SBI Focused Equity Fund: Outstanding track record of wealth creation

For this article, we looked at the best performing focused equity funds category in terms of long term SIP returns. For our analysis we looked at monthly SIP performance of different focused equity funds over long investment periods 5 years, 7 years, 10 years etc. For investing through SIPs, you should always have long investment tenures so that you can benefit from power of compounding over long tenures.

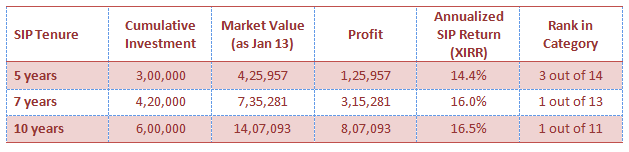

SBI Focused Equity Fund clearly stood out as an outstanding performer among its peers. The table below shows the returns of Rs 5,000 monthly SIP in SBI Focused Equity Fund over different tenures and its rank in the category. Clearly, over long investment tenures SBI Focused Equity Fund is one of the best SIP performers in its category.

Source: Advisorkhoj Top Performing SIP

The chart below shows the annualized SIP returns (XIRR) of the SBI Focused Equity Fund compared to different asset classes over different tenures (periods ending 13th January 2020). You can see that the scheme outperformed other asset classes.

Source: Advisorkhoj Benchmark Returns

We can draw several interesting and important conclusions from the chart above:-

- Over a long period of time, interest rates are on a secular decline in India. This will continue in the long term and investors have to be prepared for it.

- Gold, a favoured asset class in many Indian families, has performed well in the near to medium term but has failed to outperform equity in the long term.

- Equity is the best asset class in the long term, particularly if you are investing from your regular savings, systematically or otherwise, as most Indian households do.

- SBI Focused Equity Fund has generated considerable amount of alpha for SIP investors over different long term investment tenures.

Performance Consistency

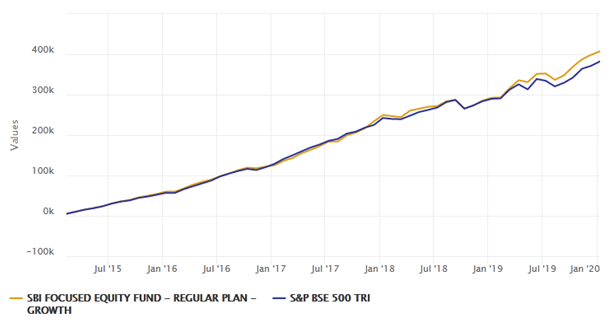

In our view performance consistency is an important attribute for good long term SIP returns because SIP investments over long periods of time are made at a different price points and market conditions. We have discussed a number of times in our blog that rolling returns is one of the best measures of performance consistency over long investment tenures. The chart below shows the 3 year rolling returns of SBI Focused Equity Fund over the last 5 years(ending 13th January 2020) versus its benchmark index S&P BSE 500 TRI. You can see that the scheme outperformed the benchmark most of the times over 3 year investment tenures in the last 5 years.

Source: Advisorkhoj Rolling Returns

The average of the annualized 3 year rolling returns of SBI Focused Equity Fund since its inception (till 13th January 2020) was around 16.0%. Please note that SBI Focused Equity Fund was launched 15 years back and therefore, when we are calculating average 3 year rolling returns we have quite a large sample of rolling returns across different market conditions. Statistically speaking, averages from a large time series sample provides greater confidence of getting similar results in the future over long investment horizons. However, investors should note that as the Indian equity market matures and becomes more efficient, scope of high alpha generation will gradually get more limited in the future and should form expectations accordingly.

Investors should not take historical returns as indicators of future returns. It should rather be taken in the context of relative performance versus other asset classes so that you can make informed investment decisions. SBI Focused Equity Fund gave more than 8% CAGR returns nearly 76% of the times in the last 15 years. The long term historical average 10 year Government bond yield was in the range of 7 - 8% - this was the typical investor expectation for fixed income assets, though the expectation should now be revised downwards as long term interest rates in our economy is on a lower trajectory.

SBI Focused Equity Fund gave more than 12% returns over 3 year investment tenures, nearly 68% of the times since its inception. We think that 11 - 12% returns should be expectations from equity as an asset class in India, factoring in long term secular GDP growth potential and inflation expectations. Though alphas may contract in the future, the long term rolling returns performance across different market conditions of SBI Focused Equity Fund shows considerable wealth creation potential for investors in the future.

Wealth creation by SBI Focused Equity Fund

The chart below shows the wealth accumulated through Rs 5,000 monthly SIP in Focused Equity Fund, Growth Option over the last 5 years (period ending 13th January 2020). You can see that with a cumulative investment of Rs 3 lakhs you could have accumulated wealth of more than Rs 4.25 lakhs over the last 5 years through monthly SIP. The annualized SIP returns (XIRR) over the last 15 years was 14.4%.

Source: Advisorkhoj Research

About SBI Focused Equity Fund

The scheme (formerly known as SBI Emerging Businesses Fund) was launched in October 2004 and has Rs 6,924 Crores of assets under management (AUM). The scheme’s AUM has nearly doubled in the last 9 – 10 months showing investor confidence and strong performance. The expense ratio of the scheme is 1.92%. Industry veteran R. Srinivasan is the fund manager of this scheme. Srinivasan has 26 years of experience and has been the managing the scheme for nearly 10 years. The long continuity of the fund manager of this scheme, in our view, has enabled the scheme to deliver strong performance.

Portfolio Construction

Focused funds are equity mutual fund schemes, which invest in a concentrated portfolio of stocks. As per SEBI’s mandate, focused funds can invest in maximum 30 funds. You should understand that, even though focused funds invest in a limited number of stocks (less than 30), they invest across multiple industry sectors and segments, thus diversifying sector risks. However, the company concentration risk is slightly higher in focused funds compared to more diversified equity funds. The chart below shows the top stocks and sectors of SBI Focused Equity Fund.

Source: Advisorkhoj Research

Summary

SBI Focused Equity Fund is suitable for long term financial goals. We think that investors should have a minimum investment horizon of 5 years for this scheme. The risk profile of this scheme is moderately high; the scheme is suitable for investors with moderately high to high risk appetites. Investors should consult with their financial advisors if focused funds and particularly, SBI Focused Equity Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY