Why large and midcap funds can be good long term investments

Large and midcap fund is one of the most popular mutual fund categories, especially among retail investors. As per AMFI’s March data total assets under management in large and midcap funds is more than 2 lakh crores (as on 31st March 2024) with more than 90 lakh folios. Large and midcap funds are diversified equity funds which invest minimum 35% in large cap stocks (top 100 stocks by market capitalization) and minimum 35% in midcap stocks (101st to 250th stocks by market capitalization). In this article, we will discuss about large and midcap funds.

Why invest in large and midcap funds?

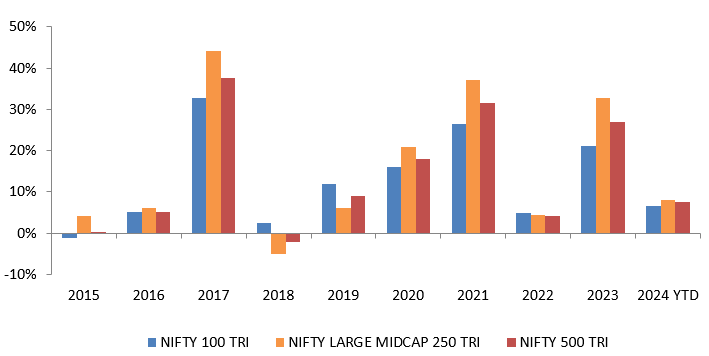

- Winners rotate across market cap segments. A diversified portfolio of large cap and midcap stocks can produce superior long-term returns, while reducing downside risks in volatile markets. The chart below shows the annual returns of Nifty 100 (large cap), Nifty 500 (broad market) and Nifty 500 TRIs over the last 10 years. You can see that Nifty Large and Midcap 250 TRI gave higher returns than Nifty 100 TRI and Nifty 500 TRI in most years.

Source: National Stock Exchange, Advisorkhoj Research; as on 31st March 2024. Disclaimer: Past performance may or may be sustained in the future

- Large and midcap funds have the potential of delivering superior risk adjusted returns. The chart below shows the 5 year rolling returns of Nifty Large Midcap 250 TRI versus Nifty 500 TRI over the past 20 years or so. You can see that over 5 year investment tenures, Nifty Large Midcap 250 TRI was able beat Nifty 500 TRI fairly consistently. The number of instances of negative returns was less for Nifty Large Midcap 250 TRI compared to Nifty 500 TRI. At the same time, the number of instances of 15%+ CAGR returns over 5 year tenures was significantly higher for Nifty Large Midcap 250 TRI. In other words, Nifty Large Midcap 250 TRI has the potential to give superior risk adjusted returns compared to the broad market.

Source: National Stock Exchange, Advisorkhoj Research; as on 31st March 2024. Disclaimer: Past performance may or may be sustained in the future

- Large cap indices like Nifty 100 has a heavier tilt towards certain sectors like BFSI, IT, Oil and Gas, FMCG. Large and midcaps provide exposure to sectors where large caps where have no presence e.g. textiles, media and entertainment etc. Furthermore, midcaps provide more balanced exposure to sectors like Capital Goods, Consumer Services, Realty and Chemicals, where large cap exposure is low. These sectors can benefit from India’s consumption driven economic growth, rising per capita income, changing global supply chain landscape (e.g. China+1), Government’s policies e.g. import substitution (Make in India), digitization, infrastructure spending, shift from unorganized to organized sectors etc.

Is this a good time to invest in Large and Midcap Funds?

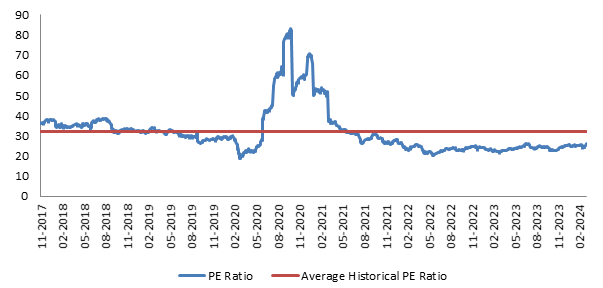

With the stock market hitting all time highs, there are concerns about valuations. In late February 2024, SEBI issued an advisory regarding froth building up in midcap and small cap stocks. We saw a bit of correction in midcap and small caps in February and March 2024. Since the middle of March, the market has consolidated but we are seeing profit booking at higher levels. Uncertainty about the timing of Fed interest rate cuts and geopolitical risks in Middle East are the two main risk factors. More volatility cannot be ruled out in the short term. In such market conditions, the large cap component of these funds can provide stability. From a valuation standpoint, the PE multiple of Nifty Large Midcap 250 is still below historical average.

Source: National Stock Exchange, Advisorkhoj Research; as on 31st March 2024. Disclaimer: Past performance may or may be sustained in the future

Medium to Long Term Outlook

The Indian economy has strong resilience amidst slowdown in other major economies. The IMF has revised FY 2024-25 GDP growth from 6.5% to 6.8%, on the back of strong domestic demand and a rising working-age population. As per IMF projections given in its World Economic Outlook database for April 2024 are right, India will overtake Japan to become the fourth largest economy in the world by 2025 and overtake Germany to become the third largest by 2027. The changing global supply chain dynamics e.g. China + 1 strategy is likely to benefit Indian companies. In the medium to long term, both large and midcap Indian companies are likely to benefit from the structural reforms made by the Government e.g. Atmanirbhar Bharat, Make in India, Digital India, Atal Innovation Mission, Defence sector reforms, labour law reforms etc.

Who should invest in Large and Midcap Funds?

- Investors looking for capital appreciation and wealth creation.

- Investors having a 5 year plus investment horizon in this scheme.

- This fund can be suitable for new or first-time investors.

- Investors with very high-risk appetite.

- Investors can invest in this scheme either through lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if large and midcap funds will be suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY