Why Fixed Maturity Plans are still better investment options than Bank FDs

Prior to 2014 mutual fund fixed maturity plans (FMPs) were very popular low risk investment options for investors, primarily because of the tax advantage debt mutual funds used to enjoy over bank fixed deposits over a 1 year or more investment horizon. In the first union budget of the NDA government, the long term capital gains minimum holding period for debt funds was increased from 1 year to 3 years. Debt fund profits from investments held for less than three years are now added to income of the investor and taxed as per the investor’s tax rate. Profits from debt fund investments held for more than three years are treated as long term capital gains, and taxed at 20% after allowing for indexation benefits. The finance minister, Arun Jaitley, argued that his move would remove the tax arbitrage enjoyed by the debt funds and bring parity with bank fixed deposits and other debt instruments. Jaitley further argued that, it was the corporate investors who primarily enjoyed this tax arbitrage because retail investors formed a miniscule percentage among debt fund investors.

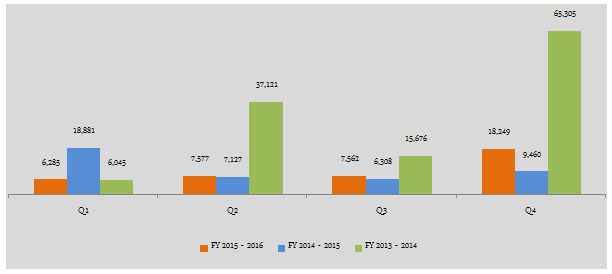

Many people in the mutual fund industry said that the 2014 Budget was a big blow for debt mutual funds and some went to the extent of sounding the death knell for Fixed Maturity Plans. It is true that, FMP subscriptions have fallen sharply after the 2014 Budget, primarily due to withdrawal of tax arbitrage benefits, but it was too early to write the obituary of FMPs. The chart below shows the total amount mobilized quarterly in close ended debt funds in FY 2015 – 2016, FY 2014 – 2015 and FY 2013 – 2014.

Source: AMFI

Please note that close ended debt fund issues are primarily FMPs and Capital Protection Plans, of which FMPs constitute the largest percentage. The chart tells us that, even though FMP subscriptions have fallen after Budget of 2014, there is still investor interest in this type of schemes.

Tax changes often have the effect of changing the way we look at investments. Investors who are investing in FMPs now have an investment horizon of three years instead of one year. This change in mindset of the investors have made FMPs and some other debt funds a part of the investor’s long term financial plans, instead of simply being a parking place for funds for a year to get high post tax yields. In this blog post, we will discuss why FMPs are still good low risk investment options for investors who have a three year investment horizon. For the benefit of readers, who are not familiar with FMPs, let us first discuss what FMPs are and how they work.

What are Fixed Maturity Plans (FMP)

Fixed Maturity Plans (FMPs) are close ended fixed income schemes. Investors can subscribe to this scheme only during the offer period (NFO period). The tenure of the scheme is fixed. Post the change in taxation of debt funds announced in 2014 Budget, FMPs now have a minimum tenure of three years to avoid short term capital gains. Investor’s cannot redeem units of FMPs during the tenure of the scheme. Upon maturity of the scheme, the maturity amount will get credited to your bank account.

FMPs usually invest in a variety of fixed income securities like, commercial papers, certificates of deposits and corporate bonds. The fund manager(s) ensures that the maturities of the securities match the tenure of the scheme. For example, if the tenure of an FMP is 1100 days, then the fund manager will invest in fixed income securities which will mature in 3 years and hold them to maturity. This is done to avoid re-investment risk. Since the bonds in the FMP portfolio are held till maturity, there is little or no interest rate risk. The returns of FMPs are very stable.

FMPs with tenures of over three years enjoy significant tax advantages over fixed deposits (FD), especially for investors in the highest tax bracket. Unlike Bank FD interest, FMP returns are not taxed during the tenure of the scheme. The returns are taxed only on maturity. There is no tax deducted at source in mutual funds for resident Indians. FMPs with tenures of over three years have their profits taxed at 20% after allowing for indexation benefits. Bank Fixed Deposit interest every year is added to the income of the investor and taxed as per the tax rate of the investor. Therefore, from a tax viewpoint, FMPs enjoy a big advantage over fixed deposits, for investment tenures of three years or more. After allowing for indexation benefits, the tax obligation is usually very small (as we will see later in this post).

Who should invest in Fixed Maturity Plans (FMP)

- FMPs are suitable for investors with low risk tolerance, looking for stable returns

- Investors who have a three year investment horizon and do not need liquidity during the tenure of the investment

- Unlike Fixed Deposits, mutual funds do not give assured returns. However, informed investors can form reasonable expectations with regards to range of returns from their FMP investments. We will discuss this in more details later

- Investors in the higher tax brackets, who lose a significant portion of their FD interest to taxes. We will discuss the taxation aspect in more details later

Why are FMPs still good investment options?

The tax advantage of FMPs is often seen as the only benefit of investing in FMPs. Lack of understanding of debt funds among both retail investors and also a large section of the financial advisor population in India, is the reason behind the under-emphasis of other benefits of debt fund investments. Let us understand the benefits of FMPs from both risk and return perspective.

Let us first discuss risks. There are primarily two kinds of risk in any fixed income investment:-

- Interest Rate Risk

- Credit Risk

There is little or no interest rate risk in FMPs. Even though bond prices change with changes in interest rates, this has no effect on the FMP returns since FMPs hold the bonds till maturity, earning the interest paid by the securities. Also, there is little or no re-investment risk, since as discussed earlier an FMP invests in fixed income securities whose maturities match the tenure of the scheme.

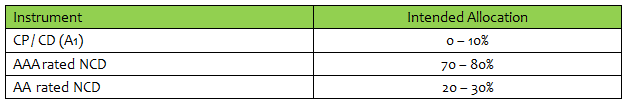

FMPs usually invest in excellent credit quality papers. The scheme information documents of FMPs have information on the portfolio allocations (investors can find the scheme information documents on the websites of the respective AMC’s or the AMFI website). The scheme information document has information on the intended portfolio allocation of the FMP’s including allocation to securities of different credit ratings. If you read the scheme information document carefully, you will observe that the FMPs usually invest in AAA or AA rated securities. Further, SEBI keeps a close watch on corporate bond investments by mutual funds and have issued guidelines with respect to the same.

Therefore, from a risk perspective, for investors who understand their risk characteristics, FMPs are good low risk investment options.

Let us now discuss returns. In the last three years, top performing FMPs were able to give higher returns than FDs even on a pre-tax basis. In Q2 2013 (which is roughly three years back), most large banks were offering around 8.75% interest rates for 3 year FDs. Over the same period top performing FMPs gave higher returns than FD (you can see top performing FMPs over the last three years, by going to our Mutual Fund research section, Top Performing Mutual Funds - Fixed Maturity Plans.

Some readers may say that, historical returns of a mutual fund are not indicative of future returns. Can FMPs beat FD interest in the future? While it is almost impossible to predict future returns of equity funds, fortunately for FMPs, given the nature of securities, which FMPs invest in and their investment strategy, we can get a reasonable idea, whether one can expect higher returns by investing in FMPs versus FDs. Please remember, we are talking about pre-tax returns at this stage (obviously FMPs have a big tax advantage, which we will discuss later).

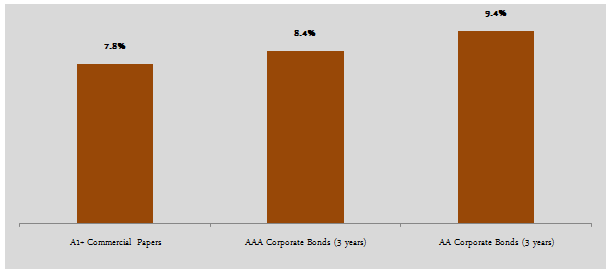

The current three year average FD interest rates of some of the leading banks range from 7% - 7.55%. Let us now look at the current yields of fixed income securities that FMPs normally invest in. As discussed earlier, FMPs usually invest in commercial paper, certificate of deposits and non convertible debentures (NCD) / corporate bonds. The chart below shows the indicative average yields for different instruments (based on National Stock Exchange data as on June 1, 2016).

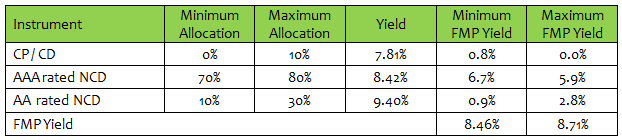

You can see that these yields are higher than the bank FD rates. Therefore, by investing in these securities in varying proportions the FMP can lock in these yields over the tenure of the scheme and give you higher pre-tax returns compared to bank FDs. Let us illustrate with the help on an example. Let us assume, an FMP has the following intended portfolio allocation (as discussed earlier, you can find this information in the scheme information document).

Firstly, evaluate the credit quality of the FMP. Based on the above portfolio allocation, you can feel comfortable about the credit risk. Let us now calculate indicative range of annual yields of this FMP.

Compare this yield to the bank FD interest and you can make your investment decision, even without factoring in tax benefits. If you follow this simple methodology of evaluating an FMP NFO next time when you invest in FMPs, you can estimate the range of returns that you can expect. Investors who prefer FDs because they do not know what returns to expect from FMPs, can use this method to get a sense of expected returns from FMPs. Investors should note that the yields used are average yields and the actual yields may be different. So they should factor in some tolerance band in terms of returns expectations. Also, when you are estimating FMP returns based on current yields, you should know yields are market driven and will change over time. But given the limited subscription window or offer period of an FMP NFOs, yields will not change all that much during the offer period and you can have a reasonable degree of confidence in your estimate. Some readers may ask the question, from where will they get the yield data for different instruments. Fortunately, many scheme information documents (SIDs) of FMPs have the indicative yields for different instruments. While, some FMP scheme information documents do not provide this information, investors, in that case, can look up the fixed income securities yield data on National Stock Exchange website, and you will get a sense of prevailing yields for different papers.

Coming back to our topic today, you have seen that based on the current NCD / corporate bond yields, it is reasonable to expect FMPs to give higher returns than bank FDs over the next three years. It is not just in the current bond market environment that FMPs can give higher returns than Bank FDs. We have seen that, FMPs can beat Bank FDs in most market conditions. The underlying reason is very simple. FMPs mostly invest in NCDs, which offer higher interest than bank fixed deposits. If you compare the current yield chart with the bank FD rates, you will see that, even AAA rated (very high quality) NCDs are offering 70 to 140 bps higher yields than current Bank FD interest rates over the same tenure. You can get better risk adjusted returns than bank FDs by investing in high quality NCDs and holding them to maturity. By investing in FMPs, you can rely on the fund manager’s expertise to invest in the NCDs with best risk return characteristics. In fact, by investing a portion of the AUM in slightly lower rated paper the fund manager can lock in higher yields, without compromising on the scheme’s risk objectives. Therefore, we believe that even on a pre-tax basis FMPs are excellent alternative investments than FDs.

Tax Advantage of FMPs

We have discussed the tax advantage of FMPs and debt funds several times in our blog and therefore, we will not discuss this at great lengths here. For the benefit of readers, who are not sufficiently familiar with the tax benefits of FMPs, let us illustrate with the help of a simple example.

Let us assume you invested र 100,000 in a 3 year FD, in March 2013. Let us assume your FD paid you an interest of 8.5%, with quarterly compounding. Let us further assume that, you are in the 30% tax bracket. Over the term of the FD, the total interest earned by you will be around र 28,700. Your tax obligation on this interest over the term of the FD will be र 8,610.

Let us now assume that you invested र 100,000 in a 3 year FMP, in March 2013. For the sake of simplicity, let us assume the FMP gave an annualized return of 8.5% over its tenure. The value of your FMP investment on maturity will therefore be र 127,700. Capital gains in debt fund investments held for over 3 years are taxed at 20% after allowing for indexation benefits. Cost inflation index (CII) in 2012 – 2013 was 852 and that in 2015 – 2016 was 1,081. Therefore the indexed cost of purchase of your FMP units will be र 126,877. The indexed cost of purchase is calculated by multiplying the initial investment (र 100,000) with the ratio of CII at the time of maturity / redemption (1,081) and CII at the time of purchase (852). The long term capital gains with indexation, therefore will र 850 (र 127,700 - र 126,877) only. The long term capital gains tax will be 20% of the long term capital gains with indexation. Therefore, in this case, your long term capital gains tax will be र 170 only. Compare this with tax on FD interest rate, and it is really a no brainier why the tax advantage enjoyed by 3 year FMPs compared to Fixed Deposit is huge tax.

Conclusion

If you understand the risk return characteristics of FMPs, you will realize that FMPs can give better risk adjusted returns than FDs, even after factoring in the risk free nature of FDs. While FDs give assured returns, you can get a sense of expected range of returns from FMPs by going through the scheme information document and calculating indicative portfolio yield based on intended portfolio allocations, as discussed in this post. Finally, FMPs enjoy a huge tax advantage over a three year investment period. If you educate yourself about FMPs, you will realize that, they are still excellent investment alternatives to FDs.

You can also read more about FMP here: Link: https://www.sbimf.com/SBI_Fund_Guru/investment-planning-page-7.aspx

Disclaimer:

Any information contained in this article is only for informational purpose and does not constitute advice or offer to sell/purchase units of the schemes of SBI Mutual Fund. Information and content developed in this article has been provided by Advisorkhoj.com and is to be read from an investment awareness and education perspective only. SBI Mutual Fund’s participation in this article is as an advertiser only and the views / content expressed herein do not constitute the opinions of SBI Mutual Fund or recommendation of any course of action to be followed by the reader

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY