360 ONE Balanced Hybrid Fund: A true to label balanced fund

In September 2023, 360 ONE AMC launched its first hybrid offering, 360 ONE Balanced Hybrid Fund. This fund is a unique proposition as it is the only true to label balanced fund that balances asset allocations to equity and debt across different market conditions. The equity and debt allocations are both maintained in 40 – 60% range. The allocations to equity and debt within this range will depend on market conditions and the fund manager’s outlook. As per the change in taxations for hybrid funds in FY 2023-24 Finance Bill, long term capital gains of this fund will be taxed at 20% after allowing for indexation benefits.

Why is asset allocation important?

All investors aim for a seamless journey to build wealth. However in reality, markets are erratic, moving up or down and leaving many investors coping with strong emotions. When market goes up, the emotion is torn between booking profits and while some may want to invest even more, believing the market will always work for them. And when the market goes down, the emotions can range from pain of losing their hard earned money to outright panic. These behavioural biases often result in investor’s making wrong decisions, which harm their financial goals in the long term.

Asset allocation balances risk and return, to provide stability to your investment portfolio and help you achieve your financial goals. A 1986 study done in the United States showed that asset allocation is the most important determinant of portfolio performance (source: Brinson, Hood, Beebower, Financial Analyst Journal 1986). Your asset allocation depends on your risk appetite and investment goals.360 ONE Balanced Hybrid Fund fulfils the need of investors who do not have very high risk appetite, but want inflation adjusted post tax real returns. A large section of retail investors who rely primarily on traditional fixed income investments e.g. Bank FDs, Post Office Small Savings Schemes, Corporate FDs etc can consider 360 ONE Balanced Hybrid Fund.

Asset Allocation Strategy

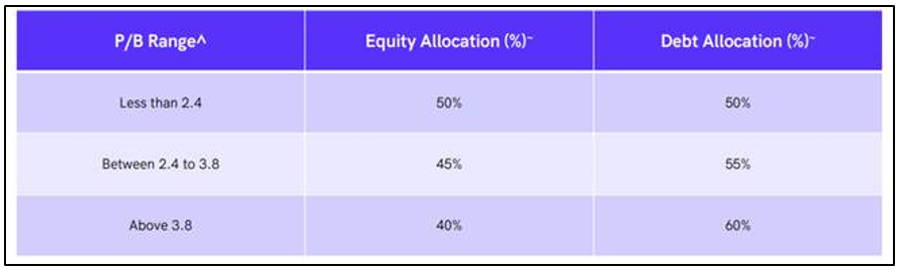

“Only when the market is trading at extreme valuations, the fund will adjust its equity allocation by 5%”, said Anunaya Kumar, President and Head of Sales and distribution at 360 ONE AMC. This ensures that the fund manager will be cognizant of the overall market valuations.

Investment Strategy

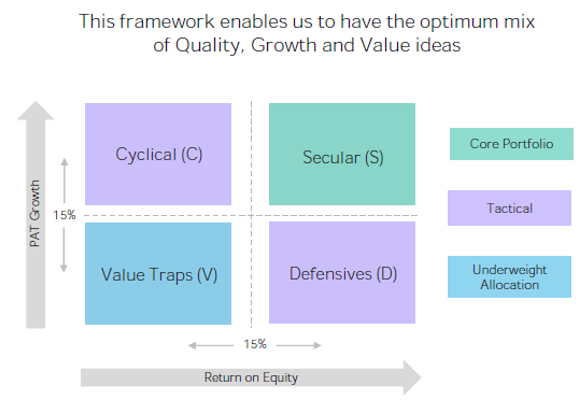

- Equity portion (40 – 60% of the portfolio): For the equity portion of the portfolio, the fund will follow a multi-cap approach. In terms of stock selection, it will adopt a bottom-up approach, utilizing the Unique SCDV Framework.In the SCDV Stocks are classified into 4 categories based on their PAT (Profit after Tax) growth and ROE (Return on Equity).

The purpose of the framework is to ensure that the fund will be investing in growing companies that can have a scalable business over time. Focusof the fund managers will be to understand the pricing power and benign competitive landscape for the business. One of the quantitative metric used by the team is to look out for industry or potential sectors for companies with competitive advantages, delivering higher ROEs than peers.Through active research the fund managers will aim to avoid sectors that are vulnerable to high regulation or where the competitive intensity is very high. Another set of companies that they try and avoid are those which have short growth cycle and the technological changes can be fast and the company may become redundant since these factors make it very difficult to assess the future projections.The Fund Managers also ensure that valuations are not the sole investment criteria but a holistic approach is taken while selecting a company for the portfolio. - Debt portion (40 – 60% of the portfolio): Kumar has explained the philosophy as, “Debt side our philosophy is to focus on ‘Sustainable Returns’ with Safety and Liquidity. The investment management process relies on analytics and research to achieve risk-adjusted returns in each product category, thereby defining an asset allocation and duration strategy that matches the risk characteristics of the corresponding schemes.”

For the Hybrid Balanced Fund, the fund manager will focus on the following:

- Style: Accrual-driven strategy with a focus on maintaining the highest credit quality (80%-100% AAA allocation)

- Duration: Low-interest rate risk, aims to maintain a modified duration of 2-3 years.

- Relative Safety: Endeavour to maintain a minimum 80% allocation in AAA Corporate bonds and Sovereign bonds, and 20% allocation will never go below AA+

- Tactical Opportunity: The fund may take exposure to Government Securities (G-Secs) to gain tactical opportunity from volatility in duration.

- Liquidity: Relatively liquid portfolio primarily composed of Sovereign and AAA Corporate bonds

Why you should invest in 360 ONE Balanced Hybrid Fund?

- Balanced asset allocation: The fund is suitable for investors who prefer a balanced asset allocation of 50% equity and 50% debt. As of 360 ONE Balanced Hybrid Fund, for now, will be the only hybrid fund maintaining an allocation range of 40%-60% in equity and 60%-40% in debt.

- Unique positioning: Investment in pure equity and debt assets, aiming to maximize risk adjusted returns. The fund will not invest in arbitrage opportunities or other asset types unlike many peer funds. Investing in pure debt instead of arbitrage may result in relatively higher stability through income accrual (depending on interest rate scenario) instead of arbitrage profits, which are highly dependent on equity market conditions.

- Taxation: As the fund will maintain equity allocation of above 35% at any given point in time, the long-term capital gains (LTCG) earned will be eligible for indexation benefit. LTCG shall be taxed at 20% after indexation after 3 years.

How has the fund performed till date?

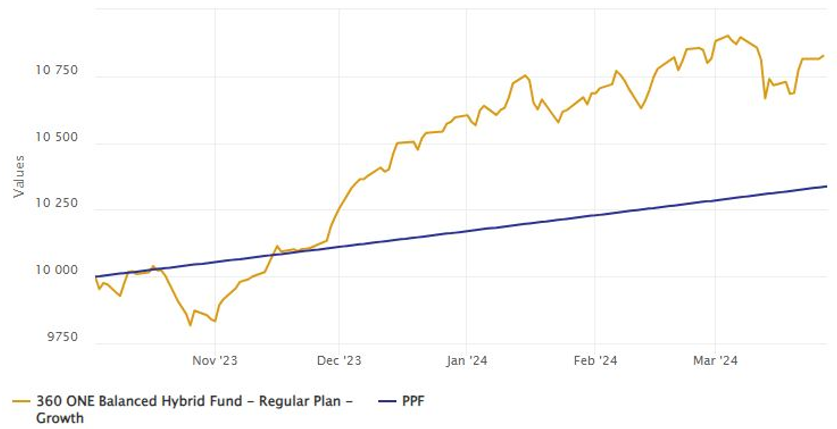

The chart below shows the growth of Rs 10,000 investment in 360 ONE Balanced Hybrid Fund versus traditional fixed income option like Post Office Small Savings Scheme till date (as on 27th March 2024). The fund has given nearly 18% returns till date.

Source: Advisorkhoj Research, as on 27th March 2024.

Why is this a good time to invest in 360 ONE Balanced Hybrid Fund?

- High Valuations: Considering the current record-high levels in the equity market, opting for a Balanced Fund could be a strategic decision. Though we have correction in midcaps / small caps over the last month or so, concerns about valuations remain.

- Long Term Wealth: Asset allocation plays a pivotal role in long-term portfolio returns. The equity portion of the fund can create wealth over long investment horizon.

- Attractive Yieldson the Debt side: Though bond yields have retreated from highs, yields are still attractive across different maturities on the yield curve.

- Recent Taxation Changes: With Debt and Debt oriented Hybrid Funds taxed at marginal rate, investing in Balanced Hybrid Fund still offers Indexation benefit albeit at slightly higher risk

Who should invest in this fund?

- Investors looking for capital appreciation and income over sufficiently long investment horizons

- Investors seeking a balanced blend of Debt and Equity exposure with relatively lower volatility

- The fund is suitable for first time investors or investors who do not have high risk appetites.

- Investors seeking options beyond conventional fixed income investments e.g. senior citizens or retired individuals aiming to generate tax-efficient returns compared to traditional fixed income options.

- Investors who have an investment horizon of 3 years or longer.

Investors should consult their financial advisors or mutual fund distributors if 360 ONE Balanced Hybrid Fund is suitable for their investment needs.

Consult with your financial advisor or PMS distributor if you want to know more about 360 ONE Phoenix PMS

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- NFO Review: Mutual Fund Industrys First Hybrid Balanced Fund

- 360 ONE Multicap PMS: Long Term Capital Appreciation in Volatile Markets

- 360 ONE Multicap PMS: 8X returns in 10 point 5 years

- 360 ONE Multicap PMS: Wealth creation track record

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

LATEST ARTICLES

- 360 ONE ELSS Tax Saver Nifty 50 Index Fund: Wealth creation with tax benefits

- 360 ONE Multi Asset Allocation Fund NFO: Multi asset allocation solution in volatile times

- 360 ONE Phoenix PMS: Long Term Equity Growth

- 360 ONE Quant Fund: One of top performing quant funds for current market conditions

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

360 ONE Asset offers uniquely structured products to cover diverse investment requirements of investors. Our mutual fund portfolio is concentrated on a few, high-quality, high-conviction stocks. This allows our fund managers to maintain focus and generate improved risk-adjusted returns.

Having pioneered the concept of benchmark-agnostic funds in India, our fund managers function in an unconstrained but research-oriented manner. While traditional asset management companies are constrained by benchmarks, our benchmark-agnostic approach enables us to pick stocks with flexibility and tap into unique multi-baggers of the future.

Investor Centre

Follow 360 One MF

More About 360 One MF

POST A QUERY