Planning for your future with you: SBI Mitra SIP

Different goals require different cash flows -

There is a popular phrase that says, ‘forewarned is forearmed.’ That is to say that when we know what is coming up, we can prepare to provide for it. In our life we have many milestones to be achieved. Apart from higher education, marriage, ensuring our and our dependents’ health, making a house, children’s education, retirement planning, there are other needs like building a corpus for a rainy day, going on that coveted vacation, buying that dream car, the list is endless. To plan for your short term and long-term goals it is important to plan in advance and invest through proper channels for building a corpus to finance that goal.

Sometimes the corpus you have built is not required all at once. The funds required for a vacation may not be in the same structure as the funds required for your retirement. In the case of retirement planning, the corpus that you accumulate will be withdrawn every month over a number of years. But to turn your retirement fund into a steady monthly source of income, you will have to start a systematic withdrawal plan. Would it not be a great thing if the corpus you accumulated over a number of years can be automatically converted into a systematic plan of withdrawal where you get regular funds throughout the period you have chosen?

Presenting to you the SBI Mitra SIP in answer to your need to make your investment and withdrawal systematic.

What is SBI Mitra SIP?

SBI Mitra SIP, is a comprehensive financial tool that is a combination of wealth creation through systematic investment (SIP) in an eligible scheme of your choice, coupled with the systematic withdrawal of the benefits through SWP to fund your short term and long-term goals. The investment period can be tailored to your financial objectives, risk tolerance, and time horizon.

How does the SBI Mitra SIP work?

- Step 1: Choose a scheme of your choice in the growth option from the basket of eligible schemes and start a monthly SIP in the denomination of your choice, subject to the minimum application amount of the scheme chosen.

- Step 2: Choose a time period that aligns with your goals. For SBI Mitra SIP, the time periods can be 8, 10, 12, 15, 20, 25 or 30 years.

- Step 3: At the end of the stipulated time period of SIP, prepare to receive the funds through predefined equated monthly SWPs through a scheme of your choice in multiples of your SIP amount.

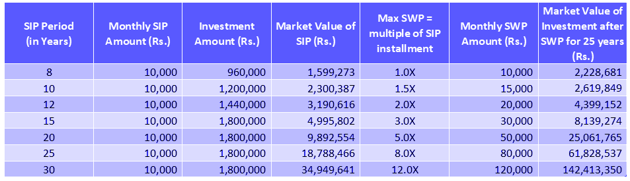

The table below illustrates the SBI Mitra SIP assuming that an investor is investing Rs 10,000 in monthly SIPs in a source scheme giving a 12% return. The target scheme through which the investor starts receiving his withdrawals (SWP) at the end of the SIP period is assumed to have a growth rate of 8%.

For example, let us assume that an investor Mr. Shastri has invested Rs 10,000/- in monthly SIPs to plan for his child’s education for 10 years starting from the time that his child was 6 years old. Mr. Shastri will start receiving Rs 15000/- as SWP towards monthly funds for his child’s education when his child is 16 years old, assuming that the returns on the source scheme was 12%. Moreover, assuming that the target scheme has a growth rate of 8%, the market value of the remaining investments made by Mr. Shastri will be Rs 26,19,849/- after he has received SWP for 25 years. This can be used either for his own retirement fund that can be again converted to an SWP for his own monthly expenses, or Mr. Shastri may dispose of the funds in a manner he deems best.

Why should you choose SBI Mitra SIP?

- The SBI Mitra SIP helps you create long term wealth for your financial independence by reaping the power of compounding through SIPs.

- It is a plan that helps you plan for your goals systematically, as well as withdraw funds systematically to realize those goals.

- You can choose from multiple source and target schemes of mutual funds based on your risk appetite and time horizon.

- The scheme inculcates discipline in your goal-based investment plan by preventing excess withdrawal from your corpus.

Who should invest in SBI Mitra SIP?

With the built-in dual feature of systematic investment coupled with systematic withdrawal plan, the SBI Mitra plan can be a preferred mode of investment for investors of different profiles. Let us take a few scenarios where SBI Mitra SIP can be aligned to the financial goals.

- Young professionals starting off their career: The best time to start your investment is as early as possible. The SBI Mitra SIP is suited to investors who have just started their career and can stay invested for a long period. Investments can be planned in such a way that the source scheme can be aggressive to reap maximum benefits from the equity market and build a sizable corpus. The target scheme can be utilized for SWP withdrawals and plan an early retirement.

- Planning for children’s education: An SIP in the SBI Mitra SIP can be started at the time of birth of the child and after 15 years the SWP starts thereby funding for the child’s education, allowances etc.

- Planning for retirement: After retirement, the income stops whereas the expenses keep occurring. The SBI Mitra SIP can be planned in such a way that the SWP payouts start from the first month after retirement. The fantastic thing about the scheme is that it is structured in such a way that you would not need to do any more documentation once your SIP stops. The funds accumulated will automatically be converted into SWP.

Contact your financial advisor or mutual fund distributor today to discuss the SBI Mitra SIP plan and take the first step towards realizing your goal.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY