SBI Magnum Midcap Fund: Strong wealth creation track record

Midcaps had been underperforming versus large caps since 2018. But midcaps have outperformed large caps over the past six months or so. With stock market at all-time high, midcaps have the potential to outperform large caps over sufficiently long investment horizon. Though midcaps are more volatile than large caps, they have greater wealth creation potential in the long term.

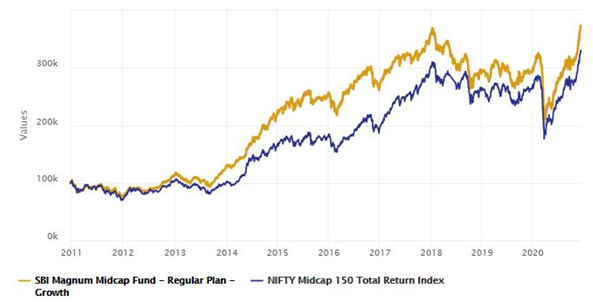

If you had invested Rs 1 lakh SBI Magnum Midcap Fund 10 years back, by now you would have accumulated a corpus of over Rs 3.75 lakhs (as of 15th December 2020). The CAGR return of this midcap equity mutual fund over the last 10 years is 14.1%. The fund was able to beat its benchmark index Nifty Midcap 150 TRI over the last 10 year period.

Fund Overview

SBI Magnum Midcap Fund was launched in March 2005 and has delivered nearly 15% returns since inception. The fund has Rs 4,113.19 Crores of Assets under Management (AUM) as on 30th Nov 2020, with an expense ratio of 2.03%. Ms. Sohini Andani is the fund manager of this scheme.

The chart below shows the NAV movement of SBI Magnum Midcap Fund over the last 1 year. You can see that the scheme has recovered from March lows and is up more than 25% on a trailing twelve month basis.

Source: Advisorkhoj Research

Rolling returns

The chart below shows the 3 years rolling returns of the fund versus its benchmark over the last 10 years. The last 10 year period saw both bull and markets. Though SBI Magnum Midcap Fund was more volatile, it was able to outperform the benchmark. The average 3 year annualized rolling return of the scheme was 18.5% (versus 17% for the benchmark). The fund underperformed in the years 2017 - 2019, but has been one of the best midcap funds of 2020.

Source: Advisorkhoj Rolling Returns Calculator

Portfolio Construction

The investment objective of SBI Magnum Midcap Fund is to provide investors with opportunities for long term growth in capital along with the liquidity. As per SEBI’s mandate the fund will invest at least 65% of its assets in midcap stocks. The fund manager uses a blend of growth and value investing. She has a bias for cyclical sectors like construction, finance, engineering, textiles, chemicals, metals, automobile etc. Cyclical sectors are expected to outperform in the medium term as our economy recovers from the recession caused by COVID-19. The fund is well diversified in terms of company concentration.

Source: Advisorkhoj Research

SIP returns

The chart below shows the returns of Rs 10,000 monthly SIP in SBI Magnum Midcap Fund over the last 10 years. You can see in the chart below that you could have accumulated a corpus of over Rs 26 lakhs in the last 10 years with a cumulative investment of just Rs 12 lakhs. The annualized SIP returns (XIRR) over the last 10 years work out to 15.12% as on 15th Dec 2020.

Source: Advisorkhoj Research

Why invest in SBI Magnum Midcap Fund?

- Different market cap segments outperform one another in different market conditions (investment cycles). Midcaps underperformed large caps in 2018-19 and is likely to outperform now.

- With markets at all time, large cap valuations seem to be on the richer side. With ample liquidity in the market, there is an opportunity of mean reversion in relative performance of market cap segments.

- SBI Magnum Midcap Fund has a strong long term track record of wealth creation.

- Even though the fund underperformed in the recent years, it seems to have turned the corner and we expect good performance from this fund going forward given the experience and excellent track record of the fund manager.

- You can invest in this fund through SIP for meeting your long term financial goals. You can also tactically invest in lump sum to increase your allocations in midcaps. If you are concerned about volatility you can invest through 3 – 6 month SWP.

Investor should consult with their financial advisors/ mutual fund distributors if SBI Magnum Midcap Fund is suitable for their risk appetite and investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY