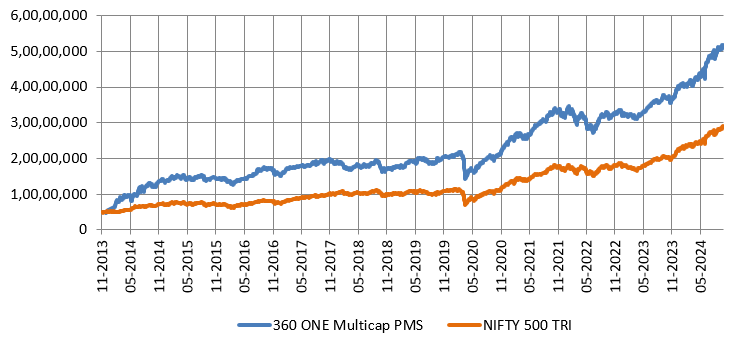

360 ONE Multicap PMS: Wealth creation track record

Current Market Context

Equity markets have been very volatile over the past month or so. The Nifty 50 has fallen by nearly 1,800 points from its all time high (as on 23rd October 2024). Multiple factors are responsible for volatility viz. weak global cues, high US Treasury Bond yields, strong US Dollar, China’s outperformance, weak Q2 corporate earnings etc. Market breadth has been negative throughout the month of October – midcaps (Nifty 150 TRI) and small caps (Nifty Small Cap 250 TRI) declined by 6% and 5% respectively. The monthly decline in October was the biggest correction in a single month since the COVID-19 pandemic. Historical data shows that big corrections create attractive investment opportunities for long term investors. In this article we will discuss the wealth creation potential of 360 ONE Multicap PMS, which has a fantastic track record of outperforming the market.

Wealth creation track record of 360 ONE Multicap PMS

If you had invested Rs 50 lakhs in 360 ONE Multicap PMS at its inception around 11 years back, the value of your investment would have multiplied to around Rs 5.1 crores (as on 30th September 2024). The scheme invests in a diversified portfolio of stocks across all three market cap segments i.e. large cap, midcap and small cap. The scheme has a great wealth creation track record (see the chart below).

Source: 360 ONE, Advisorkhoj Research, as on 30th September 2024

Why invest in 360 ONE Multicap PMS now?

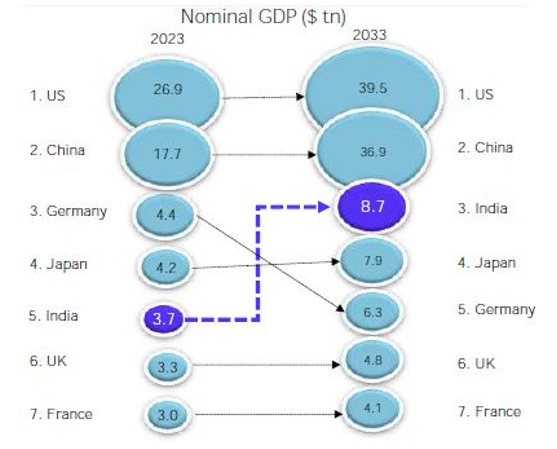

- GDP growth outlook: India is the 5th largest economy in terms of GDP. IMF is forecasting India to be the fastest growing G-20 economy in 2024. They recently updated their GDP growth forecast to 6.8% from 6.5% for FY 2024-25. India is expected to be the 3rd largest economy by 2033.

Source: For GDP, IMF World Economic Outlook- October 2023. India's GDP is estimated for FY24. GDP values for other nations are estimates for CY2023. For 2033 numbers - CEBR World Economic League Table 2024. For Market Cap data as of Sept 30, 2024. Historical and past performances are not a guarantee for future performance.

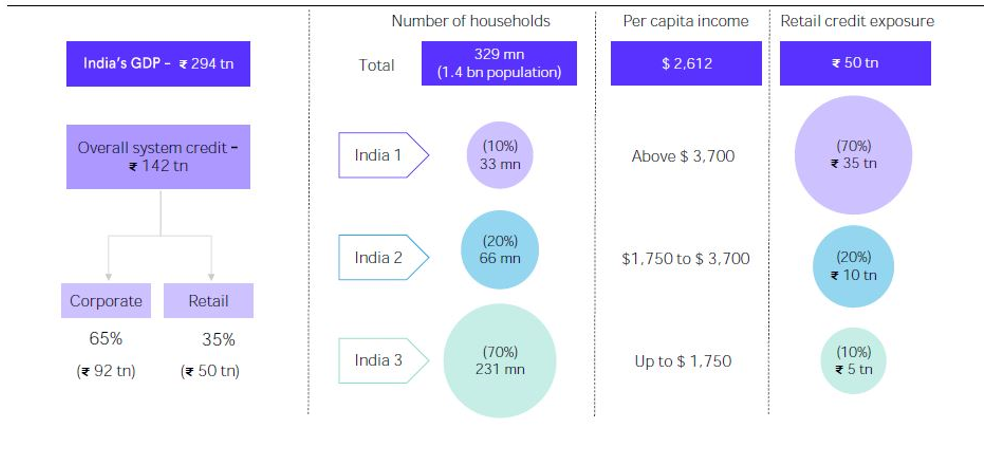

- Consumer lending opportunity: Currently only 10% of India’s population accounts for 70% of India’s USD 650 billion consumer lending market. There is huge scope of consumer lending growth as the sections in the lower income groups are brought under the ambit of retail credit.

Source: 360 ONE AMC

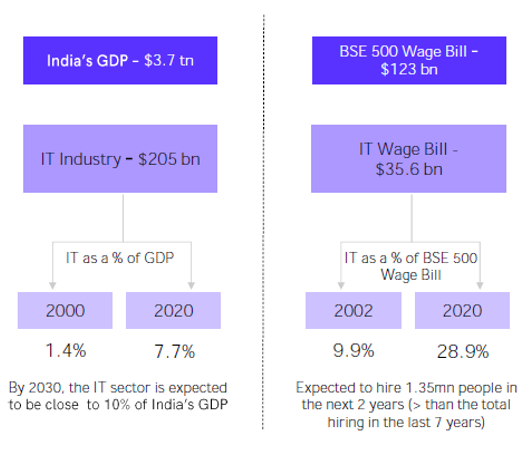

- IT sector opportunity: Over the past 2 – 3 decades India has emerged as one of the leading software sourcing hubs of the world. The share of IT sector in the GDP climbed from 1.4% to 7.7%. The IT sector is expected to hire 1.35 mn people in the next 2 years (more than the total hiring in the last 7 years). For every job that is created in the IT sector, four jobs arecreated in the rest of the economy (NASSCOM-Crisil Report). Commercial real estate benefits due to an IT boom as the IT sector covers close to 50% of the annual commercial realestate supply. The knock on effects of IT sector growth in India will be very beneficial for Indian economy and corporate sector (source: 360 ONE).

Source: 360 ONE AMC

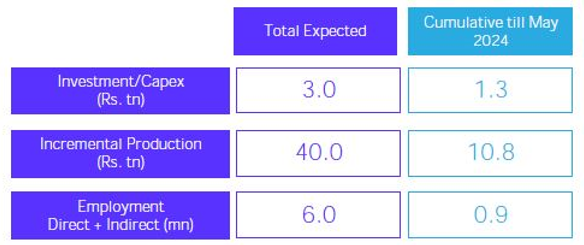

- PLI schemes boosting Private sector investments: The production linked incentive scheme (PLI) of the Government is incentivizing private sector capex spending. Total expected capex is Rs 3 Trillion, out of which Rs 1.3 Trillion. This can translate into incremental production of Rs 40 Trillion and direct / indirect employment of 6 million.

Source: 360 ONE AMC

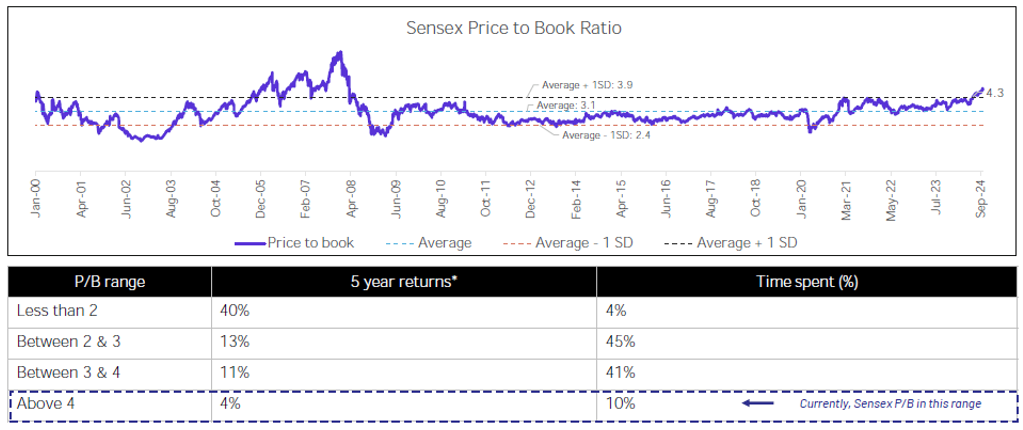

- Valuations are reasonable: Though valuations have risen, they are still not in the expensive zone for long term investors. The Sensex Price to Book at 4.3X (as on 30th September) is slightly more than 1 standard deviation of the 23 year average P/B of 3.1. Based on historical data, the market is in the 4X+ P/B range only in 10% of the instances, so we can expect mean reversion in the near term. As on 23rd October 2024, the price to book of the Sensex was 4.05, which is very close to 1 standard deviation from the mean.

Source: Bloomberg, as on 30th September 2024

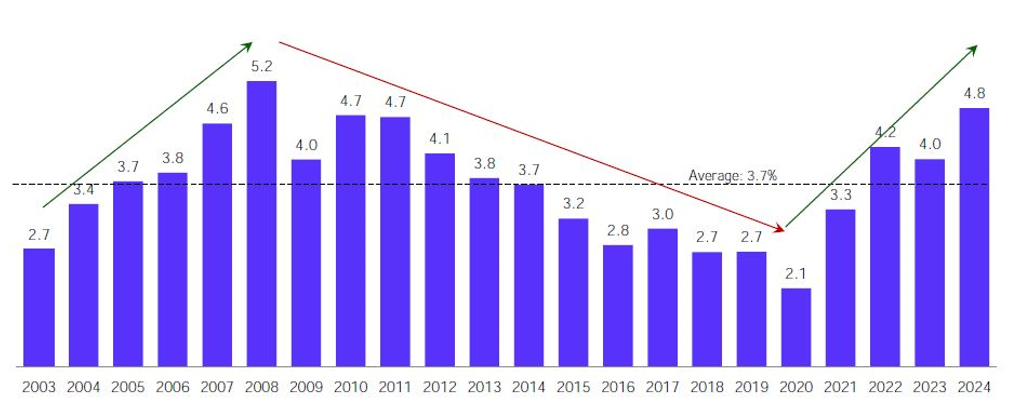

- Fundamentals are on the improving trend: Corporate profits to GDP ratio has been improving from its low in 2020 (COVID-19) after a long period (more than 10 years) of decline. Historical data suggests that improving corporate profits to GDP ratio indicates long term secular bull market for Indian equities.

Source: Motilal Oswal, corporate profits refers to earnings of Nifty 500 companies

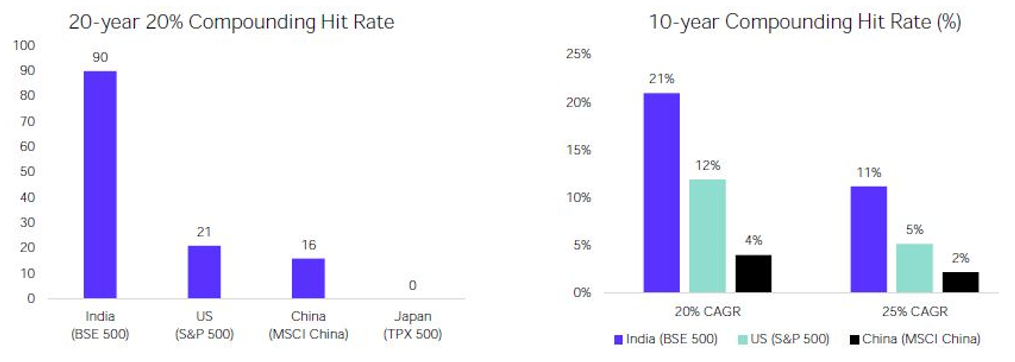

- Compounding potential of Indian equities: In last 20 years, 90 stocks in BSE 500 gave more than 20% CAGR returns. In last 10 years, 21% of BSE 500 stocks gave more than 20% CAGR returns. The 20% CAGR hit rate of Indian stocks is much higher than developed markets like US, Japan etc and emerging markets like China.

Source: Bloomberg, as on 30th September 2024

Why Multicap strategy?

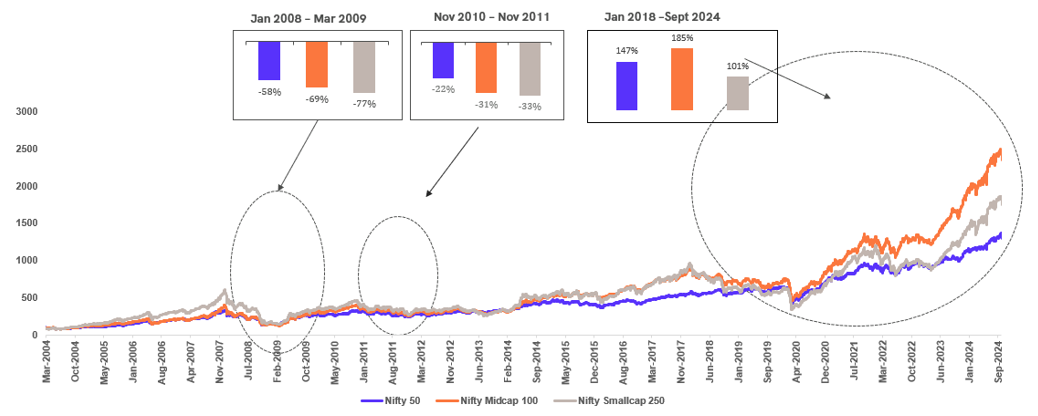

During periods of higher volatility, large cap stocks have outperformed mid and small cap stocks. On the other hand, midcaps and small caps have higher growth and wealth creation potential compared to large caps. A multicap portfolio can balance risk and return, for long term wealth creation.

Source: Bloomberg. Data as on Sept 30th, 2024; Periodic returns mentioned above are absolute returns

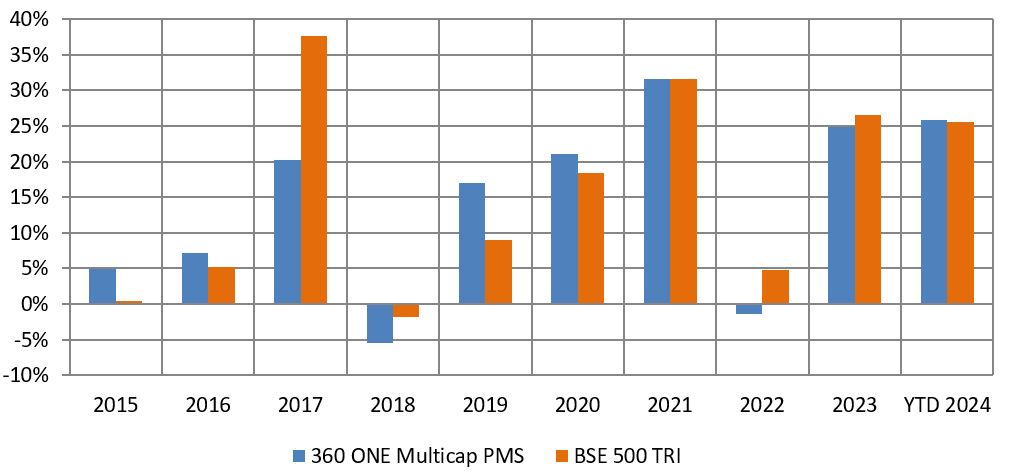

Performance of 360 ONE Multicap PMS

While the absolute return of 360 ONE Multicap PMS since inception was outstanding, you can see that 360 ONE Multicap PMS has beaten the BSE 500 TRI in most years and created alphas for investors.

Source: 360 ONE Multicap PMS. Data as on Sept 30th, 2024

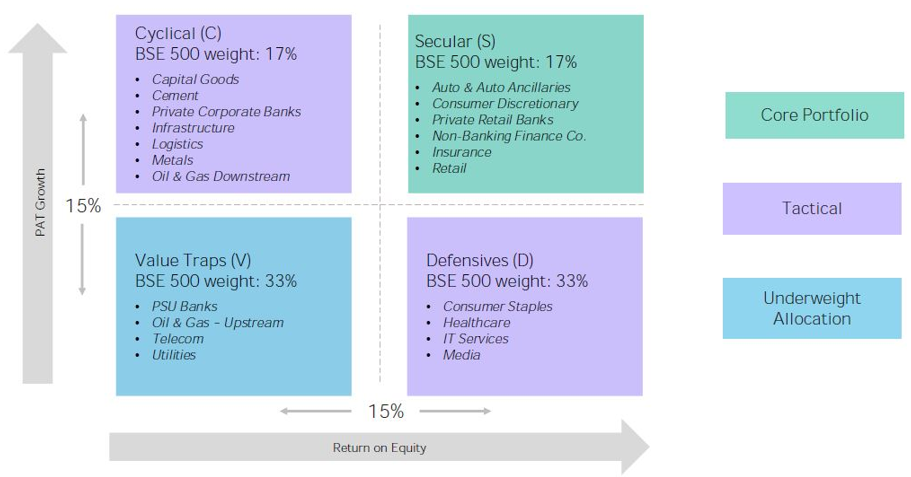

SCDV Investment framework of 360 ONE Multicap PMS

360 ONE Multicap PMS follows the highly successful proprietary SCDV investment framework of 360 ONE AMC.

Source: 360 ONE, as on 30th Sept 2024.

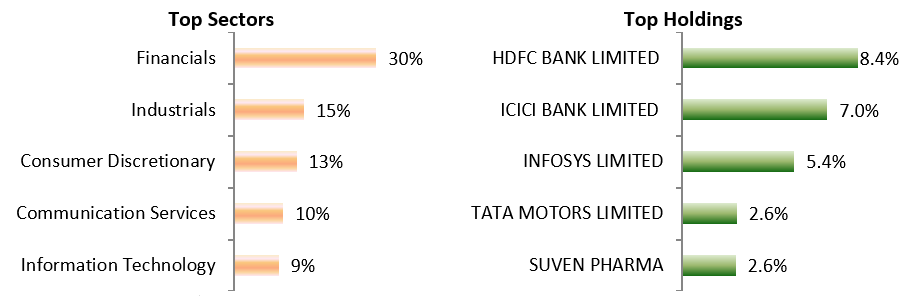

Current Portfolio Positioning

Source: 360 ONE, as on 30th September 2024.

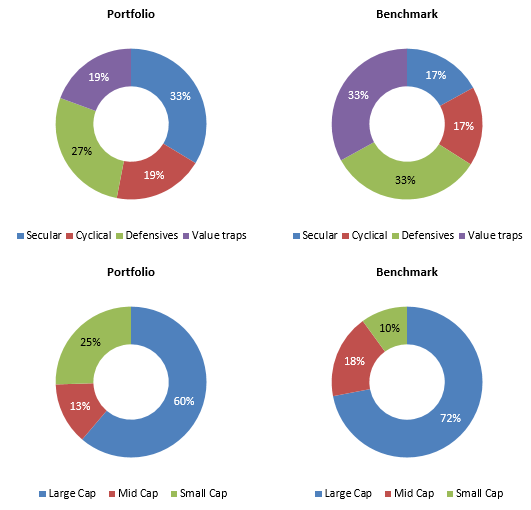

High active share

360 ONE Multicap PMS has higher allocations to secular and cyclical stocks relative to the benchmark (BSE 500). The portfolio has higher small cap allocation compared to the benchmark.

Source: 360 ONE, as on 30th September 2024.

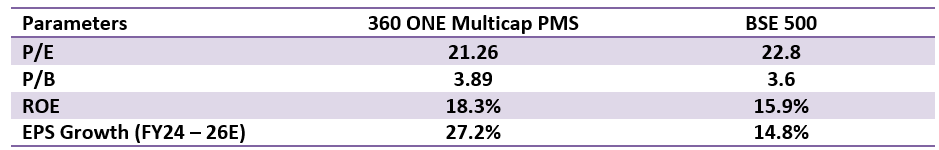

High quality portfolio with reasonable valuation

Source: 360 ONE, as on 30th September 2024.

Our take

- Though the US Federal Reserve cut interest rates by 50 bps in September, there in uncertainty about the pace of rate cuts. High US Treasury Bond bonds and strong dollar.

- FIIs have sold nearly Rs 100,000 crores in the cash market as they shifted allocations to China. In the current market context and economic outlook for 2024, we expect stock selection to be significant driver in portfolio returns.

- The long term outlook for Indian economy remains strong. According to S&P Global Market intelligence projections, India’s nominal GDP will double to US$ 7 Trillion by FY 2030-31. India’s macro-economic stability and growth potential will attract investment flows. Indian equities are positioned to enter into a new bull phase, once the short term correction is over.

- 360 ONE Multicap PMS with its track record of alpha creation is strongly positioned to deliver alphas for investors in the medium to long term.

Consult with your financial advisor or PMS distributor if you want to know more about 360 ONE Multicap PMS

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- NFO Review: Mutual Fund Industrys First Hybrid Balanced Fund

- 360 ONE Multicap PMS: Long Term Capital Appreciation in Volatile Markets

- 360 ONE Multicap PMS: 8X returns in 10 point 5 years

- 360 ONE Balanced Hybrid Fund: A true to label balanced fund

- 360 ONE Focused Equity Fund: Consistent performing top fund

LATEST ARTICLES

- 360 ONE Multi Asset Allocation Fund NFO: Multi asset allocation solution in volatile times

- 360 ONE Phoenix PMS: Long Term Equity Growth

- 360 ONE Quant Fund: One of top performing quant funds for current market conditions

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

- 360 ONE Flexicap Fund: Diversified approach to long term wealth creation

360 ONE Asset offers uniquely structured products to cover diverse investment requirements of investors. Our mutual fund portfolio is concentrated on a few, high-quality, high-conviction stocks. This allows our fund managers to maintain focus and generate improved risk-adjusted returns.

Having pioneered the concept of benchmark-agnostic funds in India, our fund managers function in an unconstrained but research-oriented manner. While traditional asset management companies are constrained by benchmarks, our benchmark-agnostic approach enables us to pick stocks with flexibility and tap into unique multi-baggers of the future.

Investor Centre

Follow 360 One MF

More About 360 One MF

POST A QUERY