Are you investing in the right hybrid mutual funds (Part 2)

In this two-part blog series, we are discussing how you can select the right hybrid fund based on your specific needs. In the first part of the post, we had discussed that before selecting a fund, you should clearly define your specific investment needs i.e. financial goal, risk appetite, risk tolerance, investment horizon, etc. Once you define your needs, you can select the right hybrid fund based on your specific needs.

In the first part of this post, we had also discussed three hybrid fund categories - Aggressive hybrid funds, Balanced advantage funds and Multi asset funds. In this part, we will discuss three more hybrid fund categories.

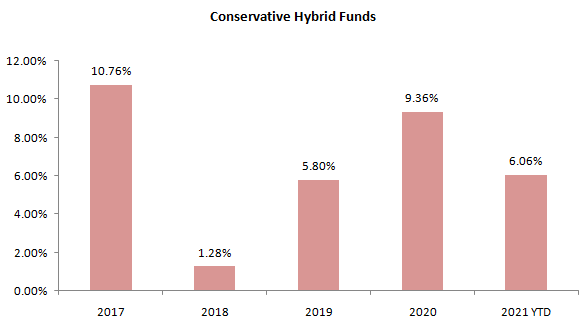

Conservative Hybrid Funds

According to SEBI’s mutual fund categorization circular, conservative hybrid funds can invest 75 – 90% of their assets in debt and money market instruments and 10 – 25% of their assets in equity and equity related securities. Since conservative funds invest primarily in debt, they are much less volatile compared to hybrid funds which have higher average allocations to equity like aggressive hybrid, balanced advantage, multi asset, etc.

Source: Advisorkhoj Research, as on 9th August 2021.

Who should invest?

Conservative Hybrid Funds are suitable for investors who are concerned about capital safety but ready to take little bit of equity risk to get higher returns than debt funds. These funds may be suitable for senior citizens or other investors who do not want to take too much risk and still want higher returns to protect their wealth against inflation. Investors with moderately low to moderate risk appetites may invest in these schemes with minimum 4 to 5 year investment tenures.

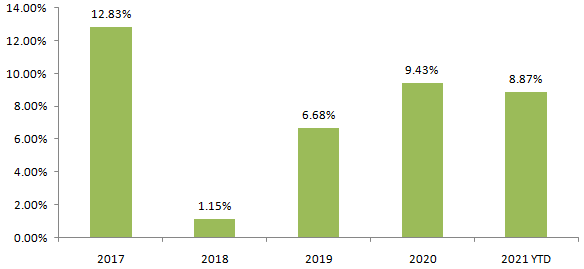

Equity Savings Funds

Equity savings funds are hybrid schemes which use hedging to manage its net long equity exposure. These schemes aim to generate arbitrage profits from the hedged portion of their equity portfolio, along with capital appreciation from the net long equity portfolio and income from the debt portfolio. Hedging enables equity savings funds to maintain gross equity exposure above 65% and enjoy equity taxation.

How are equity savings funds different from balanced advantage funds? Balanced advantage funds may also use hedging / arbitrage to manage their net long equity exposure, but balanced advantage funds can have 0 – 100% equity allocation; there are no maximum / minimum asset allocation limits. While SEBI has itself not mandated any asset allocation limit for equity savings funds, it requires the minimum hedged and un-hedged exposures to be specified in the scheme information document. In other words, balanced advantage fund managers have more flexibility to manage asset allocation compared to equity savings.

The average net long equity exposure of equity savings funds across different market conditions is usually lower than that of balanced advantage funds. Therefore, equity savings funds tend to be less volatile than balanced advantage funds (see the chart below). In terms of risk profile, you may think of these schemes to be intermediate between conservative hybrid funds and balanced advantage funds.

Source: Advisorkhoj Research, as on 9th August 2021.

Who should invest?

These funds are suitable for investors who want to invest in equity for capital appreciation or wealth creation but do not have high risk tolerance. If you want higher returns than fixed income and at the same time, want relatively lower volatility compared to other categories of equity oriented hybrid funds, you may invest in equity savings funds. The major advantage of these schemes is equity taxation. You need to have moderate to moderately high risk appetite and minimum 4 to 5 year investment tenure for these schemes.

Arbitrage Funds

Arbitrage funds are hybrid schemes which follow arbitrage strategy. Arbitrage refers to risk free profits earned by exploiting price difference of the same underlying asset in different market segments. In addition to completely hedged equity exposure (arbitrage), arbitrage funds may invest up to 35% of their assets in debt and money market instruments.

How arbitrage works?

For example, if a stock is trading at Rs 100 in the cash market and Rs 102 in the futures market, you can lock-in Rs 2 profit by buying the stock in the cash market and selling the futures in the derivative market. This profit is risk free because whether the market moves up or down, the cash and futures price will converge on the expiry on the future contract. In other words, market movement has no impact on arbitrage profits. You can see that the risk is very low in arbitrage funds.

Arbitrage funds are often used as a tax efficient alternative to overnight and liquid funds. However, you should note that arbitrage funds may show some volatility in the very short term (few days, few weeks etc). You should have investment horizon of at least three months for these funds. Further, the returns of arbitrage funds depend on market conditions. In bear markets, these funds may give lower returns because future premiums are usually low in such conditions. In bull markets, arbitrage funds may give higher returns than liquid funds.

Who should invest?

Arbitrage funds are suitable for investors whose main concern is capital safety. You can invest in arbitrage funds, if you want to park your money for a few months. As mentioned earlier, you can look at arbitrage funds as an alternative investment option to overnight and liquid funds, provided your investment horizon is at least three months. One major advantage enjoyed by arbitrage funds over overnight and liquid funds is equity taxation.

Taxation of hybrid funds

Taxation of hybrid funds depends on the average asset allocation of the scheme. If the average equity allocation of a scheme exceeds 65%, it is treated as an equity fund from a taxation standpoint. Short term capital gains (investing holding period of less than 12 months) in equity / equity oriented funds are taxed at 15% (plus applicable surcharge and cess). Long term capital gains (investing holding period of more than 12 months) in equity / equity oriented funds are tax exempt up to Rs 1 lakh in a financial year and taxed at 10% (plus applicable surcharge and cess) thereafter.

Aggressive hybrid, equity savings and arbitrage funds enjoy equity taxation. Balanced advantage and multi asset funds usually enjoy equity taxation, but you should check the taxation of thescheme you are particularly investing in with your financial advisor before investing.

If the average equity allocation of a scheme is less than 65%, it is treated as a debt fund from a taxation standpoint. Short term capital gains (investing holding period of less than 36 months) in debt / non-equity oriented funds are added to your taxable income and taxed according to your income tax slab rate. Long term capital gains (investing holding period of more than 36 months) in debt / non-equity oriented funds are taxed at 20% (plus applicable surcharge and cess) after allowing for indexation benefits. Conservative hybrid funds are taxed as debt funds.

You should know the tax consequences of your investment in order to file your income tax returns correctly and also make informed investment decisions.

You may like to read Avoid 6 common tax planning mistakes

Conclusion

Different investors have different investment needs and risk appetites. Hybrid funds offer solutions for different types of investment needs and risk appetites. In this two part post, we have discussed different types of hybrid funds and how you can go about selecting the right scheme for your needs. As always, you should consult with your financial advisor if you need help in defining your needs and selecting the right fund for your needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY