Should you invest in small cap mutual funds

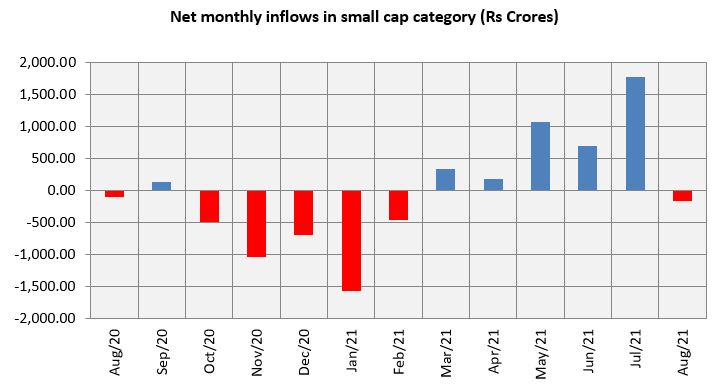

As per AMFI data, August 2021 saw net monthly outflow (redemptions exceeding purchases) in the small cap equity mutual funds category for the first time since February 2021. Redemptions may be caused by a variety of reasons but the fall in the Nifty Small Cap 250 Total Returns Index may have been one of the contributing factors. At one point in time (in the third week of August) small caps had fallen nearly 10%, but they recovered some of the losses to end the month 4% lower. Small caps have had a great rally since the COVID-19 crash of March 2020; some investors may be concerned if small caps have peaked. In this blog post, we will discuss how you should approach small cap funds.

What are small cap funds?

As per SEBI, 251st and smaller companies by market capitalization are classified as small cap stocks. Small cap funds must invest at least 65% of their assets in small cap stocks. Small cap stocks tend to be more volatile than large and midcap stocks, but they have greater wealth creation potential. You need to have high risk appetite and long investment horizons for small cap funds.

Small Caps have greater wealth creation potential

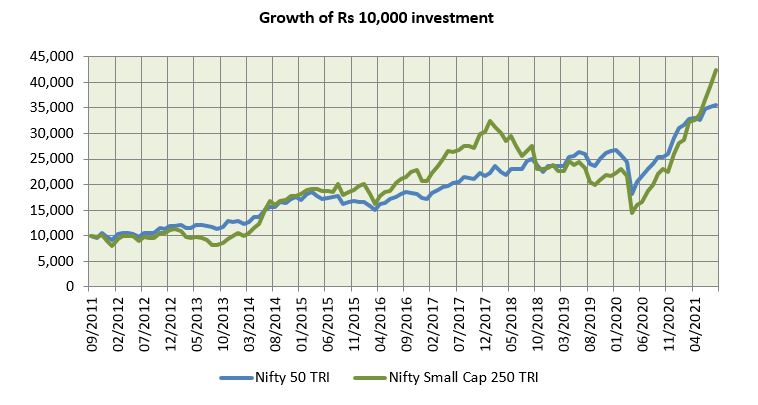

The chart below shows the growth of Rs 10,000 invested in Nifty Small Cap 250 TRI versus Nifty 50 TRI over the last 10 years ending 31st August 2021. You can see that, even though small caps are much more volatile, they have greater wealth creation potential compared to large caps. In the last 10 years (ending 31st August 2021), Nifty Small Cap 250 TRI gave 15.11% CAGR returns while Nifty 50 TRI gave 14.4% CAGR returns. The chart below shows that you need to have patience, discipline and long investment horizons for small cap funds.

Source: National Stock Exchange, Advisorkhoj Research. Period: 01.09.2011 to 31.08.2021. Disclaimer: Past Performance may or may not be sustained in the future.

You may like to know how to choose the right mutual funds according to your need

Multi-baggers are usually small caps

Historical data shows that multi-bagger stocks i.e. stocks which give 100% CAGR returns, have usually emerged from the small cap segment. Even after the COVID-19 crash in March 2020, most of the multi-bagger stocks have been in the small cap market segment (source: Dalal Street Investment Journal, August 2020). Fund managers of small cap mutual fund equity schemes can spot such multi-bagger opportunities and create wealth for investors.

Larger universe of stocks and sectors

While large cap and midcap segments are limited to 100 and 150 stocks respectively, the small cap segment has many more stocks. Even if we restrict ourselves to the top 500 stocks by market capitalization, small cap segments have as many stocks as large and midcap combined. The bigger universe of stocks can lend itself to greater value opportunities and alpha creation potential.

Further, large cap stocks are concentrated in only a few industry sectors. Large cap stocks have limited presence outside Financial Services, Oil and Gas, IT, Consumer Goods, Automobiles and Metals. These 6 sectors account for nearly 86% weight in the Nifty 50 Index. Nifty stocks have virtually no presence in sectors like fertilizers, media and entertainment, services, industrial manufacturing, chemicals, healthcare services, textiles, paper, etc.

Sectors like chemicals, packaging, sugar and tea, ceramics and sanitaryware, hotels, logistics and construction can be played better through small cap stocks. These sectors are likely beneficiaries of a number of policy reforms enacted by the Government and have a great potential in the consumption driven India growth story. Some of these sectors were badly hit by the COVID-19 pandemic, but will have strong earnings growth potential as the economy returns to normalcy and demand recovery ensues.

Did you know how much mid and small cap allocations you should have in your portfolio

Higher Alphas

The table below shows the average returns of top quartile (top 25%) small cap and large cap funds versus the respective benchmark indices representing the two market capitalization segments. Small cap stocks tend to be less researched compared to large cap stocks. Experienced fund managers can identify small cap stocks that are trading at deep discounts relative to their intrinsic values based on their growth potential for the reasons discussed above. Such small cap stocks can create significant alphas for investors.

Source: National Stock Exchange, Advisorkhoj Research (as on 10th September 2021). Average returns of all top quartile funds over the performance period for each category have been taken into consideration. Disclaimer: Past Performance may or may not be sustained in the future.

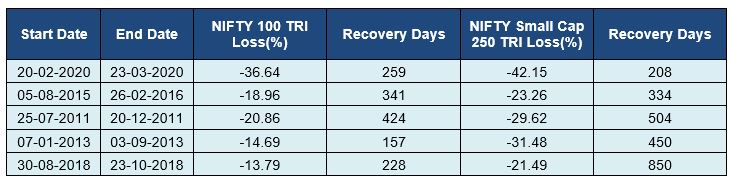

Larger drawdowns - Patience is the key

The table below shows the 5 largest market corrections for Indian equities in the last 10 years and how it impacted large caps and small caps. You can see that the small caps saw much deeper corrections. Also, the time taken to recover from market bottoms was usually much longer for small cap stocks. You need to be patient because small caps can bounce back stronger than large caps from bear market bottoms.

Source: National Stock Exchange, Advisorkhoj Research (as on 10th September 2021). Disclaimer: Past Performance may or may not be sustained in the future.

Resist urge to book profits – be disciplined in your investment

As mentioned earlier, small caps in the past have rallied stronger from market bottoms compared to large and midcaps. However, you should resist the temptation to book profits and invest according to a plan. Investors often ask, "Why my returns are not as high as market returns?"" Your returns will depend on your investment decisions. In the last one year, when small cap was one of the best performing categories in equity, redemptions exceeded purchases (see the chart below).

Source: AMFI. Period: August 2020 to August 2021.

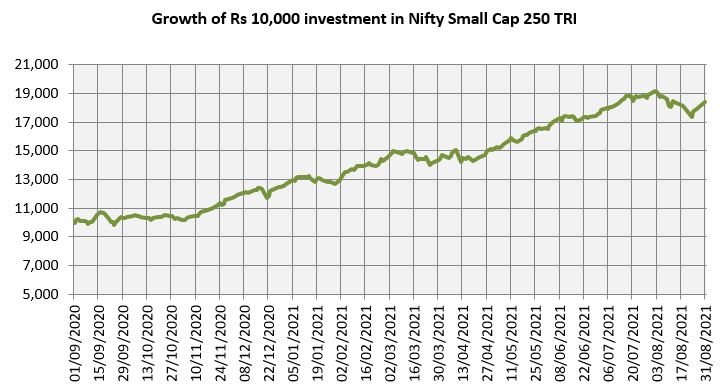

Over the same period, Nifty Small Cap 250 TRI gave more than 80% returns (see the chart below), while top quartile small cap funds gave more than 100% returns. Investors may redeem for a variety of reasons, but the investors who redeemed in this period would not have lost out on a substantial wealth creation opportunity had they remained invested a little longer.

Source: National Stock Exchange, Advisorkhoj Research (as on 31st August 2021). Disclaimer: Past Performance may or may not be sustained in the future.

Is this a good time to invest in small caps?

In our view, you can invest in small caps according to your risk appetite at any time, if you have a long investment horizon. Coming to the question, whether this is a good time to invest in small caps from a valuation standpoint, we think that one should not look at valuations (PE multiples) based on trailing twelve months earnings per share at this point of time because of the extraordinary situation prevailing over the past 12 months due to the COVID. Rather one should look at PE based forward earnings in a post-COVID scenario.

Suggested reading: What personal finance lessons can we learn from Covid 19 pandemic

The vaccination program in India has been progressed well over the past few months and a fairly large section of our population has received at least one dose of the vaccine. The Indian economy seems to be back on the recovery path based on Q1 GDP growth figures. The broader market i.e. midcaps and small caps have a stronger correlation with the overall economy and we are likely to see stronger earnings growth in small caps as the Indian economy returns to its growth path.

How to approach small caps?

Investors must remember that small caps can be quite volatile. Pullback in the market for any risk factor can cause volatility in the small caps. You should keep the following in mind when investing in small caps:

- Invest according to your risk appetite.

- Take a portfolio approach with focus on asset allocation i.e. percentage allocations to large cap, midcap and small cap, to balance risk and returns. To understand asset allocation, do read this what is asset allocation and why is it important

- Have long investment horizons, at least 5 – 7 years or longer.

- You can take advantage of higher volatility in small caps by investing through SIPs.

- There can be considerable variations in performances of different small cap schemes. Do not select schemes based on recent performance. Check the long term track record of the fund manager before investing.

Investors should consult with their financial advisors if small cap mutual funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY