Importance of investing in Hybrid category of mutual funds

Current market context

2023 was a very strong year for equity markets but there were concerns about valuations going into 2024. In February, the market regulator, SEBI issued an advisory on froth building up in midcap and small cap stocks, following which we saw some correction in these stocks. We are now in the middle of the Lok Sabha elections and there is nervousness in the market about election results. As a result we are seeing volatility over the past few weeks and this may continue till results are declared.

Domestic factors aside, from a global macro perspective, there is uncertainty about timing of interest rate cuts by the Fed in the US. The market was expecting rate cuts in the July to September quarter but now those expectations have been pushed back to the October to December quarter. Valuations continue to be source of concern. If we compare India with China, then India appears to be significantly richer in valuation compared to China from the perspective of FIIs e.g. PE multiple of MSCI India (USD) Index was 25.94, while that of MSCI China (USD) Index was 12.65 (source: MSCI as on 30th April 2024). In the short to medium term, we may see FIIs shifting allocations to China. In the medium term, resilience of the US economy when the interest rate cycle comes to an end will also be a key factor in giving a direction to global markets.

As far as the bond market is concerned, the 10-year G-Sec yields have generally been declining from Apr / May 2023 despite some volatility. Lower and lower tops indicate that yields have peaked. With the Fed announcing end of rate hikes, the yield has declined to 7.1 - 7.2% levels. Bond yields have been range-bound in the 7.1 – 7.2% range for the last couple of months due to the uncertainty about timing of rate cuts (source: Bloomberg as on 30th April 2024). However, yields are expected to decline as inflation goes down and rate cuts draw nearer.

In the commodity markets, Gold rallied by 18% in last 1 year as on 30th April 2024 despite high interest rates (source: MCX Spot Prices). Gold, as an asset class, outperforms in times of economic uncertainty and high inflation because investors seek safety in uncertain times. Falling interest rates also support rally in gold prices since lower interest rates can make gold more attractive for investors compared to Government bonds.

Asset allocation plays an important role in bringing stability to your investment portfolio in uncertain markets. In this article, we will discuss about hybrid funds which provides asset allocation solutions to investors of different risk appetites and investment needs.

Benefits of asset allocation

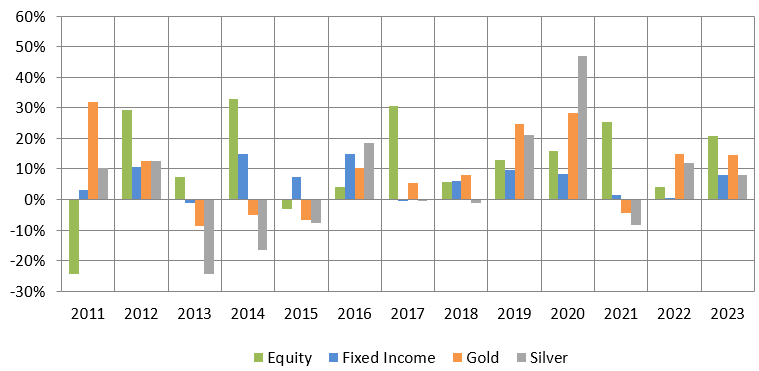

- There is low correlation between returns of different asset classes in different market conditions; equity and precious metals (e.g. gold, silver) are usually counter-cyclical to each other i.e. gold outperforms when equity underperforms and vice versa (see the chart below). Equity and gold have low correlation with fixed income. Asset Allocation will keep you disciplined in your investments and provide you a more stable investment experience viz. if one asset class underperforms, the outperformance of another asset class will balance the risks.

Source: Advisorkhoj Research, As on 31st Dec 2023, Equity: Nifty 50 TRI, Debt: Nifty 10 Year Benchmark G-Sec Index, Gold: MCX Spot Price, Silver: MCX Spot Price. Disclaimer: Past performance may or may not be sustained in the future

- Behavioural biases impacts the actual returns you get from your investments. Greed and fear are the two most common behavioural biases and influence investment decisions. Irrational euphoria in bull markets and panic in bear markets causes great harm to your long term financial interests. Asset allocation will keep you disciplined in your investments. When equities are rallying, you should be investing in debt to balance your asset allocation and vice versa. Your asset allocation should be according to your financial goals and risk appetite.

- A 1986 study done in the United States showed that asset allocation is the most important determinant of portfolio performance (source: Brinson, Hood, Beebower, Financial Analyst Journal 1986). Your asset allocation depends on your risk appetite and investment goals. Your asset allocation will change over time with changes to your risk profile and as you approach different life-stage goals. As you progress through life, your asset allocation should reflect reducing risk profile.

What are hybrid funds?

Hybrid funds are mutual fund schemes which invest in two or more asset classes e.g. equity, fixed income, gold etc. There are different types of hybrid funds with different asset allocation strategies which provide solutions for different investment needs and risk appetites:-

- Aggressive hybrid funds: These hybrid funds invest 65 - 80% of their assets in equity and equity related securities and 20 – 35% of their assets in debt and money market instruments. In terms of risk profile, these funds are the most aggressive compared to other hybrid funds.

- Balanced hybrid funds: These hybrid funds invest 50% of their assets in equity and equity related securities and 50% of their assets in debt and money market instruments. An AMC is allowed to offer either aggressive or balanced hybrid fund, but not both.

- Dynamic asset allocation funds: Also known as Balanced Advantage Funds, these funds dynamically manage their asset allocation; there is no upper or lower limit for equity or debt allocations. Dynamic asset allocation or balanced advantage funds are usually less volatile than aggressive hybrid funds.

You may also like to read: What are balanced advantage funds? - Equity savings funds: These hybrid funds can partially hedge their equity allocation using derivatives, while maintaining gross equity allocation of at least 65%. These funds must invest at least 10% of their assets in debt and money market instruments. Equity savings funds must mention their minimum hedged and un-hedged equity exposures in their Scheme Information Documents (SIDs). A big advantage of equity savings funds is that they enjoy equity taxation even with fairly low net long equity exposures because of the arbitrage component.

- Multi asset allocation funds: These hybrid funds can provide exposure to three or more asset classes e.g. equity, debt, gold, real estate investment trusts (REITs), infrastructure investment trusts (InvITs), international equity etc. Multi asset allocation funds must invest at least 10% each in three asset classes e.g. minimum 10% in equity, minimum 10% in debt and 10% in gold. Suggested reading: Is this a good time to invest in multi asset funds?

- Conservative hybrid funds: These hybrid funds invest 75 - 90% of their assets in debt and money market instruments and 10 – 25% of their assets in equity and equity related securities. These funds can be suitable for investors with moderately low to moderate risk appetites and at the same time get equity kicker for inflation adjusted returns.

- Arbitrage funds: These hybrid funds can fully hedge their equity exposure using arbitrage strategy. Arbitrage funds must maintain gross equity allocation of at least 65%. Maximum investment in debt and money market instruments is capped at 35%. These funds are suitable for parking your surplus funds for a few months since the risk is low. The main advantage of these funds compared to low risk debt funds is that arbitrage funds enjoy equity taxation.

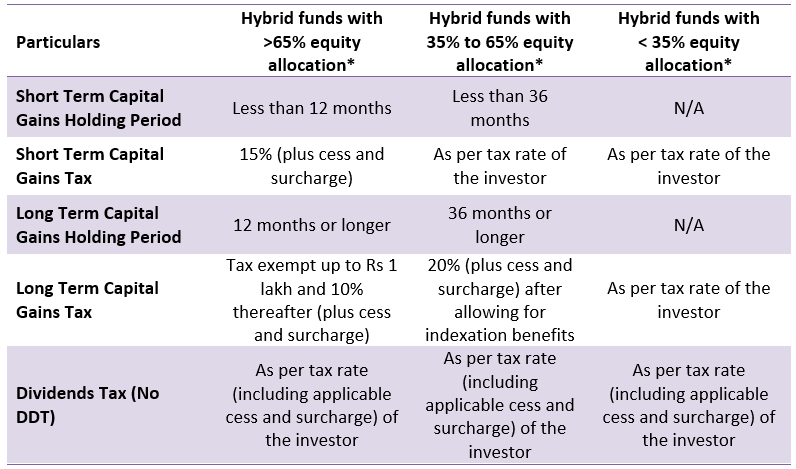

Taxation of hybrid funds

*Investors should consult with their financial advisors to know the tax treatment of their hybrid funds.

Importance of hybrid funds in your investment portfolio

- Hybrid mutual funds offer asset allocation benefits whereby investors can balance risk and return to achieve their financial goals. The equity allocation of hybrid funds can generate higher potential returns in the long term while the debt allocation reduces volatility and provides stability.

- Hybrid funds provide the benefit of periodic portfolio rebalancing. Rebalancing of assets ensures that the asset allocation of your investments do not deviate from the targeted asset allocation despite market movements. Portfolio rebalancing is aimed to reduce risk and help in generating relatively better risk adjusted returns over sufficiently long investment tenures. Please note that different funds follow different rebalancing strategies. You should read the scheme information document (SID) before investing.

- Since hybrid funds are less volatile compared to pure equity funds, they are suitable for first time or new investors looking for the long term but who do not have experience of high market volatility.

- Hybrid funds provide a more stable investment experience, especially for retail investors. Investment experience should be an important consideration because high volatility can be stressful and cause you to make wrong investment decisions due to behavioural factors.

- Hybrid funds which have more than 65% gross equity allocation (including hedging) enjoy equity taxation. Hybrid funds with 35% - 65% equity allocation can enjoy indexation benefits in taxation of capital gains in investments held for 36 months or longer.

What to look in Hybrid Funds before investing?

- Different hybrid funds have different asset allocations and risk profiles. You should always invest in the appropriate hybrid fund category according to your risk appetite and investment needs. Consult with your financial advisor, if you need help in understanding your risk appetite.

- Since different assets classes have their own market cycles, investors must look at this category in long term perspective. We recommend a horizon of 3 to 5 years minimum for noticeable returns.

- Different hybrid funds have different tax consequences. You should know the tax consequence of your investment and make informed decisions. However, investment decisions should not be made purely on tax considerations. You should invest according to your risk appetite financial goals; tax consequences should be a secondary consideration.

- You should read the scheme information document (SID) of the fund carefully and consult with your financial advisor if you need any help in understanding a product and making informed investment decisions.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY