360 ONE Balanced Hybrid Fund: The first true to label Balanced Fund off to a great start

What is Balanced Hybrid Fund?

Hybrid funds are mutual fund schemes that invest in combination of two or more asset classes e.g. equity, debt etc. Balanced Hybrid funds are hybrid schemes in which the equity and debt allocations are both maintained in 40 – 60% range (as per SEBI’s mandate). Balanced Hybrid Funds offer a simple asset allocation solution since it has only two asset classes and does not have the complexity of derivatives / arbitrage or other asset classes e.g. gold, international etc.

As per the capital gains tax changes announced in the 2024 Union Budget, short term capital gains (investment holding period of up to 2 years) from Balanced Funds are taxed as per the income tax rate of the investor. Long term capital gains (investment holding period of more than 2 years) of Balanced Funds are taxed at 12.5% (no indexation benefits).

Why is asset allocation important?

Asset allocation balances risk and return, to provide stability to your investment portfolio and help you achieve your financial goals. A 1986 study done in the United States showed that asset allocation is the most important determinant of portfolio performance (source: Brinson, Hood, Beebower, Financial Analyst Journal 1986). Your asset allocation depends on your risk appetite and investment goals. A large section of retail investors who rely primarily on traditional fixed income investments e.g. Bank FDs, Post Office Small Savings Schemes, Corporate FDs etc can consider 360 ONE Balanced Hybrid Fund.

About 360 ONE Balanced Hybrid Fund

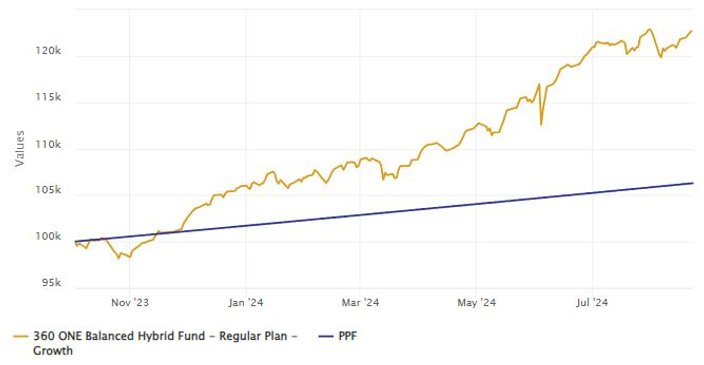

In September 2023, 360 ONE AMC launched its first hybrid offering, 360 ONE Balanced Hybrid Fund.360 ONE AMC was the first to launch this fund, and only two fund houses currently offer it. The fund has received positive interest from investors. The fund has an AUM of around Rs 778 crores (as of 31st July 2024). The chart below shows the growth of Rs 1 lakh investment in the fund since inception. The scheme has given 23.2% absolute return since inception.

Source: Advisorkhoj Research as on 22nd August 2024

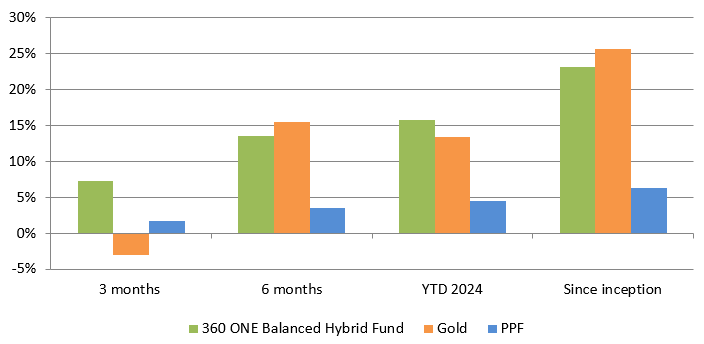

How has 360 ONE Balanced Hybrid Fund performed versus other asset classes?

360 ONE Balanced Hybrid has outperformed other asset classes like Gold and Fixed Income in 2024. The fund has also outperformed both Gold and Fixed Income in last 3 months

Source: Advisorkhoj Research as on 22nd August 2024

Investment Strategy

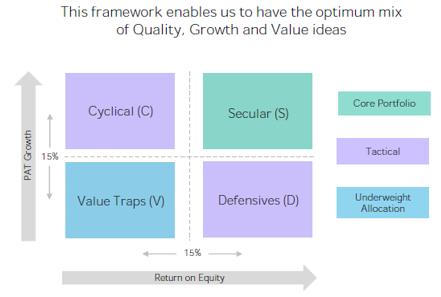

- Equity portion (40 – 60% of the portfolio): For the equity portion of the portfolio, the fund follows a multi-cap approach. In terms of stock selection, it adopts a bottom-up approach, utilizing the Unique SCDV Framework. In the SCDV Framework, stocks are classified into 4 categories based on their PAT (Profit after Tax) growth and ROE (Return on Equity).

The purpose of the framework is to ensure that the fund will be investing in growing companies that can have a scalable business over time. Focusof the fund managers will be to understand the pricing power and benign competitive landscape for the business. One of the quantitative metric used by the fund management team is to look out for industry or potential sectors for companies with competitive advantages, delivering higher ROEs than peers. Through active research the fund managers will aim to avoid sectors that are vulnerable to high regulation or where the competitive intensity is very high. Another set of companies that they try and avoid are those which have short growth cycle and the technological changes can be fast and the company may become redundant since these factors make it very difficult to assess the future projections. The Fund Managers also ensure that valuations are not the sole investment criteria but a holistic approach is taken while selecting a company for the portfolio.

- Debt portion (40 – 60% of the portfolio): Investment management process relies on analytics and research to achieve risk-adjusted returns in each product category, thereby defining an asset allocation and duration strategy that matches the risk characteristics of the corresponding schemes.

For the debt portion, the fund manager will focus on the following:

- Style: Accrual-driven strategy with a focus on maintaining the highest credit quality (80%-100% AAA allocation)

- Duration: Low-interest rate risk, aims to maintain a modified duration of 2-3 years.

- Relative Safety: Endeavour to maintain a minimum 80% allocation in AAA Corporate bonds and Sovereign bonds, and 20% allocation will never go below AA+

- Tactical Opportunity: The fund may take exposure to Government Securities (G-Secs) to gain tactical opportunity from volatility in duration.

- Liquidity: Relatively liquid portfolio primarily composed of Sovereign and AAA Corporate bonds.

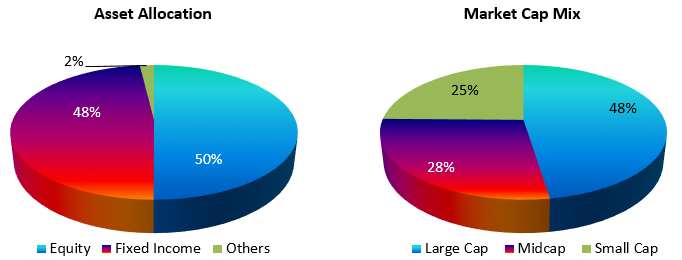

Current asset allocation and market cap mix of 360 ONE Balanced Hybrid Fund

Source: 360 ONE MF Fund Factsheet, as on 31st July 2024

SIP Performance of the Fund

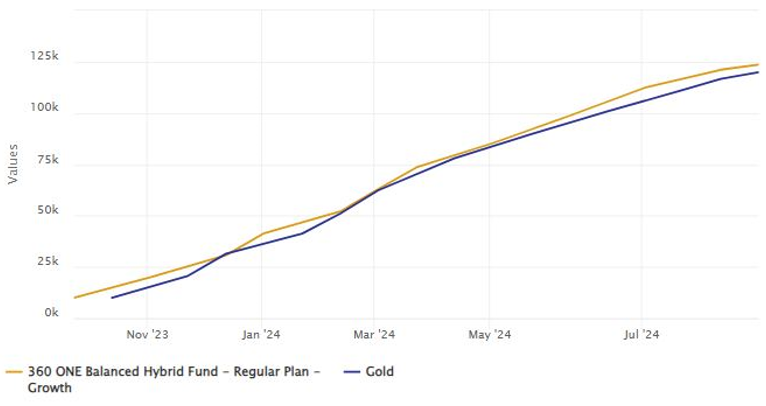

The chart below shows the growth of Rs 10,000 monthly SIP investment in 360 ONE Balanced Hybrid Fund versus Gold from inception till date (as on 22nd August 2024). It can be seen that the fund has outperformed Gold in SIP performance.

Source: Advisorkhoj Research, as on 22nd August 2024.

Current market context

Equity market is trading near its record high. We are seeing profit booking at higher levels. Though Nifty 50 valuations seem reasonable relative to long term averages, valuations may be stretched in certain pockets of the market e.g. midcaps, small caps. Among global uncertainties, timing of interest rate cuts, JPY (Yen) versus USD and other currencies, geo-political risks and last but not the least, the impact of hard or soft landing of the US economy at the end of this interest rate cycle etc, can cause nervousness and volatility in the market. At a time when valuations are on the higher side, thoughtful asset allocation can provide stability to your investment portfolio.

Why is this a good time to invest in 360 ONE Balanced Hybrid Fund?

- High Valuations: At a time when valuations are on the higher side, thoughtful asset allocation can provide stability to your investment portfolio if market turns volatile. The fund is suitable for investors who prefer a balanced asset allocation.

- Long Term Wealth: Asset allocation plays a pivotal role in long-term portfolio returns. The equity portion of the fund can create wealth over long investment horizon. The mix of large cap and mid/small cap of the fund is also balanced (50:50). This will provide relative stability as well long term growth (capital appreciation).

- Attractive Yieldson the Debt side: Though bond yields have retreated from highs, 2-3 year G-Sec yields are still attractive at around 6.9% (source: worldgovernmentbonds.com, as on 31st July 2024). AAA and AA rated papers spreads over G-Sec are in the 50 bps to 160 bps in the 2 – 3 year range of the curve (source: CRISIL, as on 31st July 2024).

- High Credit Quality: More than 93% of the fixed income portfolio is invested in AAA rated or Sovereign papers.

- Favourable Taxation: While Traditional Fixed Income, Debt and Debt oriented Hybrid Funds taxed at marginal rate, investing in Balanced Hybrid Fund still offers lower rate of long term capital gains taxation (for minimum holding period of 2 years) at 12.5% (no indexation)

Who should invest in this fund?

- Investors looking for capital appreciation and income over sufficiently long investment horizons.

- Investors seeking a balanced blend of Debt and Equity exposure with relatively lower volatility.

- The fund is suitable for first time investors or investors who do not have high risk appetites.

- Investors seeking options beyond conventional fixed income investments e.g. senior citizens or retired individuals aiming to generate tax-efficient returns compared to traditional fixed income options.

- Investors who have an investment horizon of 3 years or longer.

Investors should consult their financial advisors or mutual fund distributors if 360 ONE Balanced Hybrid Fund is suitable for their investment needs.

Consult with your financial advisor or PMS distributor if you want to know more about 360 ONE Multicap PMS

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- 360 ONE Multicap PMS: Long Term Capital Appreciation in Volatile Markets

- 360 ONE Flexicap Fund: Strategic Allocations in Volatile Markets

- 360 ONE Focused Equity Fund: Consistent performing top fund

- 360 ONE Multicap PMS: Wealth creation track record

- 360 ONE Flexicap Fund: An outstanding start for long term Capital Growth

360 ONE Asset offers uniquely structured products to cover diverse investment requirements of investors. Our mutual fund portfolio is concentrated on a few, high-quality, high-conviction stocks. This allows our fund managers to maintain focus and generate improved risk-adjusted returns.

Having pioneered the concept of benchmark-agnostic funds in India, our fund managers function in an unconstrained but research-oriented manner. While traditional asset management companies are constrained by benchmarks, our benchmark-agnostic approach enables us to pick stocks with flexibility and tap into unique multi-baggers of the future.

Investor Centre

Follow 360 One MF

More About 360 One MF

POST A QUERY