Asset Allocation is much more important than fund selection

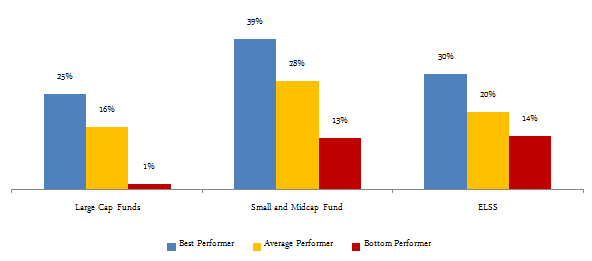

We get a large number of queries from our readers asking us whether the mutual funds they have selected for their portfolios are the “best” funds. Good fund selection definitely makes a difference to your investment returns and therefore investors should try to select the top performing funds. The chart below shows the difference in returns between the best performer, the average performer and the bottom performer, over the last 3 years (based on October 27 2015 NAVs) for various equity fund categories.

Source: Morningstar

We can see that there is a significant performance differential between the best performer and the average performer, not to mention the bottom performer. However, asset allocation plays a much more important role in your overall investment returns than fund selection. In this blog we will discuss asset allocation influences your investment returns versus fund selection within a specific asset category.

What is asset allocation?

Asset is the percentage mix of different asset classes like debt, equity, real estate and gold in your total asset or investment portfolio. In its simplest form asset allocation often refers to the percentage split between debt and equity investment. In the Indian context, real estate and gold are also very important asset classes. On an average, in India, the allocation to physical assets like real estate and gold is more than financial assets. However, for the sake of discussion in this blog, we will keep our definition of asset allocation simple and refer to it as the percentage allocation to equity versus debt. Asset allocation is the most important aspect of financial planning, since it plays a bigger role in meeting your financial goals than any other factor.

Role of asset allocation versus fund selection in final portfolio returns

We will understand this by walking through an example. Let us assume that, 10 years back you had an amount of र 500,000 to invest for your long term goals. For the sake of simplicity, we will assume that you had two investment options

- Investing in a risk free fixed income investment, e.g. Fixed Deposit, National Savings Certificate etc.

- Investing in an equity mutual fund

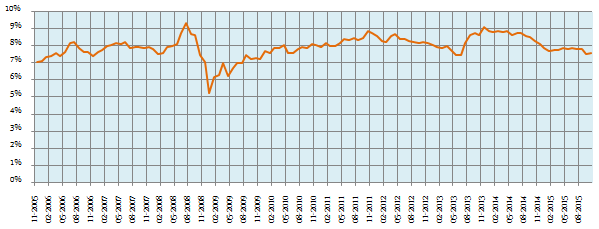

Let us first see how much returns you would have got from your risk free fixed income investment over the last 10 years. The chart below shows the 10 year Government Bond yield from October 27, 2005 to October 27, 2015.

The average 10 year Government Bond yield over this period was around 8%. Your average risk free interest during this period therefore, would also have been around 8%. Interest from most fixed income investments are taxable as per the income tax rate of the investor. If you are in the 30% tax bracket, your effective post tax return is 5.6%.

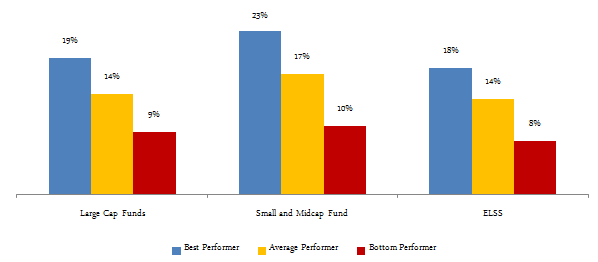

Let us now see, how the different equity mutual fund categories performed in the last 10 years. The chart below shows the difference in returns between the best performer, the average performer and the bottom performer, over the last 10 years (based on October 27 2015 NAVs) for various equity fund categories.

Source: Morningstar

If you chose the best performing large cap equity fund, over the last 10 years you would have got an annualized return of 19%. If you chose an average performer from the large cap equity fund category, your annualized return would have been around 14%. Please note that long term (holding period of more than 1 year) capital gains from equity fund will be tax free.

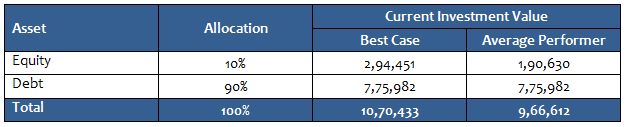

Let us assume you had split your र 500,000 investment between a large cap equity fund and a risk free fixed income investment, e.g. bank fixed deposit. The table below shows the current investment value if your equity to debt allocation was 10%:90%.

If you invested the best performing large cap equity fund, your current investment value, including the debt portion will be र 10.7 lacs, whereas if you invested in an average large fund your current investment value will be around र 9.7 lacs.

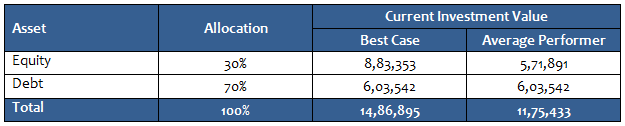

Let us now see, what your investment value would have been if you altered you equity to debt allocation to 30%:70%.

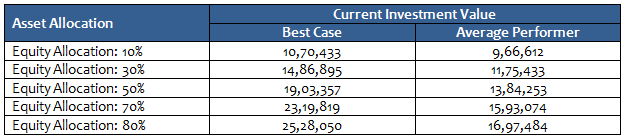

Not only is your investment value much higher with higher equity allocation, even if you chose an average large cap fund with 30% equity and 70% debt allocation, the overall returns will still beat the best case return of the 10% equity and 90% debt asset allocation. That is why we say, that asset allocation plays a more important role than fund selection in your final investment returns. Many investors devote more time in identifying the best performer and less time in determining their optimal asset allocation. On the contrary, if they get their asset allocation correct, they can get much better results even with average performers. The table below shows the current investment values for different asset allocation percentages.

It is evident from the table above that, while selecting the best performer makes a significant difference, asset allocation has a bigger impact on your final returns. Selecting the mutual fund scheme which will give the highest returns in the future is an extremely difficult, if not an impossible task. On the other hand getting your asset allocation right is a relatively simple task. While your optimal asset allocation will depend on risk profile and financial objectives, you can use some thumb rules as a starting point to determine your optimal asset allocation.

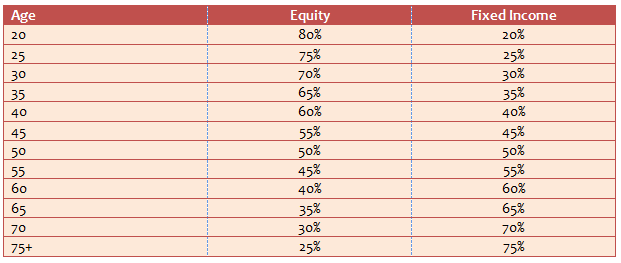

Rule of 100

This is a very popular thumb rule for measuring risk tolerance. Simply put, you should subtract the investor’s age from 100, and the result suggests the maximum percentage amount of the investor’s portfolio that should be exposed to equities. So for a 25 year old investor, this rule suggests that 75% of his or her portfolio should be invested in equities, and for a 40 year old investor, this rule suggests that 60% of the portfolio should be invested in equities. This is the conventional asset allocation model, and is ideally suited for a passive investor. The table below shows the asset allocation guidance for different age groups.

You can modify this rule, based on your risk profile and investment objectives. You can also consult with an experienced financial planner who can help you determine your most optimal asset allocation.

Conclusion

In this blog we have seen that asset allocation plays the most important in determining your overall portfolio returns. Investors should also educate themselves about asset allocation and determine which the most suitable asset allocation for the long term financial goals.

Disclaimer:

Any information contained in this article is only for informational purpose and does not constitute advice or offer to sell/purchase units of the schemes of SBI Mutual Fund. Information and content developed in this article has been provided by Advisorkhoj.com and is to be read from an investment awareness and education perspective only. SBI Mutual Fund’s participation in this article is as an advertiser only and the views / content expressed herein do not constitute the opinions of SBI Mutual Fund or recommendation of any course of action to be followed by the reader

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- How do you know if you have good funds in your mutual funds portfolio: part 2

LATEST ARTICLES

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

- SBI Multicap Fund: Off to a great start

- SBI Balanced Advantage Fund: Benefits of growth and stability

- SBI Conservative Hybrid Fund: A suitable fund for first time investors with stellar track record of consistent outperformance

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY