Should you invest in ELSS mutual funds or PPF for tax savings

Section 80C of Income Tax Act 1961 has provisions for tax payers to claim deductions from their taxable income by investing in some eligible schemes. By investing in 80C schemes under the old income tax regime, you can claim deduction equal to investment amount subject to a cap of Rs 150,000.

Section 80C schemes can be market linked or non-market linked. Nonmarket linked schemes include Public Provident Fund (PPF), Voluntary Provident Fund (VPF), National Savings Certificates, 5year tax saver bank fixed deposits etc. Nonmarket linked schemes are risk free and pay a certain rate of interest subject to prevailing interest rates or Government Bond yields in the economy. PPF is the most popular nonmarket linked tax saving scheme u/s 80C. Market linked schemes include mutual fund Equity Linked Savings Schemes (ELSS) and Unit Linked Insurance Plans (ULIP). Market linked schemes are subject to market risks. ELSS is the most popular market linked tax saving scheme u/s 80C. In this article, we will compare and contrast PPF and ELSS.

Public Provident Fund

Public Provident Fund (PPF) is a Government Small Savings Scheme. You can open PPF account in a scheduled commercial bank (PSU and private sector) or in a Post Office and make deposits. Maximum PPF deposit in a year is capped at Rs 150,000. Your PPF investment matures in 15 years and can be extendable in block of 5 years thereafter. There is limited liquidity in the interim period (before maturity). PPF pays interest on accumulated deposits and accrued interest. PPF assures capital safety since it is a Government scheme. PPF interest rates are linked to Government bond yields and may be revised on quarterly basis. Current PPF interest rate is 7.1%. The maturity proceeds from your PPF account is entirely tax free.

Equity Linked Savings Scheme

Equity Linked Savings Scheme (ELSS) is a mutual fund equity scheme which qualifies for tax savings u/s 80C. There is no upper limit of ELSS investments in a financial year but the maximum deduction you can claim from your taxable income u/s 80C is capped at Rs 150,000. ELSS has a lock-in period of 3 years. You cannot redeem units of your ELSS during the lock-in period i.e. 3 years from the date of investment. After the lock-in period, you can redeem units of your ELSS partially or fully without paying any exit load. An ELSS is essentially a diversified equity fund, which invests across industry sectors and market cap segments.

You can invest in ELSS, either in lump sum or through Systematic Investment Plan (SIP). It is important to note that, if you are investing in ELSS through SIP, each SIP instalment will be lockedin for 3 years; you should plan accordingly. Capital gains made in ELSS investments are tax exempt up to Rs 100,000 in a financial year and taxed at 10% thereafter.

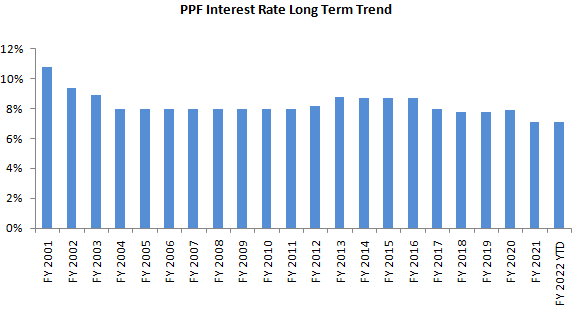

PPF interest rates have been declining in the long term

Interest rates paid by PPF are linked to benchmark Government bond yields and subject to changes as determined by the Government. In the earlier years, PPF interest rates were subject to annual review by the Government, but in recent years, PPF interest rates are subject to quarterly revisions. If you observe the long term trend of PPF interest rates (see the chart below), you will see that PPF interest rates have been on the declining trend. From FY 2014-15 onwards, PPF interest rates have either remained flat or declined. We expect PPF interest rates to decline further in the long term because as our economy grows and matures further, inflation will decline and along with it, interest rates. This has been seen in all developed economies and India will be no exception in its journey to being a developed economy.

Source: Advisorkhoj Research (as on 31st October 2021). Yearly interest rates are averages of quarterly rates. Disclaimer: Past performance may or may not be sustained in the future

Equity as an asset class has produced superior returns in the long term

Historical data shows that, equity though more volatile, has produced superior returns compared to other asset classes in the long term. The chart below shows the 10 year rolling returns (investment holding period of 10 years) of Nifty 50 TRI (total returns index of the 50 largest stocks by market capitalization) over the last 22 years. You can see that Nifty 50 TRI gave more than 10% annualized returns for most of the times across different market cycles over the last 20 years or so. The average 10 year rolling returns of Nifty 50 TRI during this period was 14.10%. Nifty 50 TRI gave more than 8% returns for 10 year investment tenures nearly 95% of the times; to put this in context, the average PPF interest rate (on compounded basis) over the last 20 years was 8.1%. Nifty 50 TRI gave more than 12% annualized 10 year rolling returns nearly 60% of the times over the last 20 years.

Source: Advisorkhoj Research (as on 31st October 2021). Returns are in CAGR terms. Disclaimer: Past performance may or may not be sustained in the future

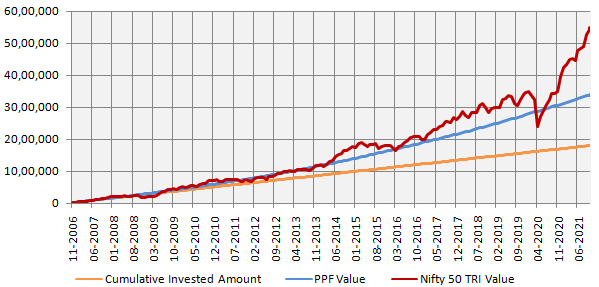

Wealth creation - ELSS versus PPF

The chart below shows the growth of Rs 10,000 monthly investment (SIP) in Nifty 50 TRI (as an asset class proxy for ELSS) versus PPF over the last 15 years. You can see that with a cumulative investment of Rs 18 lakhs, you would have been able to accumulate a corpus of nearly Rs 55 lakhs in Nifty 50 TRI, while same investment in PPF would have resulted in a corpus of Rs 34 lakhs. In terms of wealth creation potential, ELSS is one of the best investment options u/s 80C. However, as you can see in the chart below, Nifty is far more volatile. You should always invest according to your risk appetite.

Source: Advisorkhoj Research (as on 31st October 2021). Disclaimer: Past performance may or may not be sustained in the future

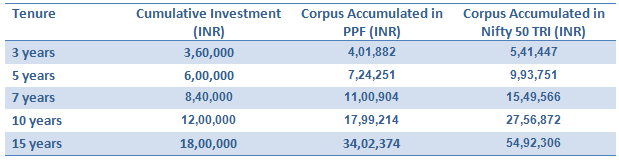

Performance over different investment tenures - ELSS versus PPF

The table below shows the returns Rs 10,000 monthly investment in PPF and Nifty 50 TRI over different investment tenures e.g. 3 years, 5 years, 7 years, 10 years etc. (period ending 31st October 2021). Investors must note here that, while we are using Nifty 50 to show indicative equity market returns for the sake of simplicity, ELSS invests across market cap segments where fund managers have to opportunity to create alphas and deliverhigher returns over sufficiently long investment horizons.

Source: Advisorkhoj Research (as on 31st October 2021). Disclaimer: Past performance may or may not be sustained in the future

Liquidity of PPF versus ELSS

Liquidity is an important consideration for many investors. The minimum tenure of PPF is 15 years, extendable in blocks of 5 years. Withdrawals not exceeding 50% of 4th year balance are permitted after a lock-in period of 7 years. PPF also offers loan facilities in specific circumstances. ELSS mutual funds with lock-in period of 3 years are the most liquid investments u/s 80C. However it needs to be mentioned here that, you should redeem your ELSS units according to your financial needs and remain invested for as long as possible based on your financial plan to get the maximum benefits.

Taxation of PPF versus ELSS

PPF is the most tax friendly 80C investment option since its maturity proceeds are entirely tax free. After PPF, ELSS is one of the most tax friendly 80C investment options. ELSS capital gains of up to Rs 1 lakh in a financial year are tax free. Capital gains in excess of Rs 1 lakh are taxed at 10%. Investors can maximize their tax benefits by harvesting tax exempt capital gains (of up to Rs 1 lakh) every year after the lock-in period and re-investing in ELSS to get tax savings under Section 80C.

Summary

In this article, we compared and contrasted ELSS versus PPF. Both PPF and ELSS are very popular tax saving investment options. If you want assurance of capital safety and are prepared to remain invested for at least 15 years, then PPF is one of the most suitable 80C investment options. However, for investors with moderately high to high risk appetites, ELSS is one the best investment options for long term wealth creation. Investors should consult with their financial advisors whether ELSS is suitable for their tax planning purposes.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY