What is IDCW in Mutual Funds

Many mutual fund investors may have come across a new term IDCW over the past couple of months. Many investors may have received emails from Asset Management Companies notifying about the change in terminology. Some investors may be aware what IDCW is, but there may be many investors who do not know what this means. In this blog post, we will discuss about IDCW, why this change was brought about by SEBI and what should investors keep in mind.

What is IDCW?

‘IDCW’ is abbreviation of ‘Income Distribution cum Capital Withdrawal’. In April 2021, SEBI changed the term “Dividend Option” to “IDCW”. If you had invested in mutual fund Dividend Options, you will now see IDCW next to the mutual fund scheme name in your account statements. This is only a change in terminology; there is no impact on investors. However, for the sake of your own investor awareness, you should understand why SEBI made this change. But first let us clearly understand what mutual fund dividends are so that you do not have any misconception.

Misconceptions about mutual fund dividends

- Mutual fund dividends are dividends paid by the underlying stocks in the scheme

Reality – Mutual fund dividends may include dividends paid by the underlying stocks. It also includes the profits made by selling stocks in the scheme portfolio. - Mutual fund dividends are extra returns over and above capital appreciation

Reality – Mutual fund dividends are not extra returns over and above capital appreciation. Mutual fund dividends are in lieu of capital appreciation. - Dividend options of mutual fund schemes book profits regularly

Reality – The underlying portfolioof growth and dividend options of a scheme is the same. Profit booking happens at a scheme level i.e. for both growth and dividend options both. The difference is in how the profits are distributed. In growth option the profits are re-invested in the scheme. In dividend option, the profit or a portion of it may be distributed to the investors at the discretion of the AMC.

Difference between company dividends and mutual fund dividends

Though mutual fund dividends may seem similar to dividends paid by companies, there are major differences between the two:-

- Companies pay dividends from the Profit After Tax (PAT) after retaining a portion of the profit as Reserves and Surplus for the future growth of the company. The management decides what portion of the profits should be paid as dividends to shareholders.

Mutual fund dividends are paid from the accumulated profits of the scheme. The AMC decides the dividend payout rate per unit. But whether a scheme pays dividends or not, all the profits of a scheme belong to the investors and are reflectedin the Net Asset Value (NAV) of the scheme. - The share price of a company may go up or down after dividends are declared.

The Net Asset Value(NAV) of a scheme will always go down after dividend is paid.

Example

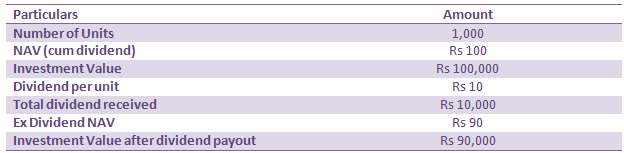

Let us understand the last point with the help of an example. Suppose you own 1,000 units of a mutual fund scheme. The current NAV (cum dividend) of the scheme is Rs 100. The scheme declares a dividend of Rs 10 per unit. Let us see how your investment gets impacted.

Note: Figures are purely illustrative for Investor Education purposes only. Consult with your financial advisor to understand the impact of dividends on your mutual fund portfolio value.

You can see that dividend received by you was notextra. It came out of your investment value. If you invested in the growth option of the scheme, the value of your investment would have Rs 100,000 instead of Rs 90,000. When you invest in shares of a company, you may expect both dividends and share price appreciation. However, in case of mutual funds, the dividends come out of the capital appreciation.

Why SEBI changed Dividend to IDCW

Income Distribution cum Capital Withdrawal refers to distribution of the income of a mutual fund scheme, which may include both dividends paid by stocks and capital gains made by selling underlying stocks of the scheme. However, SEBI also wanted to emphasize that this income is coming out of your investment value (refer to the example above), in other words, it amounts to capital withdrawal. The term IDCW is a more accurate description of mutual fund dividends and provides clarity to investors so that they can make more informed investment decisions.

Should you invest in Growth or IDCW?

You can decide based on the following considerations:-

- In Growth Option, the profits made by the scheme remain invested in the scheme. Over sufficiently long investment tenures, you can earn profit on profits. This is known as power of compounding. Power of compounding is a significant factor in wealth creation.

- In IDCW, the profits made by the scheme may be distributed to you partially or fully at the discretion of the AMC. You lose the advantage of compounding.

- If your investment objective is capital appreciation or wealth creation, you should invest in growth option.

- If you want regular cash-flows from your investments, then you may opt for IDCW. However, you should remember that income distribution is at the discretion of the AMC. There is no guaranteed income in mutual funds.

- Capital gains upon redemptions in growth option are subject to capital gains tax. Short term capital gains in equity funds (investment holding period of less than 12 months) are taxed at 15% (plus applicable surcharge and cess). Long term capital gains in equity funds (investment holding period of more than 12 months) are tax exempt up to Rs 100,000 and taxed at 10% (plus applicable surcharge and cess) thereafter.

- Income (dividends) received in IDCW is added to your gross taxable income and taxed according to your income tax slab rate. From a taxation viewpoint, IDCW is at a significant disadvantage to growth option, for investors in the higher tax brackets. You may like to read – Avoid 6 common tax planning mistakes

Conclusion

In this blog post, we have discussed about IDCW. We hope that this article, corrects the misconceptions that some investors may have about mutual fund dividends. SEBI’s change in terminology from Dividend to IDCW is aimed at clarifying the wrong perceptions about dividends. You can invest in IDCW if you need regular cash-flows from your investments. You can also explore Systematic Withdrawal Plans(SWP) for regular cash-flows from growth option of the scheme.

Suggested reading: Should you invest in mutual fund dividend option or SWP

You should take your investment needs and tax consequences into consideration and make informed investment decisions; consult with your financial advisor if required.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY