Should you invest in debt funds when interest rates are rising?

Fixed income should be an important part of your asset allocation. Fixed income will provide stability to your investment portfolio and generate income even in difficult market conditions. Traditionally investors have preferred Bank Fixed Deposits and Government Small Savings Schemes for fixed income investments. However with interest rates of traditional fixed income schemes seeing secular decline over the past 20 years or so, investors have shown increasing interest in fixed income mutual funds or debt funds.

In this blog post, we will try to explain some basic elements of investing in debt funds, so that you are able to make the right investment decision. At Advisorkhoj, we think that investor education is the best approach to achieving success in your financial goals in any environment.

Debt funds versus traditional fixed income

Let us understand how banks generate revenues and profits. You park your funds in your bank either in your savings account or as fixed deposits. The bank, in turn, lends your funds to borrowers. The interest rate which the bank charges its borrowers is substantially higher than the interest rate which banks pays you on your FDs. The difference in the two interest rates enables the bank to run its operations and generate profits for its shareholders.

Companies, who need to borrow money for their working capital or capex, often prefer to borrow directly from the public by issuing bonds, debentures or other instruments instead of borrowing from the bank. The company (issuer) will pay interest to you in form of coupons and return your principal (face value of the bond) on maturity of the bond. The interest paid by the bond or other fixed income instrument will be higher than bank FDs, but it will lower than the interest that the company would have pay if it borrowed from the bank.

You can invest in bonds, debentures or other debt or money market instruments through debt mutual funds and potentially get superior returns for the reason discussed above. The other advantage of debt funds over traditional fixed income investments is in taxation. Long term capital gains (investment holding period of 3 years or longer) in debt funds are taxed at 20% after allowing for indexation benefits. FD interest is always taxed as per the income tax rate of the investor.

However, you must also understand that while debt funds can potentially give higher returns than bank FDs, they are also subject to certain risks. Bank FDs pay assured interest rates over the term of the deposit and there is also assurance of capital protection (due to capital adequacy requirements set by RBI). Debt funds, on the other hand, are subject to interest rate and credit risks. Investors should understand these risks, so that they can make informed investment decisions.

Relationship between debt fund returns and interest rates

Bond prices have an inverse relationship with changes in interest rates. Bond prices fall when interest rates go up and vice versa. Increase or decrease in bond prices is marked to market in the debt fund net asset value (NAV). So, if interest rates go up bond prices and scheme NAV will fall. How much is the impact of interest change on NAV?

It depends on the maturity or duration of the bonds in the scheme portfolio. Higher the maturity or duration, higher is the sensitivity of the bond price to interest rate changes. A fixed income instrument with duration of 5 years will fall by 5% if interest rate goes up by 1%. So if the bond is giving 8% yield (interest), its actual return will be, 8% - 5% = 3%. A fixed income instrument with duration of 6 months will fall by 0.5% if interest rate goes up by 1%. So if the instrument is giving 6% yield (interest), its actual return will be, 6% - 0.5% = 5.5%

Impact of rising interest rates on debt fund returns

Interest rates are rising for the last few months; the RBI has already hiked the repo rate by 90 bps and more rate hikes are in offing since inflation is very high. So how will rising interest rates impact debt fund returns?

- Bond yields are related to interest rates. If RBI increases interest rates, then bond yields will also go up.

- Bond yields increase with maturity. So a longer maturity bond will pay higher coupons (interest) compared to a shorter maturity bond.

- A longer duration debt fund, despite higher yields, is likely to underperform if interest rates are rising due to higher decline in bond prices (see the example in the previous section).

- A shorter duration debt fund, despite lower yields, is likely to outperform if interest rates are rising due to lower decline in bond prices (see the example in the previous section).

- A shorter duration debt fund will also have more debt and money market instruments maturing in the near term compared to longer duration funds. The shorter duration funds will able to reinvest the maturity proceeds at higher yields; so future returns may be higher.

What are the yields at this time?

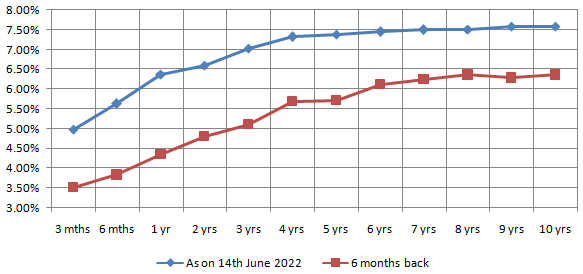

Investors should look at bond yields (rather than looking at past returns) and factor in interest rate changes, when selecting debt funds. Yield curve is a chart showing yields of bonds of different maturities. The chart below shows the yield curve of G-Secs (Government bonds of different maturities) as on 14th June 2022. You can see that the 6 month to 1 year yields are in the range of 5.6 – 6.4%. How does this compare with Bank FD interest rates?

1 year FD interest rates of major public and private sector banks are in the range of 5.1 – 5.25%. How do longer maturity G-Sec yields compare yields compare with bank FD rates? G-Sec yields in the 3 – 4 years maturity range are 7 – 7.3%. 3 to 5 year FD interest rates of major public and private sector banks are in the range of 5.5 – 5.9%.

Source: worldgovernmentbonds.com, as on 14th June 2022. Disclaimer: Yields may change depending on market conditions, foreign exchange and interest rate actions of RBI and other central banks (e.g. US Fed).

You should also note that the yields shown in the chart above are Government Bond yields which enjoy sovereign status (no credit risk). State Development Loans (SDLs) which are bonds issued by State Governments with implicit sovereign status will offer extra basis points of yields. Furthermore, highly rated instruments (AAA/A1) from private issuers will offer even higher yield. Yields will be even higher for lower rated papers but you should be mindful of credit risks and make informed investment decisions.

Accrual based strategy and interest rate risk

We had mentioned earlier that bond prices have an inverse relationship with changes in interest rates. However, if you hold a bond till maturity, then your absolute returns will not be impacted by interest rate changes. If you hold a bond till maturity, you will get the coupons (interest payments) from the issuer. You will get the face value of the bond (principal) on maturity; it is the legal obligation of the bond issuer to pay you the face value on maturity. So interest rate changes have no impact on returns if the bond is held to maturity. Debt funds with accrual based strategies hold the debt and money market instruments in their portfolio to maturity. In a rising interest rate scenario, accrual based shorter duration funds maybe more suitable for investors who do not have sufficiently high risk appetites.

Suggested reading: What are 5 important factors to look in debt mutual funds?

What should investors do?

- For relatively short investment tenures i.e. 1 – 2 years, you can invest in accrual based debt funds of up to 1 year duration profiles. Examples of such funds are overnight funds, liquid funds, ultra-short duration funds, money market funds and low duration funds.

- For 3 years plus investment tenures, you can invest in accrual based corporate bond funds or banking and PSU funds which have average maturity profiles of less than 3 years. Both corporate bond funds and Banking & PSU funds invest in highly rated bonds.

- Within a particular scheme category, there may be schemes of different duration profiles. Schemes which have longer durations may have higher yields. You should invest in according to your risk appetite and investment tenures.

- Check the credit quality of the schemes before investing. Lower rated papers will give higher yields but credit risk will also be higher. You should invest according to your risk appetite.

Investors should consult with their financial advisors, which debt funds will be suitable for them.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY