How to avoid common mistakes for a stress free retirement

Most people in India usually do not take retirement planning very seriously until they reach middle age (mid 40s or early 50s). In the past, people lived in joint families, lifestyles were simple and small savings interest rates were high; people may not have found retired lives very challenging thirty or forty years back. However, with changing social, cultural and economic conditions in our country, especially in the last two decades, many retired people are concerned how they will meet their income needs with their modest savings. This is causing stress in families and is not good for our society. In this blog we will discuss some common retirement planning mistakes that individuals must avoid, in order to achieve financial independence and be free from financial stress during their retirement years.

Not starting retirement planning early enough

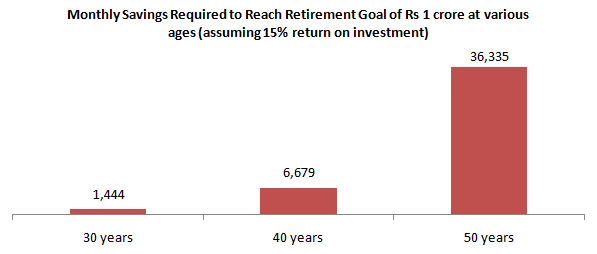

Most individuals do not think about retirement planning early in their careers. An early start has great benefits in savings and investing. I have discussed a few times in my blog that, money can help you make more money. When you invest money you get returns; when you re-invest the returns you get more returns and thus if you remain invested for a long period of time, your investment compounds in value. The earlier you start the better are the chances for creating wealth as you get more return for more time on your investments.I have heard many young people say that, they do not have enough savings to invest. You can invest in mutual funds through Systematic Investment Plans with monthly savings, as low as Rs 1,000. Many investors are not aware of the power of compounding. If an investor wants to set a goal of creating a retirement corpus of Rs 1 Crore, he or she can achieve it with a much smaller investment simply by starting earlier, as shown in the chart below.

We can see from the chart above that starting early has major benefits. Starting too late, on the other hand, will make retirement planning that more challenging, as you can see in the chart above.

Ignoring the impact of inflation in retirement planning

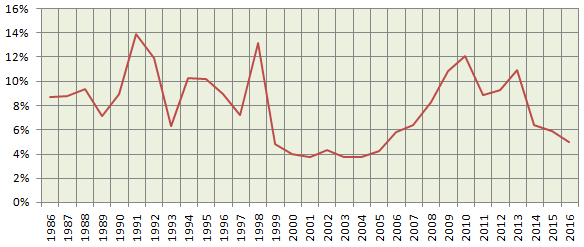

The value of money goes down over time due to the ugly nine letter word, inflation. The inflation rate may change every year depending on various economic factors but no matter, how much we hate it, inflation cannot be wished away. The chart below shows the annual (December to December) CPI inflation rates in India from 1986 to 2016.

The chart above shows that except for a 5 – 6 years period from2000 to 2006 and until very recently, the annual inflation rate in India has been mostly above 6%. The geometric mean annual inflation rate over the last 3 decades has been 7.3%. This means than an expense of Rs1,000 in 1986 would be overRs8,200 today. Even if we expect inflation to moderate in the long term to an average of 4 – 5%, living expenses will be at least 2.5 to 4 times higher 20 or 30 years later. In other words, if you are 30 years old and your monthly expense is Rs 20,000, you should expect your monthly expense at the same lifestyle to be around Rs 75,000, assuming no change in lifestyle, by the time you retire. Inflation reduces the value of savings.When you set a retirement goal for yourself, you should always factor in the effect of inflation so that you plan your savings and investment accordingly.

Misconception with regards to risk in retirement planning

Many investors traditionally believed that risk free or low risk investing to be the best retirement planning strategy. Accordingly,schemes like Public Provident Fund, National Savings Certificates, bank fixed deposits and traditional life insurance plans are favoured by many investors. When making investment decisions, you should always look at prospective returns in relation to your financial goals after factoring in inflation.

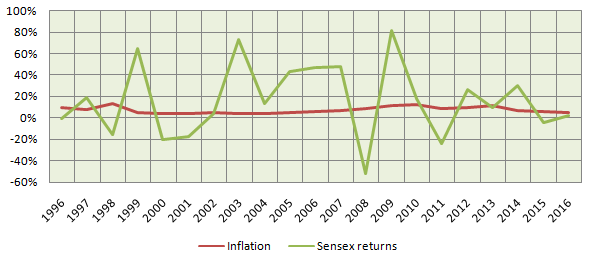

Investing in low risk investment options can actually result in taking a risk with your retirement plan. Risk free or low risk investment options often fail to beat inflation, which leaves the investor short of his retirement needs. Let us take for example traditional life insurance plans. Historically, returns of traditional life insurance plans have been around 6%, which is well below the average historical inflation rate discussed above. Post tax returns of other risk free investment options like bank fixed deposits etc.have also struggled to beat inflation. Equity as an asset class has historically been able to beat inflation in the long term and create wealth for the investor. The chart below shows the Sensex returns and the annual inflation rates over the 20 year period from 1996 to 2016.

We can see from the chart above, that while Sensex returns have been volatile, it has managed to beat inflation. The compounded annual growth rate (CAGR) of the Sensex from 1993 to 2016was around 11.4%, while the geometric mean average inflation rate during this period was 6.3%. Long term investors must not equate volatility with risk. Investors should understand that effect of volatility declines over time and it does not impact the long term investment objectives. For long term investors, not meeting the financial goal is the real risk. It is essential that equities form a significant portion of your investment portfolio to help you meet your retirement goals.

At the same time you should not take excessive risks when you approach retirement. A balanced approach is required in retirement planning. At a young age you can have high exposure to equity and as you grow older and approach retirement you should gradually decrease your exposure (as a percentage of your total investment) to equity and increase your exposure to fixed income. Asset allocation is an important aspect of financial planning. Asset allocation, more than any other factor, determines success in meeting financial goals.

Not having enough health insurance

Healthcare costs in India are increasing at a distressing rate. Based on some estimates, the annual healthcare inflation is the range of 15 – 25%. A hospitalization for a serious illness can cost Rs 5 Lakhs or above and long term hospitalization can be a tremendous financial burden on households. While health insurance is essential for all, it is even more relevant for senior citizens because health risks increase with advancing age. Employees who are covered under their company’s group health insurance policy usually do not worry about health insurance but you should know that, you will lose your health cover on retirement. IRDA's portability guidelines cover policy transfers from group to retail, allowing retiring employees to switch to the retail policy of the insurer offering the group insurance plan to their former employer. However, the premiums and the policy terms are likely to change once you switch from a group health insurance plan to a retail plan. It may be prudent to buy individual mediclaim or family floater plan before retirement even if you are covered under your employer’s group health insurance scheme, so that you can continue with the same health insurance plan even after retirement.

Not being debt free early enough

Debt in any form has a cost associated with it. Home loans, vehicle loans, credit card loans etc., have interest cost which comes out of our savings. For unsecured debt, like credit card loans, the interest cost can be quite high. Many investors over extend themselves buying a house and the home loan EMIs constitute a large chunk of their incomes. I have heard many home-owners saying that, they have very little money left in their savings account every month after paying their home loan EMIs. Interest costs comprise the major part of the home loan EMIs in the early and mid-part of the home loan term. The higher the interest and the longer we pay it, the more we put our long term financial goals at risk. We should not stretch ourselves financially when buying property with home loan and strive to be debt free early in life, so that we can free up our savings to work towards our retirement planning and other long term financial goals.

Completely avoiding risk after retirement

While the conventional financial wisdom dictated that we avoid risks after retirement and allocate our accumulated corpus to safe investments like fixed income, longer life span and high inflation requires a rethink of this approach. Retired lives can now easily be 25 to 30 years or even more. On account of high inflation and increased longevity, you can run out of your funds if they are deployed in low yielding assets. Let us try to understand with the help of a couple of examples.

Suppose you have accumulated a retirement corpus of Rs1 Crore. After retirement you deploy your funds in risk free assets like fixed deposits giving you post tax return of 7%. Let us assume your monthly expense is Rs 50,000, the inflation rate is around 5% and your income tax rate is 20%.You may think that Rs 1 Crore retirement corpus is sufficient to sustain you, but you will run out of your funds in about 18 years. If you live till around 90, which many people do, you will have to financially dependent on someone else for the last 12 years of your life.

Now let us see what if you deploy 25% of your corpus in high yielding assets like equity and the balance in low risk debt investment. Assuming you get 15% return on your equity investment, your corpus can last more than 24 years. Therefore, it is prudent not to completely avoid equity after retirement. You should set your asset allocation depending upon your financial situation.

Conclusion

In this article, we have discussed some common retirement planning mistakes that we should avoid. Retirement planning is a very important aspect of financial planning. We should take retirement planning seriously from an early stage of our careers, so that we can have a happy and fulfilling retirement.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY