should not be construed as a promise on minimum returns and safeguard of capital. Past performance may or may not be sustained in future. Different plans shall have different expense structure. Point to Point (PTP) returns in र is based on standard investment of र10,000; Since Inception date is 29th November 2021. The performance of the scheme is benchmarked against to the Total Returns variant of the Index.

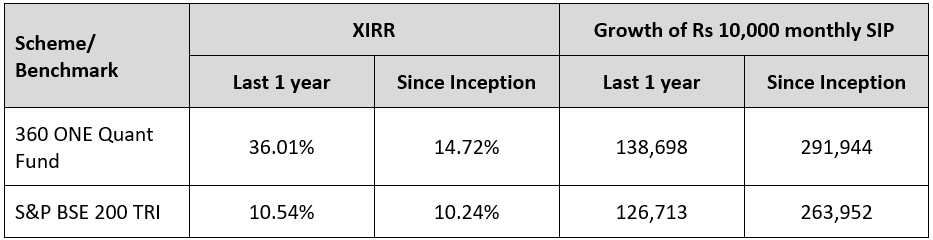

SIP Performance

Source: Advisorkhoj Research, as on 31st October 2023. The above investment simulation is for illustrative purposes only and should not be construed as a promise on minimum returns and safeguard of capital. Managed by fund manager since 29th November 2021. Since Inception date is 29th November 2021.The performance of the scheme is benchmarked against to the Total Returns variant of the Index. Past performance may or may not be sustained in the future.

Why invest in 360 ONE Quant Fund?

- Not affected by behavioural biases – 360 ONE Quant Fund strategy is systematic and rule based

- Compounding of learning – Over time the model will improve as new research is done for better metrics, portfolio construction methods

- Institutional memories – Less reliance on individuals for fund performance. Fund managers can come and go, but the fund house strategies can continue to perform.

- Objective back-testability – The fund quantitative model is back-tested across multiple scenarios to check their insanity

- Risk management – No extreme positions in stocks or sectors

- Transparent methodology – The fund follows a clearly defined process. There are no manual overrides

- Momentum investing – Momentum is a widely tested strategy across markets, asset classes and time periods, especially in India

- Track record of Alpha – Though the fund history is only about 2 years, the fund has built a track record of alpha creation

Who should invest in 360 ONE Quant Fund?

- Investors looking for capital appreciation over long investment horizon.

- Investors with high to very risk appetites

- Investors with minimum 5 years investment tenures

- You can invest in SIP or lump sum.

Investors should consult with their financial advisors or mutual fund distributors if 360 ONE Quant Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- NFO Review: Mutual Fund Industrys First Hybrid Balanced Fund

- 360 ONE Multicap PMS: Long Term Capital Appreciation in Volatile Markets

- 360 ONE Multicap PMS: 8X returns in 10 point 5 years

- 360 ONE Multicap PMS: Wealth creation track record

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

LATEST ARTICLES

- 360 ONE ELSS Tax Saver Nifty 50 Index Fund: Wealth creation with tax benefits

- 360 ONE Multi Asset Allocation Fund NFO: Multi asset allocation solution in volatile times

- 360 ONE Phoenix PMS: Long Term Equity Growth

- 360 ONE Quant Fund: One of top performing quant funds for current market conditions

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

360 ONE Asset offers uniquely structured products to cover diverse investment requirements of investors. Our mutual fund portfolio is concentrated on a few, high-quality, high-conviction stocks. This allows our fund managers to maintain focus and generate improved risk-adjusted returns.

Having pioneered the concept of benchmark-agnostic funds in India, our fund managers function in an unconstrained but research-oriented manner. While traditional asset management companies are constrained by benchmarks, our benchmark-agnostic approach enables us to pick stocks with flexibility and tap into unique multi-baggers of the future.

Investor Centre

Follow 360 One MF

More About 360 One MF

POST A QUERY