360 ONE Focused Equity Fund: Consistent performing top fund

The 360 ONE Focused Equity Fund, has recently completed 10 years since its inception in October 2014. In the ten years since its inception, the fund showed outstanding, consistent performance. If you had invested Rs 1 lakh in the fund at the time of its inception, your investment in the regular plan would have multiplied almost 4.5X to Rs 4.51 lakhs in 10 years (as on 14th Nov. 2024).

What are Focused Equity Funds?

These funds invest in a relatively concentrated portfolio of high-conviction stocks. As per SEBI guidelines, focused equity funds can invest in maximum 30 stocks. A portfolio with higher allocations to top-performing stocks in different industry sectors has the potential to outperform a portfolio with a larger number of stocks but lower allocations to top performers. Each stock in a focused fund is expected to contribute significantly to the fund's overall performance. Adding a focused fund to your mutual fund portfolio may increase potential portfolio alphas.

360 ONE Focused Equity Fund

The 360 ONE focused Equity Fund (Regular Growth Option) has an Asset under management of Rs 7,618 Crores (as on 31st October 2024), and a TER of 1.78% for its regular growth option. The scheme’s benchmark is S&P BSE 500 TRI. Mayur Patel is the fund manager and has been managing the scheme since November 2019. Mr. Rohit Vaidyanathan is the Co-Fund manager of the scheme.

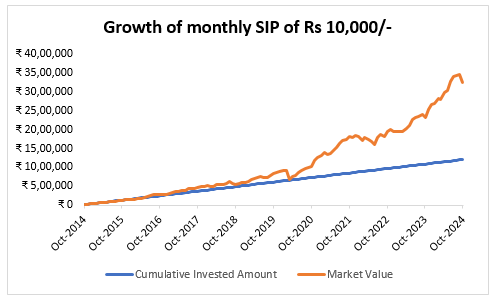

Wealth Creation through SIP in 360 ONE Focused Equity Fund

A monthly SIP of Rs 10,000/- in the scheme would have grown to Rs 31 Lakhs (as on 14th November 2024) with a cumulative investment of just Rs 12 lakhs (see the chart below).

Source: Advisorkhoj research as on 14th November 2024

Consistent outperformance relative to peers

Rolling return is one of the most unbiased measures of fund performance since it evaluates performance across different market conditions. The chart below shows the 3 year rolling returns of 360 ONE Focused Equity Fund versus the category average since the inception of the fund. You can see that the fund has consistently outperformed the category average across different market conditions. In the last 10 years since its inception, the fund gave average rolling return of 16.84% (versus category average rolling return of 11.23%). The fund gave 15%+ CAGR in 57% instances.

Source: Advisorkhoj research as on 14th November 2024.

Risk Adjusted Returns

Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund. Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of 360 ONE Focused Equity Fund over the last 10 years.

The Up Market Capture Ratio of 360 ONE Focused Equity Fund over last 1 year was 103% which implies that if the benchmark index went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 1.03%. The Down Market Capture Ratio of the fund was 93% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by 0.93% only. The market capture ratios of 360 ONE Focused Equity Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

Investment Strategy

- The fund identifies the sectors that are likely to do well in the medium term, based on the business cycle of the economy and takes focused exposure to stocks in identified sectors.

- The sectors are actively monitored and changes made to invest in sectors that will benefit from the current stage of the business cycle.

- The fund manager analyses the business cycle, which reflects the fluctuations of activity in an economy, can be a critical determinant of equity sector performance over the longer term.

- Historically changes in key economic indicators have provided a fairly reliable guide to recognizing the different phases of an economic cycle— Early, Mid and Late.

- The business cycle approach to sector investing uses probabilistic analysis to identify the shifting phases of the economy, which provides a framework.

- Generating outperformance among equity sectors with a business cycle approach may be enhanced by adding complementary analysis on industries and inflation, as well as fundamental security research, among other factors.

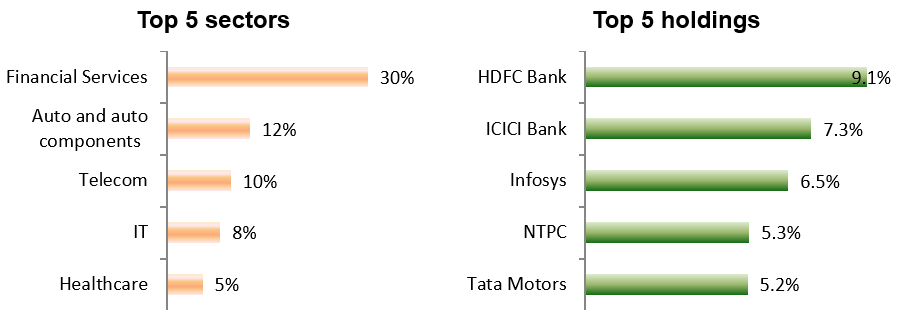

Current portfolio positioning

The scheme is market cap and sector agnostic. Currently 42% of the scheme portfolio is in large cap, 30% in midcap and 23% in small cap (as on 31st October 2024). The charts below show the top sectors and holdings of the fund.

Source: Fund Factsheet. Data as on 31st October 2024

Is this a good time to invest in 360 One Focused Equity Fund?

- The market continues to be volatile due to concerns about earnings outlook and timing of rate cuts.

- The Reserve Bank of India (RBI) has kept rates unchanged since February 2023. However, food inflation is expected to ease with a normal monsoon and strong Kharif crop output, setting the stage for potential policy easing by the RBI.

- There is optimism around the festival quarter, which could lift consumption, and rural demand is expected to improve.

- A pickup in the capex cycle could support earnings growth in the medium term.

- Valuations have moderated somewhat from high levels after the deep correction in the market.

- In the long run, the outlook remains positive, driven by strong macro factors.

Who should invest in 360 One Focused Equity Fund?

- Investors looking for capital appreciation and wealth creation.

- Investors should have at least 5-year investment horizon in this scheme.

- Investors with a high to very high-risk appetite.

- You can invest in this scheme either in lump sum or through SIP

Consult with your financial advisors or mutual fund distributor to determine if 360 One Focused Equity Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- NFO Review: Mutual Fund Industrys First Hybrid Balanced Fund

- 360 ONE Multicap PMS: Long Term Capital Appreciation in Volatile Markets

- 360 ONE Multicap PMS: 8X returns in 10 point 5 years

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

- 360 ONE Multicap PMS: Wealth creation track record

LATEST ARTICLES

- 360 ONE ELSS Tax Saver Nifty 50 Index Fund: Wealth creation with tax benefits

- 360 ONE Multi Asset Allocation Fund NFO: Multi asset allocation solution in volatile times

- 360 ONE Phoenix PMS: Long Term Equity Growth

- 360 ONE Quant Fund: One of top performing quant funds for current market conditions

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

360 ONE Asset offers uniquely structured products to cover diverse investment requirements of investors. Our mutual fund portfolio is concentrated on a few, high-quality, high-conviction stocks. This allows our fund managers to maintain focus and generate improved risk-adjusted returns.

Having pioneered the concept of benchmark-agnostic funds in India, our fund managers function in an unconstrained but research-oriented manner. While traditional asset management companies are constrained by benchmarks, our benchmark-agnostic approach enables us to pick stocks with flexibility and tap into unique multi-baggers of the future.

Investor Centre

Follow 360 One MF

More About 360 One MF

POST A QUERY