Why should Commodities be a part of your portfolio at all times?

Equity and fixed income are the traditional asset classes for retail investors. However, commodity investments can help you diversify your portfolio in asset classes other than equity and debt. Commodities are natural resources which can be used as raw material to create different products. Examples of commodities are precious metals or bullion (e.g. gold, silver), base metals (e.g. aluminium, copper, zinc etc), energy (e.g. crude oil, natural gas etc), agro products (e.g. wheat, rice, sugar etc). In this article, we will focus on precious metals or bullion as commodities.

Inflation and commodities

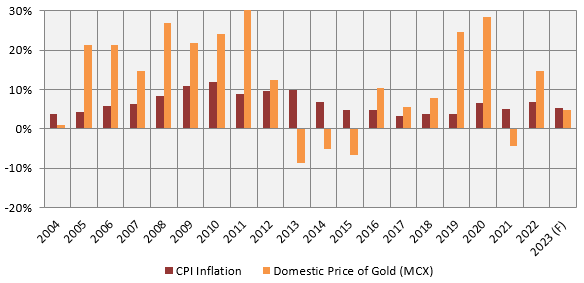

While low to moderate rates of inflation is usually good for equities, high inflation has a negative impact because consumers cut down on spending in high inflation environment. Companies which do not have pricing power are forced to reduce to price and take a hit on profit margins. Commodities as a broad asset class, can serve as hedge against high inflation. This is because inflation is caused by rising / high commodity prices. From ancient times, precious metals like gold retain their economic value or purchasing power over time. That is why precious metals are considered to stores of economic value. In the chart below, we have plotted CPI inflation over the last 20 years versus Gold’s returns. You can see that gold and silver as an asset class have generated inflation beating returns; higher the inflation, higher the returns. The years in which Gold was not able to beat inflation were the years when the US Fed changed its monetary policy from accommodative to tightening.

Source: World Bank, MCX, as on 30th September 2023. Disclaimer: Past performance may or may not be sustained in the future. The chart above is purely for investor education purposes and not for asset allocation recommendation

Low or negative correlation with equities

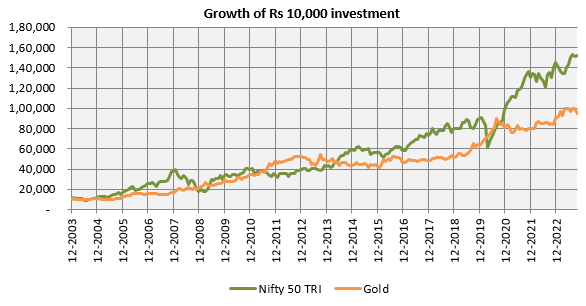

The chart below shows the growth of Rs 10,000 investment in Nifty 50 TRI (proxy for equity as an asset class) and Gold over the past 20 years. Both Nifty and Gold gave double digit CAGR returns beating inflation over this period. However, you can see that Gold outperformed when Nifty underperformed and vice versa.

Source: NSE, MCX, as on 30th September 2023. Disclaimer: Past performance may or may not be sustained in the future. The chart above is purely for investor education purposes and not for asset allocation recommendation

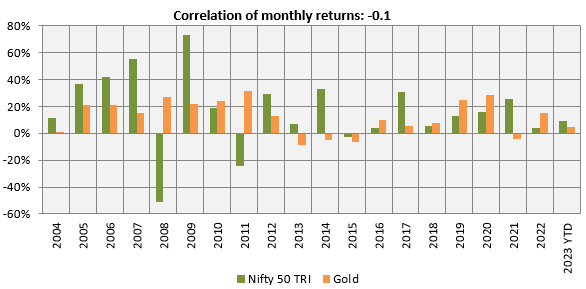

The chart below shows annual returns of Nifty 50 TRI and Gold over the last 20 years ending 30th September 2023. You can see that Gold outperformed in the years when Nifty underperformed. The correlation between monthly returns of Nifty and Gold over the 20 year period was -0.1 (negative correlation). The reason for counter-cyclical nature of Gold is that the precious metals are seen as safe haven assets; when the economic outlook worsens, investors turn to Gold for safety. Adding Gold to your portfolio will provide stability to your portfolio – bring down portfolio volatility.

Source: NSE, MCX, as on 30th September 2023. Disclaimer: Past performance may or may not be sustained in the future. The chart above is purely for investor education purposes and not for asset allocation recommendation

Relationship of interest rates and commodity prices

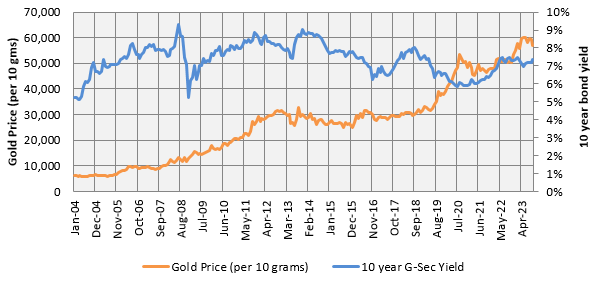

High interest rates and commodity prices have an inverse relationship. High interest rates reduce purchasing power. Consumers spend less and this pushes down commodity prices. Gold also has an inverse relationship with interest rates, i.e. price of Gold generally drops or stagnates when interest rates rise beyond a certain level. The chart below shows the price of Gold (per 10 grams) versus the 10 year Government Bond yield. We have taken the 10 year Government Bond yields as an proxy for interest rates because the 10 year Bond yield is directly related to the prevailing interest rates. You can get higher returns from Gold, when your income from debt as an asset class drops.

Source: Investing.com, MCX, as on 30th September 2023. Disclaimer: Past performance may or may not be sustained in the future. The chart above is purely for investor education purposes and not for asset allocation recommendation

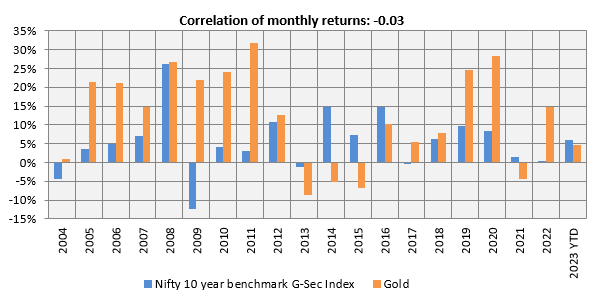

In the chart above, we have only considered yields. In addition to yield, price changes with change in interest rates can impact returns of debt as an asset class. The chart below shows annual returns of Nifty 10 year benchmark G-Sec Index (as a proxy for debt as an asset class) and Gold over the last 20 years ending 30th September 2023. The correlation between monthly returns of Nifty 10 year Benchmark G-Sec Index and Gold over the 20 year period was -0.03 (negative correlation). Low or negative correlation means that two asset are not likely to underperform together i.e. gold may provide portfolio stability when debt underperforms.

Source: NSE, MCX, as on 30th September 2023. Disclaimer: Past performance may or may not be sustained in the future. The chart above is purely for investor education purposes and not for asset allocation recommendation

Why add Silver to your portfolio?

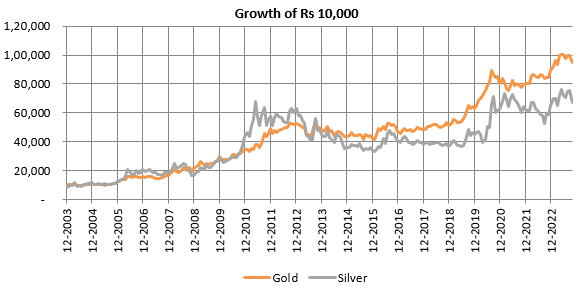

Silver is also a precious metal. Like Gold, Silver is also considered to be a store of economic value and a long term hedge against inflation. Its price behaviour in different investment cycles is similar to Gold. The chart below shows the growth of Rs 10,000 investment in Gold and Silver over the past 20 years. Like Gold, Silver also has negative correlation with equities and therefore can be used for portfolio risk diversification.

Source: MCX, as on 30th September 2023. Disclaimer: Past performance may or may not be sustained in the future. The chart above is purely for investor education purposes and not for asset allocation recommendation

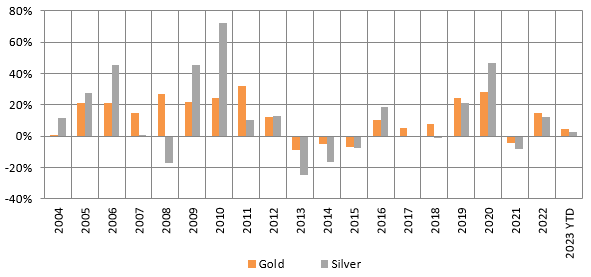

The chart below shows annual returns of Gold and Silver over the last 20 years ending 30th September 2023. You can see that price movement of Gold and Silver are similar in different investment cycles. However, Silver tends to outperform Gold in equity bull markets, especially in the early stages of economic recovery. Hence it can add further diversification to the asset allocation in your investment portfolio.

Source: MCX, as on 30th September 2023. Disclaimer: Past performance may or may not be sustained in the future. The chart above is purely for investor education purposes and not for asset allocation recommendation

Furthermore, unlike Gold, Silver has industrial use. Silver is used in new age industries e.g. solar panels, electric vehicles, smartphones, advanced electronics etc. With the growth of these new age industries, silver demand for industrial use is expected to rise significantly in the future. Though industrial demand is rising, the supply of silver is relatively constrained. Therefore, there is considerable scope of higher returns on investment from silver in the long term.

How to invest in Gold and Silver?

Indian families have been buying Gold and Silver in physical form since the ancient times; it is part of our cultural tradition. However gold and silver jewellery or other articles usually have impurities. Physical gold and silver includes storage charges e.g. bank locker fees. For financial investments, gold and silver exchange traded funds (ETFs) are much more suitable options. In gold or silver ETFs, there are no impurities or making charges; you get the value of pure gold or silver. Gold and silver ETFs are much more liquid than physical gold or silver jewellery or other articles. Gold and silver ETFs can be sold in the stock exchanges on any trading session at prevailing rates / prices.

Gold Exchange Traded Funds or Gold ETFs are financial instruments that track the price of pure Gold. Gold ETFs are backed by physical Gold. One Gold ETF unit is equal to 1 gram of gold and is backed by 99.5% pure physical gold bars (source: AMFI, Knowledge Centre, Gold ETFs).

Silver exchange traded fund or Silver ETFs are financial instruments which track the price of pure silver. These instruments invest in physical silver or silver related instruments. Physical Silver of 30 kg bars with fineness of 999 parts per thousand (or 99.9% purity) conforming to London Bullion Market Association (LBMA) Good Delivery Standards are only permitted by SEBI for silver ETFs (source: SEBI circular on Norms for Silver Exchange Traded Funds (Silver ETFs) and Gold Exchange Traded Funds (Gold ETFs) dated November 24, 2021).

You need to have Demat and trading accounts to invest in ETFs. If you do not have a demat account, you can open one with any depository participant (DP); check with your stockbroker. The stockbroker / DP will open a demat account after you submit your KYC documents (e.g. PAN, Aadhaar cards, photographs etc). Along with the demat account, the stockbroker will also open a trading account for you, so that you can buy / sell ETFs or other securities through that account.

If you do not have a demat account, then you can invest in gold or silver through gold or silver fund of funds (FOFs). Gold or silver FOFs are like any other open ended mutual fund scheme. You can purchase / redeem units of gold or silver FOFs with the Asset Management Company (AMC) at prevailing Net Asset Values (NAVs).

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY