Multi Asset Allocation Funds: Is this a good time to invest in multi asset funds?

With the stock market at record high, many investors are focusing on asset allocation. Asset allocation means diversifying your investments across different asset classes like equity, debt etc, with the objective of balancing risks and returns. Traditional asset allocation is focused on equity, debt and cash. However, there are other asset classes like gold, real estate, international equities etc which can play an important role in asset allocation. In this article, we will discuss about multi asset allocation which refers to asset allocation in more than 2 asset classes.

What are multi asset allocation funds?

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI, multi asset allocation funds must invest minimum 10% each in at least 3 asset classes. Apart from the two most popular asset classes, equity and fixed income or debt, multi asset allocation funds must invest in other asset classes like gold, real estate investment trusts (REITs), infrastructure investment trusts (InvITs) etc. The fund manager decides the proportional allocation to each asset class based on the market conditions with the objective of balancing risks and returns.

Role of different asset classes in you asset allocation

- Equity: Equity, as an asset class, has the potential to create wealth. Historical data shows that equity can give superior returns over long investment horizons. The chart below shows the growth of Rs 10,000 investment in Nifty 50 TRI over the last 10 years, ending 31st August 2023. Over this period Nifty 50 TRI gave 14.6% CAGR returns. While equity as an asset class has the potential to give superior returns over long investment horizons, it also tends to be more volatile than other asset classes. The maximum drawdown of Nifty 50 TRI in this period was -37%.

Source: National Stock Exchange, Advisorkhoj Research, as on 31.08.2023. Disclaimer: Past performance may or may be sustained in the future

- Fixed Income: The main investment objective for fixed income or debt is income. Fixed income returns have low correlation with equity returns and therefore, can provide stability to your portfolio in market downturns. The chart below shows the growth of Rs 10,000 investment in Nifty 10 year Benchmark G-Sec Index over the last 10 years, ending 31st August 2023. Fixed income is the least volatile of all asset classes.

Source: National Stock Exchange, Advisorkhoj Research, as on 31.08.2023. Disclaimer: Past performance may or may be sustained in the future

- Gold: Gold has a lot of cultural significance in India; it is considered to be an auspicious metal in many Indian households. Gold, as an asset class, is seen as a store of economic value. Historical data shows that gold can be hedge against inflation in the long term. The chart below shows the growth of Rs 10,000 investment in Gold (in INR) over the last 10 years, ending 31st August 2023. Over this period gold gave 14.6% CAGR returns, but in the last 5 years (as 31st August 2023) Gold gave 15%+ CAGR returns. Gold as asset class is less volatile than equity. The maximum drawdown of gold in the last 10 years was -19%.

Source: Multi Commodity Exchange, Advisorkhoj Research, as on 31.08.2023. Disclaimer: Past performance may or may be sustained in the future

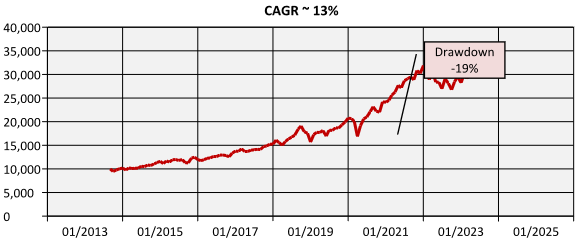

- International: International stocks as an asset class is increasingly becoming popular in India. In just the last 3 years mutual fund industry assets under management (AUM) in Fund of Fund investing overseas has multiplied nearly 5 times. However, there is still relatively less awareness of international as an asset class among retail investors. Most investors tend to ignore single country risk associated with their home country. International investing will provide you exposure to global macro-trends like Artificial Intelligence, Electric Vehicles, Alternative Energy, Fintech, Biotech and Life Sciences etc. You can get exposure to companies which are global brand names and have vast global markets. You can also benefit from INR depreciation. The chart below shows the growth of Rs 10,000 investment in S&P 500, the index of 500 large cap companies in the United States (in INR) over the last 10 years, ending 31st August 2023. Over this period S&P 500 gave 13% CAGR returns in rupee terms. The maximum drawdown of S&P 500 in INR over this period was -19% during the outbreak of the COVID-19 pandemic.

Source: National Stock Exchange, Advisorkhoj Research, as on 31.08.2023. Disclaimer: Past performance may or may be sustained in the future

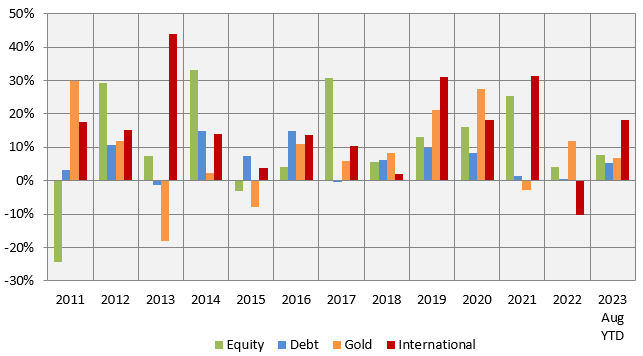

Why multi asset allocation achieves better risk diversification?

You can see that different asset classes have different risk return characteristics. Asset allocation in different asset classes will provide richer diversification. Since Multi Asset Allocation funds invest in 3 or more asset classes they provide stability to your portfolio returns across investment cycles. There is low correlation between returns of different asset classes in different market conditions. Equity and gold are usually counter-cyclical to each other i.e. gold outperforms when equity underperforms and vice versa (see the chart below). Adding gold to your investment portfolio provides much better risk diversification compared to a portfolio comprising of just equity and debt. There is low or even negative correlation between returns of the different countries (see Nifty and S&P 500 returns in the chart below). Adding international will give even richer diversification to your portfolio.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2023. Equity as an asset class is represented by Nifty 50 TRI, debt as an asset class has been represented by Nifty 10 year benchmark G-Sec and for gold we have used MCX spot prices, international is represented by S&P 500 in INR. Disclaimer: Past performance may or may not be sustained in the future.

Multi Asset Allocation Funds compared to other hybrid fund categories

Source: Advisorkhoj Research, as on 31st August 2023. Disclaimer: Past performance may or may not be sustained in the future

Is this a good time to invest in Multi Asset Allocation Funds?

High inflation persisted for a long time in the post COVID world. The central banks have been aggressively raising interest rates for the past 12 – 15 months. Equity, as an asset class, remained remarkably resilient even in the face of rising interest rates. However, the market is expecting that we are reaching the end of this interest rate cycle. RBI has held repo rates flat at the last few MPC meetings. Though the US Federal Reserve continued to hike rates, the market is expecting either one last rate hike in September or no rate hike.

High US Treasury Bond yields and strong dollar was providing headwinds to gold. However, the market expects bond yields to decline as inflation comes down. With equities at record highs, gold may outperform in the medium term.

Bond yields have crept up over the last few months with the 10 year bond yield at around 7.2%. This may be a good level for long term investors since you may get capital appreciation along with income, when yields decline in the future when the RBI starts cutting interest rates.

Multi Asset Allocation Funds can provide you tax efficient exposure to gold, while optimizing asset allocation to equities and debt for your long term investment objectives. Investors should consult with their financial advisors, if Multi Asset Allocation Funds will be suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Importance of staying invested in the choppy market

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY