SBI Mutual Fund Bandhan SWP: Taking care of financial needs of your family

Family is the most important social unit in most cultures around the world, but in India taking care of family members, especially those in need, is taken very seriously given our long tradition of joint family system. Most Indians feel obliged to take care of the needs of members of their family or extended family even if they are not living together, e.g. taking care of financial needs of aged parents, siblings, children etc. SBI Mutual Fund’s Bandhan SWP is designed to create an income stream for your family members.

You may read this: Gift your father confidence with SBI Mutual Fund Bandhan SWP

What is SWP?

Systematic Withdrawal Plan (SWP) is a mutual fund investment plan, whereby you can withdraw fixed amounts at regular intervals (e.g. monthly) from you investment in any mutual fund scheme. Through SWP, the cash-flows will be generated for you by the Asset Management Company (AMC) by redeeming the required number of units at applicable Net Asset Values (NAVs). Let us understand this with help of an example.

Let us assume you have 20,000 units of a mutual fund scheme and the current NAV is Rs 100; the market value of your investment is Rs 20 lakhs. You want Rs 10,000 of cash-flows every month from your investment. To generate Rs 10,000 for you the AMC will redeem 100 units and credit the money to your bank account; you will be left with unit balance of 19,900. Next month, if the NAV rises to Rs 101, the AMC will redeem 99 units (Rs 10,000 divided by Rs 101) to generate Rs 10,000 for you and you will be left with unit balance 19, 801. In the following month if NAV rises to Rs 102, the AMC will redeem 98 units (Rs 10,000 divided by Rs 102) to generate Rs 10,000 SWP and your unit balance will be 19,703. The market value of your investment will be 20.01 lakhs (19,703 units X Rs 102 NAV). The SWP will continue as long as you have sufficient unit balance for the next withdrawal. With a reasonable SWP withdrawal rate you can generate regular cash-flows and enjoy capital appreciation at the same.

You may check this tool Systematic Withdrawal Plan Calculator

Key Benefits of Bandhan SWP

- The most important feature of SBI MF Bandhan SWP is that beneficiaries need not be investors. For example you can invest in a SBI MF scheme and through Bandhan SWP let the SWP monthly payouts be credited to your parent’s (or any other immediate family member’s) bank account. Eligible beneficiaries in Bandhan SWP are spouse, children or sibling above 15 years in age and parents of the investors

- Another important feature of Bandhan SWP is that the beneficiaries (your family member’s) will not be taxed for the cash-flows received by them from the SWP. The investor will be liable for short term or long term capital gains tax (if any) arising out of the SWP. The money transferred to the beneficiaries (your family member) will be treated as a gift. Under the current tax laws, gift tax is not levied on the money received as gifts from relatives.

- The investor / co-investor will continue to enjoy the ownership of the active or available units of the scheme from which they initiate Bandhan SWP and will be entitled to benefits of capital appreciation thereof. With Bandhan SWP you can have dual benefits of gifting your family happiness by helping family members financially, while creating wealth for you and you co-investor (if any).

- In the event of an unfortunate death of the investor, the recipients of SWP regular cash-flow benefits will not be entitled to ownership of the units unless they are nominees of the investors. In case the investor passes away during the tenure of the investment, the ownership of the investment will remain with the co-investor (if any) or pass on to his / her nominees.

How Bandhan SWP creates cash-flows for your family members and wealth for you?

Though SBI MF introduced Bandhan SWP about 2 years back, we will show how a hypothetical SWP from a SBI MF scheme would have created cash-flow stream for your chosen beneficiary (let us assume it is your mother) and wealth for you.

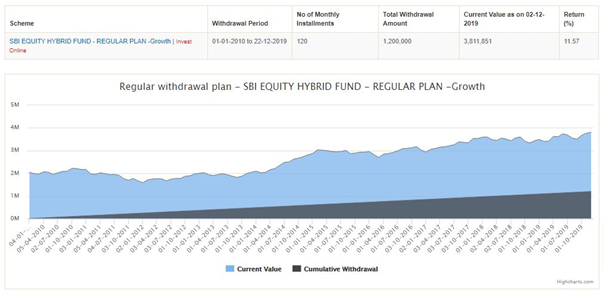

In this example, let us assume we started an SWP with a lump sum investment of Rs 20 lakhs in SBI Magnum Equity Hybrid Fund – Growth Option (erstwhile SBI Balanced Fund) 10 years back on 1st December 2009. The monthly SWP amount was Rs 10,000 which was credited to your mother’s bank account on the 1st of every month or the next business day (if the 1st of the month was a non-working day). The chart below shows the cumulative money drawn through SWP and the value of the investment.

Source: Advisorkhoj SWP calculator

You can see that through this SWP your mother would have received cumulative benefits of Rs 12 lakhs, while the market value of your investment would have grown to Rs 38.1 lakhs. This shows that through Bandhan SWP you can grow your own wealth while gifting happiness to your loved ones.

Taxation of Capital Gains

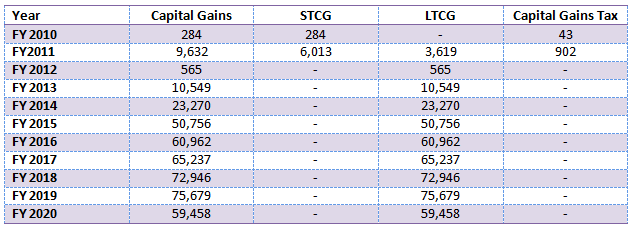

It is important to reiterate that the beneficiary of the Bandhan SWP cash-flows has no tax liability arising out of the income from the SWP. In this case the money received by your mother is tax exempt in her hands. However, you will be liable for capital gains taxation. Short term capital gains (units held for less than a year) for equity and equity oriented funds will be taxed at 15%. Long term capital gains (units held for more than a year) for equity and equity oriented funds of up to Rs 1 lakh in a financial year is tax exempt. Long term capital gains in excess of Rs 1 lakh in a financial year will be taxed at 10%. The table below shows the capital gains taxation of the SWP example discussed above.

You can see that in the above example your total tax liability was less than Rs 1,000 though the cumulative cash-flow for your mother which was Rs 12 lakhs. If you want to initiate Bandhan SWP from your investment in an SBI MF scheme where you invested before 31st January 2018, the Government has allowed grandfathering of capital gains up to 1st February 2018. For questions related to your specific tax situations please consult with your chartered accountant or tax advisor.

How to start SBI Bandhan SWP?

You can start SBI Bandhan SWP with the following steps:-

- If you are an existing SBI Mutual Fund investor, you can start SBI Mutual Fund’s Bandhan SWP from your existing investment in any open ended mutual fund scheme of SBI Mutual Fund. If you do not have investments in SBI Mutual Fund then you first need to invest in growth option of any open ended mutual fund scheme to avail of Bandhan SWP. Please note that, Bandhan SWP can be done only from growth option of a scheme.

- To initiate SBI Mutual Fund’s Bandhan SWP, you should specify beneficiary details, withdrawal amount and duration of SWP. The beneficiary should be your family member. Eligible beneficiaries include child / sibling aged 15 years and above, spouse and parents of the investor. The beneficiary availing the facility should be a resident Indian.

- The minimum monthly withdrawal amount is Rs 5,000 and minimum duration is 12 months.The investor needs to submit the KYC documents of the beneficiary. If the beneficiary is KYC compliant, then only the acknowledgement copy is required. Else the investor must submit proof of identity and proof of address documents of the beneficiary.

- Since the Bandhan SWP facility is available only for family members, proof of relationship between investor and beneficiary needs to be submitted. Passport, PAN card, Marriage Certificate etc. where the name of the beneficiary is mentioned can be submitted as proof of relationship.

- For crediting SWP payments to the beneficiary’s bank account, cancelled cheque leaf of the Bank account or Copy of Bank Statement/Passbook of the beneficiary family member needs to be submitted.

Conclusion

In this post, we discussed about SBI Mutual Fund’s Bandhan SWP. Investors who want to provide cash-flows to their family members and also invest for their own financial objectives can opt for Bandhan SWP. Investors who are approaching retirement and have dependent parents may find Bandhan SWP useful. Investors should consult with their financial advisors, if Bandhan SWP is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY