Credit Risk Fund: Good medium term investment options for higher returns

Till about 2014, debt mutual funds were seen primarily as tax arbitrage opportunities vis a vis bank term deposits (FD). In the first union budget of the present NDA Government, debt mutual fund taxation was changed and debt mutual funds no longer enjoyed tax advantage in the first three years of investment tenor. When the tax changes were announced in 2014, I remember quite a few financial experts saying that these changes will kill retail interest in debt mutual funds. However, based on the investment queries and comments received by us in advisorkhoj.com and other online platforms, interest in debt mutual funds has grown in the past 4 years. Interest in debt mutual funds is a sign of the growing maturity of Indian investors and is result of the efforts put in by the mutual fund industry and the IFA community in educating retail investors about debt mutual funds.

Debt market has been challenging in the past 1 year

The past 1 year has not been kind to debt mutual funds. The 10 year Government Bond yield saw an increase of almost 150 basis points in the last 12 months. Rising yields have a negative impact on bond prices; long duration debt mutual funds, Gilt funds and dynamic bond funds gave poor returns in the past 1 year. Long term debt mutual funds were very popular with investors from 2014 till last year, as interest rates were on a declining trajectory during that period. But funds with long duration (maturity) profiles suffer the most when interest rates rise, because these funds have high sensitivity to interest rate changes; longer the duration of a bond, the more sensitive it is to interest rate changes. Bonds with short or medium duration profiles are much less sensitive to interest rate changes and short duration debt mutual funds performed much better in the last 1 year.

Debt mutual fund investment strategies

There two broad fixed income investment strategies in debt mutual funds – duration call and accrual strategy. In duration call, the fund manager invests in certain duration (maturity profiles) based on his / her interest rate outlook. In accrual strategy, the fund managers hold the bonds till maturity and accrue the interest paid by them over the residual maturity term of the bond. Upon maturity bonds pay the face value back to the investor and therefore, bond price changes in the interim, do not affect returns in a hold to maturity (accrual) strategy. Debt mutual funds which employ accrual strategy are more suitable for investors who want to reduce interest rate risk and get stable income.

Accrual Strategy

In accrual strategy, the fund managers invest in short to medium duration bonds, with the aim of holding them till maturity. As discussed earlier short duration bonds are much less sensitive to interest rate changes compared to long duration bonds. Unlike long duration funds, where fund managers invest mostly in Government bonds (G-Secs), in accrual strategy, fund managers invest primarily in corporate bonds or debentures, commercial papers etc.

Corporate bonds or debentures pay higher interest (coupons) than Government bonds – spread between AAA and AA rated debentures and G-Secs of similar residual maturities in the yield curve is currently around 100 to 110 bps. Interest rate risk is not the primary risk factor in accrual strategy but corporate bonds or debentures are subject to credit risk. Fund managers of corporate bond schemes do extensive credit evaluation of debentures to minimize credit risk for investors. Corporate bond yields are at a 2 year high and this a good time for investors to lock in these yields with accrual strategy. Over 2 – 3 years tenors corporate bond funds can give good returns to investors; we recommend 3 years plus tenors for these schemes, because investors can avail long term capital gains taxation benefits for3 years plus investment tenors.

Credit Risk Funds

Credit Risk Funds are a variant of corporate bonds where the fund manager aims to capture higher yields by investing in slightly lower credit rated debentures or commercial papers, while maintaining the credit quality of the portfolio by investing in highly rated papers as well in the portfolio. In the last 3 and 5 years, credit risk funds as a category gave 8.1% and 9.1% returns respectively, while in the same periods corporate bond funds, gave 6.8% and 8.1% returns respectively (please see our MF category monitor).

Though fairly intuitive, let us spend some time discussing why credit risk funds give higher returns than the usual corporate bond funds for the benefit of less experienced investors among our reads. The risk versus return relationship is a fundamental premise in finance, irrespective of asset classes. It is very intuitive also – if you are taking more risks, as an investor you will also want higher returns. Midcap stocks are more risky than large cap stocks; that is why midcaps give higher returns than large cap in the long term. Similarly, lower rated debentures are more risky than higher rated debentures. Therefore, issuers of lower rated debentures have to pay higher rate of coupon (higher interest rate), if they want to attract investors.

Different grades of credit risk

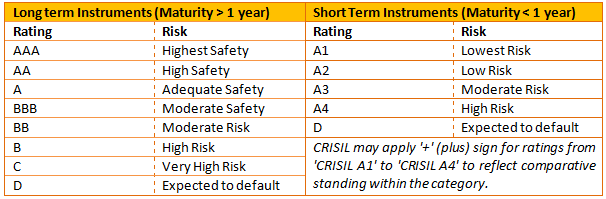

Let us first understand what credit risk is. Credit risk refers to risk of non-payment of interest (coupon) or principal (face value) or both by the bond issuer. Rating agencies like CRISIL, ICRA etc., assign credit ratings to different debt papers (debentures, CPs etc.) to indicate their credit risk assessment of the papers. The table below describes the credit rating scale used by CRISIL to rate fixed income securities.

Source: CRISIL

Lower the rating of a bond, higher the bond yield (interest paid by the bond as a percentage of the price). Yields on A rated papers can be 175 to 200 bps higher than that on AA rated papers. Similarly the yield spread between A and AAA rated papers can be 200 to 225 bps. Credit risk funds aim to capture the higher spread producing higher returns for investors while managing risks at the same time. Managing risks require considerable level of fund management experience and expertise in credit assessment. The fund house also should have robust credit risk monitoring mechanisms and processes. When selecting credit risk funds for investments, the track record of the fund manager and the AMC is of great importance.

Impact of rating changes on returns

Changes in financial situation of a company can impacts its credit risk profile and cause the rating agencies to change the credit rating of its debt papers (e.g. debenture, commercial paper etc.). The change can be either positive or negative – upgrade or downgrade. If the rating of a debenture gets upgraded the price of the debenture rises resulting in capital appreciation for the investor; on the other hand if the debenture gets downgraded, the price of the debenture will fall resulting in loss for the investor.

From time to time, reports of rating downgrades get published in media causing fear psychosis among investors. Unfortunately in modern media, negative stories get much more publicity than positive stories. Instances of corporate bond funds or credit risk funds making a loss due to ratings down grade are quite rare. Further, reports of rating upgrades do not receive much attention in the media, even though there are as many instances of rating upgrades as there are of downgrades. As discussed earlier, fund managers do extensive credit risk evaluation before investing in corporate bonds, especially slightly lower rated corporate bonds. Good fund managers aim to invest in papers which can get upgraded resulting in price appreciation. Even if a bond in a credit risk fund portfolio gets downgraded, its negative impact can be cancelled out by another bond getting upgraded.

Objective understanding of risk – how to invest

Investors should have an objective understanding of risks, instead of being led by incorrect perceptions. Firstly, one should not assume that a lower rated paper will invariably default or get downgraded. There is also the probability of the paper getting upgraded. As per a CRISIL report based on 1988 to 2015 data, the average default rate of A rated papers over 3 year tenor is only 4.8% while that of BBB rated paper in 5.7%. The default rate of BB rated paper is higher at 13%. If you want to be conservative, select credit risk funds which have low percentage allocation to BB or lower rated papers. If you want to be even more conservative, select funds which have low allocations to BBB or lower rated papers. However, the more conservative you are, lower will be your returns.

Secondly, just because a bond in the scheme portfolio gets downgraded you should not panic and sell. The downgrade may be due to some temporary factors and the bond may get upgraded in the future. Even if it does not gets upgraded as long as the fund does not default, you will get the yield you want by holding the bond to maturity. You should trust your fund managers to make the right investment decisions.

Thirdly, you should look at concentration risk - percentage of single issuer holding in scheme portfolio. Lower the concentration, lower is the credit risk of the overall scheme portfolio. In most of the cases, where funds faced distress due to rating actions (downgrades), the exposure to a single issuer was high. SEBI has advised firms to lower concentration risk. AMCs usually have internal guidelines on concentration risks. As an investor, you should also do your homework, go through the scheme factsheet and see holding percentages in the scheme portfolio. If the scheme’s exposure to one issuer is less than 8 - 9%, then even in the event of a downgrade, the impact on overall returns will be fairly small.

Conclusion

In this blog post, we discussed about credit risk mutual funds. Historically, the credit risk fund category has been one of the best performing debt mutual fund categories. In our view, AMCs with strong performance track-records have managed credit risk quite well, even in difficult economic environments. In the current environment, when yields are high and widened credit spreads, there is an opportunity to get higher returns by investing in credit risk funds. Over 3 years plus investment tenors these funds are also much more tax efficient than traditional fixed income investment avenues. However, you should understand the risk factors well and select the right funds. Investors should consult with their financial advisors, if credit risk mutual funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Importance of staying invested in the choppy market

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY