Importance of staying invested in the choppy market

Current Market Context

The market is trading near 52-week lows. The Nifty is down 15% from the 52-week high, while small caps are down nearly 25%. Uncertainty caused by Trump Administration's trade policies have dragged global equity indices down, as recession fears increase globally. China and European Union have responded with retaliatory tariffs on US exports. The Indian Government on the other hand, has adopted a more pragmatic stance seeking resolution of bilateral trade issues with the United States through negotiations. With considerable amount of uncertainty in the near term and global risk-off sentiments, the market may continue to be volatile in the short term.

Cyclical nature of Markets

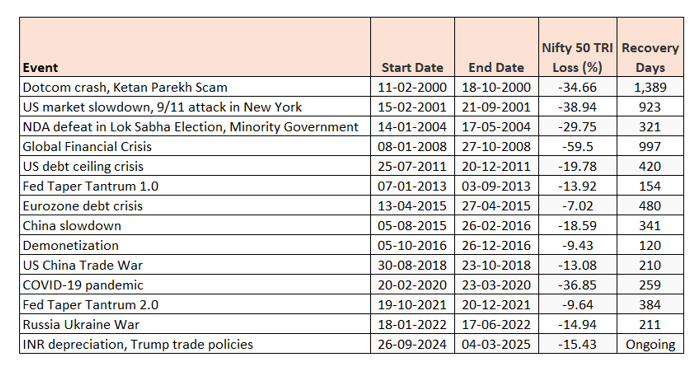

Equity markets are cyclical i.e. cycles of bull and bear markets repeat every few years. Historical data shows that we have one or more major (more than 15%) market corrections in 5 years (see below).

Source: NSE, Advisorkhoj Research, as on 31st March 2025. Disclaimer: Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing.

Needless to market eventually recovered in all these corrections (except the last correction which is still continuing). However, the magnitude of the drawdown, drawdown period (from peak to trough) and recovery period differed based on the nature and severity of the event.

Importance of discipline in times of volatility

Psychological biases often influence decisions made by investors. Greed and fear are the two most common behavioural biases and influence investment decisions. Irrational euphoria in bull markets and panic in bear markets causes great harm to your long-term financial interests. If you redeem your investments when prices have fallen sharply, you will be selling at low prices and may make a permanent loss. On the other hand, if you remain patient and remain invested, you give your investment the time to recover (see the table above).

Investing through SIP help you stay disciplined

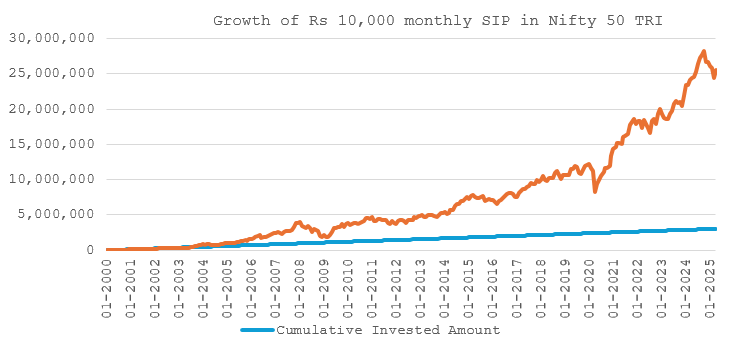

Through SIP you invest a fixed amount every month in a mutual fund scheme of your choice. By investing fixed amounts every month, you do not have to time the market since you are investing at all prices both low and high – this is known as Rupee Cost Averaging. Once you start your SIP, you simply need to remain disciplined till you achieve your financial goal. The chart below shows the growth of Rs 10,000 monthly SIP in Nifty 50 over the past 25 years (since 1st January 2000). As discussed earlier, we had many deep corrections and bear markets in the last 25 years. Through a monthly SIP of Rs 10,000 in Nifty 50 (cumulative investment of Rs 30.4 lakhs) you could have accumulated corpus of Rs 2.55 crores (as on 31st March 2025 – this shows the power of compounding in SIPs over long investment tenures. The annualized SIP return (XIRR) over this period was 14.3%.

Source: NSE, Advisorkhoj Research, as on 31st March 2025. Disclaimer: Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing.

Higher probability of getting consistent returns over long investment tenures

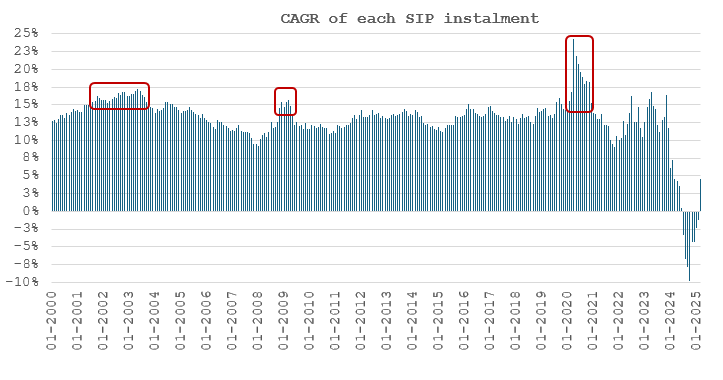

We calculated the returns of each SIP instalment over the last 25 years (for Nifty 50 TRI). The chart below shows how returns were distributed for all the SIP instalments (300+ instalments). You can see that the CAGR returns of 75% of the SIP instalments were in the 10% – 15% CAGR range (58% in the 12% – 15% CAGR range)

Source: NSE, Advisorkhoj Research, as on 31st March 2025. Disclaimer: Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing.

How rupee cost averaging is a silent hero?

The chart below shows the annualized return of each SIP instalment in Nifty 50 TRI over the past 2025 years. You can see Rupee Cost Average in action here. Instalments near market bottoms and early recovery phase of market gave more than 15% returns. SIPs take advantage of market volatility of reducing the average cost of acquisition of units. This boosts overall portfolio returns.

Source: NSE, Advisorkhoj Research, as on 31st March 2025. Disclaimer: Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing.

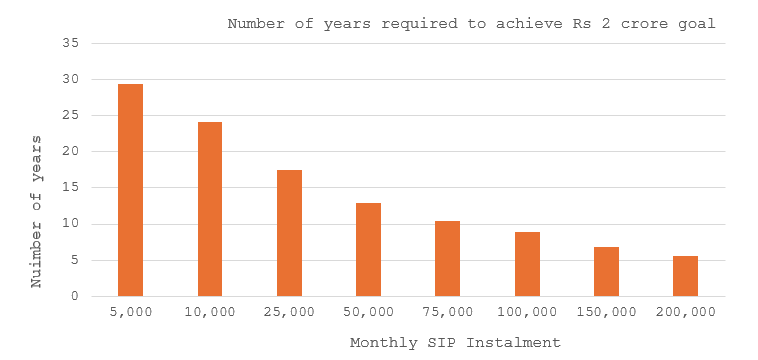

Increase your SIPs to reach your goals faster

SIP is not only for smaller amounts. In fact, with larger amounts you can get closer to your goals much faster (see the chart below). If you can increase your SIPs at a time when the market is down you can also get the advantage of lower prices.

Source: Advisorkhoj, AMFI, Mean CAGR returns considered for illustration is 12.93% by taking mean of 10-year rolling returns between 1 June 2013 and 30 May 2023 of Nifty. SIP investments on first day of every month for the stated periods have been considered for this illustration. SIP Returns are calculated on CAGR basis. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023 and as amended from time to time to define the concept of power of compounding. Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing.

Use SIP Step Up

Salaried investors usually get annual increment. Increments are based on a number of factors e.g. inflation, company's performance, employee's performance etc. Even though investors' income goes up, their SIP often remains fixed. SIP Top up is a mutual fund facility, whereby you can increase the SIP amount by a predetermined rate or additional amount at stipulated intervals. The chart below shows the growth of Rs 10,000 SIP in Nifty 50 TRI with (10% annual step up) and without step up over the past 25 years since 1st Jan 2000. You can see that with an incremental cumulative investment of Rs 37 lakhs through SIP Step-up, you could have created an additional corpus of Rs 1.5 crores. SIP Top up is particularly beneficial to the investors who want to build up a corpus in a shorter time frame.

Source: NSE, Advisorkhoj Research, as on 31st March 2025. Disclaimer: Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing.

STP can be smart investment options

If you have lump sum funds which you want to deploy in equity funds but concerned about continuing volatility, then you can invest the lump sum in a low-risk debt fund and transfer fixed amounts at regular intervals (weekly, fortnightly, monthly etc) to the equity fund through Systematic Transfer Plan (STP). Like SIP, STP also takes advantage of volatility through Rupee Cost Averaging.

Conclusion

Equity as an asset class is intrinsically volatile. However, there are periods where investors can face extreme volatility which can test their patience, especially for new investors who do have experience of bear markets. We are going through such a period now and we do not know how long it will last. In this article, we discussed about volatility and how to deal with it. Investors should understand the difference between investment loss and volatility. You are likely to make a loss in this market if you redeem but if you remain invested, market will eventually recover. Systematic investing will in fact help you benefit from volatility. You should be patient, continue your SIPs and take advantage of STP if you have lump sum funds.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY