Balanced Advantage Fund: Protection against volatility

After a few months of tranquility, volatility has returned to the stock market with full fervor. This month the Nifty has already fallen by 537 points and the possibility of the market extending its losses are quite high. For the past few months several mutual fund houses have been recommending balanced advantage funds to investors. These hybrid mutual funds aim to reduce downside risks and give good risk adjusted returns to investors in the long term. In protracted periods of volatility balanced advantage funds are good investment choices as they provide stability to your investment portfolio.

What are Balanced Advantage Funds?

The technically correct name of this category of fund is Dynamic Asset Allocation Funds. In these funds the asset allocation between equity and fixed income (debt) is managed dynamically depending on prevailing market conditions. When stock prices are high, the fund manager shifts the asset allocation from equity to debt and stock prices are low, asset allocation is shifted from debt to equity. When stock prices are very high, the maximum portion of scheme portfolio is invested in debt securities and in the ensuing correction investors do not see a big fall in the investment value. When stock prices are very low, the fund manager shifts back to equity, so that investors are able to get maximum benefits from the ensuing recovery.

Valuation and market trend

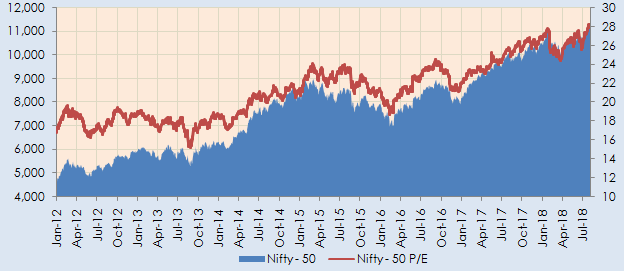

Let us first understand observed relationship between valuations and market movement. The chart below shows the Nifty movement (blue) and Nifty Price to Earnings ratio (a measure of market valuation) over the last 6 years.

Source: National Stock Exchange

You can see that whenever an inflexion point is reached in Nifty P/E ratio, there has been a trend reversal in Nifty. In other words, market corrects from high P/E level and rallies from low P/E levels. The chart shows that valuation is a leading indicator of market movement. Instead of taking positions based on market movement, balanced advantage fund managers shift the asset allocation based on valuation – shift to debt when valuation is high and shift back to equity when valuation is low.

Asset Allocation Model

All balanced advantage funds have in-house mathematical models, which recommend asset allocation ranges for different valuation levels. These models are created on the basis of the fund manager’s hypothesis of asset allocation at different valuation levels which generates best returns for investors over a sufficiently long investment horizon. These models are then back-tested using historical data to see if the investment objectives were suitably met.

Once deployed, the model will determine the asset allocation based on changes in valuation. Asset allocation rebalancing can take place daily or at other intervals. In other hybrid mutual funds, the fund managers have the latitude of taking asset allocation calls within certain ranges as per the scheme’s mandates, e.g. increasing equity exposure from 65% to 80%. However, in balanced advantage funds, asset allocation decisions are purely mathematical leaving little or no room for judgement. Equity allocation can range from 20% to 80% depending on valuations. Fund managers decide which stocks and bonds to buy or sell, but will stick to the asset allocation determined by the model.

Different fund houses use different valuation measures like price to earnings ratio, price to book ratio etc. for the dynamic asset allocation models. Different models will give different results in different market conditions and over different investment tenors. Investors should study long term track record of different balanced advantage funds before investing.

Use of derivatives

Balanced Advantage Funds use derivatives to manage active equity exposure through hedging. This helps the fund managers keep gross equity exposure above 65% to avail equity taxation, while at the same time, adhering to asset allocation determined by the model. Apart from availing tax benefit, derivatives also helps the fund managers generate returns for investors through arbitrage. Arbitrage are risk free profits made by the scheme by exploiting pricing mismatches between the spot (cash) and the derivatives (Futures and Options) segments of the market.

Tax Advantage

As mentioned earlier, balanced advantage funds are taxed as equity funds. Short term capital gains (investment held for less than 12 months) are taxed at 15%. Long term capital gains (investment held for more than 12 months) are tax exempt up to gains of Rs 1 Lakh; gains in excess of Rs 1 Lakh are taxed at 10%. Dividends paid by balanced advantage funds are tax free in the hands of the investor, but the fund house has to pay 10% dividend distribution tax (DDT) before paying dividends to investors. The tax advantage of balanced advantage funds is extremely beneficial for investors compared with fixed income investments.

Conclusion

Hybrid mutual funds offer investment solutions for a range of risk appetites from moderately conservative to moderately aggressive. If you do not want too much volatility in your investment and want good returns in the long term then balanced advantage funds can be good investment options. Balanced advantage funds at times will not be able to capture the full market upside because in India markets tend to rally even at very high valuations. However, balanced advantage funds helps investors in down markets by limiting losses and preserving gains. These funds are also highly tax efficient. As such, balanced advantage funds are excellent investment options for new investors or investors who are worried about volatility. Investors should consult with their financial advisors if balanced advantage funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY