360 ONE Flexicap Fund: Very promising start for this flexicap fund

360 ONE MF launched their flexicap fund in June 2023 and has delivered 20.59% return till 31st January 2024. Though the fund has not yet completed a year, the strong performance of the fund has caught our attention. The investment strategy of 360 ONE Flexicap Fund is unique and has the potential of consistently generating alphas for investors over long investment horizons. In this article, we will review 360 ONE Flexicap Fund.

About Flexicap Cap Funds

Flexicap funds are diversified equity mutual fund schemes which can invest across market cap segments. There are no upper or lower limits with respect to allocations to any market cap segment. The fund managers of these schemes can invest any percentage of their assets in any market cap segment viz. large cap (top 100 companies by market cap), midcap (101st to 250th companies buy market) and small cap (250th and smaller companies) according to their market outlook. Flexicap funds category is one of the most popular equity mutual fund categories in India.

Why Flexicap?

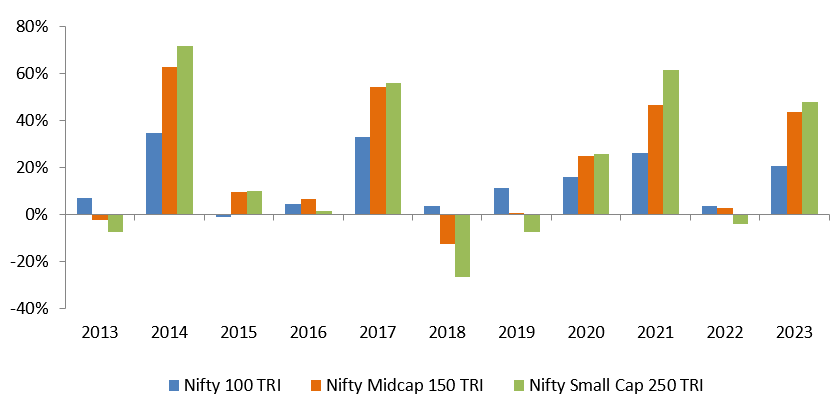

- Winners rotate across market cap segments: One market cap segment cannot keep outperforming or underperforming across all market conditions or investment cycles. Historical data shows that winners rotate across different market cap segments – see the chart below. Flexicap fund managers can generate more consistent returnsby rotating allocations to capture top performing market cap segments across investment cycles based on their market outlook.

Source: National Stock Exchange, Advisorkhoj Research (as on 31st December 2023). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

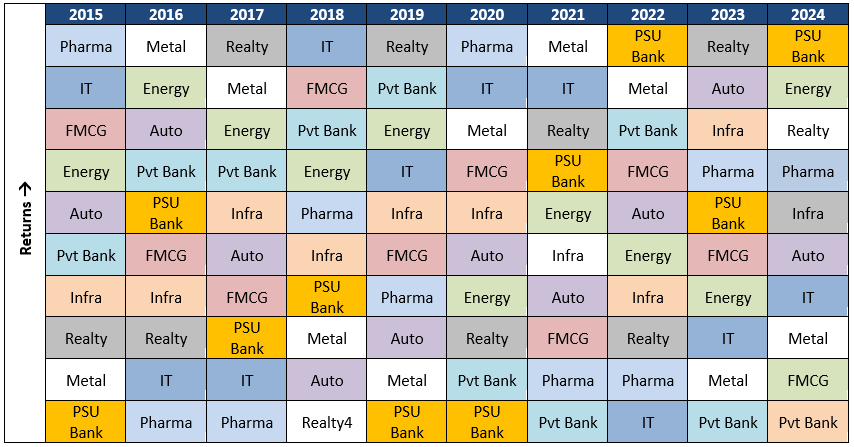

- Winners rotate across industry sectors: Like market cap segments, winners also keep rotating across industry sectors (see the chart below). Some sectors may outperform in some quarters or years, and others may outperform in other quarters or years. Flexicap funds diversify across industry sectors and can change sector allocations based on top down or bottoms up approach depending on the strategy of the fund manager.

Source: National Stock Exchange sector indices, as on 27th February 2024. Disclaimer: Past performance may or may be sustained in the future.

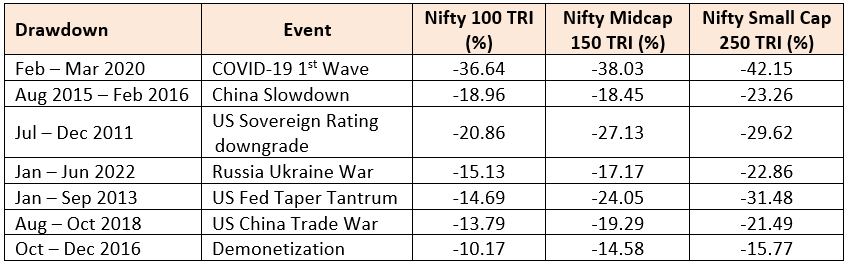

- Manage downside risks: The table below shows the 5 biggest drawdowns in the market in the last 10 years or so and the impact on various market capitalization segments. You can see that large caps are considerably less volatile than midcap and small cap stocks. The manager of a Flexicap Fund can prudently manage risks by shifting allocations between market cap segments based on his / her outlook.

Source: National Stock Exchange, Advisorkhoj Research (as on 31st January 2024). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

- Ideal for retail investors: Diversification across different market cap segments can reduce unsystematic risks and generate more consistent returns. Flexicap Funds are ideal for investors who are not able to decide how much allocations they should have towards each market cap segments and want the fund managers to decide on market cap allocations.

360 ONE Flexicap Fund - Strong performance till date

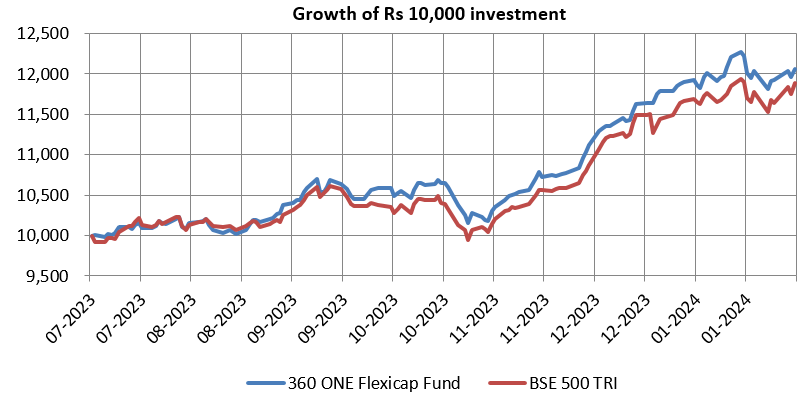

360 ONE Flexicap Fund is sector agnostic and does not have any market cap bias. The fund manager, Mayur Patel employ bottom up stock picking approach. The chart below shows the growth of Rs 10,000 investment in 360 ONE Flexicap Fund versus its benchmark index S&P BSE 500 TRI since the inception of the scheme. You can see that the scheme has outperformed the benchmark generating alphas for investors.

Source: Advisorkhoj Research, as on 31st January 2024

Investment Strategy of 360 ONE Flexicap Fund

The fund manager follows SCDV Framework along with internal (financial analysis, corporate governance checks, risk reward evaluation, etc) and external analysis (conferences, investor presentations, management interaction, primary visits across supply chain, etc) for stock selection.

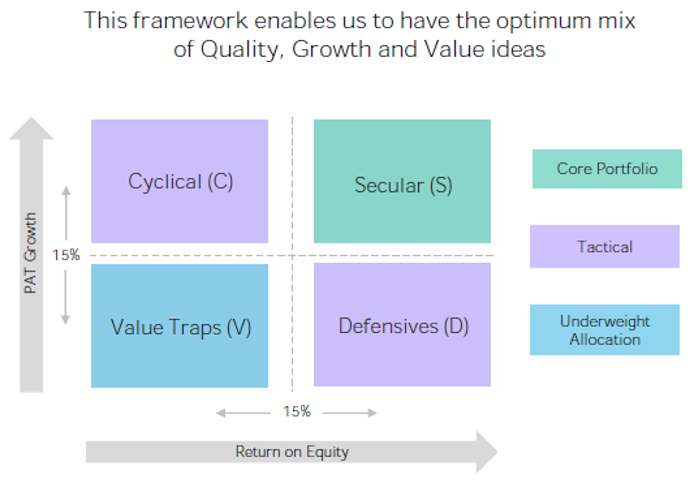

SCDV Framework

In the SCDV Stocks are classified into 4 categories based on their PAT (Profit after Tax) growth and ROE (Return on Equity).

- Secular: Companies delivering high PAT and ROE growth rates, playing out India’s secular upward growth shift.

- Cyclicals: High growth companies which typically have high capital expenditures and hence a lower ROE. These have relatively higher sensitivity to business and economic cycles.

- Defensive: Companies that have high ROE and lower growth rates, low capital expenditures and sensitivity to business cycles, but that provide a cushion to returns during downturns.

- Value Traps: Companies that register low growth rates and ROE, which are typically avoided across public equity strategies.

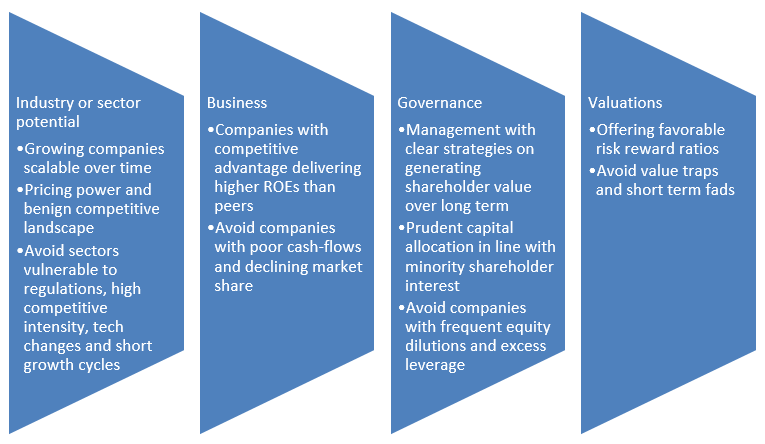

Investment philosophy

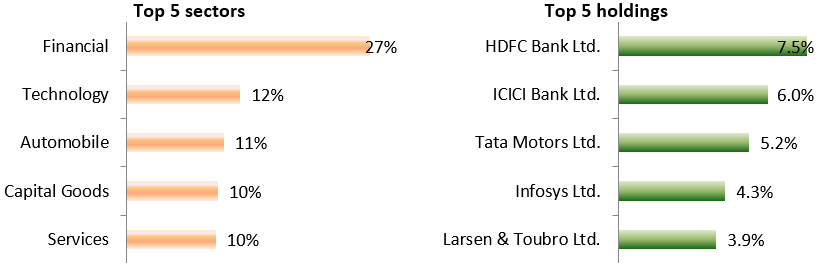

Current Portfolio Positioning

The scheme has 51% allocation to large caps and 46% allocations to mid (22%) and small caps (24%)

Source: 360 ONE Factsheet, Advisorkhoj Research, as on 31st January 2024

Why invest in 360 ONE Flexicap Fund?

- Unique SCDV framework – It enables the fund managers to capture ideas across different market cap segments (Growth, Quality, Value etc)

- Strong bottom-up stock selection – Identify investment opportunities across market cap segments based on in-depth fundamental research

- Technology enabled investment process – Custom build research management system, including multiple analytical tools that help to generate investment ideas

- Seasoned fund management team with a track record – The fund managers have combined experience of 45 years

- Opportunistic investment in special situations – The fund may also invest in opportunities arising from IPOs / FPOs, OFS, promoter buying, demergers and acquisitions

Who should invest in 360 ONE Flexicap Funds?

- Investors with long term investment horizon i.e., 5-7 yearor more.

- Investors with a high-risk appetite who can tolerate the short term volatility associated with equity investments.

- They are suitable for investors who want to invest from their monthly savings through SIP for their long term financial goals like children’s higher education, marriage, retirement planning, wealth creation etc.

- Investors who wish to avoid the complexities of dete rmining allocation among large, mid, and small-cap stocks independently.

You should consult with your financial advisor, if 360 ONE Flexicap is suitable for your investment needs.

Consult with your financial advisor or PMS distributor if you want to know more about 360 ONE Phoenix PMS

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- 360 ONE Multi Asset Allocation Fund NFO: Multi asset allocation solution in volatile times

- 360 ONE Phoenix PMS: Long Term Equity Growth

- 360 ONE Quant Fund: One of top performing quant funds for current market conditions

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

- 360 ONE Flexicap Fund: Diversified approach to long term wealth creation

360 ONE Asset offers uniquely structured products to cover diverse investment requirements of investors. Our mutual fund portfolio is concentrated on a few, high-quality, high-conviction stocks. This allows our fund managers to maintain focus and generate improved risk-adjusted returns.

Having pioneered the concept of benchmark-agnostic funds in India, our fund managers function in an unconstrained but research-oriented manner. While traditional asset management companies are constrained by benchmarks, our benchmark-agnostic approach enables us to pick stocks with flexibility and tap into unique multi-baggers of the future.

Investor Centre

Follow 360 One MF

More About 360 One MF

POST A QUERY