SBI Savings Fund: A good short term investment option

We have repeatedly stressed the importance of putting your idle money to productive use. If you keep hard earned money in savings bank account for long periods of time, then in real terms (adjusted for inflation), you will be eroding your wealth. This is because low savings yields cannot keep with the decline in purchasing power of money. Let us assume you had Rs 1 Lakh lying idle in your savings bank account for the last one year. You would have got an interest of Rs 4,000. If the inflation rate of your consumption basket is 5%, then in terms of purchasing power of money, you would have seen wealth erosion.

If you had invested your idle money in SBI Savings Fund, a money market fund, you could have got an income of more than Rs 8,000 from your investment– more than double the savings bank interest amount. This one example to show why you should always endeavour to put your money in productive use by investing it in the appropriate asset. There are several considerations when you decide where you want to invest your money - They are your liquidity needs, investment time-frame and risk appetite.

In this blog post, we will discuss a relatively low risk investment option with sufficiently high liquidity over short investment tenures – money market funds with specific reference to SBI Savings Fund.

SBI Savings Fund

As mentioned earlier, SBI Savings Fund is a money market mutual fund. Money market mutual funds which invest in money market securities like commercial papers, certificate of deposits, treasury bills etc. provide high liquidity, low risk and good yields (compared to savings bank interest rate). These funds are suitable for parking your idle funds for a year or so; depending on your specific investment needs you can invest in these funds over longer tenures as well. SBI Savings Fund was launched in 2004 and has nearly Rs 10,400 Crores of assets under management (AUM). The expense ratio of the scheme is 0.83%. R.Arun is the fund manager of this scheme.

Low Risk

The modified duration of SBI Savings Fund is only 0.4. This means that the scheme has very limited interest rate risk. If you hold this scheme for 6 months and there is a 25 basis points (bps) increase in interest rates, then effect of interest rate increase on the scheme NAV will only be 10 bps (0.1%). Even if there are two rate increases of 25 bps each in 12 months, the price effect on the scheme NAV will be 20 bps (0.2%). If the yield to maturity of the scheme portfolio is 7%, then even after the interest rate increases, you will get potential 6.8% returns (everything else remaining constant). Further, the price effect of interest rate increase will partially be offset by the higher yields of money market instruments, which may replace maturing lower yield instruments during your investment tenor.

Regular Advisorkhoj readers know that apart from interest rate risk, the other risk factor in debt funds is credit risk. SBI Savings Fund scores high even on the credit risk parameter. The credit rating profile of the instruments in the scheme portfolio is on average A1+. A1+ is the highest credit rating of money market instruments and denotes very high degree of safety. Therefore, both from an interest rate risk and credit risk perspective, SBI Savings Fund scores quite high, making this fund suitable for investors, who want low risk and stable returns.

High Liquidity

Money market funds have high liquidity, which means that the funds are able to meet redemption requirements of investors at any point without any significant impact to the NAV of the schemes. SEBI mandates AMCs to carry out liquidity stress test of their money market funds at least once a month or more frequently if required. The AMCs risk management mechanisms, in compliance with SEBI’s risk management framework, will ensure that the investors of SBI Savings Fund enjoy high liquidity to meet any near term requirements. For redemptions made after 3 days from investment date, no exit load is levied. This means investors can draw their money any-time after 3 days from the investment date without any penalty. Redemptions made within 3 days from the date of investment will attract an exit load of 0.1%.

Returns

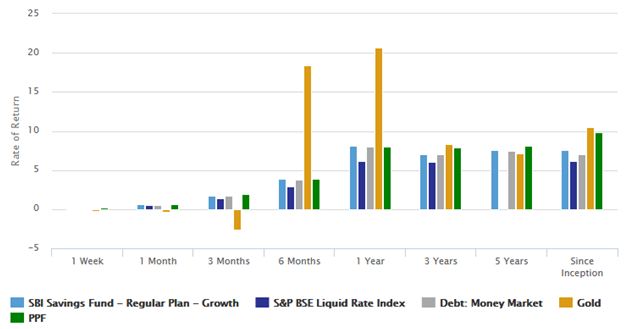

The chart below shows the annualized returns of SBI Savings Fund versus the money market debt fund category, S&P BSE Liquid Rate Index and other asset types over various trailing time periods. You can see that SBI Savings Fund outperformed the category across most time-scales. You can see that the scheme beat the category average over different time periods.

Over the last 1 to 5 years, annualized returns of the scheme ranged from 7.6 to 8%. In the last 1 year the scheme gave 8.1% return. While returns of money market funds will depend on the prevailing yields in money market, historical data shows that money market fund returns are almost always higher than savings bank interest.

Historical dividends

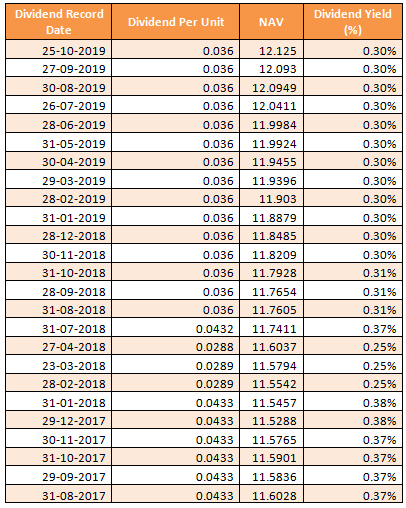

SBI Savings Fund has been paying regular monthly dividend for more than a year now. The table below shows the monthly dividend track record of the scheme.

Investors should know that debt mutual fund dividends are tax free in the hands of the investor but the AMC has to pay 28.84% Dividend Distribution Tax (DDT) before paying dividends to investors.

Why invest in SBI Saving Fund?

While we have already discussed the benefits of SBI Savings Fund in this post, it may be useful for some of our readers to do a brief recap of the benefits.

- Like any other mutual fund, SBI Savings Fund is subject to market risks (interest rate risk). However as discussed in this post, the interest rate risk is very limited since the scheme invests in very short maturity money market instruments. The scheme invests in instruments with high credit quality and hence, the credit risk is also very low.

- Money market mutual funds offer high liquidity. There is no exit load on withdrawals made after 3 days from the date of investment in SBI Savings Fund.

- While mutual fund returns are not assured, historical data shows that SBI Savings Fund across various time-scales were able to beat savings bank interest rate by a wide margin.

- While money market funds do not offer any tax advantage over savings bank account over shorter investment tenors, over 3 years plus investment tenors debt mutual funds (including money market funds) enjoy considerable tax advantage over savings bank and FDs. Savings bank and FD interest income is taxed as per the income tax rate of the investor, while debt mutual fund long term capital gains (investment held for 3 years or more) are taxed at 20% after allowing for indexation benefits. Indexation benefits reduce the tax obligation of investors in higher tax brackets considerably. For shorter tenor, investors in the 30% tax slab can consider investing in the dividend re-investment option.

- SBI Mutual Fund is one of the oldest, largest and most respected Asset Management Companies in India. Schemes of SBI Mutual Funds are among the best performing funds across multiple mutual fund categories.

Conclusion

While we work very hard to earn money, we must also make our money work, so that our money grows. In this post, we discussed how you can put your idle money to productive use to make more money, without giving up on liquidity and flexibility for your near term needs. We discussed several advantages of investing in SBI Savings Fund versus keeping your money parked in your savings bank accounts. Investors should consult with their financial advisors if SBI Savings Fund is suitable for their investment needs.

Suggested reading – Demystifying mutual fund investing myths

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY