Stay Invested with Mutual Fund Systematic Investment Plans

Do you think investments are synonymous to lump sums? The reason why you have been shying away from investments is you were under the impression that you need a big amount of money to generate substantial returns. What if you found out you could invest small amounts and accumulate a substantial corpus for your financial goals of your life? That would be amazing! This amazing feat is possible and is called Systematic Investment Planning or SIP. SIPs are a form of investments which allows you to invest small sums at regular intervals instead of having to shell out a lump sum. We often indulge in the habit of keeping away small sums of money in our piggy banks because we are not aware of what more to do with it. SIP is a very simple solution to the problem. Let us look at some ways why SIPs are beneficial for you.

Sure Shot Way to Invest

You always plan to invest and it does not happen because something important always comes up. Hence, at the end of the year you will have saved nothing or very little. SIPs provide a reason for you to invest every month. It inculcates a degree of compulsion to continue the investment. Monthly investments could also be carried out through the auto debit feature where the stipulated sum will be deducted every month on a particular date from the account directly. You only have to ensure adequate balance in your account. It is making a monthly commitment after all it is just a small amount.

Missed a Month: You are Still Invested

There is a common myth which states that if you missed investing in a certain month you are not invested anymore. While this sounds scary, it is nothing but a myth. The reality is despite missing a month you still remain invested. When you pay a certain sum in a fund you are buying units of that particular fund. For example you are investing Rs. 5000 in a fund NAV of which is Rs. 20 per unit. Hence, every month you are purchasing 250 units of the fund. If you miss out a month you fail to purchase the extra 250 units that month. Your remaining accumulated investment in form of units continues to accumulate returns the same way.

Rupee Cost Averaging

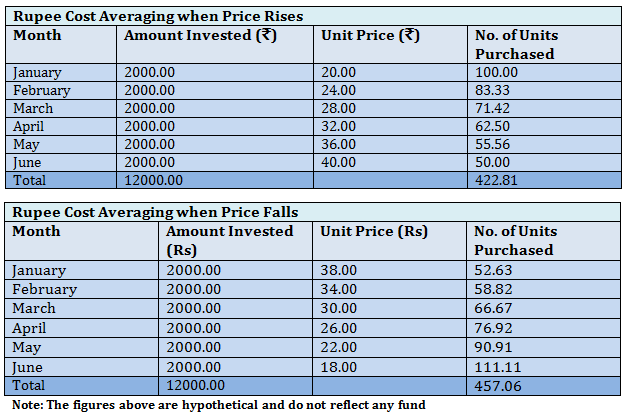

SIPs are a means to get the most of Rupee Cost Averaging. Investors often try to carry out the tedious process of timing the markets. They buy when prices are low and sell when prices are high. It may not be possible for every investor to keep a watch on the market. Hence, they can get most of the market fluctuations by investing in SIPs. As an investor when you invest on a monthly basis you buy units of a particular fund. You buy more units when the markets are low and lesser units when the markets are high. Through Systematic Investment Plans, whether the markets are rising or falling, you continue to be in a stable place in your investments. Let us examine that through an illustration.

From the above two tables you can see that SIP investments are a stabilizing factor through market fluctuations. Hence, they reduce the risk on investment relieving you from constant worry and the need to time the markets.

The Most Convenient Mode

We all struggle with our string of financial commitments. SIPs then become a convenient mode of investment as you have to pay a small sum. Rs. 60,000 at one go seems like a big amount of money for investments but Rs. 5000 monthly is easily achievable. At the end of the year you will have invested Rs. 60,000 without having to carry the burden to having to pay a lump sum. It is also a good option for beginners who are testing waters and do not want to part with a big amount. The ideal method for investing in volatile funds also happens to be SIPs where you reduce the volatility by paying small amounts.

Stay Invested

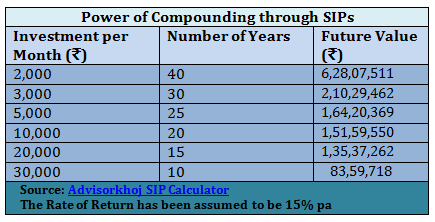

The two factors that you need when you invest in SIPs is a monthly commitment and patience to stay invested for a long time period. It is not the amount that matters in mutual funds as much as the time period does. Mutual Funds work on the principle of compounding returns. The power of compounding is such that even small amount of money accumulated over time can become one gigantic amount. Let us see an example of the same.

Through the illustration above you can see that the time period of investment heavily contributes to the returns. In the first case when someone invested only Rs. 2000 they still got a hefty return because of the time period of 40 years. So even if you are investing a big amount every month for a short period of time you will generate only moderate returns. Hence, have time by your side and money will soon make its way.

Conclusion

Systematic Investment Plans makes you believe small is powerful. You need not have a lot of money to make a lot of money but just a commitment to keep investing the small sums without fail. This way you do not have to compromise on your financial commitments and part with lump sums. You are entering an avenue of relatively safe investments and prospective substantial returns. You do not even have to try and time the market because that has already been taken care for you. So go ahead and start your investing journey, one small at a time.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY