360 ONE Quant Fund: 2X growth in less than 3 years

What is quantitative investing?

Quantitative investing or quant investing is a rule-based investment strategy that uses statistical techniques to make investment decisions. Quant funds are thematic equity mutual fund schemes, which utilize complex mathematical models and algorithms to make investment decisions. These funds harness the power of data, statistics, and computer programming to identify patterns, trends, and opportunities in the financial markets. Though the investment strategy of quant funds is driven by quantitative models, they are actively managed schemes. The fund managers of quant schemes develop the quantitative models and review the models on a periodic basis. In this article we shall review the 360 ONE Quant Fund whose performance even in the short time since its inception has caught our attention.

360 ONE Quant Fund – Regular Growth Option

The 360 ONE Quant Fund is an Equity (Quantitative) fund which uses the combination of momentum and quality factor in investment strategy. This fund was formerly known as the IIFL Quant Fund, is managed by Mr. Parijat Garg and Co Fund Manager Mr. Ashish Ongari. The AUM of the scheme is 631.71 Crores (as on 31st March 2025) The fund has given 18.16% CAGR returns since its inception in November 2021. Though 360 ONE Quant Fund is still relatively young in terms of vintage, the fund's strong performance despite the volatility in markets could be attractive for investors.

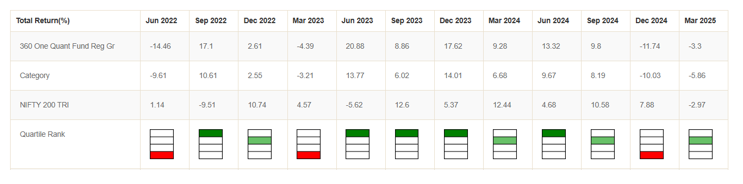

Consistent good performance

The 360 ONE Quant Fund has featured in the top quartiles in the 3 years out of 4 since its inception (YTD), which demonstrates the fund's consistent good performance. Also, the scheme has featured in the top and upper mid quartiles in 9 out of 12 quarters since its launch. (as on 31st Mar, 2025)

Source: Advisorkhoj Research as on 31st March 2025

Outperformed market benchmark

The chart below shows the 1 year rolling returns of 360 ONE Quant Fund versus the market benchmark Nifty 200 TRI since the inception of the fund. You can see that the fund was able to outperform Nifty 200 TRI most of the times over 1 year investment tenure. The average and median rolling returns of 360 ONE Quant Fund was significantly higher than Nifty 200 TRI. The fund has given 15t%+ CAGR returns in more than 70% of the instances (1 year tenure) since inception.

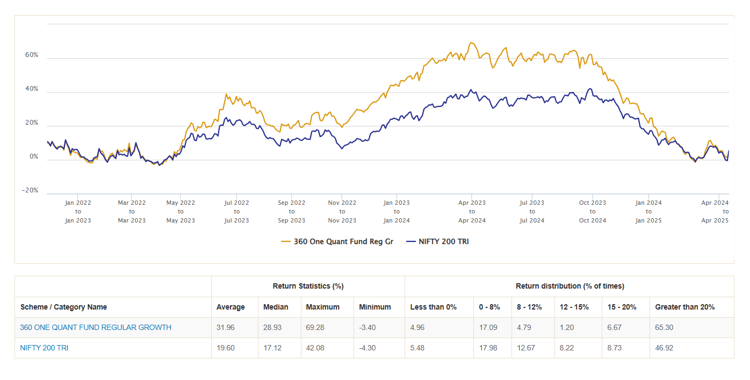

Given below is the chart that shows the 2-year rolling return of the fund vs the market benchmark Nifty 200 TRI. As is evident from the chart the 360 ONE Quant Fund has beaten the benchmark by a huge margin. It also gave above 20% returns in 98.2% of the observations (instances).

Source: Advisorkhoj Research as on 31st March 2025

Strong risk adjusted returns

Market capture ratio is a measure of the performance of a mutual fund scheme relative to the market benchmark in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market's upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market's downside was arrested by the fund. Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of 360 ONE Quant Fund over the last 3 years.

The Up Market Capture Ratio of 360 ONE Quant Fund over last 1 year was 134% which implies that if the benchmark up by 1% in a month, then the scheme's Net Asset Value (NAV) went up by 1.34%. The Down Market Capture Ratio of the fund was 112% which implies that if the benchmark index went down by 1% in a month, then the scheme's Net Asset Value (NAV) went down by 1.12%. The market capture ratios of 360 ONE Quant Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

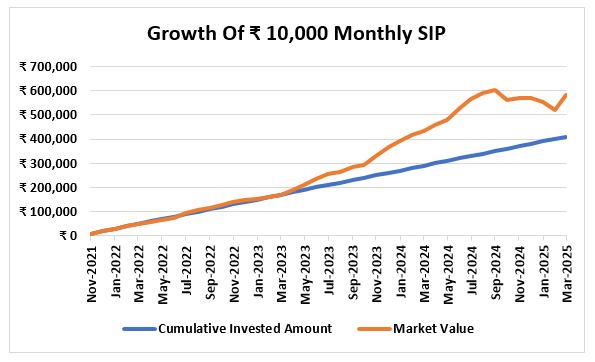

SIP Performance

A monthly SIP of Rs 10,000/ started at the inception of the fund would have grown to Rs 5.80 lakhs (as on 31st March 2025) against a cumulative investment of Rs 4.1 lakhs, giving an XIRR of 19.2%.

Source: Advisorkhoj Research as on 31st March 2025

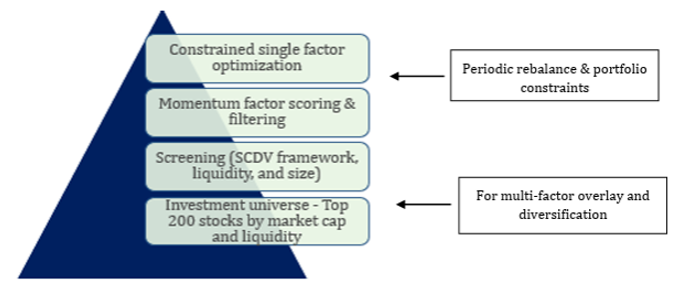

Investment Process - 360 ONE Quant Fund: The fund's investment process is rooted in a factor-based approach, primarily leveraging quality and momentum factors within a defined set of portfolio constraints

- First step is to review the investment universe of Top 200 companies by market cap and liquidity listed on National Stock Exchange (NSE) or Bombay Stock Exchange (BSE).

- A screening of stocks is done basis SCDV framework, liquidity and size of the firm.

- Once screening of list of stocks is done, each stock is updated with their momentum factor score. The momentum score is calculated using stock price and total returns over a period, usually a year, for each stock.

- The entire portfolio construction process is done using the inhouse proprietary quantitative models to calculate factor scores. The factor construction is continuously reviewed, and methodology is based on academic literature and internal research.

Source: 360 ONE AMC SID

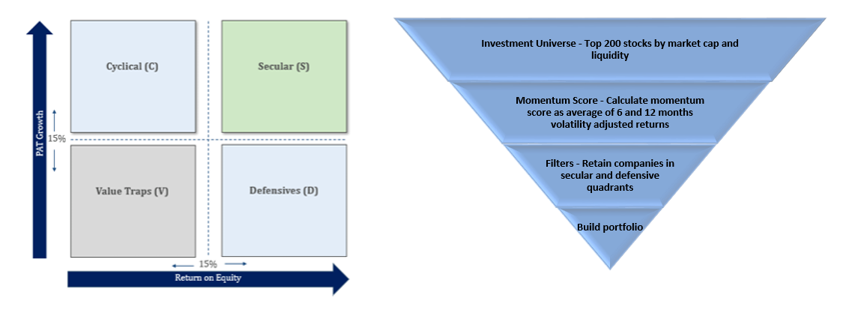

Stock selection Strategy

The 360 ONE Quant Fund uses the SCDV framework to screen stocks having higher profitability and stable earnings trajectory (see illustration). SCDV framework classifies companies into 4 quadrants -

- Secular: Companies delivering 15% PAT and ROE growth rates, playing out India's secular upward growth shift e.g. financial services, consumer discretionary, auto and auto ancillaries etc.

- Cyclicals: High growth companies which typically have high capital expenditures and hence a lower ROE e.g. Infrastructure, logistics, capital goods etc. These have relatively higher sensitivity to business and economic cycles.

- Defensive: Companies that have high ROE and lower growth rates, low capital expenditures and sensitivity to business cycles, but that provide a cushion to returns during downturns e.g. consumer staples, healthcare etc.

- Value Traps: Companies that register low growth rates and ROE, which are typically avoided across public equity strategies etc.

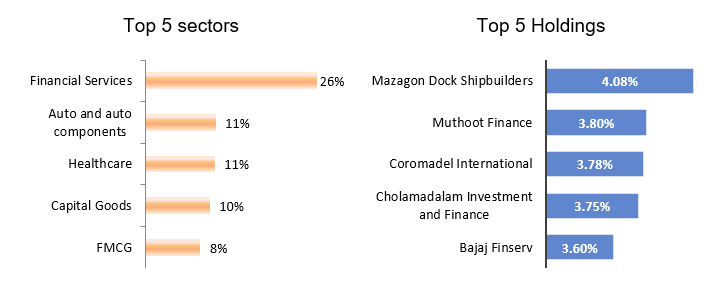

Portfolio Construct

The portfolio of the scheme has a large cap bias with 61% exposure to stocks belonging this market cap and 39% in Midcap stocks. The chart below shows the top 5 sectors and holdings of the fund invests.

Source: Fund Factsheet as on 31st March 2025

Who should invest in 360 ONE Quant Fund?

- Investors looking for capital appreciation over long investment horizon.

- Investors with high to very risk appetites

- Investors with minimum 5 years investment tenures

Consult you financial advisors or mutual fund distributors to know if 360 ONE Quant Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- 360 ONE Multicap PMS: Long Term Capital Appreciation in Volatile Markets

- 360 ONE Flexicap Fund: Strategic Allocations in Volatile Markets

- 360 ONE Focused Equity Fund: Consistent performing top fund

- 360 ONE Multicap PMS: Wealth creation track record

- 360 ONE Balanced Hybrid Fund: The first true to label Balanced Fund off to a great start

360 ONE Asset offers uniquely structured products to cover diverse investment requirements of investors. Our mutual fund portfolio is concentrated on a few, high-quality, high-conviction stocks. This allows our fund managers to maintain focus and generate improved risk-adjusted returns.

Having pioneered the concept of benchmark-agnostic funds in India, our fund managers function in an unconstrained but research-oriented manner. While traditional asset management companies are constrained by benchmarks, our benchmark-agnostic approach enables us to pick stocks with flexibility and tap into unique multi-baggers of the future.

Investor Centre

Follow 360 One MF

More About 360 One MF

POST A QUERY