What is Asset Allocation and why it is important

What are asset classes?

Asset classes refer to categories of investments that have the same fundamental characteristics. The four common asset classes are equity, debt, gold and real estate. Equity and debt are financial assets. Gold and real estate can be in form of physical assets (e.g. gold jewellery, gold bars,residential or commercial property, etc.) or financial assets (e.g. Gold ETFs, Gold fund-of funds, digital gold, REITs, etc). You can have various sub-categories within each asset class.

Financial assets versus physical assets

Traditionally in India, a high percentage of household savings was allocated to physical assets like real estate and gold. However, financial assets have several advantages over physical assets. Financial assets are bought from and sold to institutions or well regulated financial markets. Physical assets require you to find a buyer or seller. Financial assets are much more liquid than physical assets.

Secondly, price of financial assets are much more transparent since they trade in well functioning regulated markets. On the other hand, there is no formal secondary market of physical assets like real estate. Price of physical assets is based on negotiation between buyer and seller.

Finally, there is lesser risk of frauds and misdeeds in financial markets since they have regulatory oversight. We are seeing a shift from physical assets to financial assets in India over the past few years. The shift towards financial assets has accelerated post demonetization by the Government. In this article, we will focus on financial assets.

Suggested reading: How to choose the right mutual fund according to your need

What is asset allocation?

Asset allocation is mix of different asset classes in your investment portfolio. It is the most important aspect of financial planning. Research has shown that asset allocation is a much more important factor in portfolio performance attribution compared to individual investments. In this article, we will discuss the importance of asset allocation.

Take the optimal amount of risk to get desired returns

Risk and return are directly related. You need to take risks to get higher returns. The average retail investor in India is risk averse. However, you should understand that risk free returns may not be able to beat inflation on a post tax basis in the long term. On the other hand, if you take too much risk, you may be exposing your financial interests to the vagaries of capital markets, when you are near your financial goals. Asset allocation ensures that you take the right amount of risk; too much or too little risk can both harm your financial goals.

You may like to read what should you do when the stock markets are at high level

Asset allocation keeps you disciplined

Risk attitudes changes with market cycles; greed and fear drive investment preferences. In bull markets, investors keep investing equity at higher and higher prices. Consequently, they may experience big portfolio drawdowns in ensuing corrections. In bear markets investors panic and redeem their equity investments at low prices. These investors not only suffer permanent losses in bear markets, but also miss out on the opportunity of investing at attractive valuations. Asset allocation keeps you disciplined because your investment decisions are not driven by reaction to market movements, but purely by considerations of asset allocation. In bull markets, you will rebalance your asset allocation from equity to debt to bring it to your target asset allocation. Similarly in bear markets, you will rebalance your asset allocation from debt to equity. This not only reduces portfolio volatility; it can also produce superior risk adjusted returns.

Risk diversification through Asset Allocation

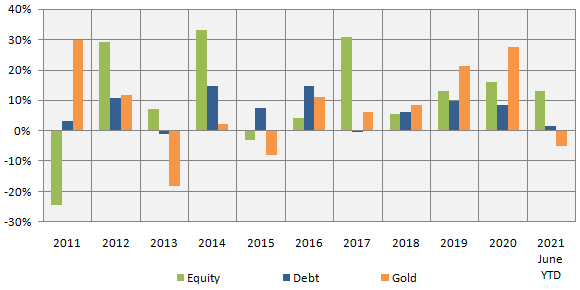

In very plain language, it is about not putting all your eggs in one basket. There are different asset classes like equity, debt, gold, etc.; each with different risk / return characteristics. There is low or even negative correlation in returns of two or more asset classes. You can see in the chart below that equity (represented by Nifty 50 TRI) and gold are usually counter-cyclical to each other i.e. gold outperformed when equity underperformed and vice versa. Similarly, debt (represented by Nifty 10 year benchmark G-Sec Index) had low correlation with performance of other asset classes like equity or debt. Diversifying your portfolio across asset classes limits downside risk and provides stability.

Source: National Stock Exchange, Advisorkhoj Research, 1st Jan 2011 to 30th June 2020. Equity: Nifty 50 TRI; Debt: Nifty 10 year benchmark G-Sec Index; Gold: Gold Price in INR. Disclaimer: Past performance may or may not be sustained in the future.

What does asset allocation depend on?

Your asset allocation will depend on the following factors:-

- Your financial goals – short term, medium term and long term

- Your age and risk appetite

- Your assets and liabilities

You should consult with your financial advisor, if you need help in understanding your risk appetite and your target asset allocation.

What should be my ideal asset allocation?

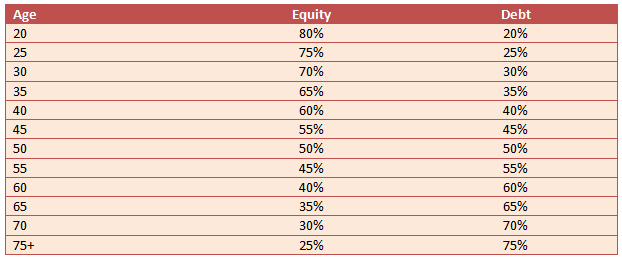

Your ideal asset allocation will depend on your financial goals, your financial situation and your risk tolerance. Rule of 100 is a popular thumb rule for asset allocation. Simply put, you should subtract the investor’s age from 100, and the result suggests the maximum percentage amount of the investor’s portfolio that should be exposed to equities. So for a 25 year old investor, this rule suggests that 75% of his or her portfolio should be invested in equities and the balance in debt. The Rule of 100, by no means, is the perfect asset allocation tool because it is simply based on age and does not take financial situation or goals into consideration, but it can provide some guidance.

Conclusion

In this article we discussed how asset allocation helps with risk diversification and protects your hard earned money from the vagaries of capital market. Investors should always give adequate importance to asset allocation and ensure that they have optimal asset allocation irrespective of market cycles. We also discussed how mutual funds can help investors with asset allocation. Investors should discuss their asset allocation with financial advisors and take suitable investment decisions.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY