5 Reasons why financial life begins at 30: A wake up call for all young investors

You are in your early twenties, you have just passed your graduation / post-graduation and you have been placed in a corporate through campus interview. You join your first job and you have already made plans how would you spend your first salary; no sorry not your first salary, in fact your first couple of salaries. It is not before long that you realize that you are 30 and you have not saved / invested any amount of money (excluding your tax saving investment that is usually done in the month of December to March) during the past few years of your professional life. There are exceptions to the rule everywhere we cannot deny any of a few being present in this category too.

Usually as one passes to the various phases of professional / investment life, they usually spend and invest according to the following pattern -

Stated below are major reasons why at 30 you get a wake-up call to start investing.

Working under pressure: By the age of 30 a common Indian man or woman are married and might be a parent of a child too. It is by this time that you realise that there are mouths to feed and take care of. You would have already felt the pressure of these responsibilities when you go through the following stages of life

- Marriage – Marriage and honeymoon expenses, purchase of consumer durables and furniture to transform bachelorette apartment into a home

- Pregnancy and delivery – doctors fees, hospitalisation expenses, expenses on various religious rituals associated with pregnancy and child birth

- Parenthood – Expenses of a nanny, baby food and care products, celebrating your child’s 1st birthday, child’s admission to a play school.

When you celebrate your 30th birthday you realises that you have not saved anything to meet your further responsibilities – children education, marriage, real estate purchase etc. At this juncture of your life making the first investment stroke is very important

Short Term Small Goals versus Long term big financial goals

When you were in school, college and post graduation you have this habit to study for your examinations and work for your projects at the last moment. Sometimes in your professional career too you would have the tendency to leave all your work pending until the day before submission. During the 20’s your financial responsibilities /goals are small and short term like vacation, down payment for a vehicle, purchase of furniture & fixture for home in contrast to your goals later in life such as down payment for house property, children’s education, children’s marriage. These short term goals can be met easily by saving diligently a couple of months in time, however when you touch 30 you realize that this slip short work shall not continue for long.

At this stage of your life you should know the 7 golden savings tips without compromising your lifestyle

A real life financial crisis acts as an eye opener

As they say that one has to lose money in the market to understand the way the equity market operates; in the same way a real life experience teaches you what no financial planner would have been successful at making you understand.

By the age of 30 either you or anybody in your acquaintances would have been going through or would have gone through a financial predicament. This crisis would have been on account of job loss, unfortunate death, accident, disability, critical illness, hospitalisation expenses leading to a financial gloom. Imagine a time when a friend comes and asks for your financial help for overcoming such crisis or vice versa.

When you hear about or experience such incidents that you decide to have a thorough overhaul of your money management techniques. You decide to keep aside money for emergencies and you start saving and investing systematically in recurring deposits (RD) or in Mutual Funds systematic investment plans or in the equity market.

However, you should know 7 things before starting to invest through mutual fund SIPs

A reality check of your net worth

At 30 you would have been working for at least over half a decade. You calculate that in these over 5 years of your professional life how much have you saved and invested after putting 10-12 hours at work each day; you realise that it is near to NIL. You do quick back of the envelope calculation of how have you spent your hard earned salary but to vain. You understand that the best utilization of your salary was to pay back your education loan (only if you had one), the rest of the money you would have spent off on gadgets, travelling, partying, buying consumer durables and furniture etc. The question keeps ringing a bell in your mind “where has all my money gone” the answer for which you will never be able to get.

At this stage of your life you should avoid these 6 common asset allocation mistakes

Quality does matter

At 30 you realize that it’s not only the quantity that you have saved but also the quality of investments that make a major difference. You might have saved for yourself to peddle through crisis; however your investment does not provide the liquidity that you require during emergencies. You understand that the money that you had saved for hay days such as in an ULIP plan does not even return the capital employed, from a 3 to 5 years prospective. You acknowledge the fact that “0% interest on EMI through credit card” is a misnomer.

After reading this article there are a few basic financial objectives which you should achieve by the age of 30:

Understand the “power of compounding” and “rupee cost averaging”

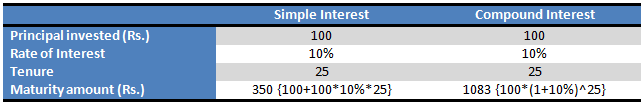

There are two basic types of interest calculation that can be done – simple interest and compound interest. Simple interest, as the name suggests it calculates interest on the basic amount invested; however compound interest calculates interest on the interest already earned. Let us understand this with a basic example as follows and also read how compounding interest works?

Rupee cost averaging is the technique of buying a particular investment through a fixed amount on a regular schedule, regardless of the price. More quantity is purchased when prices are low, and fewer quantities are bought when prices are high. Eventually the average cost of purchasing a unit becomes lesser and lesser. You should note that if you start early power of compounding can be magical!

Systematic investment becomes important when an investor earns a regular income such as salary for meeting his day to day needs. Starting a mutual fund SIP early in your working career and staying invested with it is the best idea.

Prepare an emergency corpus

Having an emergency corpus helps you to financially manage a job loss, illness and accidents etc. The corpus should help you survive through the storm of insurgencies. It is said that three to six months salary should be kept aside for emergency.

Debt Free

It is advisable that you free yourself from all debt especially credit cards. Credit card bills accumulation is just like a parasite eating into your earnings. If you have any education loan please note that it should be settled by the time you become 30. The basic technique of building a debt free portfolio is to spend less than you earn. Make sure that you pay off your EMI at the beginning of each month and manage the rest of the month’s expenditure with the remaining. While remaining debt free is a great ides but you should also know how to make your money work harder

Save for unbudgeted expenditure

At least once in a couple of months you will have to shell of sum that you have not budgeted for such as vehicle, consumer durables repair, etc. This expenditure brings the month’s budget to a total chaos. If you save at least 10% of your take home salary for these unbudgeted requirements then you’ll have enough saved to pay for the repairs or buy a new one without damaging your monthly bills. If you feel that you cannot save 10% of your earning then you should cut down your expenditure accordingly to fit it in.

Start building a retirement corpus

You might think that 30 is too early to start preparing for your retirement; however you should start taking baby steps to achieve the goal, for this you could start investing in a Mutual Fund SIP with an amount as low as Rs. 500 - Rs. 1000 per month. This will help you in planning your life goals with mutual funds and help you retire rich!

Conclusion

If you make sure that you take these basic steps at 30 you would be better prepared for a better financial life tomorrow. With growing work pressure and stress level we are retirement from our working life a lot earlier than what it used to be in our parents case. But surprisingly the average life expectancy in India has increased considerably. This effectively means that you might have to retire early form your working career but you will have to live long post your retirement. Therefore, Retirement planning should be the first priority when you start your career.

Remember financial mistakes in our early years have adverse consequences later on

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY