Are midcap valuations a cause of concern for mid cap mutual funds

In Advisorkhoj.com, we are getting a number of comments from investors who are worried about the equity market levels. My view on valuations is that, they are a point in time data. High valuations can hurt you in the near term, but if you invest in quality growth stocks and have a long investment horizon, then you give enough time for earnings to catch up with valuations. I like to give the Google example, why current valuations may be irrelevant for the long term investor. Google initial public offering (IPO) took place in 2004 and shares were offered at $85. The trailing twelve month (TTM) Price / Earnings (67.5) ratio of Google at the time of listing was 67.5 (for your reference, Nifty P/E is currently around 26.8).

While different industry sectors may trade in different valuation ranges, investors who have experience of investing in stock markets will agree that a P/E ratio of 67.5 looks quite high. How much returns has Google given to investors till date since its IPO? The share price of Google on close of trading session on December 22, 2017 was almost $1,068.9 – absolute return of 1,158% and CAGR (annualized returns) of over 19% in the last 13 years or so.

What is the P/E ratio of Google now? It is currently 35.6 (based on the last closing price) which means that earnings growth over the last 13 years has been very high. Hopefully, the Google example reinforces the point that, you invest in good stocks and have a long investment horizon then point in time valuations are irrelevant. By investing in top performing mutual funds you can invest in a portfolio of good stocks and by remaining invested for a long period of time you can create wealth.

Then again, there will be some investors who think that, if they wait for the market to correct before investing, they can get more returns. One can make more money by timing the market, but market timing is difficult. Why? For one, you never know how much further prices will go up before falling. Secondly, if it has fallen substantially, you do not know how much further it will fall and so you will wait. Thirdly, even if you wait for the market to bottom out after a big crash, you will not feel confident about investing till the market has recovered somewhat and confidence is restored.

While many investors through experience may have learnt about the difficulty of market timing and believe in long term investing, there is no denying that, if valuations appear super expensive and a correction seems imminent, investors would like to wait before investing. Over the last 2 years or so, many investment experts, including some fund managers, are expressing their concerns about midcap valuations – I have been hearing these midcap valuation related concerns almost every other day on business news channels.

Midcap equity mutual funds have been very popular with retail investors over the last 3 years or so. The mid and small cap equity mutual funds category gave average 19% compounded annual returns over the last 3 years versus 10% average annualized returns given by the large cap equity funds category. But this great rally is making midcap stocks look much more expensive than large cap stocks. I have heard many experts saying that, while the broader market appears expensive, midcaps will hurt the most in the next crash. Some people are pointing to the fact that some midcap funds have stopped taking lump sum investments or stopped fresh subscriptions altogether is sign of trouble in coming times. Some more extreme voices are even comparing the midcap valuations with IT valuations just before the dotcom crash in 2000. It is natural for retail investors who have invested in midcap funds to feel nervous when they see midcap related concerns aired on TV or online.

As mentioned before, I have been hearing these concerns for the last 2 years, yet over the last 12 months the midcap funds category gave average 47% returns, while large cap category gave average 33% returns. In the last 3 months, when the voices airing these concerns have become louder, midcap funds have given 12% returns while large cap funds have given 6% returns. Some may say that, these high returns in last 3 to 12 months are ominous signs because irrational exuberance usually precedes a big crash. At the same time, there are alternative views on the topic of midcap valuations. In this two part blog post, we will discuss the concerns regarding midcap valuations and share our perspective on the same.

There are two approaches to investor education – one approach emphasizes the importance of systematic and disciplined investing without worrying about what is happening in the market or with prices and the other approach is to educate investors about the asset class price behavior, prepare them for what may happen in the near term and teach the importance of long term investing. The first approach has its merits because disciplined investing will lead to good results in the long term, but it assumes that investors will not be affected by volatility, which we think is an incorrect assumption. In Advisorkhoj, we follow the second approach because the knowledgeable investors are better prepared to handle different situations and make the best decision.

Conventional large cap versus midcap pricing

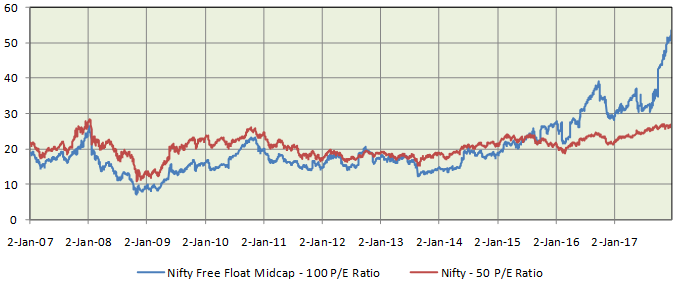

Let us understand why midcap valuations are a cause of concern for many. Traditionally large cap stocks trade at a premium to midcap stocks. This is because large cap companies are perceived to be less risky than midcap companies. Midcap companies are thought to be more sensitive to economic cycles and hence are more vulnerable in economic downturns. Large companies have leadership in terms of market share and more financial resources; therefore, they are less affected in recessions compared to midcap companies. Further, midcap stocks tend to under-researched compared to large cap stocks and therefore, they are usually priced at a discount. In the chart below we have shown the historical P/E ratios (the most common valuation metric) of Nifty – 50 (the benchmark index of the 50 largest market cap stocks) versus Nifty Free Float Midcap – 100 (a popular benchmark index for midcap stocks) over the last 10 years. Please observe the chart carefully because it tells us a number of important things.

Source: National Stock Exchange

You will observe that Nifty 50 P/E ratio has always been higher than the P/E ratio of Nifty Free Float Midcap – 100 across different market cycles till about the June 2015. Observe that even at the height of exuberance in 2007 when midcap stocks and funds were on a roll, the Midcap index was cheaper (lower P/E ratio) than the Nifty. Now see how this trend got reversed sometime in the middle of 2015 and the valuation gap has widened since then. Midcap stocks trading at a premium to large cap stocks for a fairly long period of time (2.5 years and counting) is an unusual situation. This has got investment experts (including some fund managers) worried.

Further observe that the Nifty P/E ratio now is almost at the same level as pre 2008 crash P/E ratio, but the Nifty Free Float Midcap – 100 P/E ratio is more 100% higher than what it was just before the 2008 crash. This for many investors can be quite worrying, as this may indicate that an asset bubble is building. High stock prices have to be justified by high earnings (EPS) growth. The current valuation of the Midcap index suggests that, earnings have quite a bit of catching up to do.

Why has caused the reversal in large cap versus midcap valuation trend?

Investors should understand that prices in the short term are a function of demand and supply. Since the time Foreign Institutional Investors (FII) were allowed to invest in Indian stock market (after the economic liberalization in the early nineties), FII activity dominated trading volumes in the stock market; volumes attributed to activity of domestic investors historically constituted a small percentage. FIIs primarily buy or sell large cap stocks. Hence prices of large cap stocks depend on foreign fund flows, but there is minimal impact of FII activity on midcap stocks. Since FIIs dominated the market, sentiment of domestic investors were influenced by FII activities.

However, the situation has changed in the last few years. Though FIIs still account for majority of stock market volumes, a lot of domestic money is also flowing into the stock market especially through mutual funds. We had mentioned earlier that, midcap funds have been very popular with retail investors over the last 5 years. A lot of retail money has flown into the midcap segment through mutual funds and this caused prices of midcap stocks to rise and remain firm, even when FIIs pulled out money from India causing the large cap stock prices to fall.

Is high P/E ratio bad?

High P/E ratio is bad and low P/E ratio is good – this is simplistic thinking. We should understand what P/E ratio signifies. P/E ratio signifies the price we are ready to pay to buy the future earnings of a stock. Why do investors pay higher price to buy earnings of one stock and lower price to buy earnings of another stock? If investors expect future earnings (EPS) of a stock to grow faster, then they will be ready to pay a higher price – if earnings grow, the share price will also grow and the investor will get good returns.

These types of stocks, whose earnings are expected to grow at faster rate, are called growth stocks. Recall the Google example we discussed at the beginning of this post – Google is a classic example of a growth stock; even though the P/E ratio was high, the EPS of Google grew at a phenomenal pace and investors got outstanding returns. If we disregard the conventional thinking about large cap versus midcap valuations, higher midcap P/E simply indicates that investors expect midcap earnings to grow faster than large cap earnings.

Can midcap earnings grow faster than large cap earnings?

Refer back to the Nifty P/E versus Nifty Free Float Midcap – 100 P/E chart. You will observe that, the spectacular midcap rally began since the NDA won the elections in May 2014. The market believes that, the maximum benefits of the Government’s structural reforms and initiatives like financial inclusion (Jan DhanYojna), Make in India, Digital India, RERA, Demonetization and GST will be reaped by midcap and small cap companies. Certain industry sectors like ball bearings, specialty chemicals, farm equipment, automobile ancillaries, etc. have only midcap or small cap companies. These sectors have tremendous growth potential in the India Growth Story.

Midcap companies tend to be less capital intensive than large cap companies which are into capital intensive business like banking, metals, energy, automobiles etc. Many large cap companies are burdened by huge debt levels which in turn has also affected large cap banks especially PSU banks in the form of NPAs. Being in less capital intensive businesses, quality mid-cap companies have much lower debt levels and interest burden. Lower debt levels will enable midcap companies to superior return on equity and earnings growth when demand picks up. Quite a few midcap companies have delivered more than 30% return on equity over the last three years. This may explain why midcap stocks are continuing to outperform the market (Nifty) even at such valuations.

Finally, large cap companies are affected by global factors while midcap companies are more affected by local factors. For example, which large cap oil exploration companies were adversely affected by lower crude prices over the last three years, midcap companies which consume petroleum benefited from lower prices. Similarly, while large cap export oriented IT and Pharmaceutical companies were affected by the developments in the US and Brexit, midcap companies were by and large immune to these developments.

Conclusion

Advisorkhoj’s perspective on large cap versus midcap valuations is that, we need to challenge the conventional thinking on this topic. We need to go back to the basics of what P/E ratio really means. In this post, we discussed that high midcap valuations imply that investors are expecting midcap earnings to grow faster than large cap earnings. We also discussed the factors which are likely to cause midcap earnings to grow faster than large cap earnings in the medium to long term. But while some valuation premium for midcap may be quite justified, the question is how much premium should worry investors? Stay tuned for more in the next part……

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY