Equity Savings Funds can be good options in an uncertain environment

The last few months have been a rough ride for investors. Global equity markets have been highly volatile due to high inflation and the War in Ukraine. Indian equities have also seen large corrections due to FII selling. The broader market (midcaps and small caps) is down 10 – 12%, while Nifty 50 TRI is down 6% on a year to date basis (as on 25th May 2022). The near term outlook for equities is uncertain since the central banks are expected to hike interest rates several times this year to cool down inflation. Rising interest rates is unfavourable for equity as an asset class, as investors prefer to invest in risk free Government bonds in such environment. With bond yields rising, longer duration debt funds are also underperforming due to mark to market losses, and this is expected to continue till we reach the end of this interest rate cycle. We have seen large redemptions in debt mutual funds in Q4 of FY 2021-22.

What should investors do?

In volatile market, reducing capital losses become a primary concern for investors. Asset allocation is of utmost importance, if you want to reduce downside risks to your portfolio. Asset allocation is spreading your investments over different asset classes e.g. equity, fixed income, gold. While you may want to reduce risk in your portfolio, you may also want to get inflation adjusted returns over a medium to long investment horizon. Asset allocation balances risk and returns.

Hybrid mutual funds provide asset allocation benefits. In this article, we will discuss about a sub-category of hybrid funds, Equity Savings Funds. Equity savings funds invest in equity, fixed income and arbitrage. The risk profile of equity savings is lower compared to other equity oriented hybrid funds. Equity savings funds can be good medium to long term investment options in these market conditions, for investors who do not have a high risk appetite.

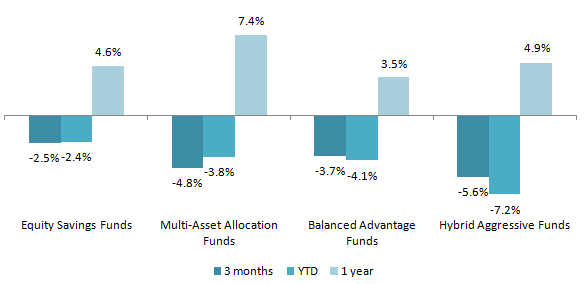

Performance of Equity Savings Funds

The chart below shows the category average returns of different hybrid funds categories over the last 3 months, year to date and last 1 year. You can see that the downside risk has been lowest in the equity savings category.

Source: Advisorkhoj Research, as on 24th May 2022. Disclaimer: Past performance may or may not be sustained in the future.

Asset allocation of equity savings funds

- As per SEBI, minimum allocation to equity and arbitrage should be 65%. The fund manager may change allocations to equity and arbitrage based on the market outlook, but the overall exposure to equity and arbitrage should be 65% to 90%.

- These schemes are also required to mention their minimum hedged (arbitrage) and unhedged (equity) exposures in their Scheme Information Document.

- If the outlook is unfavourable, then fund manager may increase allocation to arbitrage and reduce allocation to equity. If the outlook is favourable, then fund manager may increase allocation to equity and reduce allocation to arbitrage.

- As per SEBI, minimum allocation to debt and money market instruments should be 10%. The maximum exposure to debt and money market will not exceed 35%.

- On average over a full investment cycle, average exposure to equity, arbitrage and debt can be roughly one third in each.

- Since equity savings funds have minimum 65% exposure to equity and arbitrage (which involve equity related securities), these schemes enjoy equity taxation.

How do equity savings funds work?

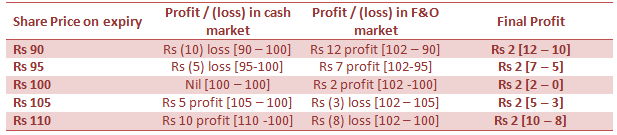

- Arbitrage: Arbitrage by definition is defined as risk free profit, by exploiting pricing mismatches in the equity market. Let us understand how arbitrage works. Let us assume that price of a stock in cash market at the beginning of a month is Rs 100 and its price in the futures (F&O) market is Rs 102. The fund manager can lock-in Rs 2 of risk-free profits by buying the stock in the cash market and selling futures in the F&O market. The profit is locked in because on expiry of the futures contract the cash price and the futures price will converge irrespective of whether price moves up or down. The table below shows various scenarios of share price changes and the final profit of the fund manager.

![Various scenarios of share price changes and the final profit of the fund manager Various scenarios of share price changes and the final profit of the fund manager]()

Note: Figures in the table are purely illustrative for investor education purposes. Please note that we have not considered transactions costs (e.g. STT, brokerage etc) in arbitrage trades. Transaction costs will have an impact on profits.

- Debt and Money Market: In the fixed income / money market portion of equity savings funds, the fund managers usually employ accrual strategy to generate income and minimize interest rate risk. In accrual strategy, fund managers hold the debt and money market instruments in their portfolio till maturity and accrue the interest (coupons) paid by the debt or money market instruments. They usually invest in shorter duration instruments to minimize interest rate risks. However, some fund managers may take duration calls depending on their interest rate outlook.

- Equity: Equity savings funds take active (unhedged) exposure within specified allocation ranges. Fund managers may increase or decrease active equity exposure depending on market conditions.

Covered calls facility for mutual funds

In September 2021, SEBI introduced covered calls facility for mutual funds. This provision will allow mutual funds to earn extra income by writing (selling) call options for the stocks held by the scheme in the mutual fund’s portfolio.

Let us understand this with the help of an example. Suppose Nifty 50 is currently trading at 16,000. The call option price (premium) for Nifty strike price of 16,200 is Rs 30. If you write (sell) a Nifty 50 call option for strike price of 16,200 you will get Rs 30 upfront on income. If buyer of your call option has the right to buy Nifty 50 at 16,200 even if the Nifty goes higher than that level. Suppose the level of Nifty at expiry of the options contract is 16,300; you will have to buy Nifty at 16,300 and sell it to the buyer at 16,200; you make a loss of Rs 100. However, you have already received Rs 30 as the option premium when you sold the option. So your net loss is Rs 70.

Let us now consider the scenario if level of Nifty at expiry is 15,900. Remember, the call option buyer has the right to buy at a certain strike price, but not an obligation to buy. If Nifty falls to 15,900 the buyer will simply not buy. In other words, you keep the profit of Rs 30, which you got when you sold the option.

It is important for investors to understand that unlike arbitrage, covered call is not a risk-free strategy. In arbitrage, there is no risk whether the market moves up or down. On the other hand, in covered calls, the downside risk protection is only to the extent of the option premium, which is the income you get by writing (selling) the call option.

Equity savings funds use covered calls along with arbitrage to get some additional protection for the un-hedged equity exposure and extra returns for investors. Stocks with covered call protection are disclosed in the scheme portfolios and fund factsheets. Equity savings funds use covered calls only for the stocks held in their scheme portfolios. In the event, of the call option getting exercised, the scheme can sell the stock in its portfolio and there will be no loss for the investor.The total notional value of the call option shall not exceed 15% of the total market value of equity shares held in the scheme.

Taxation Advantage

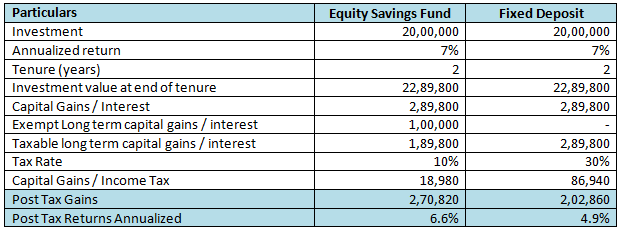

Equity Savings Funds are taxed as equity funds. Short term capital gains (holding period of less than 12 months) are taxed at 15% (plus applicable surcharge and cess). Long term capital gains (holding period of more than 12 months) of up to Rs 1 lakh are tax exempt and taxed at 10% (plus applicable surcharge and cess) thereafter. Dividends paid by Equity Savings funds are added to investor’s taxable income and taxed as per the income tax rate of the investor. The table below illustrates the tax advantage of Equity Savings funds versus a traditional fixed income investment e.g. Fixed Deposits.

Note: Above example is purely illustrative. Please consult with your financial or tax advisor to know the tax consequences of your investment.

Who should invest in equity savings funds?

- Investors who want to get higher returns than traditional fixed income investments without taking high risk.

- Investors with moderate to moderately high risk appetites.

- Investors with at least 3 – 5 years investment horizon.

Investors should read the scheme information document carefully to understand the asset allocation and risk profile of their schemes.

Investors should consult with their financial advisors or mutual fund distributor before investing.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY